80gg Income Tax Rebate Web Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment he she

Web 30 mai 2022 nbsp 0183 32 Why is the Deduction Limit Kept Low Under Section 80GG of Income Tax Act The maximum limit for claiming deduction is Rs 60 000 under Section 80GG This is kept low because the rent across cities has Web 21 nov 2021 nbsp 0183 32 Section 80GG Income Tax Deduction in respect of rent paid Yash Khiwasra Income Tax Articles Trending Download PDF 21 Nov 2021 49 272 Views

80gg Income Tax Rebate

80gg Income Tax Rebate

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2019/07/Section-80GG-1.png?fit=1047%2C604&ssl=1

House Rent Allowance 80GG Of Income Tax Act HRA Rebate U S 80GG In

https://i.ytimg.com/vi/F0uXsnTRBuA/maxresdefault.jpg

Beyond Section 80C 10 Ways To Save Taxes The Fact Eye

https://thefacteye.com/wp-content/uploads/2020/10/Deduction-where-House-rent-is-paid-and-HRA-not-received.jpg

Web Section 80GG of the Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment Web 5 juin 2023 nbsp 0183 32 What is Section 80GG of Income Tax Act Check out how to claim deduction under Section 80GG House Rent Allowance HRA calculation Eligibility criteria and more

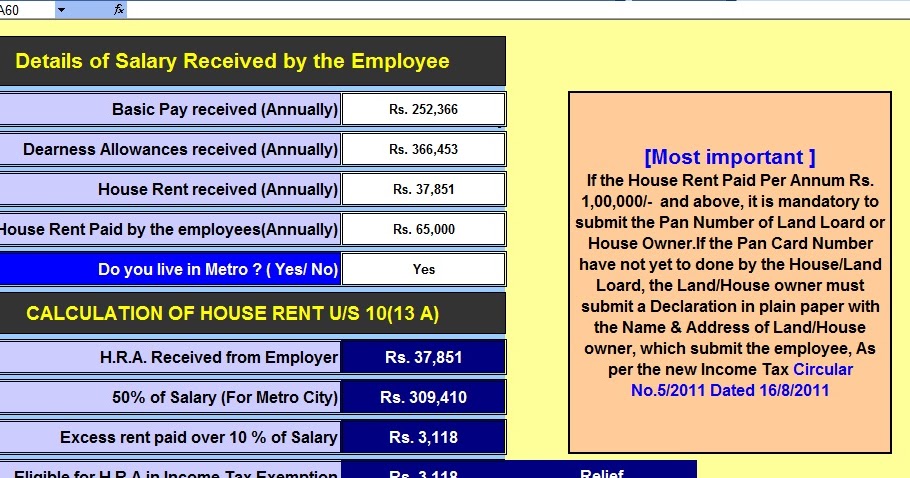

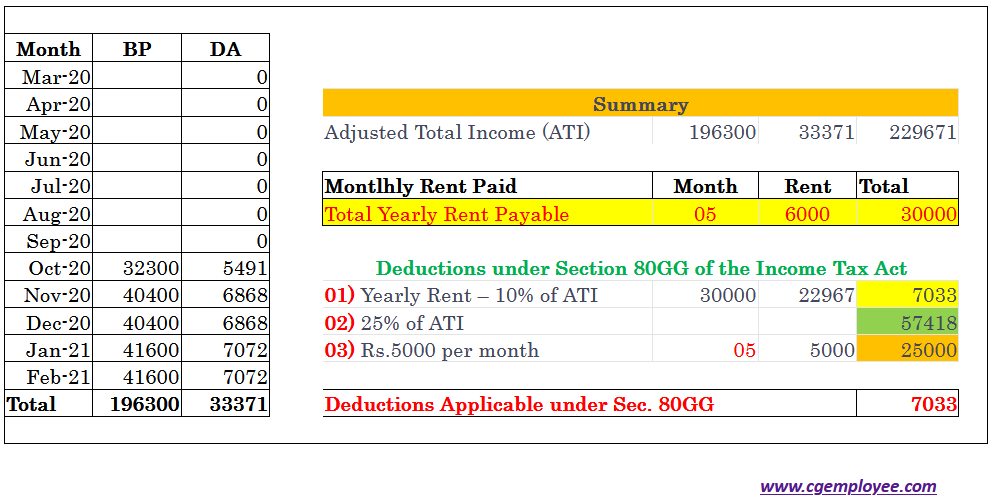

Web 26 juin 2018 nbsp 0183 32 Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residence Such deduction is Web How to Calculate Tax Deduction Under Section 80GG Tax deductions under Section 80GG of the Income Tax Act 1961 are based on Tax Rule 2A a Rs 5000 per month or Rs

Download 80gg Income Tax Rebate

More picture related to 80gg Income Tax Rebate

Form 10BA Claim Deduction Under Section 80GG Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2019/03/30164650/Group-5.png

80GG Deduction Under Income Tax Rent Paid HRA Deduction How To

https://i.ytimg.com/vi/Xsd9lhUCMqU/maxresdefault.jpg

10 Section 80G SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

https://i.ytimg.com/vi/4IIJJwZhwZ4/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyATKHkwDw==&rs=AOn4CLDs0U9X0idomlEmdivpVGal3fezFg

Web 24 janv 2023 nbsp 0183 32 Section 80GG Deductions Against Rent Paid Conditions and Eligibility Discussed in detail is how to claim tax benefit on HRA under Section 10 13A and Web 80GG is a deduction under Chapter VI A of the Income Tax Act 1961 It has been introduced to provide relief to those individuals who do not receive any house rent

Web 10 sept 2023 nbsp 0183 32 Section 80GG of Income Tax Act Deductions and Exceptions Updated On 04 Sep 2023 Section 80GG of the Income Tax Act provides deductions related to Web 18 ao 251 t 2021 nbsp 0183 32 Section 80GG is deduction under VI A of the Income Tax Act Find out how you can claim deductions under 80GG for rent paid Know its eligibility deduction limit

Section 80GG Income Tax Deduction On House Rent Paid Section 80GG

https://i.ytimg.com/vi/UsaAY2dmghw/maxresdefault.jpg

Tips And Tricks Follow THESE 5 Techniques To SAVE Income Tax News

https://english.cdn.zeenews.com/sites/default/files/2023/01/14/1141615-untitled-design-2023-01-14t180752.618.jpg

https://groww.in/p/tax/section-80gg

Web Section 80GG of Income Tax Act is specifically designed for those who do not receive home rent allowance from their employers If a person s salary includes HRA payment he she

https://navi.com/blog/section-80gg

Web 30 mai 2022 nbsp 0183 32 Why is the Deduction Limit Kept Low Under Section 80GG of Income Tax Act The maximum limit for claiming deduction is Rs 60 000 under Section 80GG This is kept low because the rent across cities has

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Section 80GG Income Tax Deduction On House Rent Paid Section 80GG

Section 80GG Deduction Get Tax Benefit On Rent Paid If Not Getting HRA

Section 80GG Tax Claim Deduction For Rent Paid CGEmployee

Deduction In Respect Of Rent Paid 80GG EZTax

80GG Deduction On House Rent Paid With Automated Income Tax

80GG Deduction On House Rent Paid With Automated Income Tax

Section 80GG Of Income Tax Act II Rent Paid Deduction U s 80GG II Tax

Section 80GG Tax Claim Deduction For Rent Paid

What Is 80gg In Income Tax In Hindi 80gg Deduction 80gg Of Income

80gg Income Tax Rebate - Web 22 oct 2014 nbsp 0183 32 Under Section 80GG The Tax Deduction amount under 80GG is Rs 60 000 per annum Section 80GG is applicable for all those individuals who do not own a