529 Plan Georgia Tax Benefit Path2College 529 Plan offers compelling income tax benefits Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan contributions from their Georgia adjusted gross income Individual filers can deduct up

Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers or 4 000 for individual filers per year ATLANTA GA Georgia families have a few weeks left to take advantage of a tax deduction on their 2023 tax return by saving for college through Georgia s Path2College 529 Plan Path2College is the only 529 plan to offer a

529 Plan Georgia Tax Benefit

529 Plan Georgia Tax Benefit

https://webresources-savingforcollege.s3.us-west-2.amazonaws.com/images/articles/article_image_20200102212900_state_tax_deduction_map_110119.jpg

What Is A 529 Savings Plan Community 1st Credit Union

https://www.c1stcreditunion.com/webres/Image/personal/savings/529 plan_512030656.jpg

The Unique Benefits Of 529 College Savings Plans

https://www.thetaxadviser.com/content/dam/tta/issues/2023/may/529-2.png

Unique tax advantages 100 tax deferred growth and Georgia taxpayers can reduce their state taxable income by up to 8 000 per beneficiary per year if married filing jointly 4 000 for single filers If you are a Georgia resident who plans to put a child through college it s important to learn about the tax benefits available by contributing to the state s 529 college savings program also known as the Path2College 529 Plan

The Georgia Path2College 529 Plan a TIAA managed 529 savings program features a year of enrollment track with 10 portfolios and six static investment options including a Principal Plus Interest Portfolio with a minimum effective annual The Georgia 529 plan offers tax benefits to residents who save for a college education and for K 12 expenses Read about the plan and its tax benefits In June 2022 Georgia held about 4 3 billion in 529 plans

Download 529 Plan Georgia Tax Benefit

More picture related to 529 Plan Georgia Tax Benefit

529 Tax Benefits By State Invesco Invesco US

https://www.invesco.com/content/dam/invesco/education-savings/en/landing-page/LNDG-HRO-tax-benefit-investor.jpg

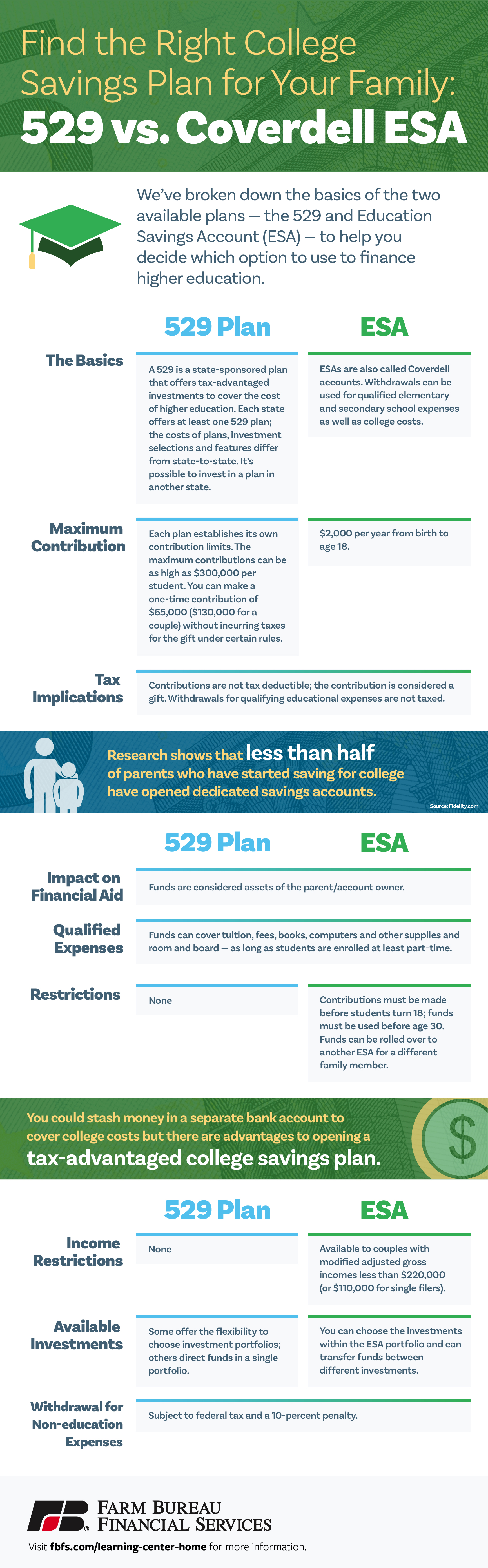

ESA Vs 529 Which Is Right For Your Family Farm Bureau Financial

https://qffc.blob.core.windows.net/images/images/default-source/images/06_02-529-vs-esa-infographic-01.jpg?sfvrsn=15f338b1_0

