80tta Deduction Eligibility To claim a deduction under Section 80TTA of the Income Tax Act 1961 in India for the interest income earned from savings

Key Points 80TTA Deduction for AY 2023 24 Maximum Limit As per the Income Tax Act the 80TTA limit for AY 2023 24 is Rs 10 000 Suppose your interest The following taxpayers can claim the deductions under section 80TTA of the Income Tax Act Individual taxpayers or Hindu Undivided Family HUF Indian Residents

80tta Deduction Eligibility

80tta Deduction Eligibility

https://images.newindianexpress.com/expressdeals/assets/images/content/2023/03/09/original/Section_80D-Deduction-Eligibility_and_Limit.jpg

Section 80TTA Deduction What It Is And How To Use It

https://assets-news.housing.com/news/wp-content/uploads/2022/05/27194827/80TTA-All-about-80TTA-deduction.jpg

What Is Section 80TTA 80TTA Deduction In Hindi Income Tax

https://i.ytimg.com/vi/MViFwi59sMw/maxresdefault.jpg

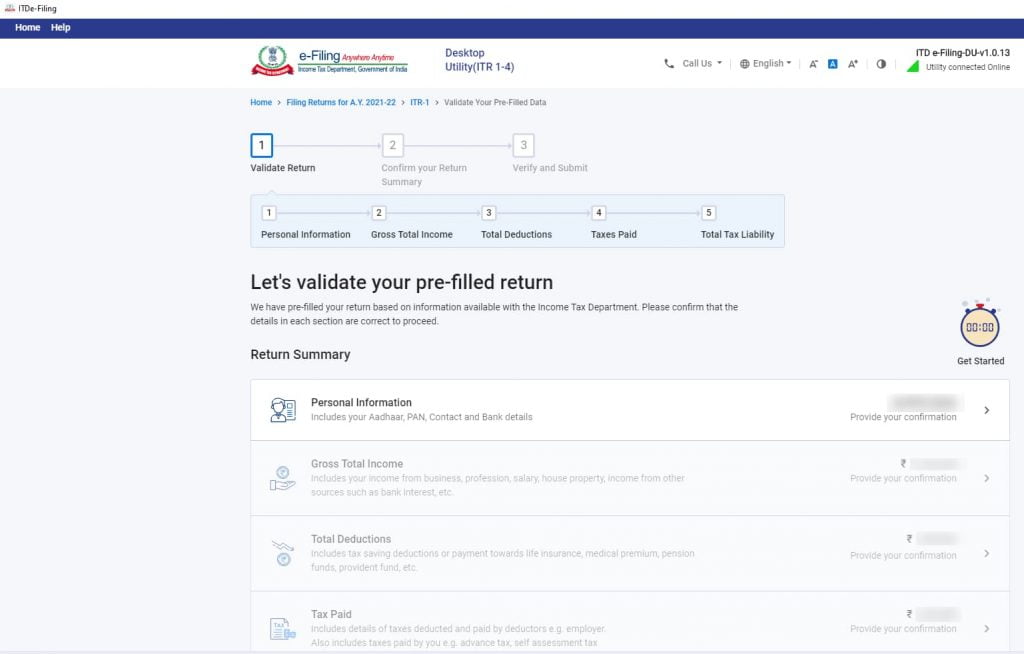

The most important factors for Section 80TTA eligibility are Taxpayer residing in India Group of individuals under HUF NRI with an NRO savings account Age below 60 Who can claim deduction under section 80TTA If you opt for the old existing income tax regime while filing ITR for FY 2022 23 AY 2023 24 then you can claim a tax

Deduction Under Section 80TTA Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct Who is Eligible to Claim Deductions Under Section 80TTA Income Tax Act What is the Maximum Limit of Deduction Under 80TTA What all Interest Incomes Come

Download 80tta Deduction Eligibility

More picture related to 80tta Deduction Eligibility

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

https://i.ytimg.com/vi/zEDH4xhkCfE/maxresdefault.jpg

Pin By State Bank Of India On YONOSBI Cooperative Society How To

https://i.pinimg.com/originals/cc/77/56/cc7756ee38ff8c67660e5454edf707f8.jpg

New 2020 Section 80TTA Deduction TDS On Interest ArthikDisha

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2020/10/Section-80TTA-Deduction-ArthikDisha-1-2.png?resize=1200%2C1200&ssl=1

How to Claim the 80TTA Income Tax To claim a deduction under Section 80TTA follow the steps mentioned below Determine Eligibility The first step is to determine your The following incomes qualify for deductions u s 80TTA Interest earned through a savings bank account Interest earned from a post office savings account

Eligibility for Claiming Deductions under 80TTA Deductions under Section 80TTA can be claimed by an Individual taxpayer or Hindu Undivided Family HUF How Here Is A Simple Guide S ection 80TTA offers a financial benefit to individuals and Hindu Undivided Families HUF in India granting a deduction of up to Rs 10 000 on interest

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

https://cdn1.npcdn.net/image/16461036862a2b9367f2ff16eb9b748ff28b5b7ef8.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Section 80TTA Claim Tax Deduction On Savings Account Interest Income

https://life.futuregenerali.in/media/2qsf3zkl/taxation-on-savings-interest.jpg

https://tax2win.in/guide/section-80tta

To claim a deduction under Section 80TTA of the Income Tax Act 1961 in India for the interest income earned from savings

https://www.taxmani.in/income-tax/80tta.html

Key Points 80TTA Deduction for AY 2023 24 Maximum Limit As per the Income Tax Act the 80TTA limit for AY 2023 24 is Rs 10 000 Suppose your interest

Interest On Savings Account Income Tax Deduction Section 80TTA

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Section 80TTA Of Income Tax Act 80TTA Deduction Applicability Eligibility

Section 80TTA How You Can Claim Tax Deduction

Section 80TTA Deduction Limit Under Income Tax Act Paisabazaar

Section 80TTA Income Tax Act Claim Deduction On Interest Income

Section 80TTA Income Tax Act Claim Deduction On Interest Income

Section 80TTA All About Claiming Deduction On Interest

TAX DEDUCTION UNDER SECTION 80TTA DEDUCTION ON SAVINGS INTEREST

Section 80TTA Of Income Tax Act 2023 Guide InstaFiling

80tta Deduction Eligibility - Section 80TTA allows you to claim deductions on the interest income earned on saving accounts with banks cooperative societies and post offices 80TTA Calculator helps you