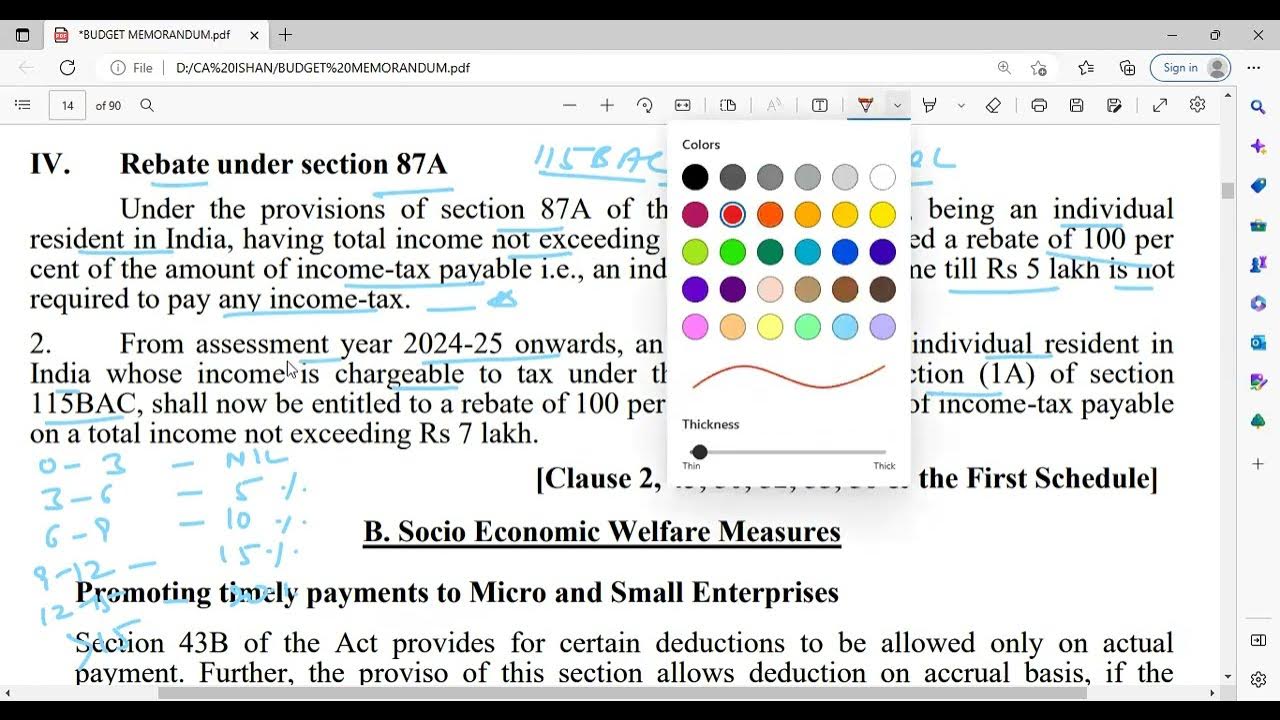

87a Rebate For Ay 2023 23 Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

Web 10 f 233 vr 2023 nbsp 0183 32 The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under Web 14 sept 2019 nbsp 0183 32 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual

87a Rebate For Ay 2023 23

87a Rebate For Ay 2023 23

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

https://i.ytimg.com/vi/wZNZ6YgMsIc/maxresdefault.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Section 87A rebate increased from the current Rs 5 Lakhs to Rs 7 Lakhs in the alternative tax regime The Finance Minister Smt Nirmala Web 1 avr 2023 nbsp 0183 32 Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A Rebate under New Tax Regime for AY 2024 25 is as under Rebate u s 87A limit has been increased to Rs 25000 for those with taxable income up to Rs 7 lakhs in new tax regime New Web 3 f 233 vr 2023 nbsp 0183 32 The Budget 2023 has revised the threshold limit of tax rebate u s 87A for the new tax regime Before we get into discussing about how Section 87A rebate is calculated lets first see How much rebate can be

