80g Tax Rebate Web 9 f 233 vr 2023 nbsp 0183 32 Last updated on February 9th 2023 Section 80G of income tax act allows tax deductions on donations made to certain

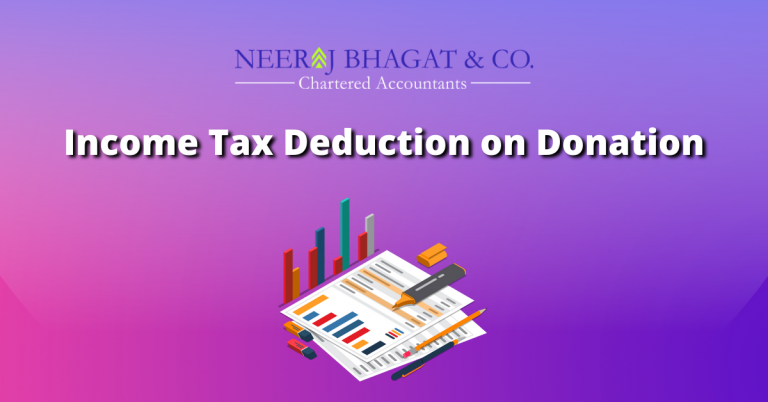

Web 12 avr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

80g Tax Rebate

80g Tax Rebate

https://i.ytimg.com/vi/IFJZkfE-tyM/maxresdefault.jpg

Are SIP Donations Eligible For 80G Tax Exemption Ketto

https://i0.wp.com/ketto.blog/wp-content/uploads/2022/10/Does-SIP-Donation-eligible-for-80G-Tax-Exemption_.png?w=1920&ssl=1

Tax Rebate For Section 80G 80g Consultancy 80g Section 80g 80g

https://www.80g.co/wp-content/uploads/2019/01/section-351II-and-III-500x199.png

Web 10 janv 2019 nbsp 0183 32 Tax rebate for section 80g refers to a reimbursement that is possible if your tax obligations are more than what you have paid in Web 7 sept 2021 nbsp 0183 32 929 25 67 2 6 74 Manga World 129 6 8 85 6 39 Nava Bha Ven 383 23 95 5 89 BSE Top Gainers Captain Tech

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities Web 21 oct 2019 nbsp 0183 32 You can gain donation tax rebate under Section 80G for donations made to those institutions or relief funds which are prescribed for tax exemption The donations in section 80G are eligible for deductions

Download 80g Tax Rebate

More picture related to 80g Tax Rebate

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://www.careindia.org/wp-content/uploads/2022/05/tax-exemption-desktop-min.jpg

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://www.careindia.org/wp-content/uploads/2022/05/Secton80g-1024x768.jpg

80G Donation Limit 80G Deduction Under Income Tax Calculation Of

https://i.ytimg.com/vi/-UzKNqOp9o8/maxresdefault.jpg

Web 9 f 233 vr 2023 nbsp 0183 32 Section 80G registration of Income Tax Act 1961 allows a reduction either in the form of deduction or rebate to those individuals who make donation to listed funds Web 29 mai 2021 nbsp 0183 32 Make a meaningful impact and avail tax benefits by donating to ISKCON Dwarka under Section 80G Your contribution supports noble causes while reducing your taxable income Donate today and make a

