80c Repayment Of Housing Loan Principal Amount Section 80C of the Income Tax Act allows for a deduction of payment of principal component and it is allowed on the basis of actual payment made in the financial year and not on the basis of amount due

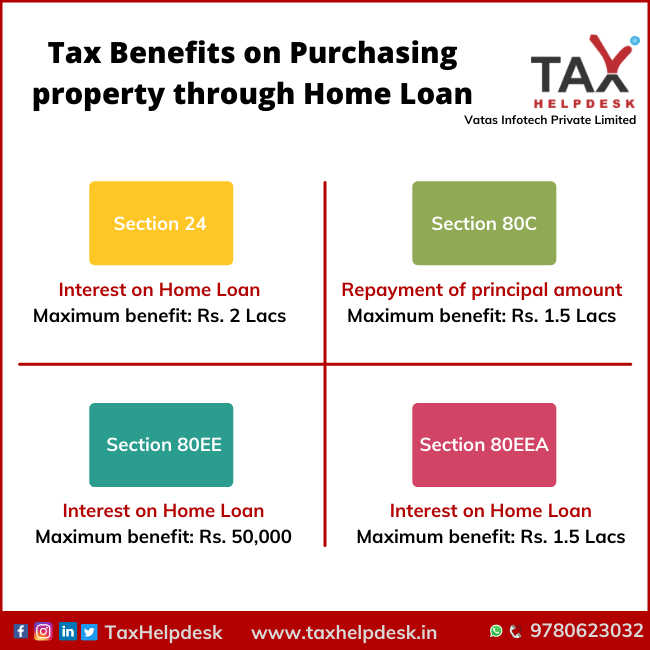

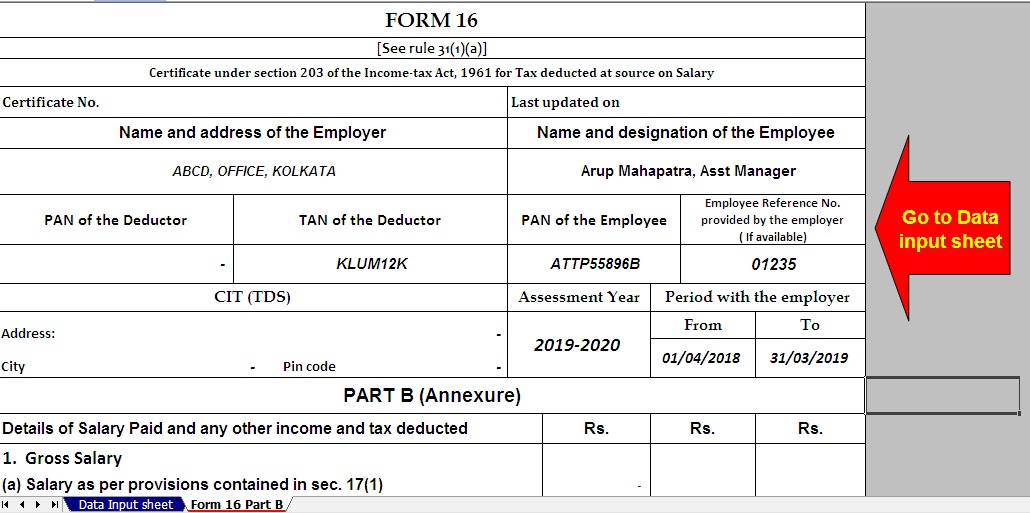

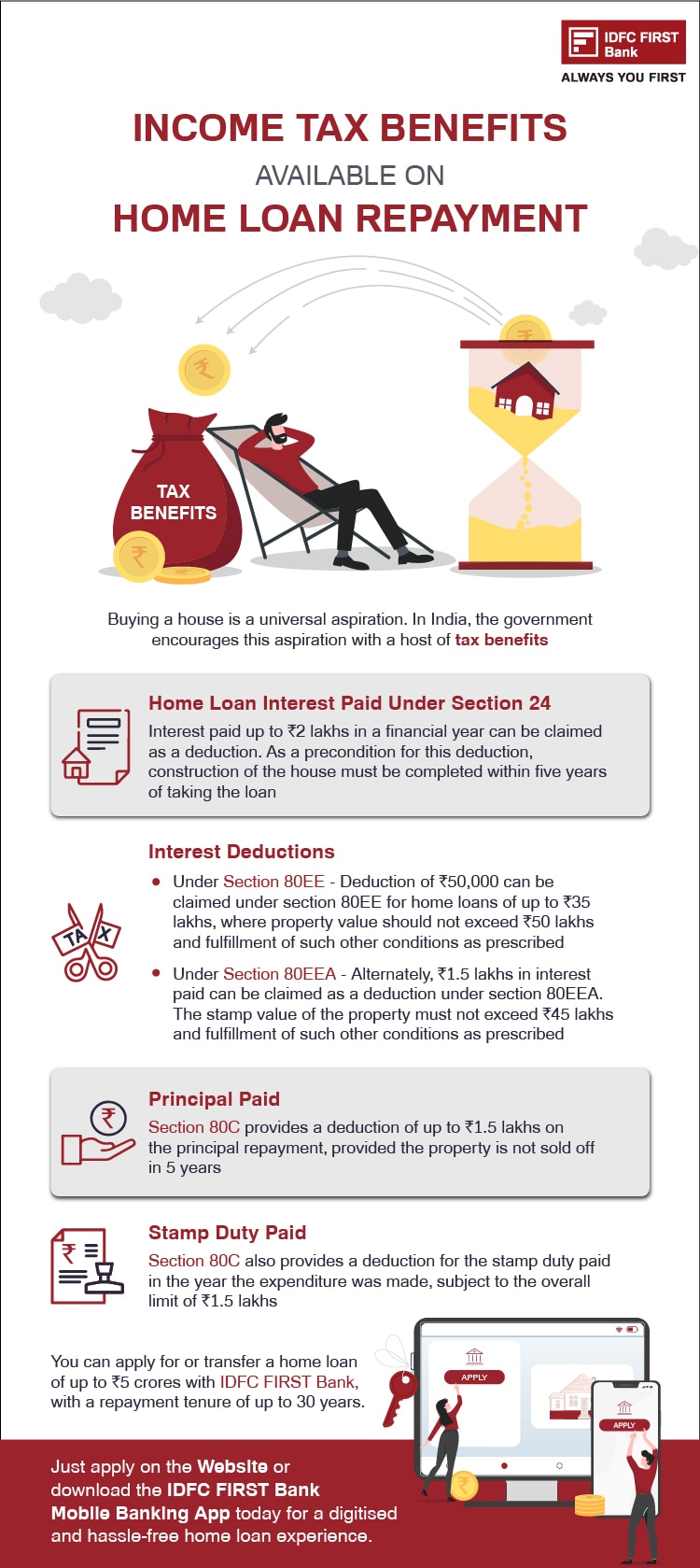

These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1

80c Repayment Of Housing Loan Principal Amount

80c Repayment Of Housing Loan Principal Amount

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

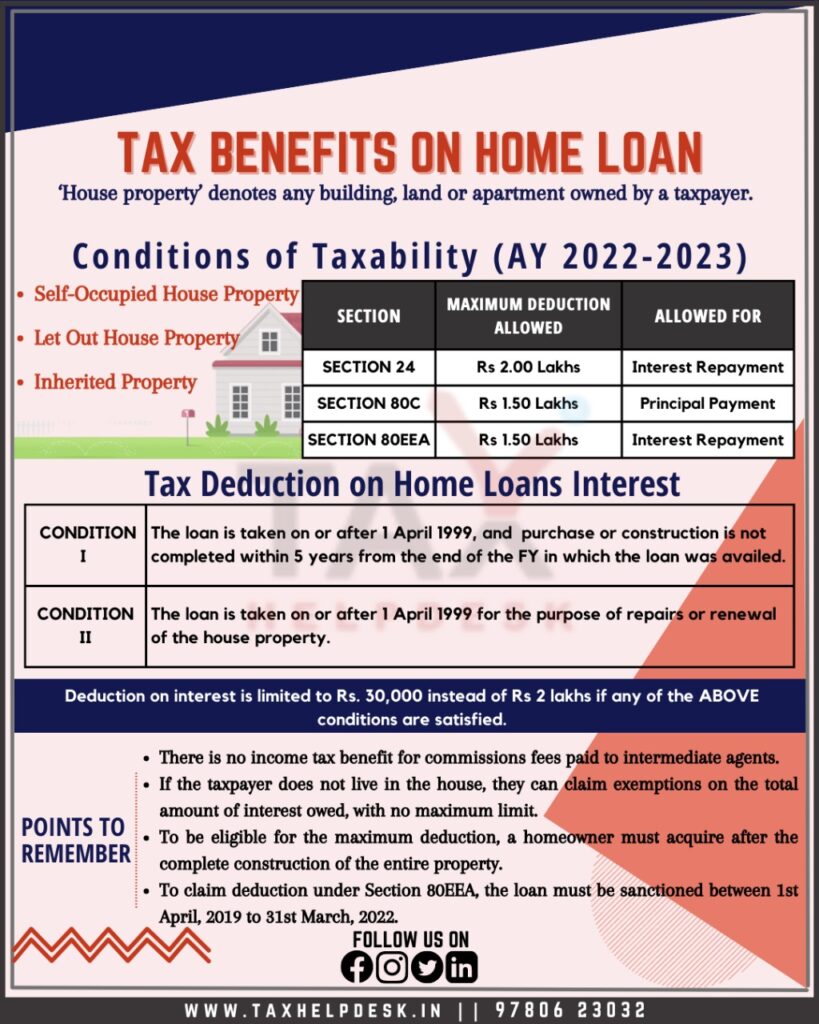

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Yes the principal repayment of a home loan is eligible for deduction under Section 80C subject to the overall limit of 1 50 000 However the property should not be sold within five years of As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre Under section 80 c of the Income Tax Act tax deduction of a maximum amount of up to Rs 1 5 lakh can be availed per financial year on the principal repayment portion of the EMI This deduction can only be

Download 80c Repayment Of Housing Loan Principal Amount

More picture related to 80c Repayment Of Housing Loan Principal Amount

80C Deduction

