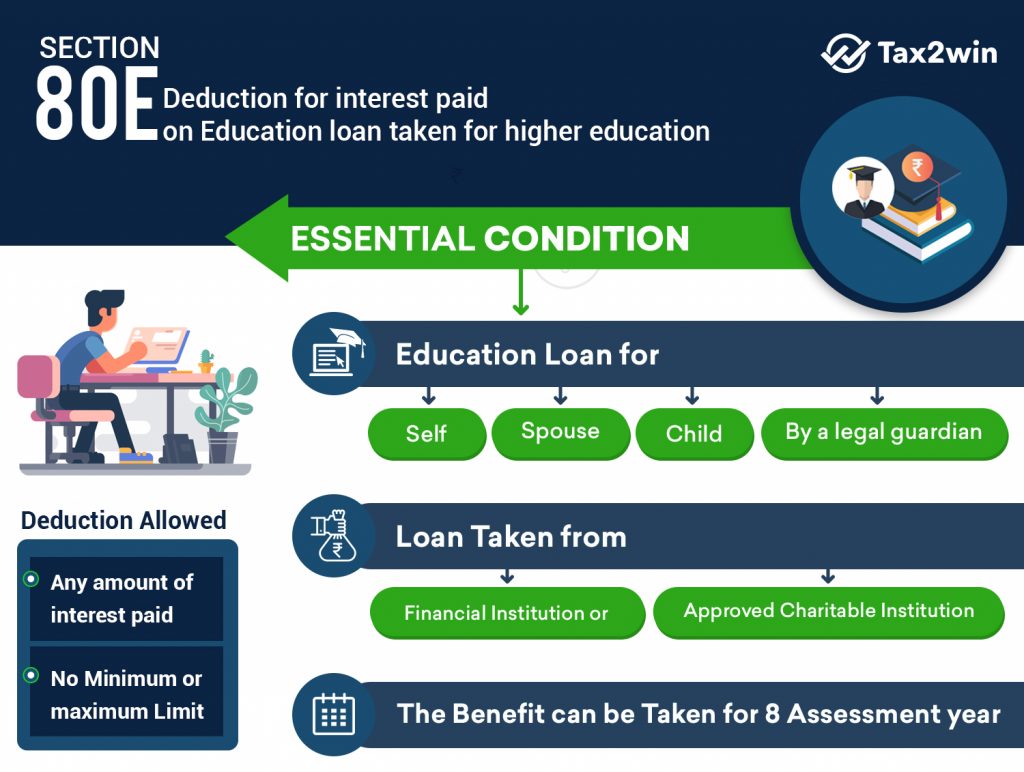

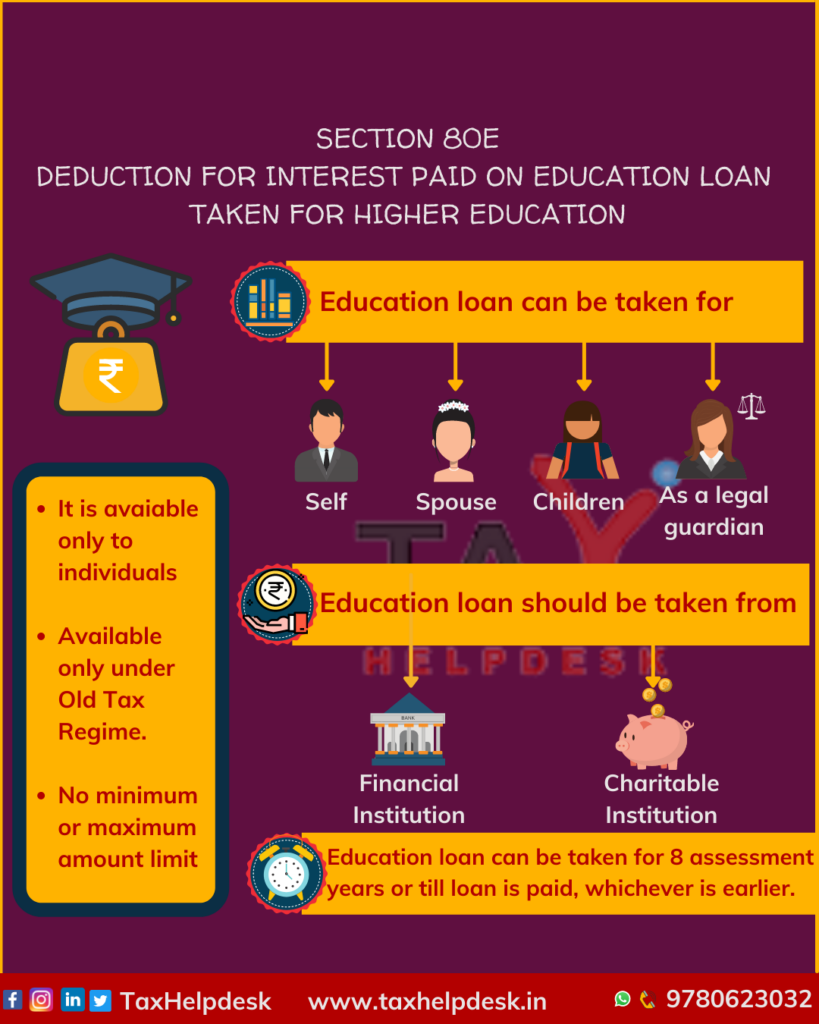

80e Income Tax Rebate Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing A set of criteria is

