50 Tax Deduction For Disabled Person In Pakistan In Pakistan the Income Tax Ordinance 2001 plays a pivotal role in regulating income taxation for individuals and entities Section 60 of this ordinance holds a special place as it outlines deductible allowances against income tax liability for various payments and contributions

Mentioned penalties shall also be reduced by 75 50 and 25 in case return is filed by the person within one two or three months respectively after the due date Senior citizens can avail 50pc tax rebate in payable income says FBR Senior citizens over 60 years of age are entitled to claim 50 per cent rebate in the payment of tax outstanding against them

50 Tax Deduction For Disabled Person In Pakistan

50 Tax Deduction For Disabled Person In Pakistan

https://i.ytimg.com/vi/anjk-5IQEAQ/maxresdefault.jpg

Section 80DD Tax Deduction For Care Of Handicapped Disabled Persons

https://i.ytimg.com/vi/v8EqSbXYMwQ/maxresdefault.jpg

Section 80DD Income Tax Deduction For Disabled Person Medical

https://www.finacbooks.com/assets/img/blog/section-80dd-income-tax-deduction-for-disabled-person-medical-treatment.jpg

FBR has clarified that withdrawal of exemption reduced rates should not be confused with imposition of new taxes It is very clearly and candidly informed that the present budget proposals do not contain any new item for taxation of pensions or major components of salary as initially discussed Employment income exemptions Significant exemptions available under salary income are as follows Medical allowance expenses Reimbursement of expenses on medical treatment or hospitalisation or both received by an employee is exempt from tax Medical allowance of up to 10 of basic salary is exempt if the facility of reimbursement

There is an upper limit on the amount of donation eligible for tax benefit being 30 of taxable income where donor is an individual or AOP and 20 where donor is a company These percentages are reduced by 50 where donor and donee are associates SUBJECT REVISION OF CONVEYANCE ALLOWANCE TO DISABLED EMPLOYEES The President has been pleased to revise the rate of Special Conveyance Allowance admissible to disabled employees of Federal Government paid out of

Download 50 Tax Deduction For Disabled Person In Pakistan

More picture related to 50 Tax Deduction For Disabled Person In Pakistan

Know Tax Deduction For Disabled Individuals Under Section 80U Future

https://i.ytimg.com/vi/vZZuP6jwyms/maxresdefault.jpg

Section 80DD Tax Deduction For Maintenance And Medical Treatment Of

https://www.succinctfp.com/wp-content/uploads/2013/07/80DD-Deduction_Treatment-Maintenance-Exps-towards-Disabled-Dependant.png

Active Taxpayer Advantages Disadvantages In Pakistan EmployeesPortal

https://employeesportal.info/wp-content/uploads/2019/09/Active-Taxpayer-Advantages-Disadvantages-in-Pakistan.jpg

To encourage employment of people with disabilities and to provide relief to them it is proposed to reduce tax liability of such persons on income up to Rs 1 million by 50 per cent The income tax rate in Pakistan ranges from 5 to 35 depending on the individual s or company s income bracket The income tax is calculated on the basis of the taxable income which is the income earned after deducting expenses and exemptions

KARACHI Filing of income tax return is not mandatory for persons including widow orphan and disabled persons for sole reasons mentioned in the Income Tax Ordinance 2001 KARACHI The list of persons and institutions having total exemption from income tax under Income Tax Ordinance 2001 The Federal Board of Revenue FBR updated Income Tax Ordinance 2001 up to June 30 2019 for tax year 2020

Income Tax Deduction U s 80U Tax Deduction For Disabled Individuals

https://i.ytimg.com/vi/B0sq8Bccap0/maxresdefault.jpg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

https://pkrevenue.com/deductible-allowance-against...

In Pakistan the Income Tax Ordinance 2001 plays a pivotal role in regulating income taxation for individuals and entities Section 60 of this ordinance holds a special place as it outlines deductible allowances against income tax liability for various payments and contributions

https://download1.fbr.gov.pk/Docs/2021923179152610...

