5 Year Fd Tax Benefit Verkko Minimum Amount Rs 100 amp in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly

Verkko 18 jouluk 2017 nbsp 0183 32 This arrangement makes FDs a safe investment option Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make Verkko It is ideal for investors seeking low risk returns and reduced tax liabilities You can start small with a minimum investment of Rs 10 000 You can also save up to Rs 46 800 in

5 Year Fd Tax Benefit

5 Year Fd Tax Benefit

https://i.ytimg.com/vi/-5f7zy-s9VY/maxresdefault.jpg

Tax On FD Interest What Are The Post tax Returns On An FD

https://life.futuregenerali.in/media/qolbr5pc/tax-on-fix-deposits.jpg

Investment In 5 Years Fixed Deposits Also Offers Tax Benefit

https://thetaxtalk.com/wp-content/uploads/2016/12/227-min.png

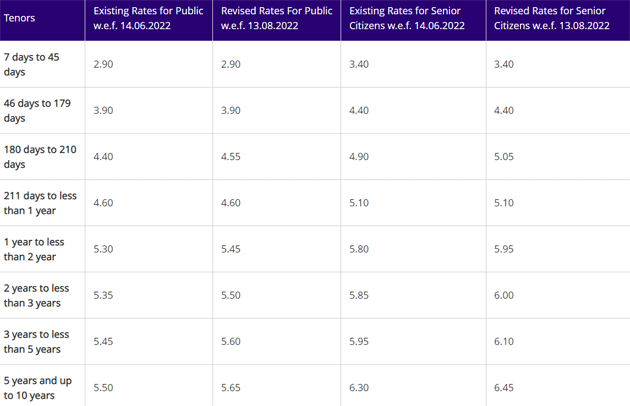

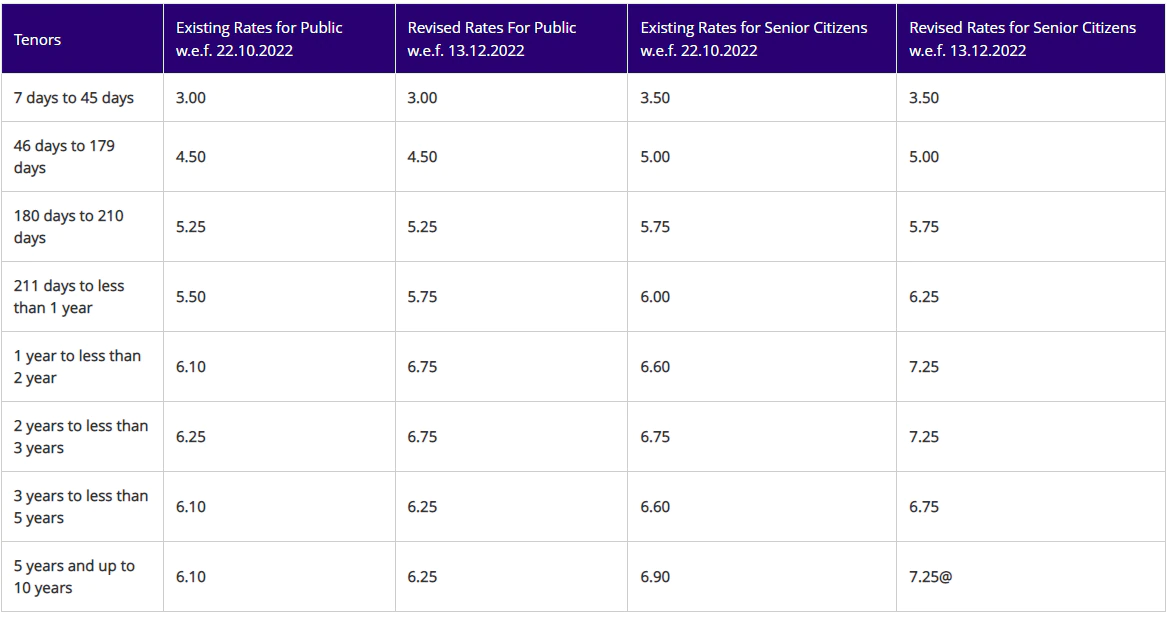

Verkko FD Interest Rate 6 80 5 3 to 7 depending on bank Tax benefit on maturity Interest earned is taxable Interest earned is taxable Tax on interest earned Tax Verkko What are its Benefits If you invest in a tax saver FD with AU Small Finance Bank you can earn high interest rates If you are a senior citizen you re entitled to earn 0 50

Verkko 18 maalisk 2022 nbsp 0183 32 The amount invested up to Rs 1 50 000 per financial year in a 5 year tax saver FD qualifies for deduction from total gross income and thus reduces tax Verkko If you are investing in a Tax Saver FD you re eligible to claim deductions of up to Rs 1 5 lakh in a financial year Tax Saver FD interest rates remain fixed throughout the five

Download 5 Year Fd Tax Benefit

More picture related to 5 Year Fd Tax Benefit

Property Tax Assessment In Canada Loans Canada

https://loanscanada.ca/wp-content/uploads/2023/05/Property-Tax-Assessment.png

NSC Vs 5 Year Tax Saving FD In Bank Which Is Better Option

https://myinvestmentideas.com/wp-content/uploads/2021/04/NSC-Vs-5-Year-Tax-Saving-FD-in-bank-–-Which-is-better-option.jpg

On demand Pay Ease Rising Grocery Costs Edenred Benefits

https://edenredbenefits.com/wp-content/uploads/2022/06/iStock-1167803836.jpg

Verkko Tax Saving Fixed Deposit PPF Maturity 5 years 15 years Deduction available u s 80C Rs 1 50 000 Rs 1 50 000 Interest Rate Fixed by the Bank Fixed by the Govt Tax Verkko 9 marrask 2023 nbsp 0183 32 What are Tax Saving FD Tax saving FDs are Fixed Deposits that offer tax benefits along with earning interest income A tax deduction of up to INR

Verkko A Tax saving Fixed Deposit FD is an investment option offered by banks and non banking financial companies A tax saver FD has a lock in period of 5 years and Verkko The 5 year locked tax free FD offers a tax deduction on investments deposited for up to a tax saving FD investment limit The minimum deposit amount in a tax saving FD is