Web 12 janv 2022 nbsp 0183 32 Tax deduction under this section can be claimed by the parents as well as the children So the person who is going to repay the loan whether the child or the Web 28 juin 2019 nbsp 0183 32 What is section 80E of Income Tax Section 80E is the income tax deduction from taxable income which covers the deduction on the interest

80e Income Tax Rebate

80e Income Tax Rebate

https://i.ytimg.com/vi/GMyVG7nHb3k/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYUCBeKGUwDw==&rs=AOn4CLBzdHsitEG4Y4102hcjJuJ1JJSw9g

Deduction U s 80E Income Tax Deduction 80E Tax Deduction On

https://i.ytimg.com/vi/jL0KmGSmhLc/maxresdefault.jpg

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

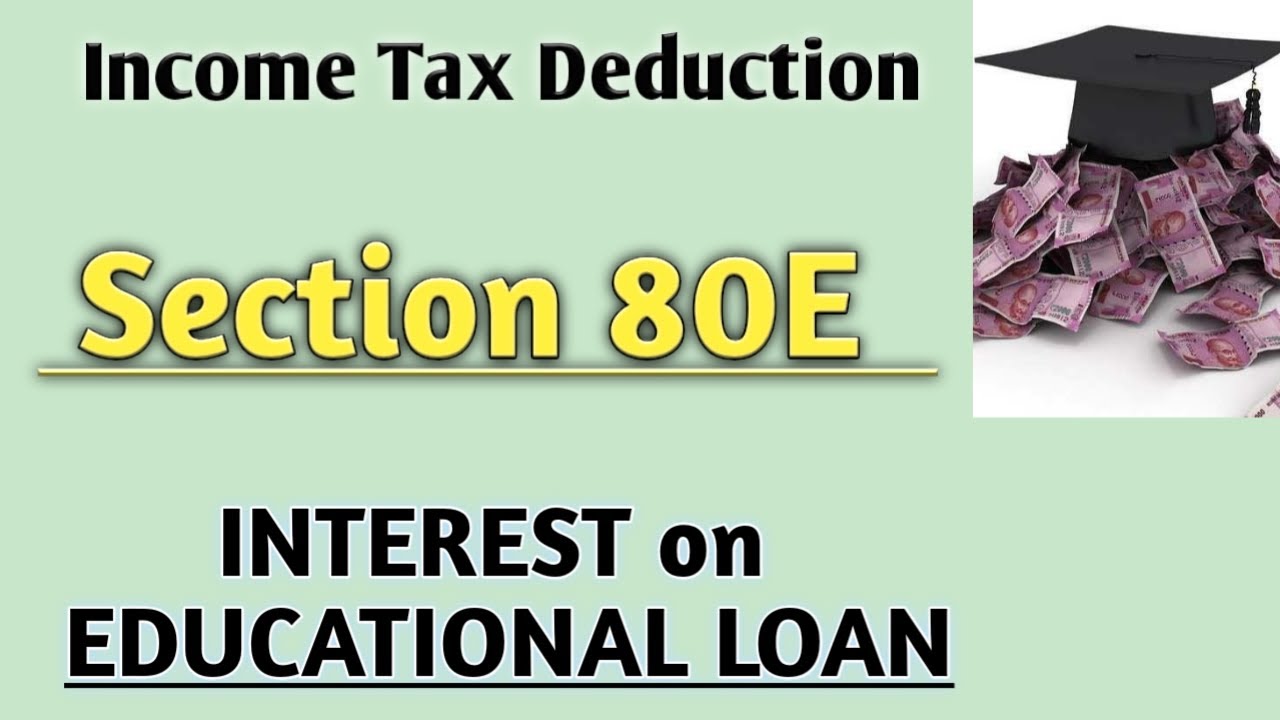

Web Section 80E Income Tax Deduction for Education Loan As per the Income Tax Act a taxpayer is allowed to claim deduction under Chapter VI A for the Repayment of Education Loan Section 80E and for the Repayment of Web Results Amount you save The amount you save if you opt for the 80 E tax benefits when repaying for years Effective ROI This will be the actual rate of interest you will be paying on your loan instead of 8 5 Know

Web 11 sept 2023 nbsp 0183 32 Section 80E of the Income Tax Act provides provisions for tax deductions on educational loans This is available only for the interest component of the loan This Web Income Tax Deduction Under Section 80E Given the rising cost of higher studies we end up spending a considerable amount of savings to meet the same If you intend to take a

Download 80e Income Tax Rebate

More picture related to 80e Income Tax Rebate

Section 80E Income Tax Deduction Interest On Education Loan FY 2022

https://i.ytimg.com/vi/wgPaiPU_Yew/maxresdefault.jpg

How To Save Maximum Tax In India 2021 22 Investodunia

https://blog.tax2win.in/wp-content/uploads/2019/03/80E-Deduction-for-interest-paid-on-loan-taken-for-higher-education-1024x772.jpg

