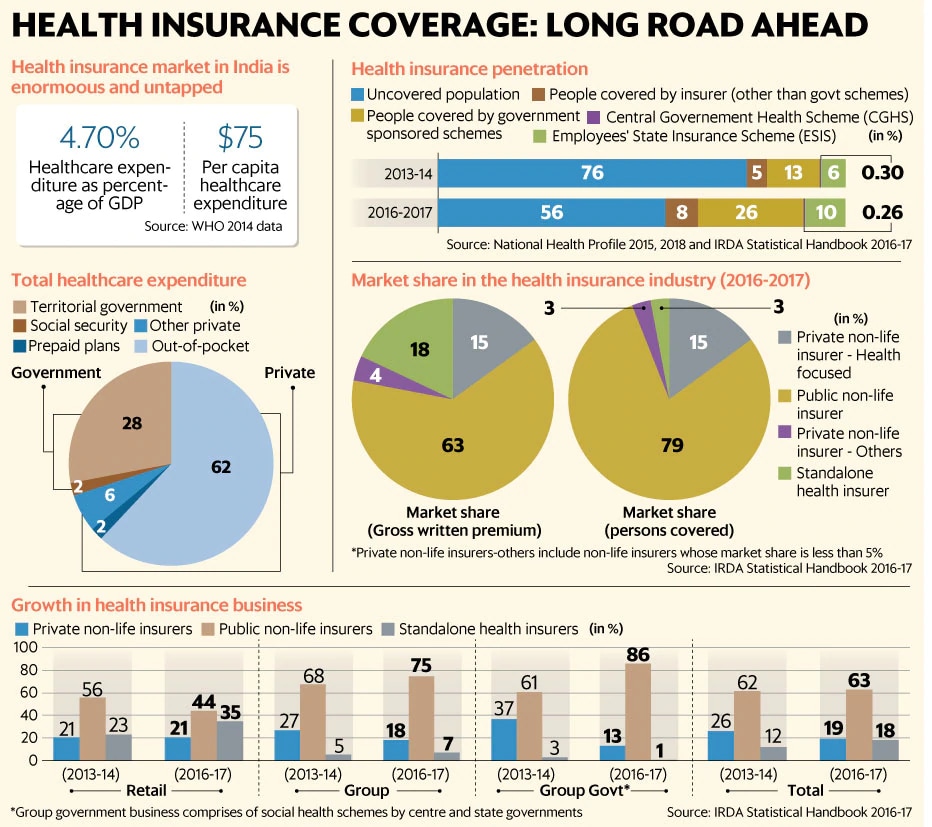

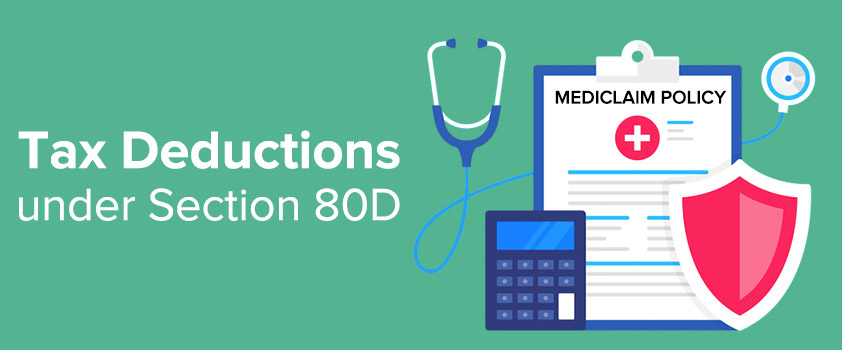

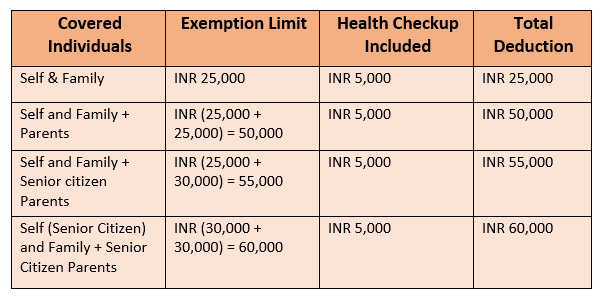

80d Deduction Income Tax Act Verkko 8 jouluk 2023 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This deduction is also available for top up health plans and critical illness plans The best part is that it is over and above the Rs 1 5 lakh limit deductions claimed under Section 80C

