7500 Ev Rebate 2024 The IRS first started handing out tax credits to EV buyers in 2022 after the passing of the Inflation Reduction Act up to 7 500 for new cars The policy was a key part of President Biden s

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit 225 000 for heads of households 150 000 for all other filers You can use your modified AGI from the year you take delivery of the vehicle or the year before whichever is less If your modified AGI is below the threshold in 1 of the two years you can claim the credit

7500 Ev Rebate 2024

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg)

7500 Ev Rebate 2024

https://duet-cdn.vox-cdn.com/thumbor/0x0:4928x3280/2400x1600/filters:focal(2464x1640:2465x1641):format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg

3 Best Electric Cars Still Eligible For 7 500 EV Tax Credit

https://www.motorbiscuit.com/wp-content/uploads/2022/05/Front-view-of-blue-2022-Ford-Mustang-Mach-E-one-of-the-best-electric-cars-still-eligible-for-7500-EV-tax-credit.jpg?w=1200

EV Buyers Can Get An Instant 7 500 Rebate On Their New Vehicle Starting Next Year DNyuz

https://dnyuz.com/wp-content/uploads/2023/09/Hilton-will-install-20000-Tesla-chargers-at-its-hotels-to.jpeg

7 500 EV tax credit may be easier to get in 2024 per Treasury rule Personal Finance Treasury Department aims to make it easier to get 7 500 EV tax credit in 2024 Published Tue Oct 10 In order to claim the credit on an EV purchase buyers need to slot under an adjusted gross income limitation of 300 000 for married couples filing jointly 225 000 for head of household or

The Inflation Reduction Act offers a tax credit worth up to 7 500 to those who buy new electric vehicles It also offers a 4 000 credit for used EVs New rules for 2024 will allow buyers to get The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

Download 7500 Ev Rebate 2024

More picture related to 7500 Ev Rebate 2024

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Tesla Launches budget Models In The US But There s A Catch

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1fMCR1.img

Oregon Pausing Generous 7 500 Rebate For Buying An EV

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18PdQX.img?w=1920&h=1080&m=4&q=50

As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable EV buyers will get an instant rebate of as much as 7 500 starting in 2024 The Verge Electric Cars Cars Transpo EV buyers will get an instant rebate of as much as 7 500

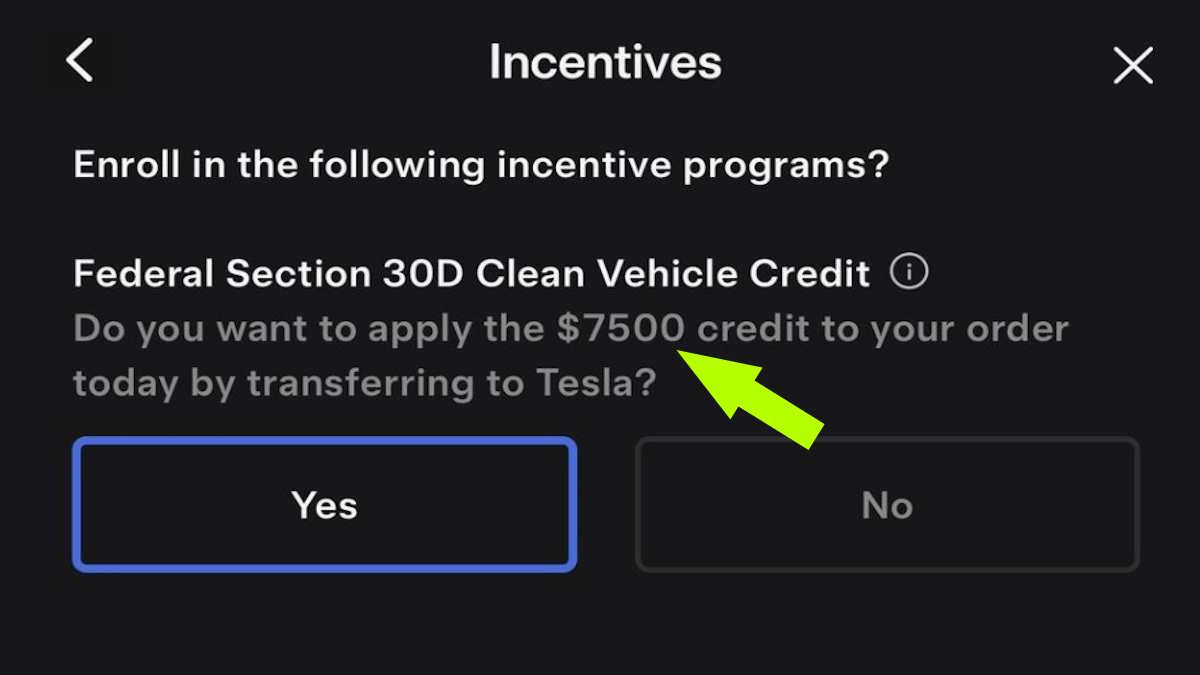

The new regs published October 6 2023 bring happy news for EV buyers Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and A tax credit of up to 7 500 is available on new and used EVs that meet certain criteria The amount of the tax credit depends on where the EVs are made where their battery components and

GM Electric Vehicles Will Be Eligible For 7 500 Tax Rebate In 2 3 Years Autoblog

https://s.aolcdn.com/os/ab/_cms/2022/09/15124603/chevy-equinox-ev-detroit-auto-show-01.jpg.jpg

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t Be Easy NCPR News

https://media.npr.org/assets/img/2023/01/06/gettyimages-1243236963-1--742bba825bbd259580ed72411dbf7eae6b5409ca.jpg

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg?w=186)

https://fortune.com/2024/01/26/irs-ev-tax-credit-7500-instant-discount/

The IRS first started handing out tax credits to EV buyers in 2022 after the passing of the Inflation Reduction Act up to 7 500 for new cars The policy was a key part of President Biden s

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

2024 Chevy Equinox To Bring Affordable EVs To Hot selling Compact SUVs

GM Electric Vehicles Will Be Eligible For 7 500 Tax Rebate In 2 3 Years Autoblog

Point Of Sale Instant Rebate Easier Access To The 7 500 EV Tax Credit In 2024 YouTube

GM Electric Vehicles Will Be Eligible For 7 500 Tax Rebate In 2 3 Years Autoblog

Tesla Finally Offering The 7 500 EV Tax Credit As An Instant Rebate At Point Of Sale Torque News

Washington Governor s 7 500 EV Rebate Remains Uncertain

Washington Governor s 7 500 EV Rebate Remains Uncertain

Oregon Pausing Generous 7 500 Rebate For Buying An EV

Federal Rebate EV 2023 Up To 7 500 FREE Money Global Assist Hub

EV Tax Credit Extension With 7 500 Point of sale Rebate 4 000 For Used EVs Could Pass Senate Soon

7500 Ev Rebate 2024 - 7 500 EV tax credit may be easier to get in 2024 per Treasury rule Personal Finance Treasury Department aims to make it easier to get 7 500 EV tax credit in 2024 Published Tue Oct 10