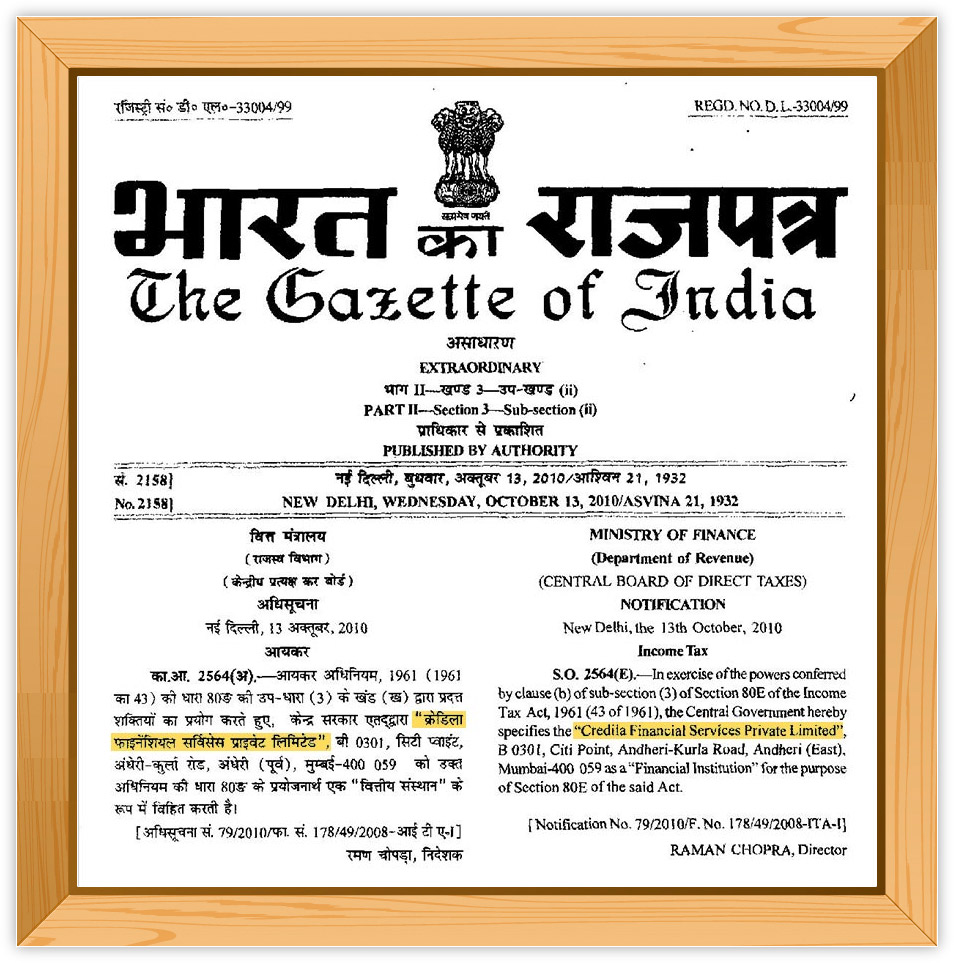

80E Income Tax Benefit Gazette Notification

https://www.hdfccredila.com/images/Credila_80E_Income_Tax_Benefit.jpg

Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are metTax benefits have been laid down under Section 80E of the Income Tax Act For deduction Web 28 oct 2021 nbsp 0183 32 Claim Education Loan Interest Portion in income tax Return of F Y 2020 211 Deduction allowed is the total interest part of the EMI paid during the financial

Web Section 80E of the Income Tax Act Gone are the days when one has to take a pause or quit the plan pf higher studies due to unavailability of funds in the family Read more Best Web Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilit 233

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

https://media-exp1.licdn.com/dms/image/C5112AQHqrwHBQU8UDg/article-cover_image-shrink_720_1280/0/1576673225796?e=2147483647&v=beta&t=3aN3iFT6ITtGnzVxkxMfzfmVxLs-QDmExdmA0MLCDgc

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing A set of criteria is

https://navi.com/blog/section-80e-income-tax-act

Web 12 janv 2022 nbsp 0183 32 Tax deduction under this section can be claimed by the parents as well as the children So the person who is going to repay the loan whether the child or the

Deduction Under Section 80E Interest Paid On Higher Education

Under Section 80E You Can Claim Income Tax Deduction For Interest Paid

How To Save Tax Under Section 80C 80E 80G 80DDB FY 2020 21

Deduction U s 80E Setion 80E Of Income Tax Education Loan YouTube

Section 80E Tax Deduction On

Solved Qu stion 34 Acon Corporation Has Provided The Chegg

Solved Qu stion 34 Acon Corporation Has Provided The Chegg

Deduction Under Section 80E Income Tax Act 1961 CommerceLesson in

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

Income Tax Rebate Under Section 87A

80e Income Tax Rebate - Web Results Amount you save The amount you save if you opt for the 80 E tax benefits when repaying for years Effective ROI This will be the actual rate of interest you will be paying on your loan instead of 8 5 Know