80d Tax Rebate For Regular Checkup Web 1 mars 2022 nbsp 0183 32 Cost of preventive health check up Rs 7 000 So tax deduction under Section 80D Rs 20 000 Rs 5 000 Rs 25 000 Case 3 Premium paid Rs 24 000

Web 13 juin 2019 nbsp 0183 32 Secure your health and save on taxes with Section 80D Explore the income tax deductions available for medical insurance premiums Understand the eligibility Web 15 f 233 vr 2023 nbsp 0183 32 All tax savings are inclusive of cess at 4 Deduction on preventive health check ups Section 80D allows an individual to claim tax benefit for preventive health

80d Tax Rebate For Regular Checkup

80d Tax Rebate For Regular Checkup

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up.jpg

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/tax-us-80d-chart.png

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

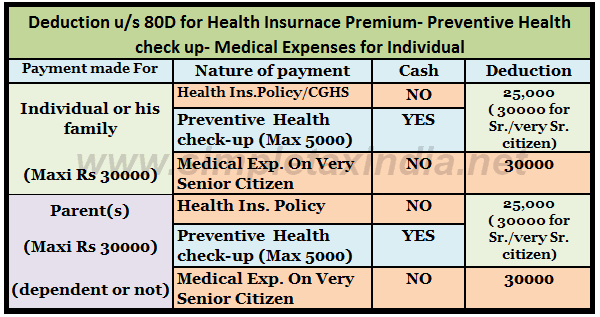

Web Payment made for preventive health check up Medical expenditure on the health of Resident very senior citizen for whom no amount is paid to effect keep in force health mode of payment other than cash DEDUCTION UNDER SECTION 80D Reset Web 16 f 233 vr 2016 nbsp 0183 32 The maximum amount including all family members is allowed as Rs 5 000 Remember that there is no separation The cost of

