500 Dollar Child Tax Credit The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child

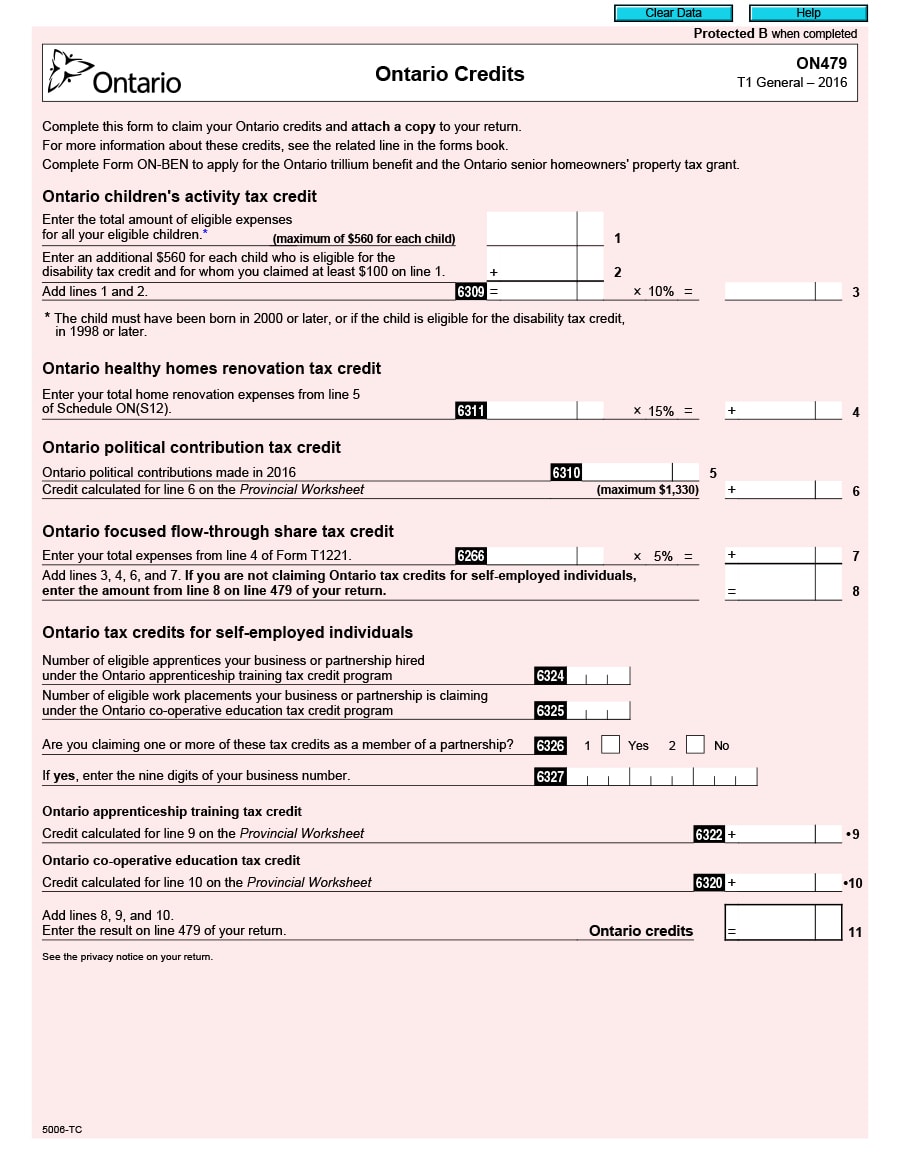

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents The maximum credit amount is 500 for each dependent who meets certain conditions This credit can be claimed for Dependents of any age including those who are age 18 or older Dependents who have Social Security numbers or Individual Taxpayer Identification numbers

500 Dollar Child Tax Credit

.png)

500 Dollar Child Tax Credit

https://files.taxfoundation.org/legacy/docs/Child-Credit-Received-(Large).png

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

https://ppittman.com/wp-content/uploads/2021/08/Child_Tax_Credit.jpg

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

https://www.wilsonlewis.com/wp-content/uploads/2021/06/Child-Tax-Credit.jpg

Key Takeaways The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s The maximum amount you can receive for each dependent is 500 Your eligibility will depend on your income and whether your dependent qualifies Get information about the credit for other dependents including if you are eligible and how to claim it LAST UPDATED January 11 2024 SHARE THIS PAGE Have a question