Verkko Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr Citizen mode other than cash Payment made for preventive health check up Verkko Tax Deduction Under Section 80D of Income Tax Act 1961 Under Section 80D tax deduction can be claimed on premium paid on health insurance Who is covered for tax deduction

80d Deduction Income Tax Act

80d Deduction Income Tax Act

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/Income-Tax-Act-80D.png

Section 80D What Is Section 80D Eligibility Deduction Calculation

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/income-tax-80d.jpg

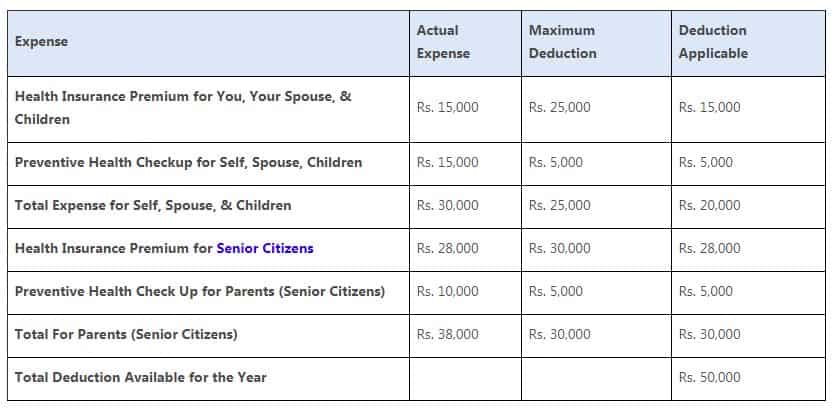

Verkko 9 maalisk 2023 nbsp 0183 32 What is the limit of deduction under section 80D of Income Tax You can claim a deduction of up to Rs 25 000 for medical insurance premiums for yourself your spouse and your children If you are paying your parents health insurance premium you can claim an additional deduction of Rs 25 000 Verkko 5 tammik 2022 nbsp 0183 32 Section 80D deduction is also available for the members of Hindu Undivided Families on the mediclaim taken for any of them Here too members aged less than 60 years will be eligible for tax benefits of up to Rs 25 000 It goes up to Rs 50 000 when the insured is above 60 years of age

Verkko 23 jouluk 2022 nbsp 0183 32 Under Section 80D of the Income Tax Act an individual can claim a deduction for the following medical expenses incurred during the financial year Medical insurance premium paid by the taxpayer through any mode of payment other than cash Expenses incurred under any Central Government health schemes Sum paid on Verkko 10 maalisk 2023 nbsp 0183 32 The maximum tax deduction allowed under Section 80D is Rs 25 000 for premiums paid for self spouse and dependent children and an additional Rs 25 000 for premiums paid for parents If the parents are senior citizens age 60 years and above the maximum deduction limit increases to Rs 50 000