https://www.taxmani.in/wp-content/uploads/2022/12/80c-deduction-for-ay-2022-23-1024x576.jpg

Seven Home Loan Repayment Options Borrowers Should Know About

https://assets-news.housing.com/news/wp-content/uploads/2020/09/03170050/Seven-home-loan-repayment-options-borrowers-should-know-about-676x400.jpg

Section 80C Of The Income Tax Act 5 Smart Things To Know About

https://img.etimg.com/thumb/msid-48313019,width-640,height-480,resizemode-75,imgsize-163975/section-80c-of-the-income-tax-act.jpg

In addition to the interest deduction you can also claim a deduction for the principal amount you repay on your home loan under Section 80C of the Income Tax Income tax benefits for home loans include deductions under Section 80C for principal repayment up to 1 50 lakh and under Section 24 b for interest paid

There are also certain expenditures permitted under section 80C that can help you save tax If you have incurred any of the expenses mentioned below in the Repayment of home loan Those repaying a home loan can claim deductions of up to Rs 1 50 lakhs per annum against home loan principal repayment Section 80C

Principal Repayment Needs A Separate IT Section Housing News

https://assets-news.housing.com/news/wp-content/uploads/2016/02/23141006/Principal-repayment-needs-a-separate-IT-section-iStock_000063753849_Medium-blog.png