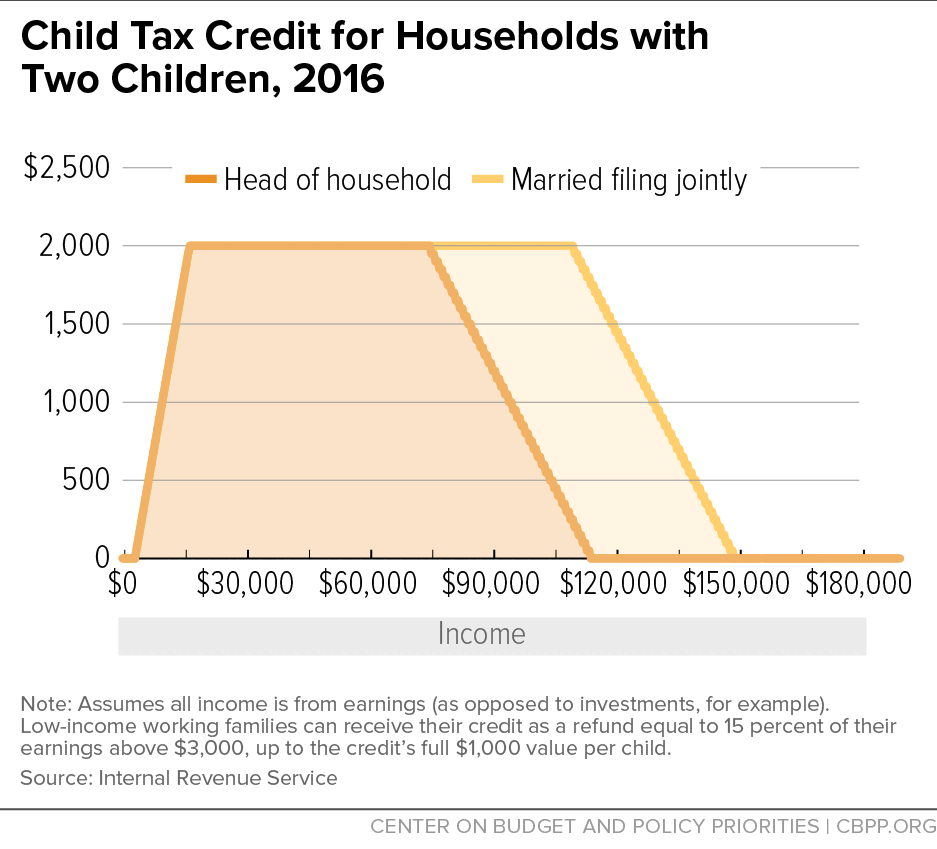

Make permanent the American Rescue Plan s expansion of the Child and Dependent Care Tax Credit so that families can continue to get back up to 8 000 of their child care expenses All families will get the full Child Tax Credit if they make up to 150 000 for a married couple or 112 500 for a family with a single parent also called Head of Household Eligible

Download 500 Dollar Child Tax Credit

More picture related to 500 Dollar Child Tax Credit

Child Tax Credit Form Free Download

http://www.formsbirds.com/formimg/tax-credit-form/4138/child-tax-credit-form-l4.png

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/atoms/files/5-24-16tax-f2.png?itok=OTypI8hk

Child Tax Credit Changes Coming Soon Update From The IRS

https://goqbo.com/app/uploads/2021/06/Child-Tax-Credits-1024x683.png

How much is the new Child Tax Credit If the new tax deal is passed by the Senate the CTC amount will remain at 2 000 per child But a third tweak to the credit could mean that more The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC

The Legislature passed the program in June and Gov Phil Murphy signed it into law providing a refundable credit of up to 500 per year for each child under the age of six The program was For the 2023 tax year you can get a maximum tax credit of 2 000 for each qualifying child under age 17 although there is an income limit of 400 000 for married couples and 200 000 for individuals 1 Now there are two types of tax credits refundable and nonrefundable Both types lower your tax bill

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

Form 8812 Additional Child Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/122/1226/122622/page_1_thumb_big.png

.png?w=186)

https://www.irs.gov/newsroom/child-tax-credit-most...