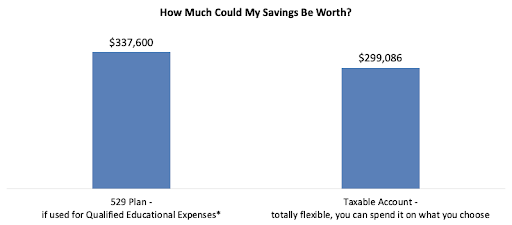

Should I Save In A 529 Plan

https://cdn.buttercms.com/7SWSxVKxSOSHGZ1r46CP

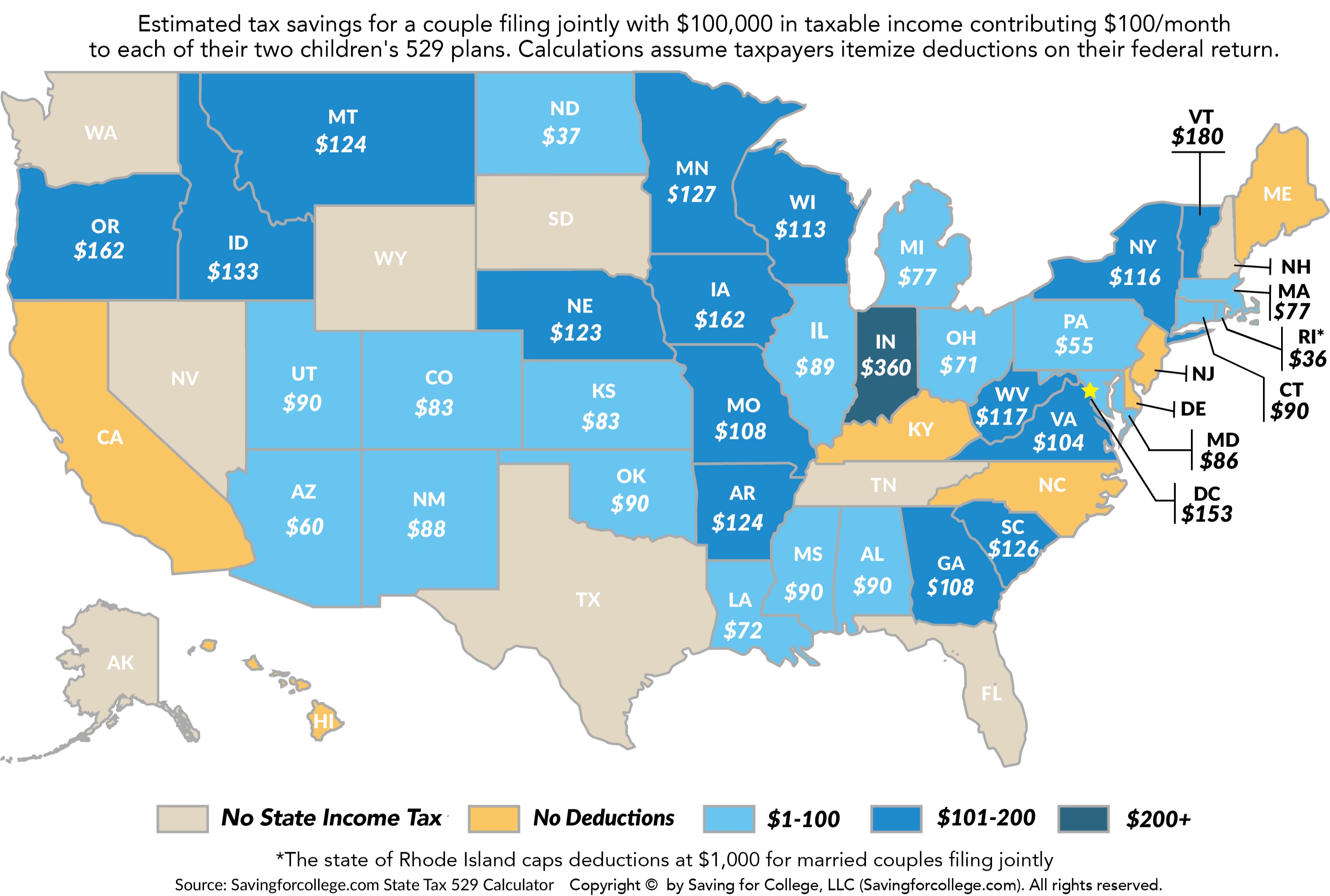

Tax Benefits of Georgia s 529 Plan Starting with tax year 2020 married Georgia taxpayers who file jointly and invest in the Path2College 529 Plan can deduct up to 8 000 from their state taxable income per account each year Single filers can deduct up to 4 000 per child For those focused on fees the state of Georgia s Path2College 529 Plan is the nation s lowest cost 529 plan1 Georgia s Path2College 529 Plan s average annual asset based fees are just 09 compared to 0 51 for all 529 plans