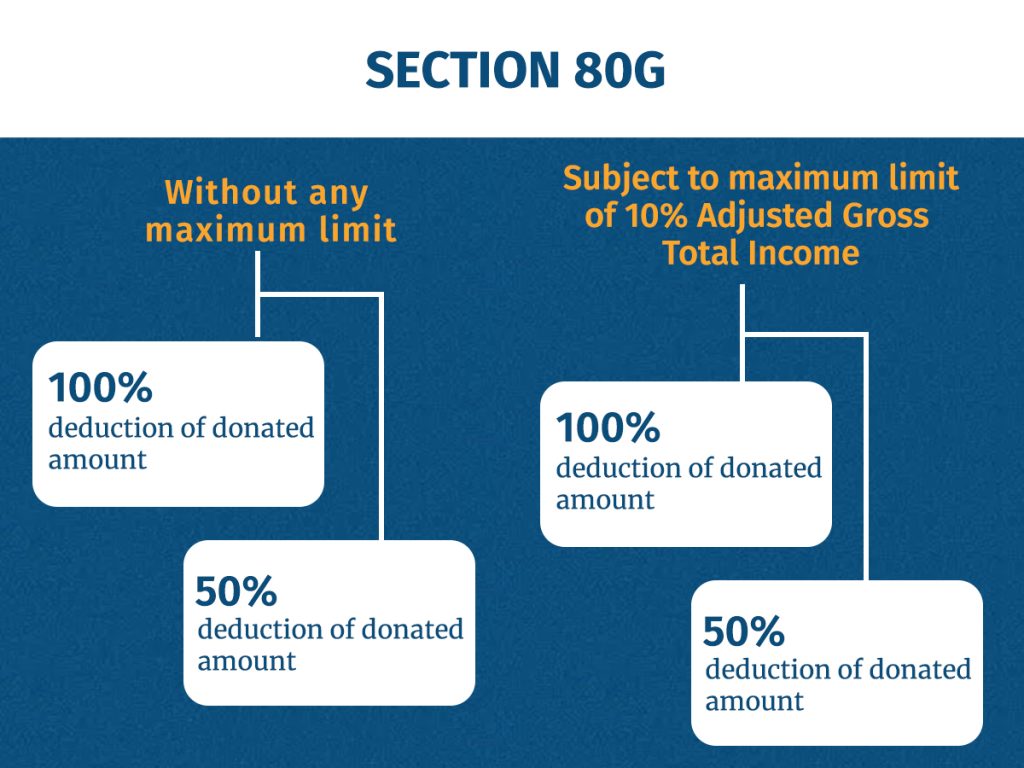

Web Section 80G deduction of the Income Tax Act is allowed for amount paid by the taxpayer as donation to any fund or institution or charitable Trust All donations are not treated equally under Income Tax Act Donations to Web 12 juil 2023 nbsp 0183 32 As per the provisions of section 80G not every donation qualifies for a 100 deduction It depends on the eligibility of the organization to which donation is made The

Where Can I Donate Clothes For Tax Deduction

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-2.jpg

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

https://vakilsearch.com/blog/wp-content/uploads/2021/05/VS_Blog-Images_3-19.png

https://learn.quicko.com/section-80g-deductio…

Web 9 f 233 vr 2023 nbsp 0183 32 Last updated on February 9th 2023 Section 80G of income tax act allows tax deductions on donations made to certain

https://economictimes.indiatimes.com/wealth/t…

Web 12 avr 2023 nbsp 0183 32 Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions

Does 80G Allow Deduction For Charitable Contribution Learn By Quicko

Where Can I Donate Clothes For Tax Deduction

Donations Under Section 80G Deductions In Income Tax Teachoo

Explanation Of Section 80G Tax ExemptionLimit Yadnya Investment Academy

Income Tax Deduction On Donation Who Is Eligible For Deduction U s 80G

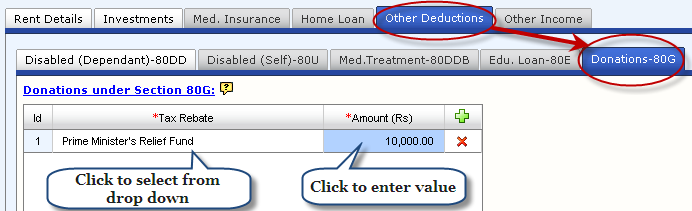

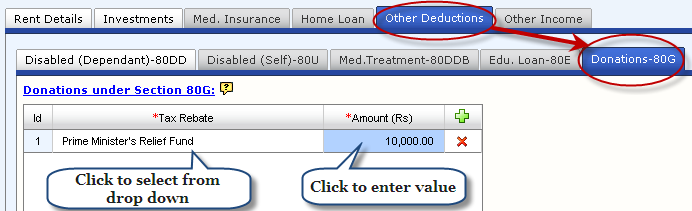

Donations 80G

Donations 80G

Learn About Tax Deducation Under 80G Narayan Seva Sansthan

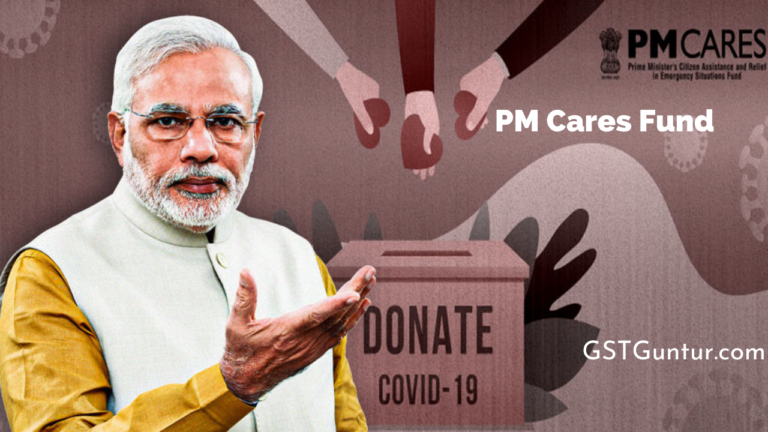

PM Cares Fund 80G Tax Deduction Covid 19 Chief Minister Relief Fund

How Can Section 80G 80GG Help You Avail Tax Benefits

80g Tax Rebate - Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities