80g Donation Example Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is

Any assessee who has paid any sum by way of donation is eligible to claim deduction under this provision to the extent of 50 to 100 of the donation made For certain donations the deduction is limited to 10 of Make Tax Deductible Donation under Section 80G Donations to SERUDS Charity will be eligible for 50 tax exemption under Section 80G of Income Tax Act Indian Donors will get instant Tax Exemption Receipts their

80g Donation Example

80g Donation Example

https://psddaddy.com/wp-content/uploads/2019/11/charity.jpg

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

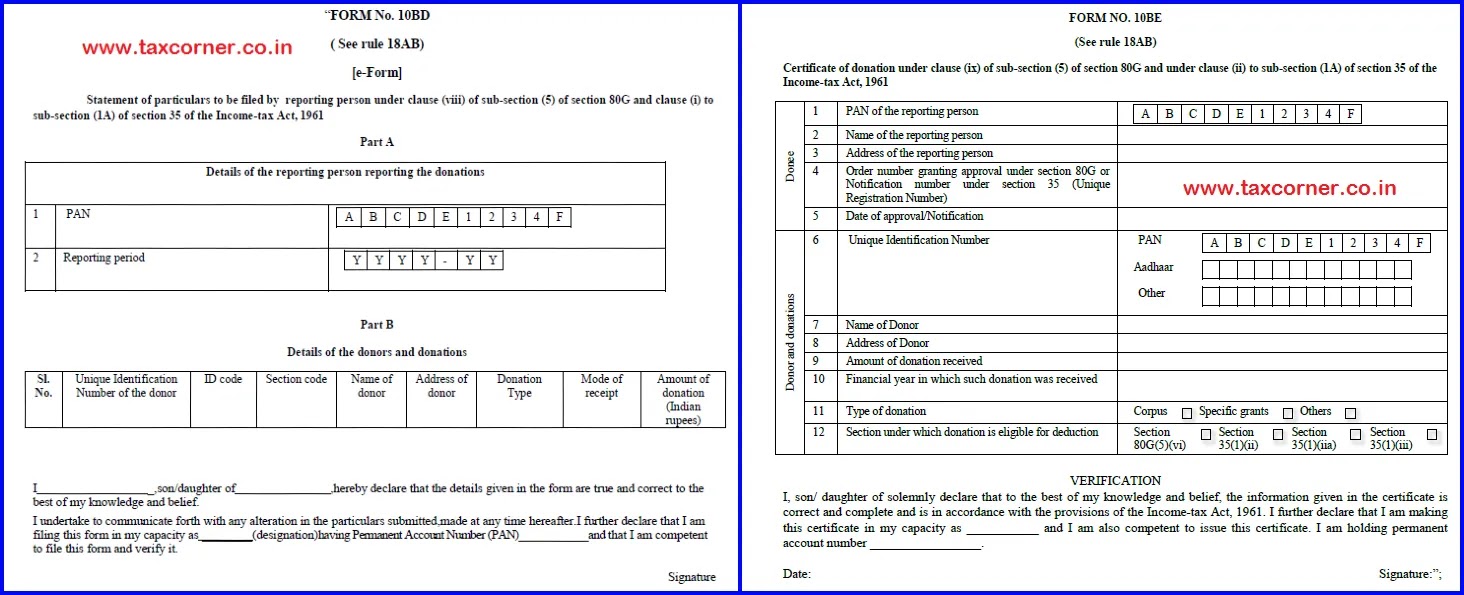

Needed File Online Form No 10BD For Donations Eligible 80G

https://carajput.com/blog/wp-content/uploads/2022/08/statement-of-donation-in-form-no-10bd-certificate-of-donation-in-form-10be-section-80g-5-and-rule-18ab.jpg

Only donations in cash cheque are eligible for the tax deduction under section 80G Donations in kind do not entitle for any tax benefits For What is Section 80G Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a

Section 80G of the Income Tax Act provides deductions for donations made to specified funds charitable institutions and organizations The purpose is to encourage philanthropy and social Section 80G of the Income Tax Act provides tax incentives to individuals contributing to eligible charitable trusts or institutions This section allows for deductions on donations made to

