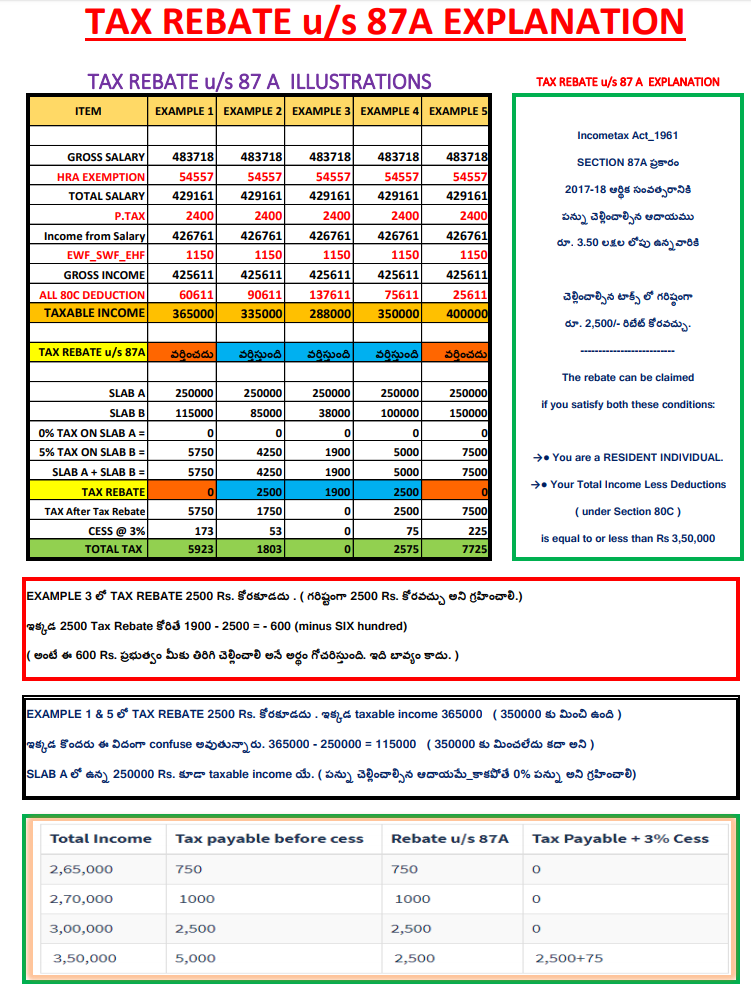

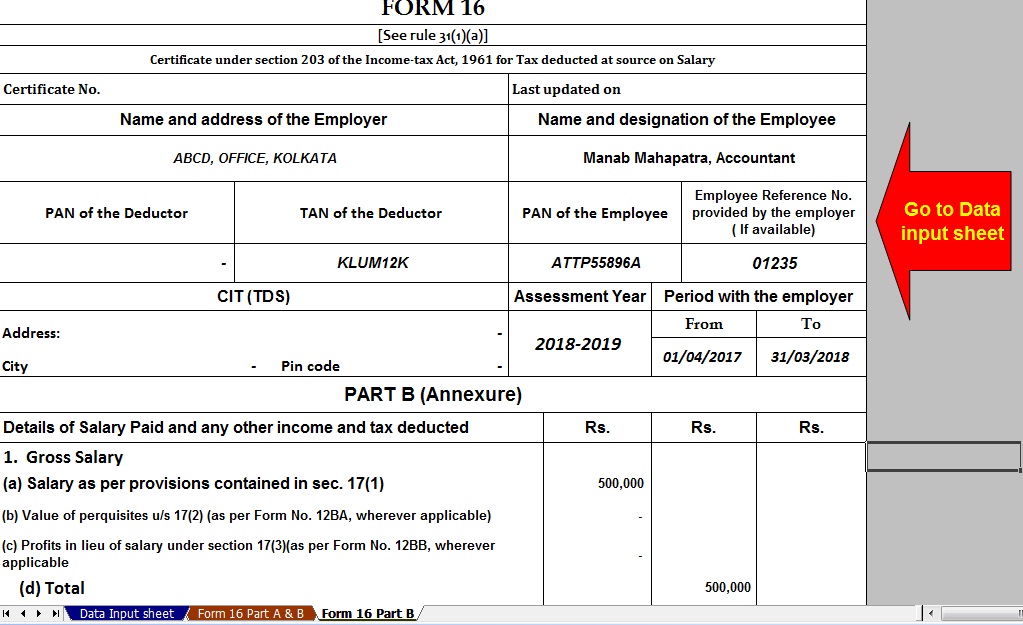

87a Income Tax Rebate Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

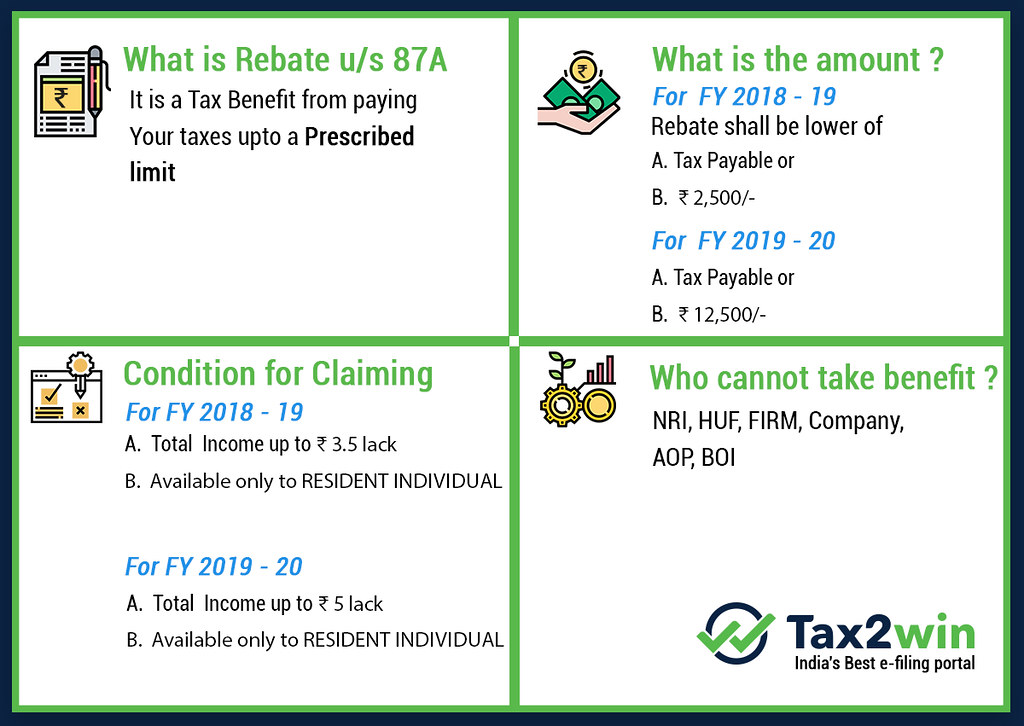

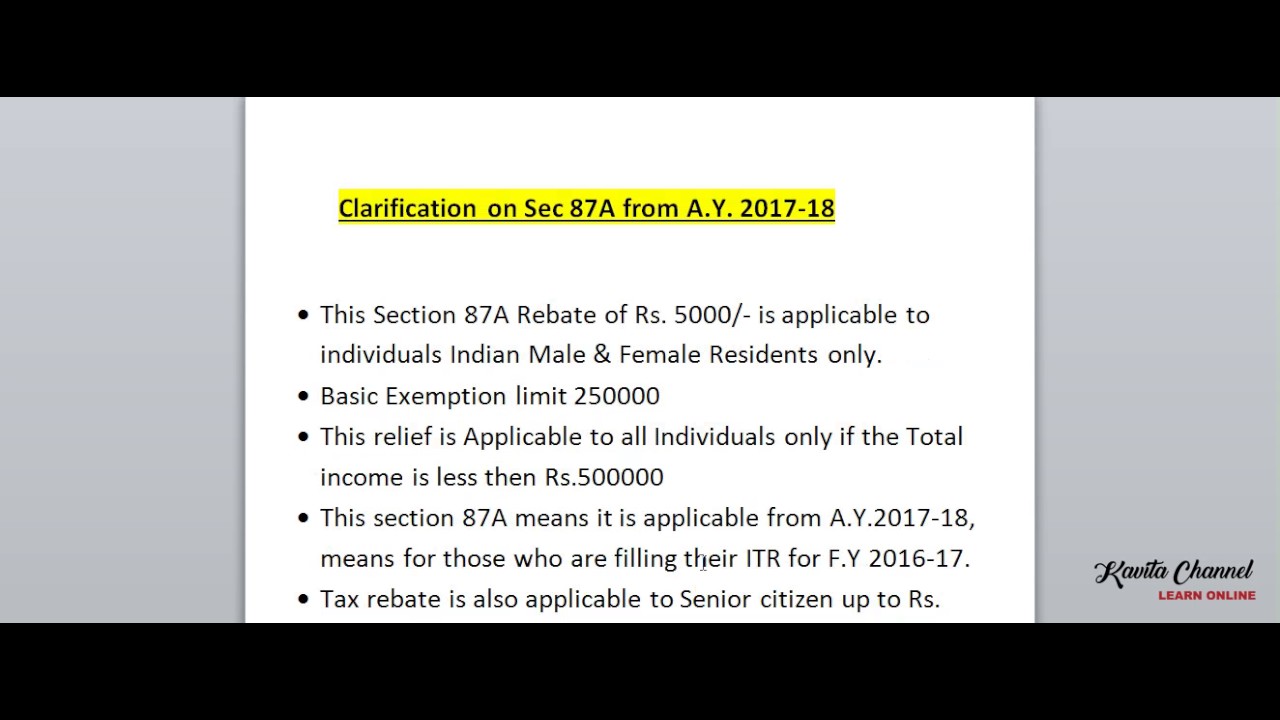

