80g Deduction Limit With Example Web 11 Dez 2023 nbsp 0183 32 Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s Web The deduction available under Section 80G is over and above the deduction of Rs 1 50 000 allowed under Section 80C Recommended Read How to save tax in 8

80g Deduction Limit With Example

80g Deduction Limit With Example

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

80G Deduction Limit How To Calculate Deduction Limit For 80G Of IT Act

https://newtaxroute.com/wp-content/uploads/2020/07/80G-deduction-limit-1.png

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2019/03/80G-deduction-in-respect-of-donation-to-funds-charitable-institutions-590x550@2x.jpg

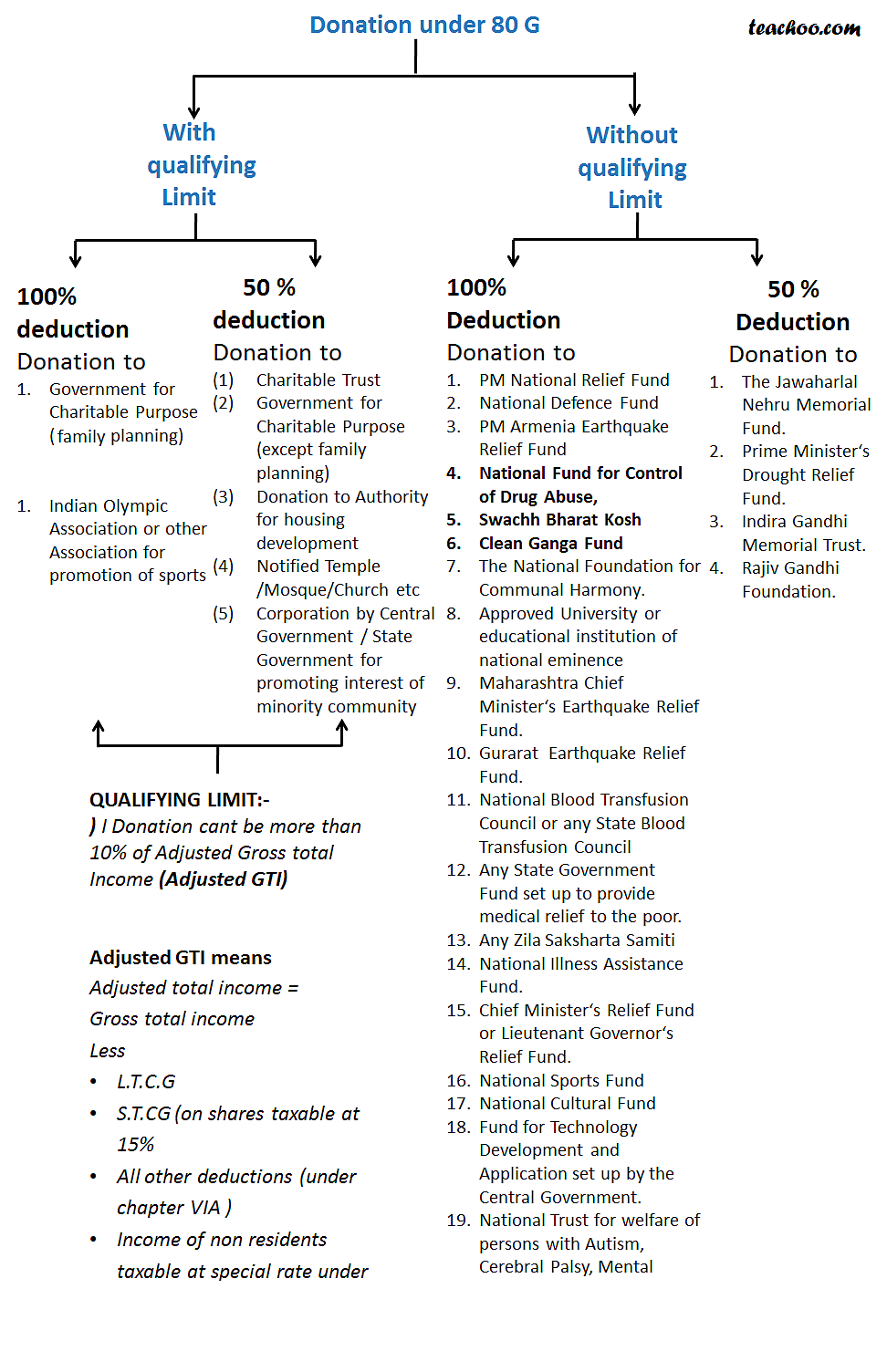

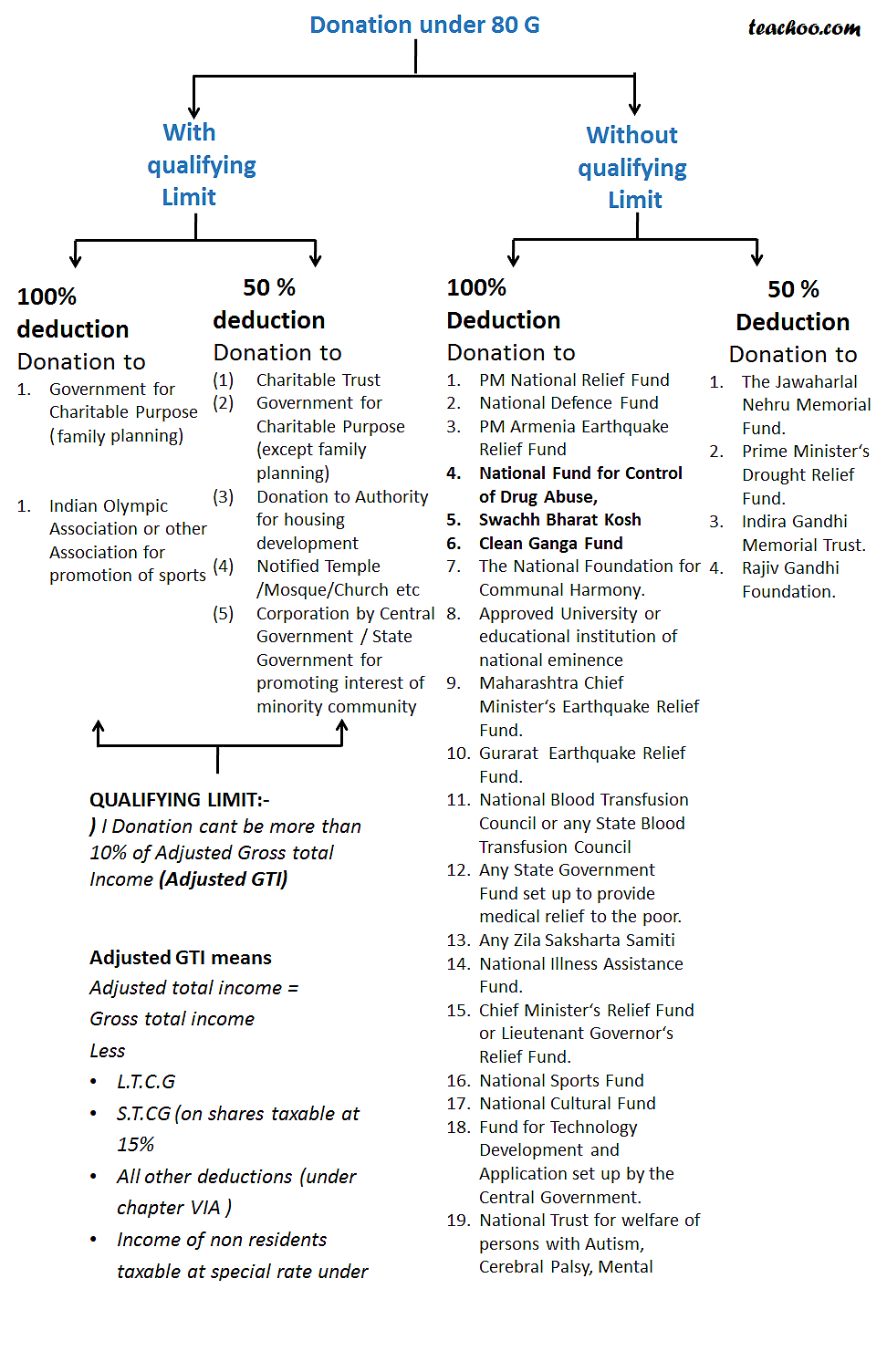

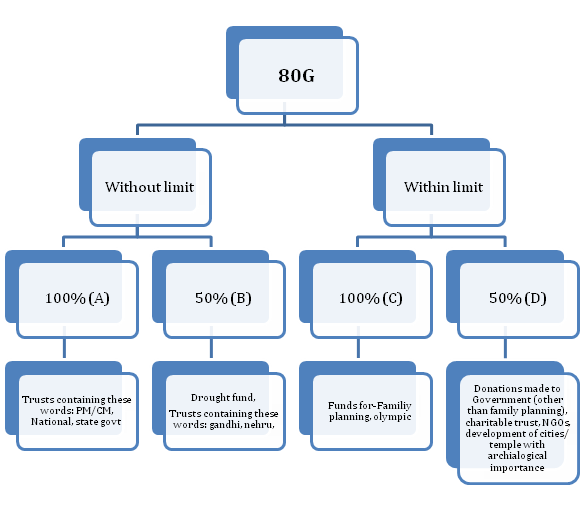

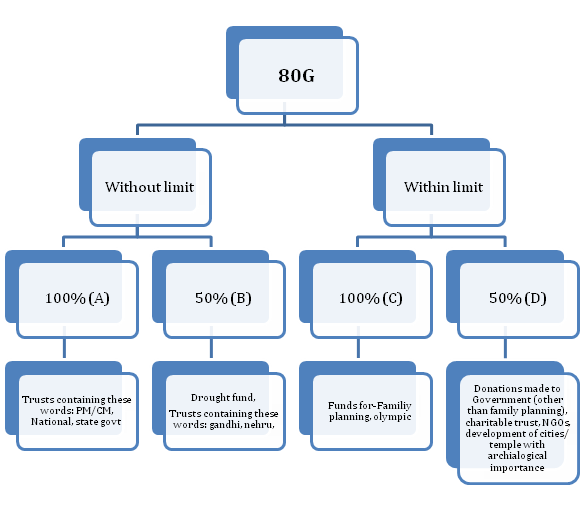

Web 24 Okt 2023 nbsp 0183 32 Example 100 Deduction Subject to 10 of Adjusted Gross Total Income or Donations Eligible for 100 Deduction Without Qualifying Limit and so on In this illustration let us calculate the amount Web 14 Juli 2020 nbsp 0183 32 80G deduction list Donee Notified Funds 80G Deduction Limit Any other fund or any institution which satisfies the conditions mentioned in Section 80G 5 50 Government or any local authority to