Personal Loan Sample Letter Secretary Job Objective Resume Resume

https://i.pinimg.com/originals/47/9e/4b/479e4b7b21b114356c3e2d5dfe1b821c.jpg

https://taxguru.in/income-tax/tax-benefits-ho…

Section 80C of the Income Tax Act allows for a deduction of payment of principal component and it is allowed on the basis of actual payment made in the financial year and not on the basis of amount due

https://housing.com/news/home-loans-gui…

These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

Want To Save Tax Over And Above 80C Limit Of Rs 1 5 Lakh Invest In

Principal Repayment Needs A Separate IT Section Housing News

Home Loan Principal Repayment 4 Expenses To Help You In Tax saving

How New Tax Regime May Impact Homebuyers In FY24 Mint

Deduction Of Principal Component And Interest Paid On Housing Loan

INCOME TAX CALCULATION UNDER OLD AND NEW TAX REGIMES FOR F Y 2020 21

INCOME TAX CALCULATION UNDER OLD AND NEW TAX REGIMES FOR F Y 2020 21

Home Loan Tax Deductions India

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Self Declaration For Claiming Housing Loan Principal Interest Benefit

80c Repayment Of Housing Loan Principal Amount - Can I claim tax benefits on the principal repaid on a housing loan Yes you can avail of tax benefits on the principal amount repaid on the home loan from total income under