Mentioned penalties shall also be reduced by 75 50 and 25 in case return is filed by the person within one two or three months respectively after the due date

Income Tax Deduction For Disabled Persons Section 80U And 80DD YouTube

Income Tax Deduction U s 80U Tax Deduction For Disabled Individuals

Self employed Individuals Are Allowed To Take A Tax Deduction For Their

Navigating The Details Of Tax Preparation Gets Even More Complex When

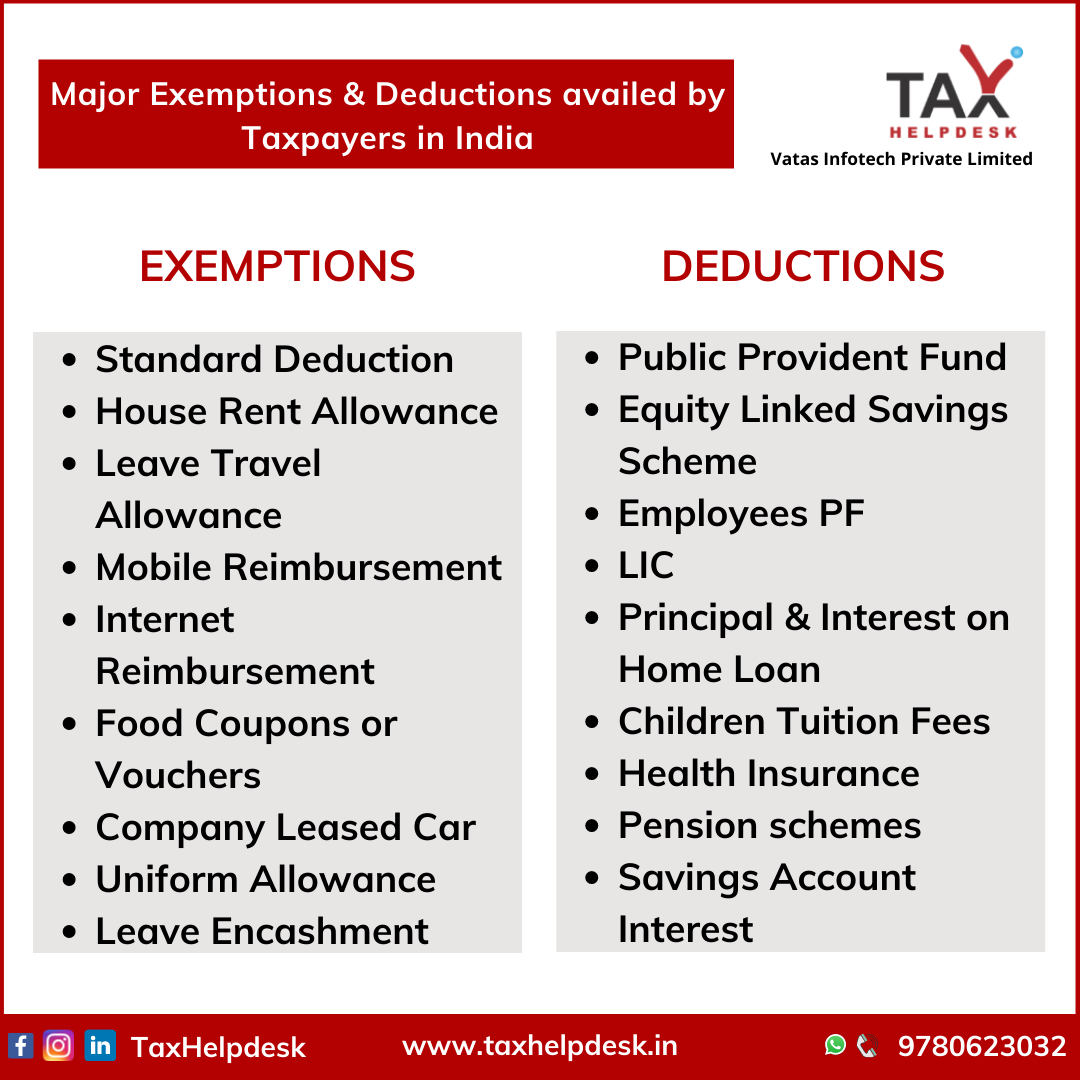

Major Exemptions Deductions Availed By Taxpayers In India

Claiming Deduction On Interest Under Section 80TTA Of Income Tax Act

Claiming Deduction On Interest Under Section 80TTA Of Income Tax Act

Claim Income Tax Deduction For Medical Treatment Of Specified Diseases

Tax Deduction Definition TaxEDU Tax Foundation

How To Maximize Your Charity Tax Deductible Donation WealthFit

50 Tax Deduction For Disabled Person In Pakistan - Calculate monthly income and total payable tax amount on your salary Learn more about tax slabs