Download 80g Donation Example

More picture related to 80g Donation Example

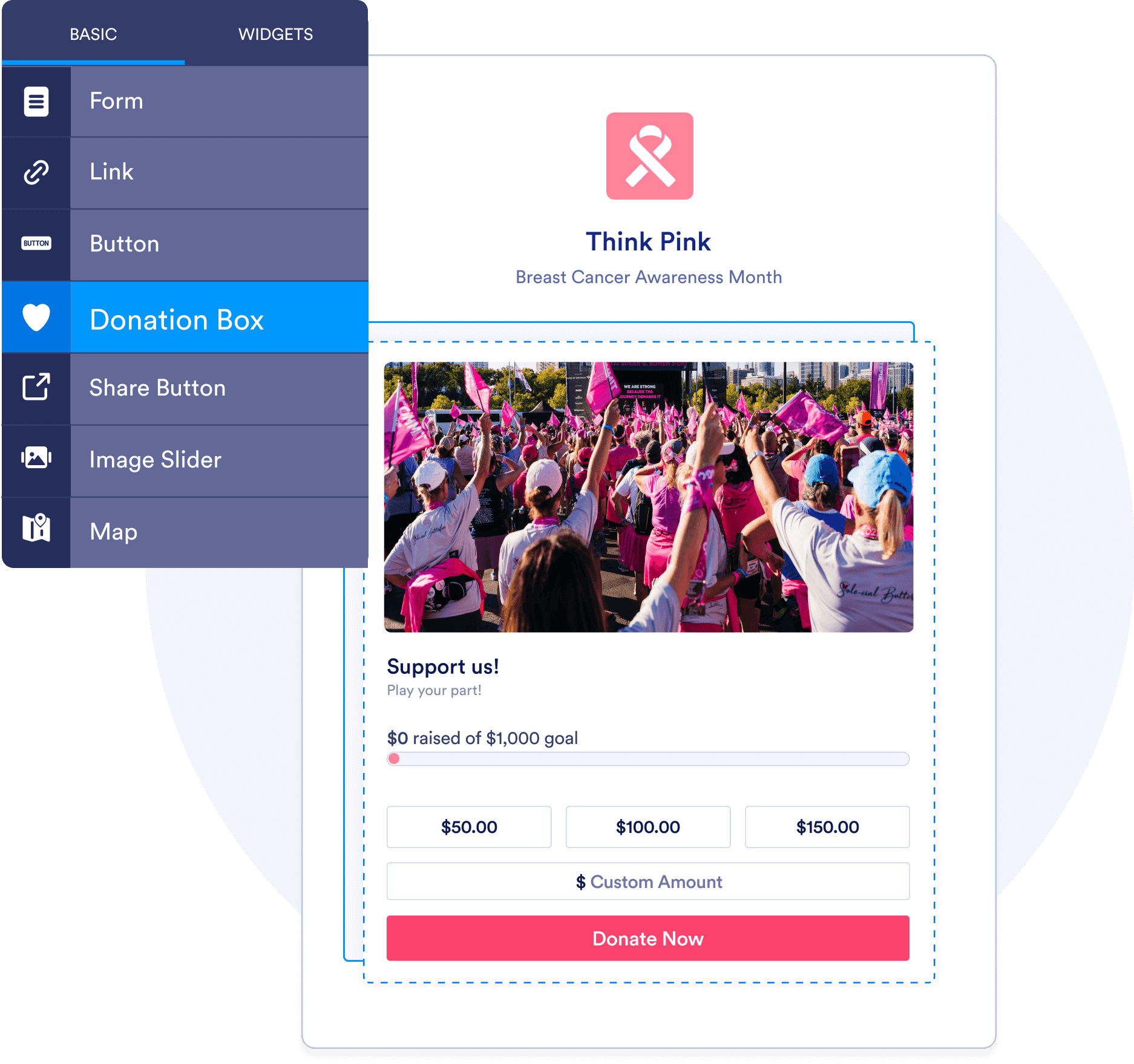

Donation Apps An Easy Way To Collect Donations

https://cdn.jotfor.ms/p/products/donation-apps/assets/img-min/how-to/slide1.png

Add A Donation The Sebaus Foundation

https://sebaus.org/wp-content/uploads/2021/10/logo-1-highres.png

Donation Receipt Format Free Download

http://mybillbook.in/s/wp-content/uploads/2023/02/donation-receipt-format.jpg

For claiming the deduction under section 80G it is important to understand the acceptable mode of payment through which donation contribution can be made Deduction under section 80G is available only when the Section 80G offers a tax deduction for donations to certain prescribed funds and charitable institutions Here are the details of the section Eligible Assesses This section is

Section 80G of the Income Tax Act provides deductions for donations made to certain charitable institutions and funds The amount of deduction varies depending on the Section 80G of the Income Tax Act 1961 allows individuals to claim deductions for donations made to specified relief funds or charitable institutions Donations made under this

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2019/03/80G-deduction-in-respect-of-donation-to-funds-charitable-institutions-590x550@2x.jpg

Fundraiser Clipart Donation Picture 1176321 Fundraiser Clipart Donation

https://webstockreview.net/images/donation-clipart-fundraiser-12.png

https://tax2win.in › guide

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is

https://www.taxmann.com › ...

