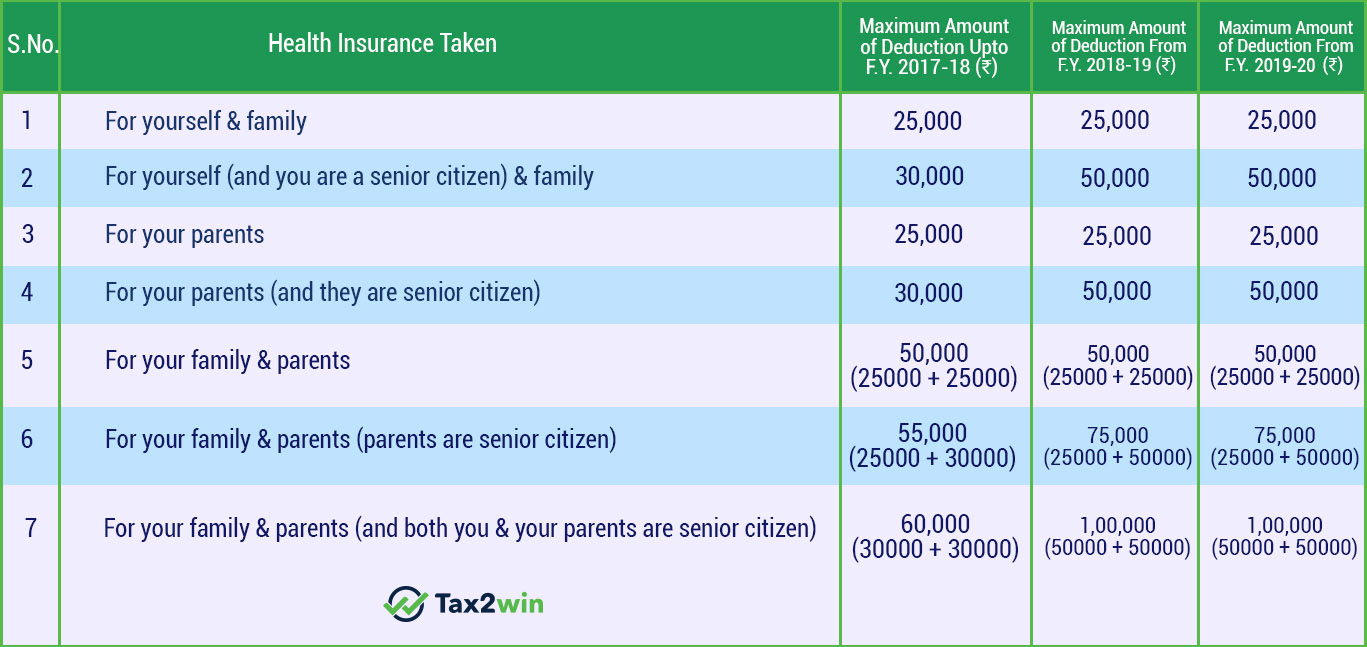

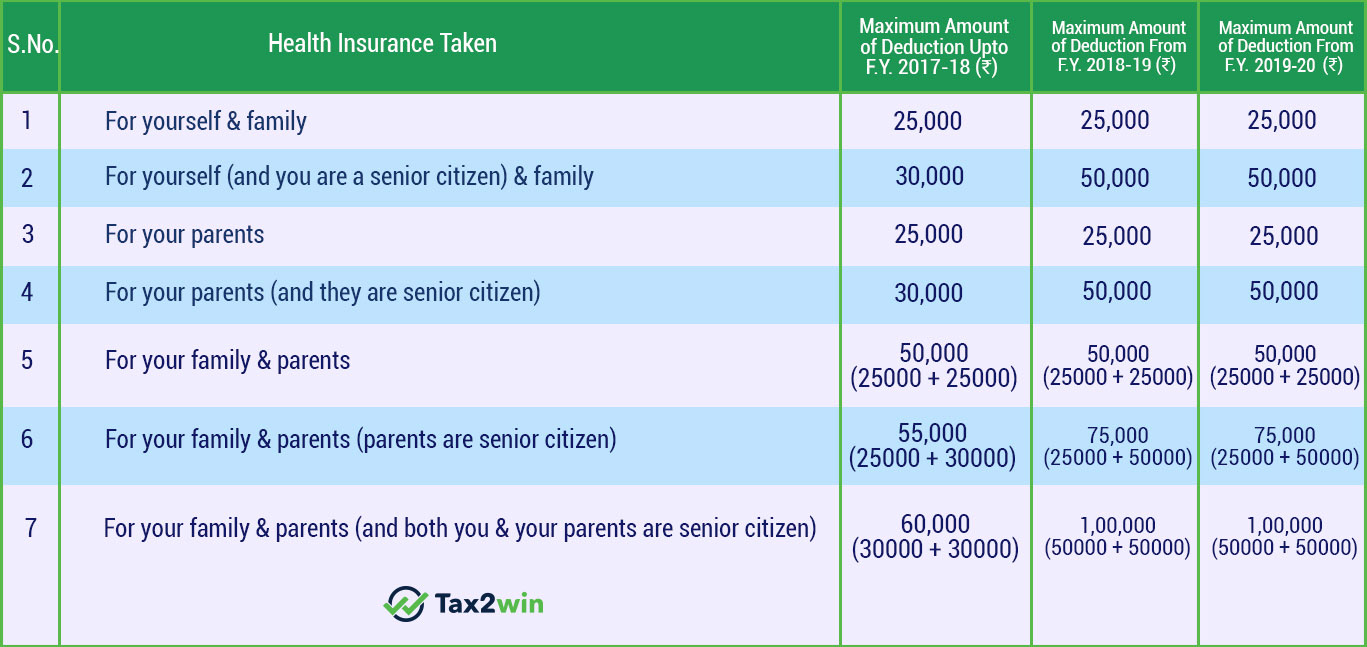

80d Tax Rebate Web Here s all about tax deductions of near INR 25 000 and up to INR 50 000 you can claim separately for self spouse parents and dependent under

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over Web 13 juin 2019 nbsp 0183 32 If you have medical insurance and want to maximize your tax savings

80d Tax Rebate

80d Tax Rebate

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

What s The Distinction Between PMI And Home Loan Defense Insurance

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up.jpg

Web 12 sept 2023 nbsp 0183 32 If you purchase health insurance you can avail deductions up to Web 5 janv 2022 nbsp 0183 32 In case both your parents or either of them is aged above 60 years the maximum tax rebate increases up to Rs 50 000 per annum HUF Section 80D deduction is also available for the members of Hindu

Web Section 80D offers tax deductions on health insurance premiums of up to a maximum Web Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health

Download 80d Tax Rebate

More picture related to 80d Tax Rebate

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

How To Claim Health Insurance Under Section 80D From 2018 19

https://i0.wp.com/myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Web 8 juil 2020 nbsp 0183 32 Case 1 When the policyholder who is under the age of 60 has opted only

Web Section 80D provides for tax deduction from the total taxable income for the payment by Web 1 f 233 vr 2023 nbsp 0183 32 Step 1 Login to the Income Tax E filing Portal Firstly you need to log in to

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

https://www.forbes.com/advisor/in/tax/section …

Web Here s all about tax deductions of near INR 25 000 and up to INR 50 000 you can claim separately for self spouse parents and dependent under

https://www.financialexpress.com/money/income-tax/tax-benefits-u-s-80d...

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

80D Tax Deduction Under Section 80D On Medical Insurance

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

Deduction 80D Upload Form 16

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Section 80D Of Income Tax Act Know The Deduction Limit For AY 2020 21

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

80d Tax Rebate - Web Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health