Download 80d Deduction Income Tax Act

More picture related to 80d Deduction Income Tax Act

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up.jpg

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

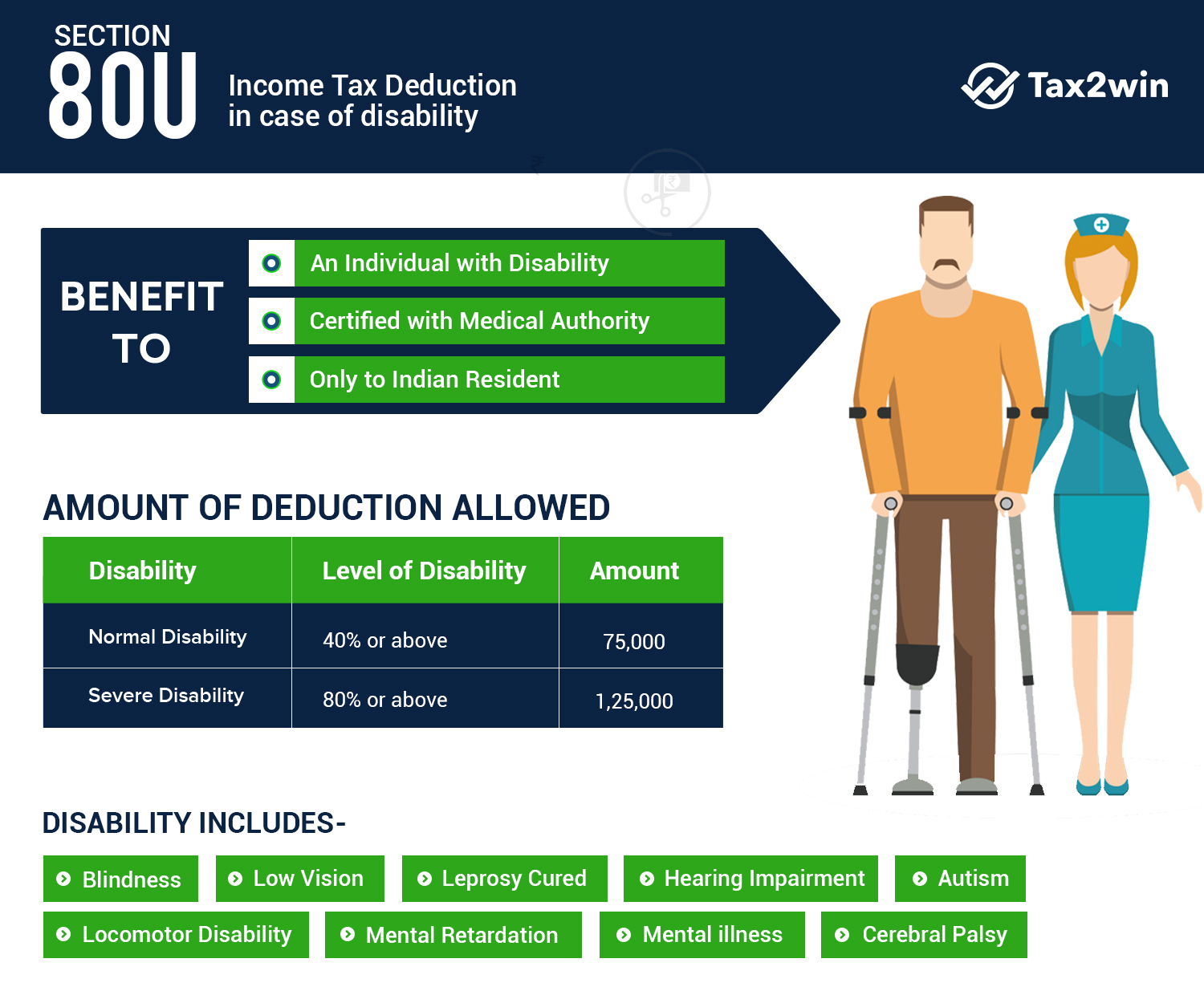

Verkko 15 jouluk 2023 nbsp 0183 32 Section 80D of the Income Tax Act 1961 functions as a provision that facilitates tax deductions for individuals investing in health insurance Under this section taxpayers can avail themselves of tax deductions of up to Rs 25 000 on health insurance premiums paid within a financial year Notably this limit is different for senior citizens Verkko 14 tuntia sitten nbsp 0183 32 To maximise your tax savings make the most of deductions available under Section 80C for investments 80D for health insurance premiums Section 24 for home loan interest and Section 80CCD for

Verkko 7 jouluk 2023 nbsp 0183 32 Section 80D Deduction for FY 23 24 Updated on December 8 2023 64440 views Section 80D of the income tax Act 1961 provides tax benefits on the health insurance policies You can claim a tax Deduction for the health insurance premium paid for self parents children and spouse Moreover 80D section also Verkko 20 Sep 2019 73 704 Views 9 comments Deduction under section 80D of the Income Tax Act is available in addition to the deduction of INR 1 50 Lakhs available collectively under section 80C section 80CCC and section 80CCD 1 Deduction under section 80D is available basically for two types of payment namely 1

Section 80D Income Tax Act Dialabank Best Offers

https://www.dialabank.com/wp-content/uploads/2019/11/Section-80D.jpg

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/80U-Deduction-in-case-of-disability.jpg

https://cleartax.in/s/medical-insurance

Verkko 8 jouluk 2023 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This deduction is also available for top up health plans and critical illness plans The best part is that it is over and above the Rs 1 5 lakh limit deductions claimed under Section 80C

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Verkko Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr Citizen mode other than cash Payment made for preventive health check up

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Section 80D Income Tax Act Dialabank Best Offers

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act For Medical Bills Under Section 80D

Income Tax Act For Medical Bills Under Section 80D

Income Tax Calculator Section 80D Allows You This Much Of Tax

Section 80D Deduction Income Tax IndiaFilings

Deduction 80D Upload Form 16

80d Deduction Income Tax Act - Verkko 15 jouluk 2023 nbsp 0183 32 Income Tax Act Section 80D authorises tax deductions up to 226 185 25 000 for self and family covers spouse and children on health insurance premiums paid If your parents are over 60 the deduction rises to 50 000 rupees Moreover you can get an additional tax break of 50 000 rupees if your elderly parents have health insurance