Any assessee who has paid any sum by way of donation is eligible to claim deduction under this provision to the extent of 50 to 100 of the donation made For certain donations the deduction is limited to 10 of

Donation Box Vector Illustration Donut Donation Charity PNG And

Chapter VI A 80G Deduction For Donation To Charitable Institution

Donation Free Of Charge Creative Commons Handwriting Image

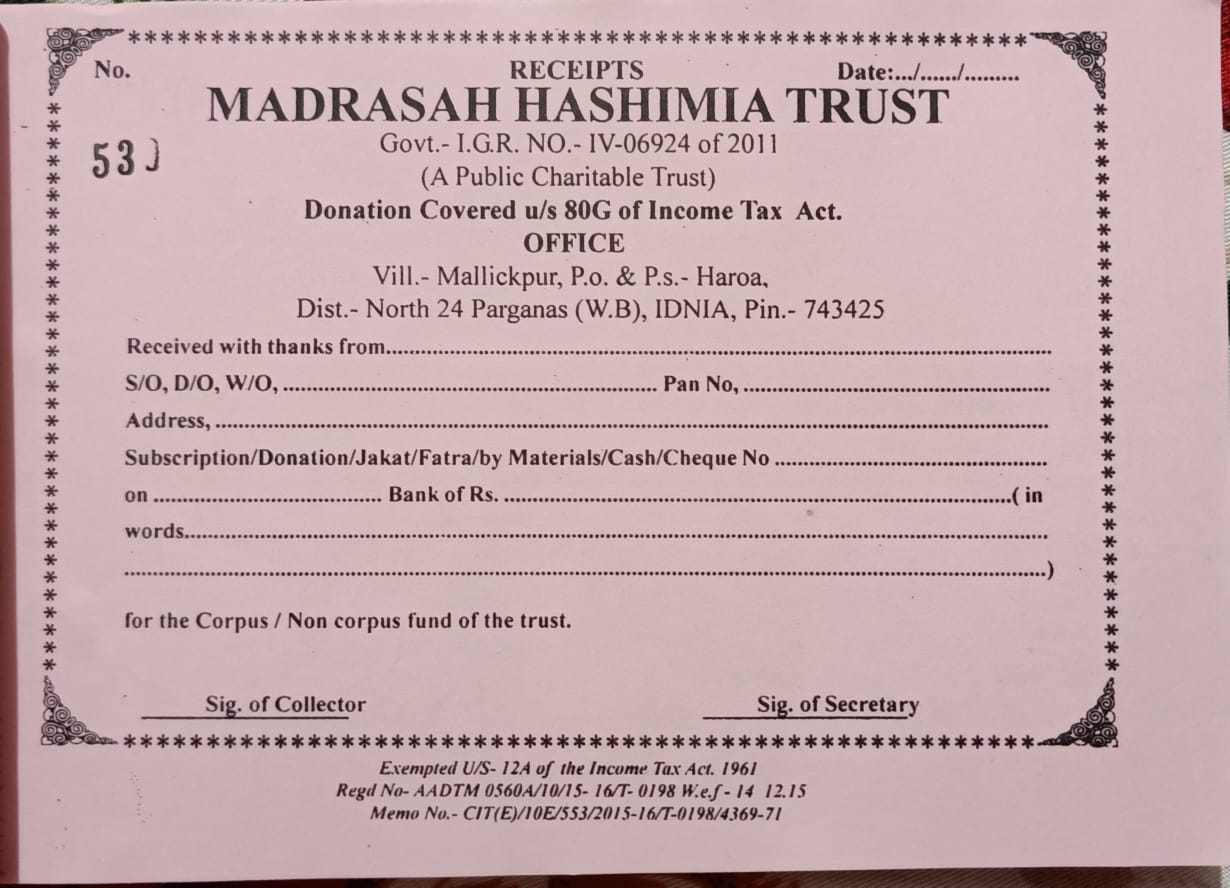

Donation Receipt Madrasah Hashimia Trust