For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000 per beneficiary for those filing a joint return and up to 4 000 Here are the special tax benefits and considerations for using a 529 plan in Georgia Contributions Georgia offers a state tax deduction for contributions to a 529 plan of up to 4 000 for single filers and 8 000 for married filing jointly tax filers Minimum 25

529 Plan Infographic

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

529 Tax Benefits By State Invesco US

https://www.invesco.com/content/dam/invesco/education-savings/en/landing-page/LNDG-HRO-tax-benefit-fp.jpg

https://www.path2college529.com/learn/how-does-a-529-plan-work

Path2College 529 Plan offers compelling income tax benefits Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan contributions from their Georgia adjusted gross income Individual filers can deduct up

https://www.path2college529.com/resources/faq

Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers or 4 000 for individual filers per year

Nj 529 Plan Tax Benefits Tiffaney Bernal

529 Plan Infographic

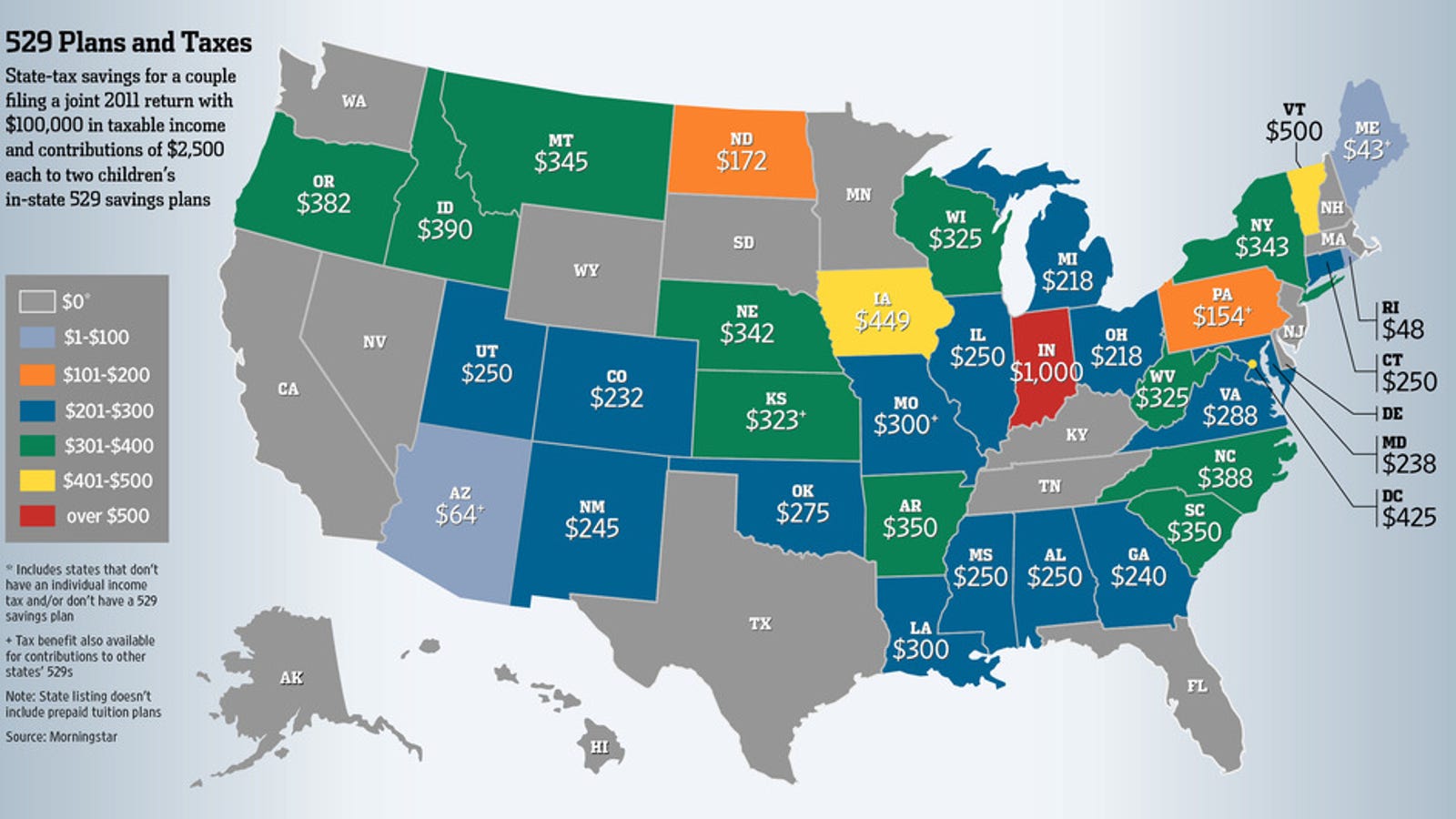

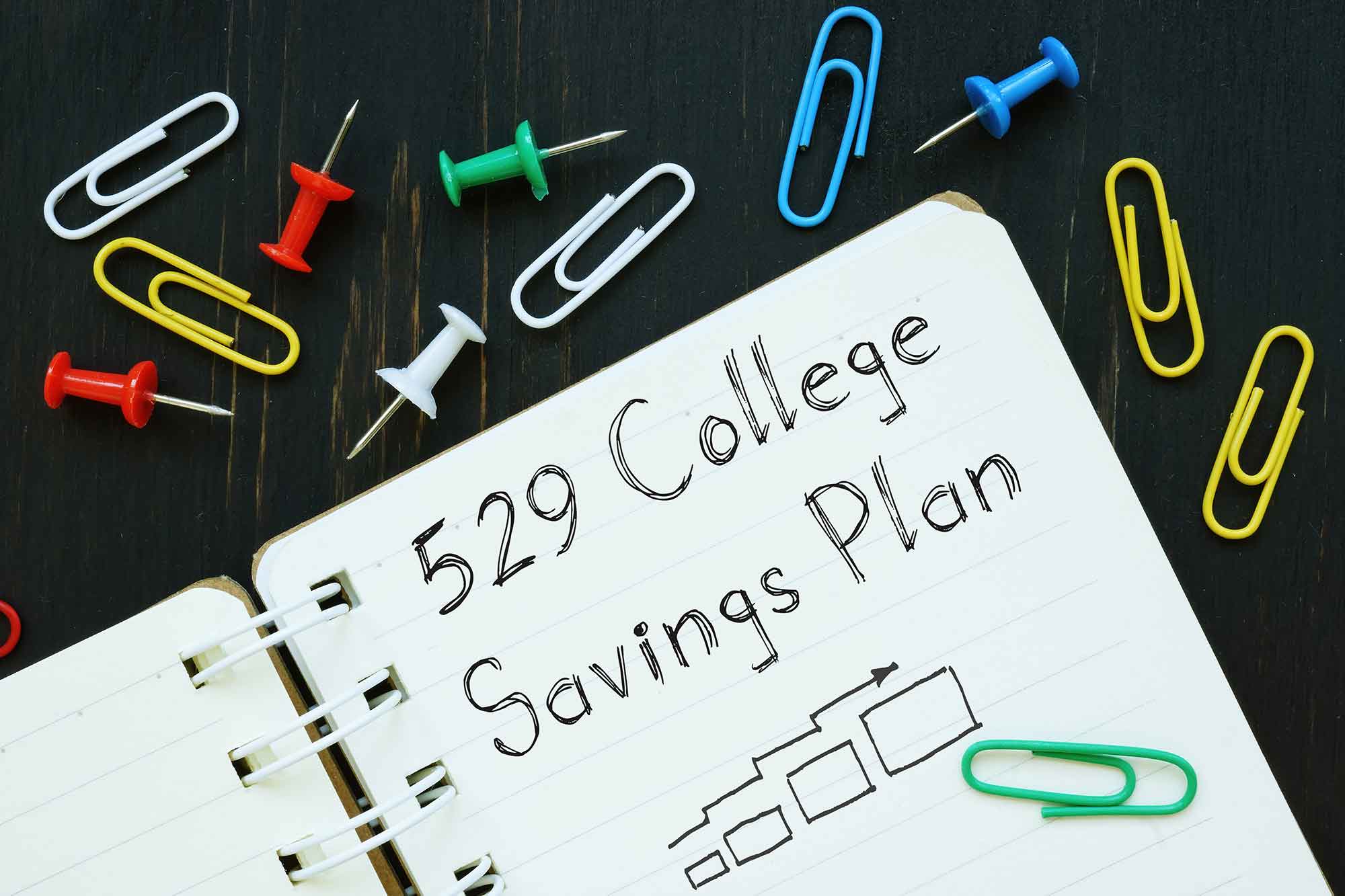

The Tax Benefits Of College 529 Savings Plans Compared By State

529 College Savings Plans State by State Tax Benefit Comparison 2015

The Best And Worst 529 Plans Forbes Advisor

529 Plan Benefits You May Not Know About Mercer Advisors

529 Plan Benefits You May Not Know About Mercer Advisors

If 529 Plans Get Taxed Here s Another Tax free Option

The New Tax Code Has Extra Perks For 529 Savers Your State May Not

529 Versus ESA The Best For College Savings Mark J Kohler

529 Plan Georgia Tax Benefit - The Georgia Path2College 529 Plan a TIAA managed 529 savings program features a year of enrollment track with 10 portfolios and six static investment options including a Principal Plus Interest Portfolio with a minimum effective annual