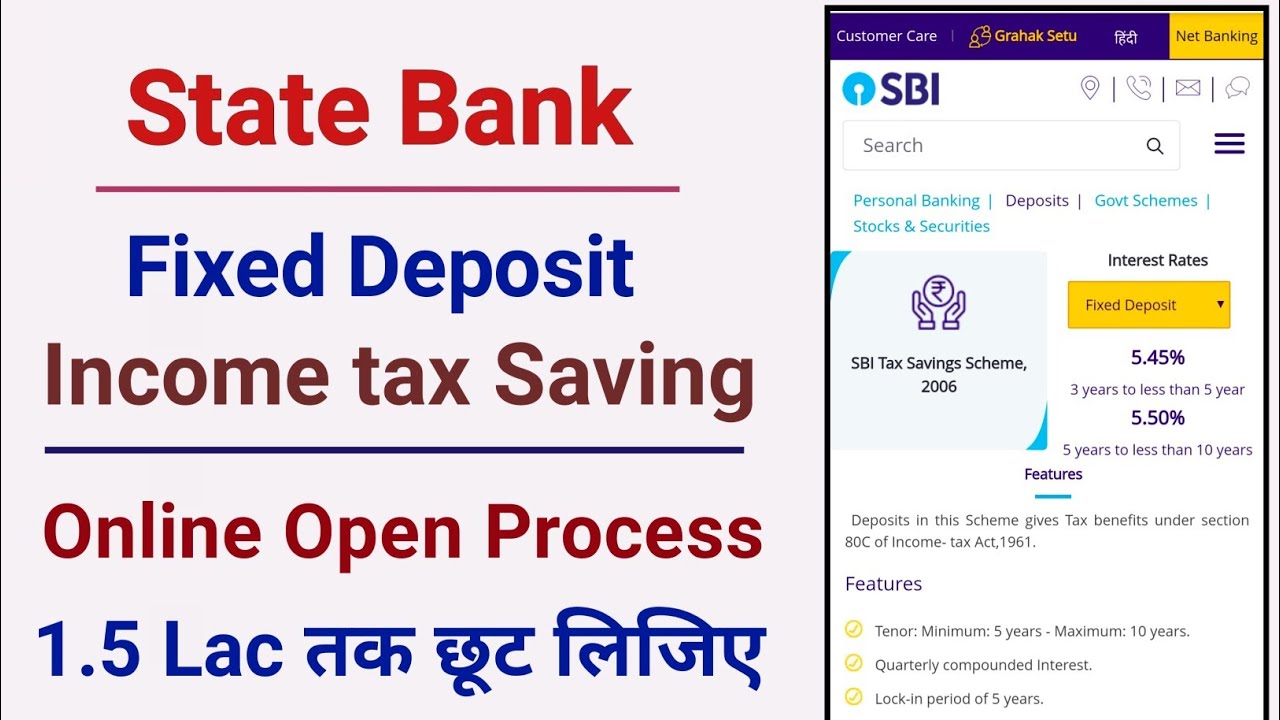

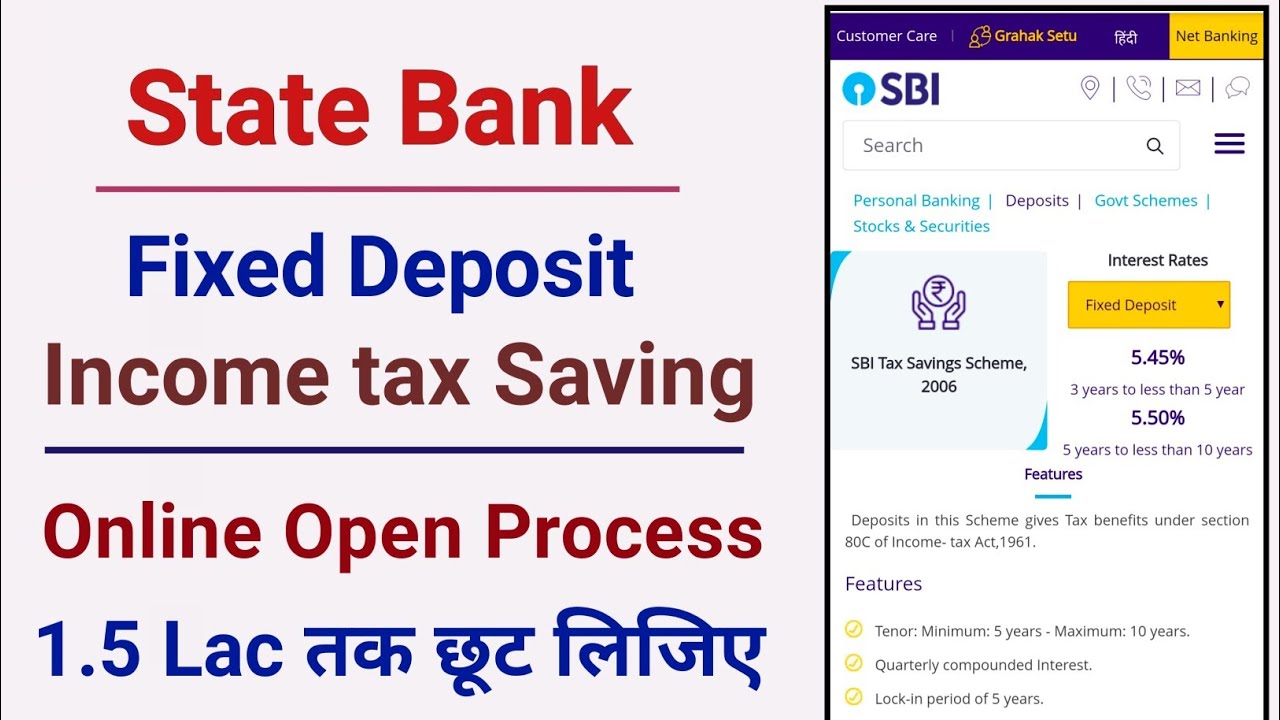

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

https://i.ytimg.com/vi/MF15NuqozMg/maxresdefault.jpg

Huge Tax Benefit Macdonald Group Real Estate

https://images.squarespace-cdn.com/content/v1/5f68d97d7e85dd55cedcae22/f73ac24c-ca11-4a11-bf43-1853683916cc/Huge+Tax+Benefit+Thumbnail.jpg

https://www.hdfcbank.com/.../five-year-tax-saving-fixed-deposit

Verkko Minimum Amount Rs 100 amp in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked with Monthly and quarterly

https://cleartax.in/s/fixed-deposit

Verkko 18 jouluk 2017 nbsp 0183 32 This arrangement makes FDs a safe investment option Tax Benefit You can get a tax deduction under Section 80C of up to Rs 1 5 lakh when you make

SBI FD Interest Rates This SBI FD Allows You To Withdraw Money Anytime

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

PPF 5 Year FD Withdrawal And Tax Benefits

An Easy Tax Benefit For Exporters That Can Save Big Money

)

5 Year Major Appliance Warranty Under 500 00 BBQGuys

5 Year Annuity Polish National Alliance

5 Year Annuity Polish National Alliance

Updates On International Tax Developments Global Financial Centres

SBI Released New FD Interest Rates 2023 Big News SBI Increased FD

Income Tax Exemptions On Fixed Deposits 2023

5 Year Fd Tax Benefit - Verkko Five Year Tax Saving Fixed Deposit Eligibility Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms amp