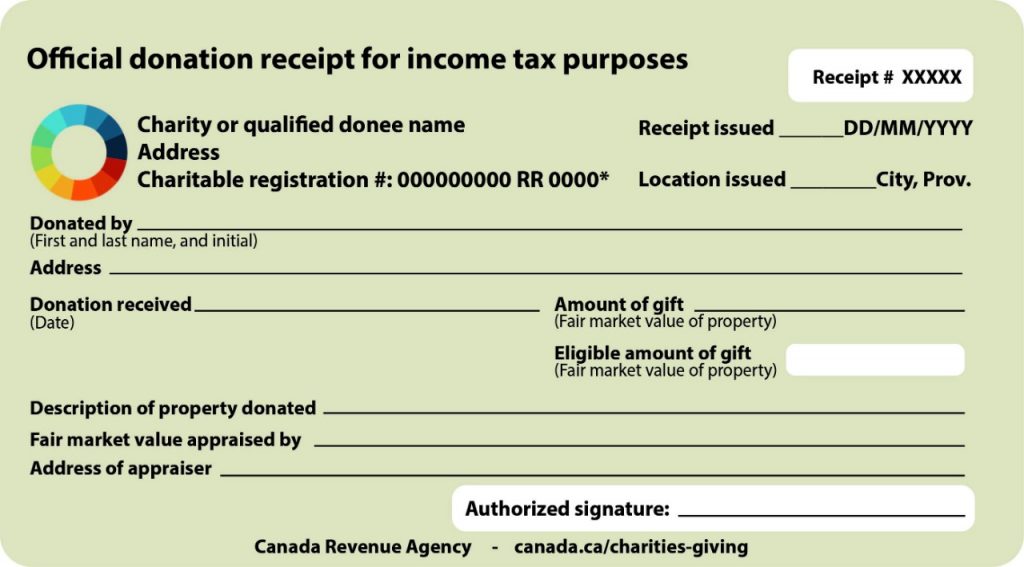

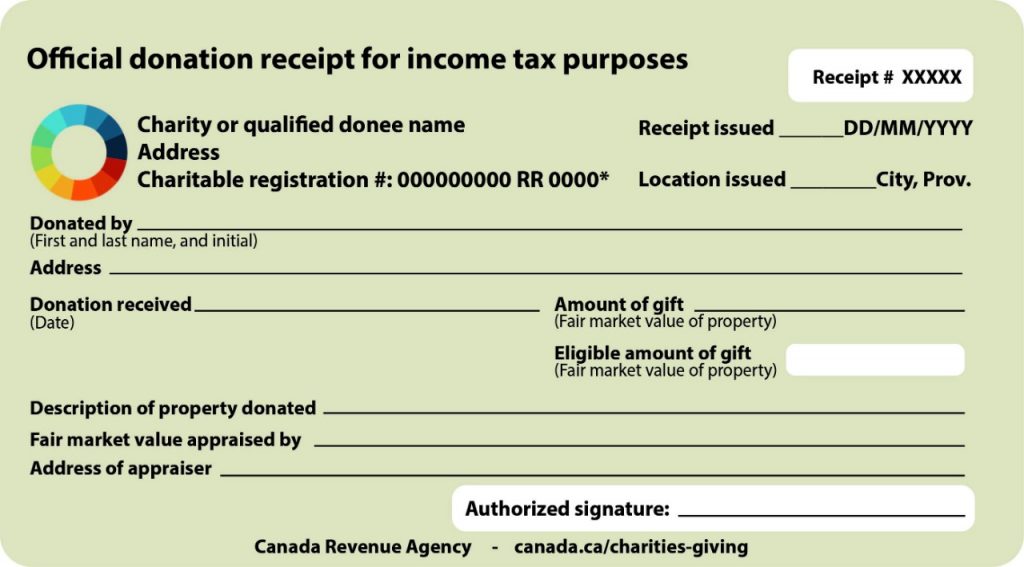

Image Result For Nonprofit Donation Letter For Tax Receipt Donation

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Donation

GILSTORY The Stories Of People I Met Along The Way

How To Create A Donation Page

80g Donation Example - When you donate money to a charity or NGO you can get a tax deduction under Section 80G of the Income tax Act 1961 This means that you can reduce the amount of tax