Web 24 Sept 2022 nbsp 0183 32 32 8K In This Article Show What is Section 80G Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Web 20 Apr 2023 nbsp 0183 32 The most that can be deducted in accordance with Section 80G is 50 of the lower of the following amounts a the amount contributed i e Rs 90 000 b the

Download 80g Deduction Limit With Example

More picture related to 80g Deduction Limit With Example

How Can Section 80G 80GG Help You Avail Tax Benefits

https://wp.sqrrl.in/wp-content/uploads/2018/10/Section-80G.png

80G Donation Limit 80G Deduction Under Income Tax Calculation Of

https://i.ytimg.com/vi/-UzKNqOp9o8/maxresdefault.jpg

Explanation Of Section 80G Tax ExemptionLimit Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/07/Section-80G.png

Web 6 Aug 2023 nbsp 0183 32 Section 80G says that donations over Rs 2 000 should be made in a way other than cash Section 80G says that you can deduct up to 100 or 50 with or Web 12 Apr 2023 nbsp 0183 32 Chartered accountant Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to

Web Exemption Limit under Section 80G Under section 80G there is no defined maximum deduction limit It all depends on the type of fund or institute you donate and sometimes Web 28 Sept 2019 nbsp 0183 32 1 Donations qualified for 100 deduction without qualifying limit 2 Donations qualified for 100 deduction subject to 10 of the adjusted gross total

Deduction Under Section 80G With Solved Examples Based On 80G

https://i.ytimg.com/vi/lEt3isjXRrQ/maxresdefault.jpg

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-3-1180x395.jpg

https://cleartax.in/s/donation-under-section-80g-and-80gga

Web 11 Dez 2023 nbsp 0183 32 Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

https://taxguru.in/income-tax/all-about-deduct…

Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s

Section 80G Deduction Revision Part 4 YouTube

Deduction Under Section 80G With Solved Examples Based On 80G

Section 80G Deduction For Donation To Charitable Organizations

Section 80G Deduction When 100 When 50 Chapter 5 Income From Sa

Information On Section 80G Of Income Tax Act Ebizfiling

What Is The Procedure Of 80g Registration In India Corpbiz

What Is The Procedure Of 80g Registration In India Corpbiz

Tax Deduction U s 80G Of Income Tax Act relief On Charity

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Exhausted Your 80C Limit Claim Deduction U s 80G For Donations To Ch

80g Deduction Limit With Example - Web 26 Dez 2023 nbsp 0183 32 A few tax benefits do have some restrictions While certain donations can have up to a 100 deduction there are a few with limits Generally Section 80G