Download 87a Rebate For Ay 2023 23

More picture related to 87a Rebate For Ay 2023 23

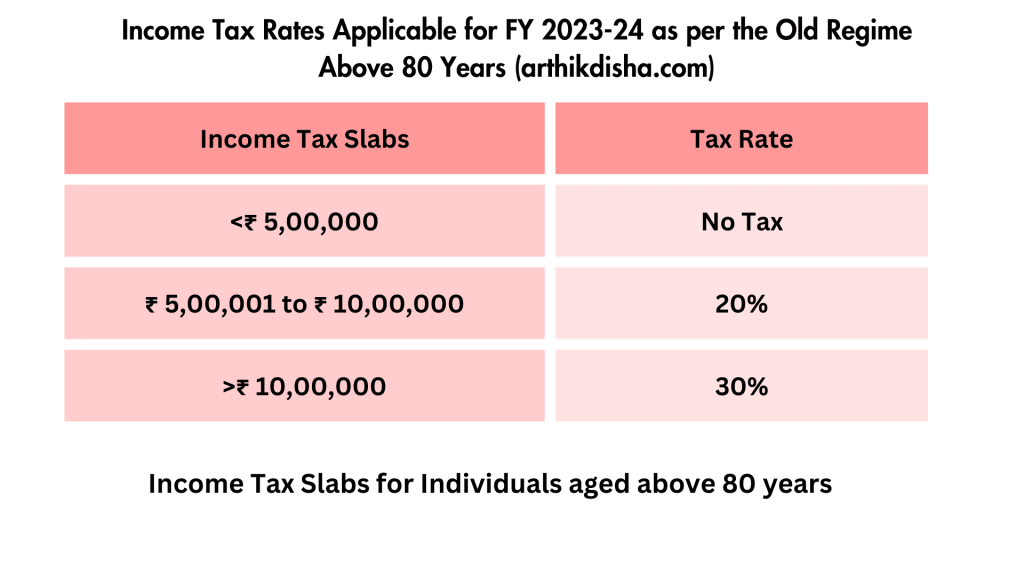

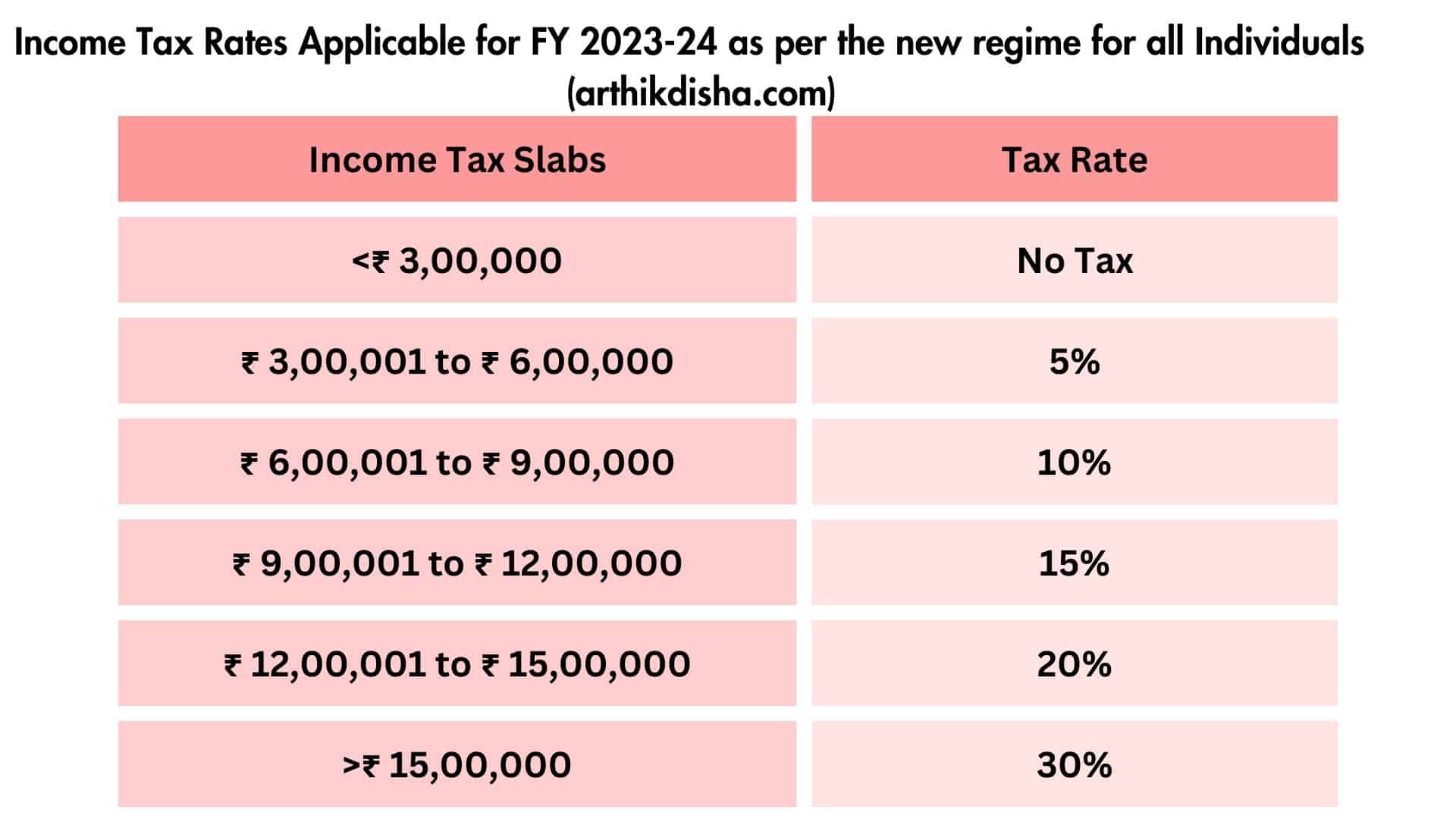

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be Web 20 f 233 vr 2023 nbsp 0183 32 20 02 2023 by Alert Tax Team Updates Rebate 87A for AY 2024 25 The alternative tax regime increased the section 87A rebate from Rs 5 Lakhs to Rs 7

Web The amount of rebate allowable under section 87A has been increased to 12500 from AY 2020 21 onwards Therefore the increased amount of rebate shall take effect from 1st April 2020 and will accordingly apply Web 17 juil 2023 nbsp 0183 32 87A Tax Rebate under the New Regime FY 2023 24 amp AY 2024 25 The basic exemption limit under the new income tax regime is 7 00 000 You will have to

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-what-is-rebate-under-section-87a-for-ay-2020-21-financial-control-from-87a-rebate-ay-2023-20-post.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092144_Microsoft-365-Office-1024x948.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

https://economictimes.indiatimes.com/wealth/t…

Web 10 f 233 vr 2023 nbsp 0183 32 The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under

Sec 87A Rebate Income Tax Malayalam AY 2022 23 CA Subin VR YouTube

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate U s 87A

Union Budget 2023 Rebate U s 87A Enhanced For New Income Tax Regime

Is Section 87A Rebate For Everyone SR Academy India

BUDGET 2023 REBATE UNDER SECTION 87A NO TAX UPTO 7 LACS YouTube

BUDGET 2023 REBATE UNDER SECTION 87A NO TAX UPTO 7 LACS YouTube

Know New Rebate Under Section 87A Budget 2023

Is Section 87A Rebate For Everyone SR Academy India

Rebate U s 87A Of Income Tax 7 Lakhs Income Tax

87a Rebate For Ay 2023 23 - Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A Rebate under New Tax Regime for AY 2024 25 is as under Rebate u s 87A limit has been increased to Rs 25000 for those with taxable income up to Rs 7 lakhs in new tax regime New