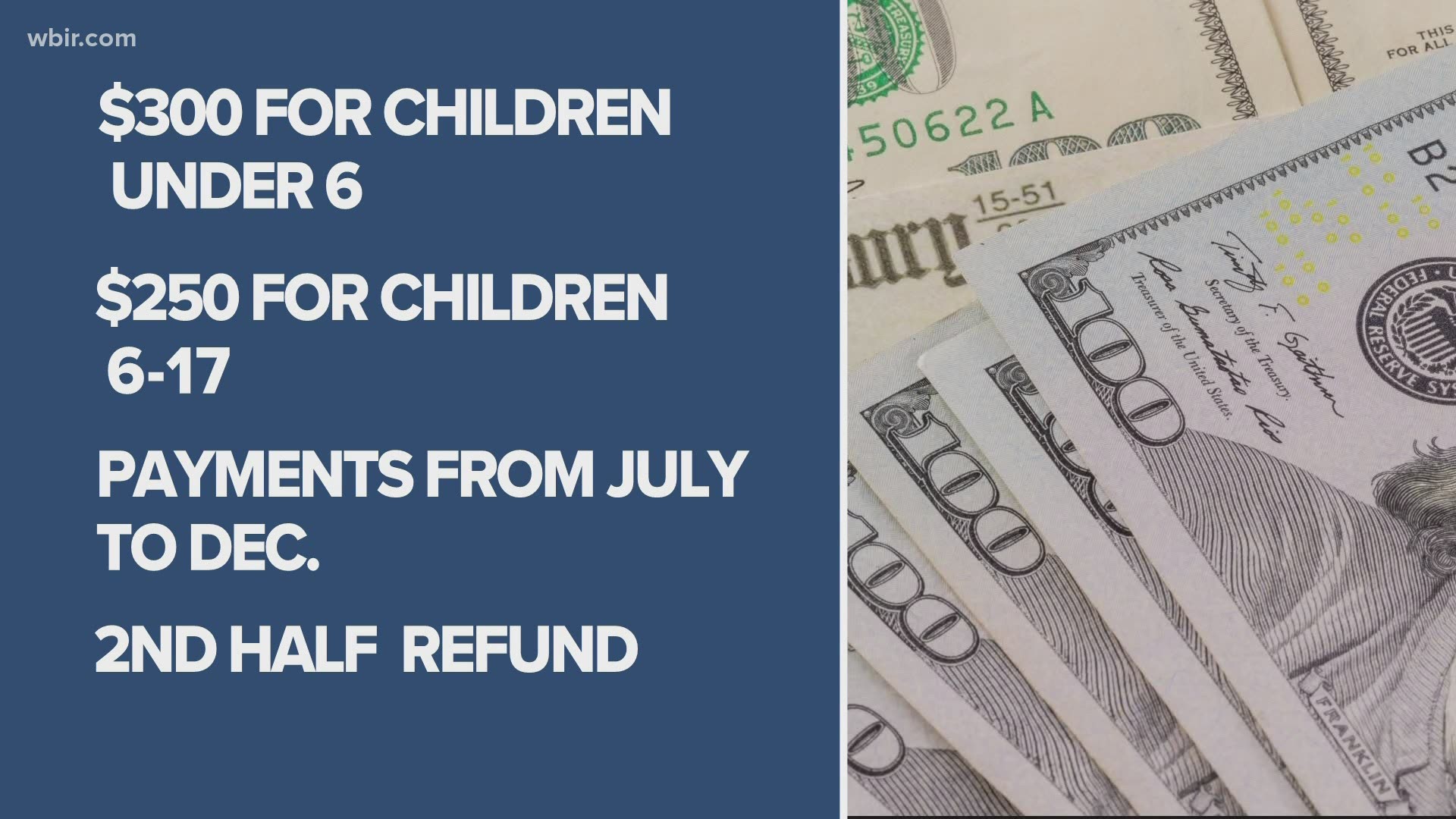

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 for children under the age of 6 and to 3 000 per child for children between ages 6 and 17 Before 2021 the credit was worth up to 2 000 per eligible child

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

Child Tax Credit Benefits Fort Myers Naples Markham Norton

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

Advance Child Tax Credit Gift Or Not TaxMedics

23 Latest Child Tax Credit Worksheets Calculators Froms

Child Tax Credit Schedule 8812 H R Block

Hoosiers Hopeful After IRS Announces Monthly Child Tax Credit Payments

Hoosiers Hopeful After IRS Announces Monthly Child Tax Credit Payments

T21 0045 Tax Benefit Of The Child Tax Credit By Expanded Cash Income

Child Tax Credit You Can Opt out Of Monthly Payment Soon Wnep

Advance Child Tax Credit Payments Start Today Cook Co News

500 Dollar Child Tax Credit - All families will get the full Child Tax Credit if they make up to 150 000 for a married couple or 112 500 for a family with a single parent also called Head of Household Eligible