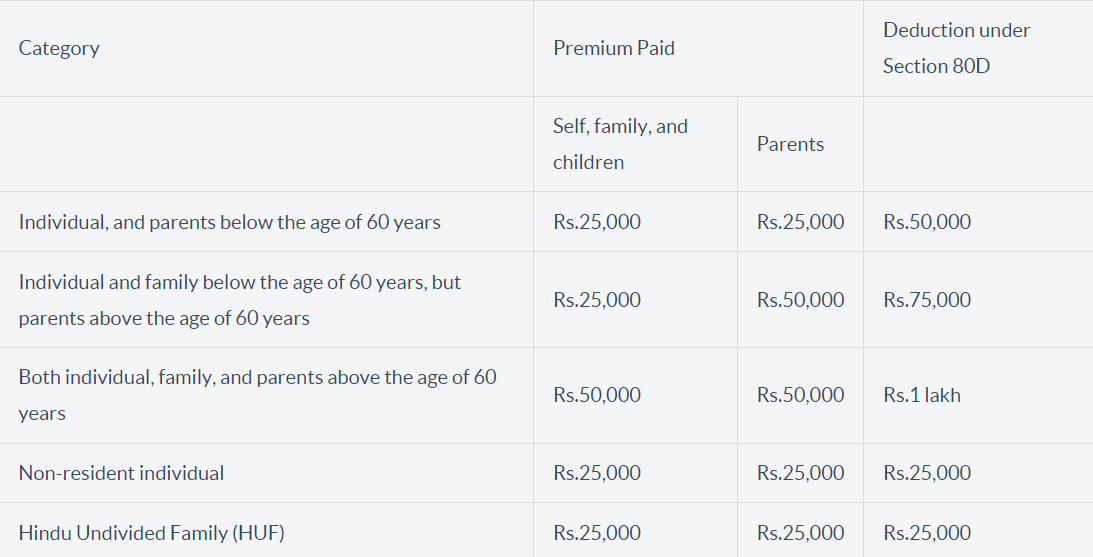

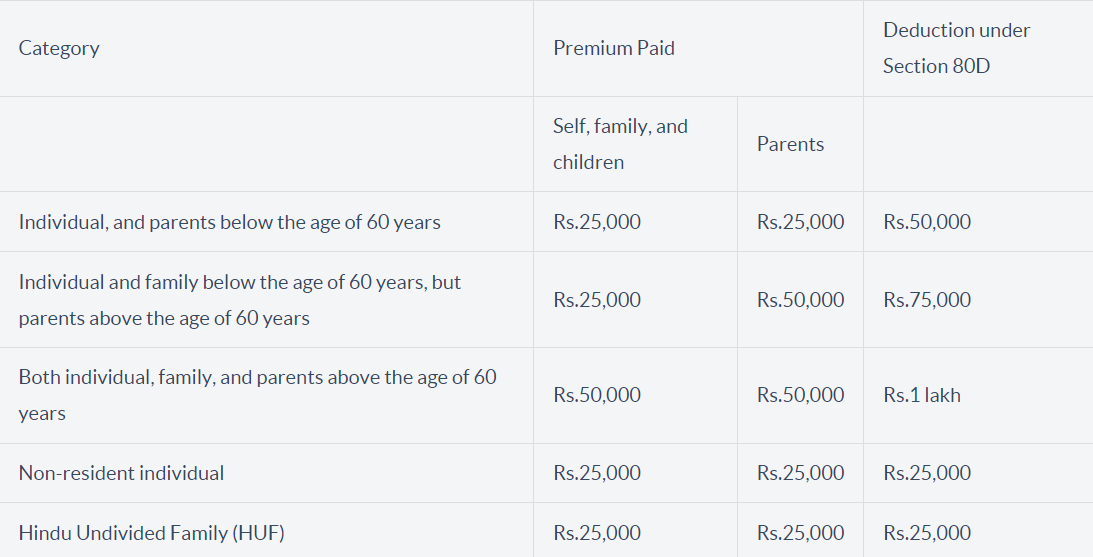

Web 10 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income Tax Act 1961 allows an individual to claim a deduction of up to Rs 25 000 Rs 50 000 for senior citizens in respect of any Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

Download 80d Tax Rebate For Regular Checkup

More picture related to 80d Tax Rebate For Regular Checkup

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

https://4.bp.blogspot.com/-2BihF6FG36E/WIbyy4F5x1I/AAAAAAAAPlM/kPJoPX-nK148RZ2z3EoRedH3Vrs1_6p5ACLcB/s1600/DEDUCTION%2BSECTION%2B%2B80D%2BHEALTH%2BINSURANCE%2BPREVENTIVE%2BHEALTH%2BCHECK%2BUP%2BMEDICAL%2BEXP..png

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/Income-Tax-Act-80D-1.jpg

Income Tax Ceiling Limit In India Homeminimalisite

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Web Under Section 80D of the Income Tax Act in India individuals can claim a maximum deduction of up to Rs 5 000 per financial year for preventive health check ups This deduction is available for the taxpayer as well as Web 1 f 233 vr 2023 nbsp 0183 32 Under Section 80D of the Income Tax Act you can get preventive health checkup income tax benefits Section 80D allows tax benefits against the medical insurance premium that you pay for yourself your spouse children and your parents The benefit can go up to Rs 25 000 Rs 50 000 depending on the age of the insured person

Web 1 f 233 vr 2023 nbsp 0183 32 In accordance with the provisions of section 80D of the Income Tax Act a deduction of Rs 25 000 is available in which you can also claim any payment towards Web 26 d 233 c 2021 nbsp 0183 32 Sub limit for preventive health check up is up to 5 000 per annum Medical expenditure incurred up to 50 000 per annum if no amount has been paid towards insurance

How To Claim Health Insurance Under Section 80D From 2018 19

https://i0.wp.com/myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

https://www.paybima.com/.../preventive-health-check-up-and-its-tax-benefit

Web 1 mars 2022 nbsp 0183 32 Cost of preventive health check up Rs 7 000 So tax deduction under Section 80D Rs 20 000 Rs 5 000 Rs 25 000 Case 3 Premium paid Rs 24 000

https://tax2win.in/guide/section-80d-deduction-medical-insurance...

Web 13 juin 2019 nbsp 0183 32 Secure your health and save on taxes with Section 80D Explore the income tax deductions available for medical insurance premiums Understand the eligibility

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

How To Claim Health Insurance Under Section 80D From 2018 19

Anything To Everything Income Tax Guide For Individuals Including

PREVENTIVE HEALTH CHECK UP IN 80 D Income Tax

80D Tax Benefit Madhan s Money Tricks

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

What Is The Limit Of Income Tax Exemption Under Section 80D Quora

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Epf Contribution Table For Age Above 60 2019 Frank Lyman

80d Tax Rebate For Regular Checkup - Web Payment made for preventive health check up Medical expenditure on the health of Resident very senior citizen for whom no amount is paid to effect keep in force health mode of payment other than cash DEDUCTION UNDER SECTION 80D Reset