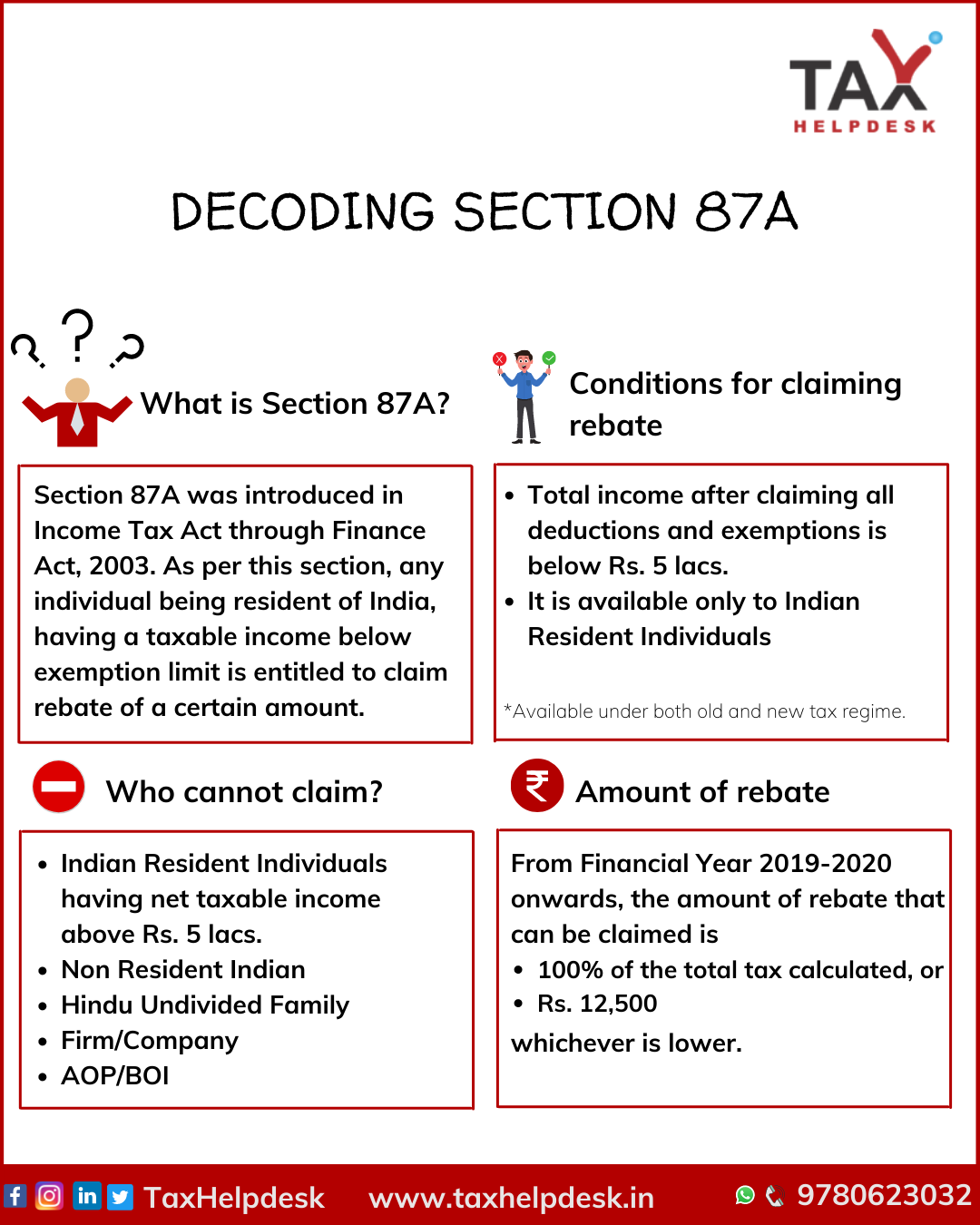

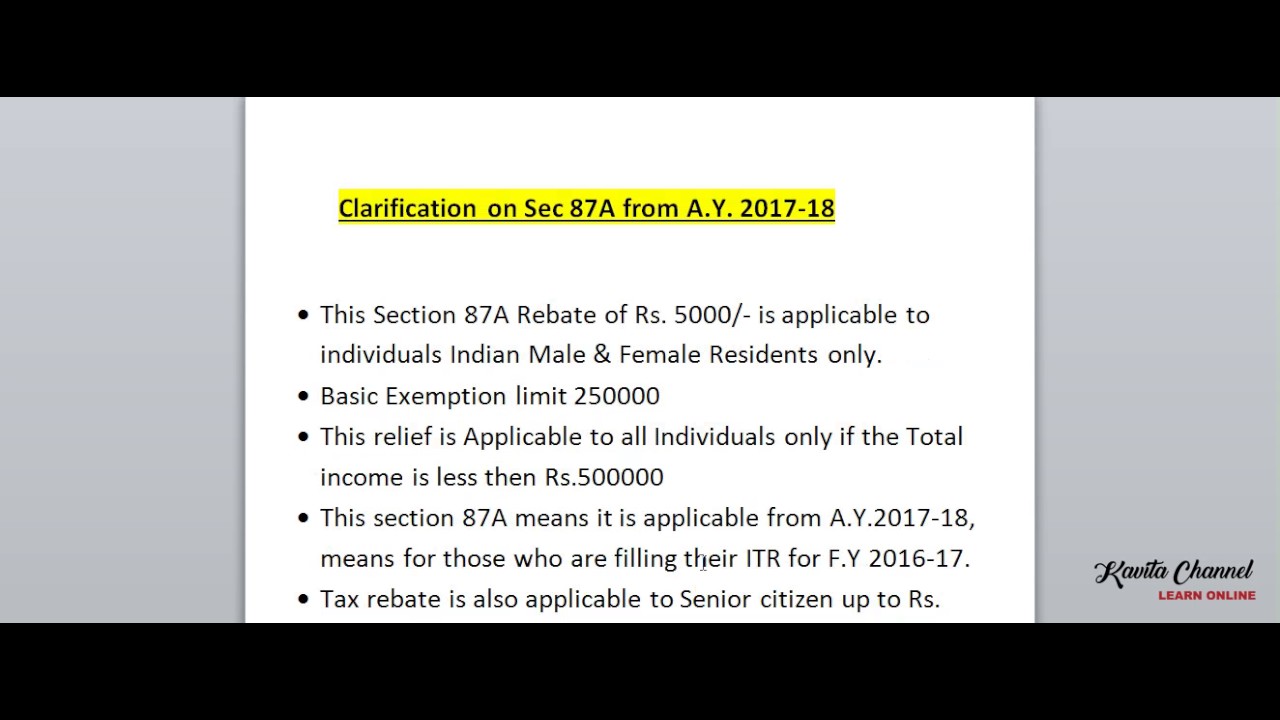

Web Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand Web 14 sept 2019 nbsp 0183 32 Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate

87a Income Tax Rebate

87a Income Tax Rebate

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

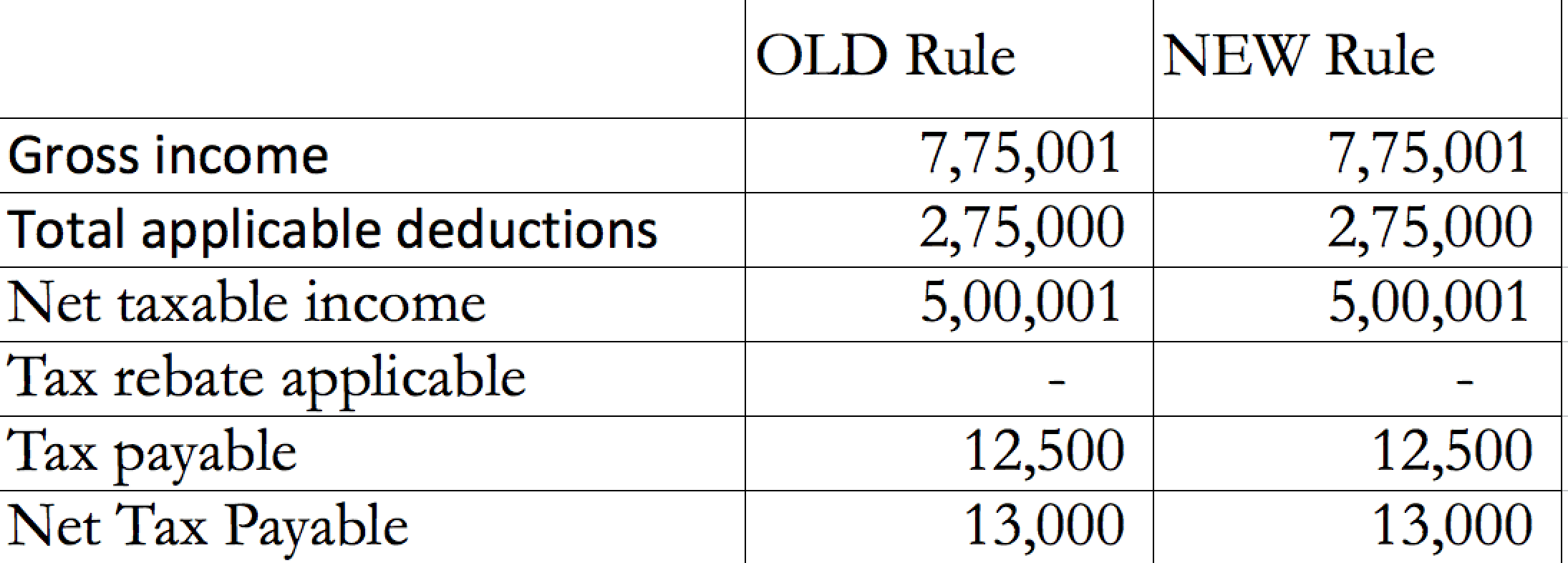

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Web 26 avr 2022 nbsp 0183 32 Tax rebate under Section 87A is available for both old and new tax regimes for Financial Year 2021 2022 The assessment Year 2022 2023 The limit remains the Web You can claim the 87A rebate on your gross tax liability before cess and arrive at the net tax liability In case your total income is below 5 lakhs the maximum rebate under section

Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can get Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim

Download 87a Income Tax Rebate

More picture related to 87a Income Tax Rebate

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year Therefore the Section 87A Tax rebate is available under both Web July 19 2023 Table of Contents What is Income Tax Rebate Demystifying Section 87A Section 87A Income Tax Rebate Who Qualifies and Who Doesn t How Does One

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you Web Code g 233 n 233 ral des imp 244 ts Article 87 A Les cookies nous permettent de personnaliser les annonces Nous partageons des informations sur l utilisation de notre site avec nos

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

https://incometaxindia.gov.in/Acts/Income-tax Act, 1961/2021...

Web Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate Of Income Tax Under Section 87A YouTube

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Rebate Of Income Tax Under Section 87A YouTube

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

87a Income Tax Rebate - Web 25 janv 2022 nbsp 0183 32 Taxpayers with income up to Rs 5 lakh can claim a tax rebate of up to Rs 12 500 for AY 2021 22 or as 87A rebate for FY 2020 21 This means that if your annual