Ac Rebate 2024 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Ac Rebate 2024

Ac Rebate 2024

https://tricountyair.com/wp-content/uploads/2022/10/Tri-county-Air-2022-Inflation-Reduction-Act_-Do-You-Qualify-for-an-AC-Heating-Rebate-or-Tax-Credit_.png

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

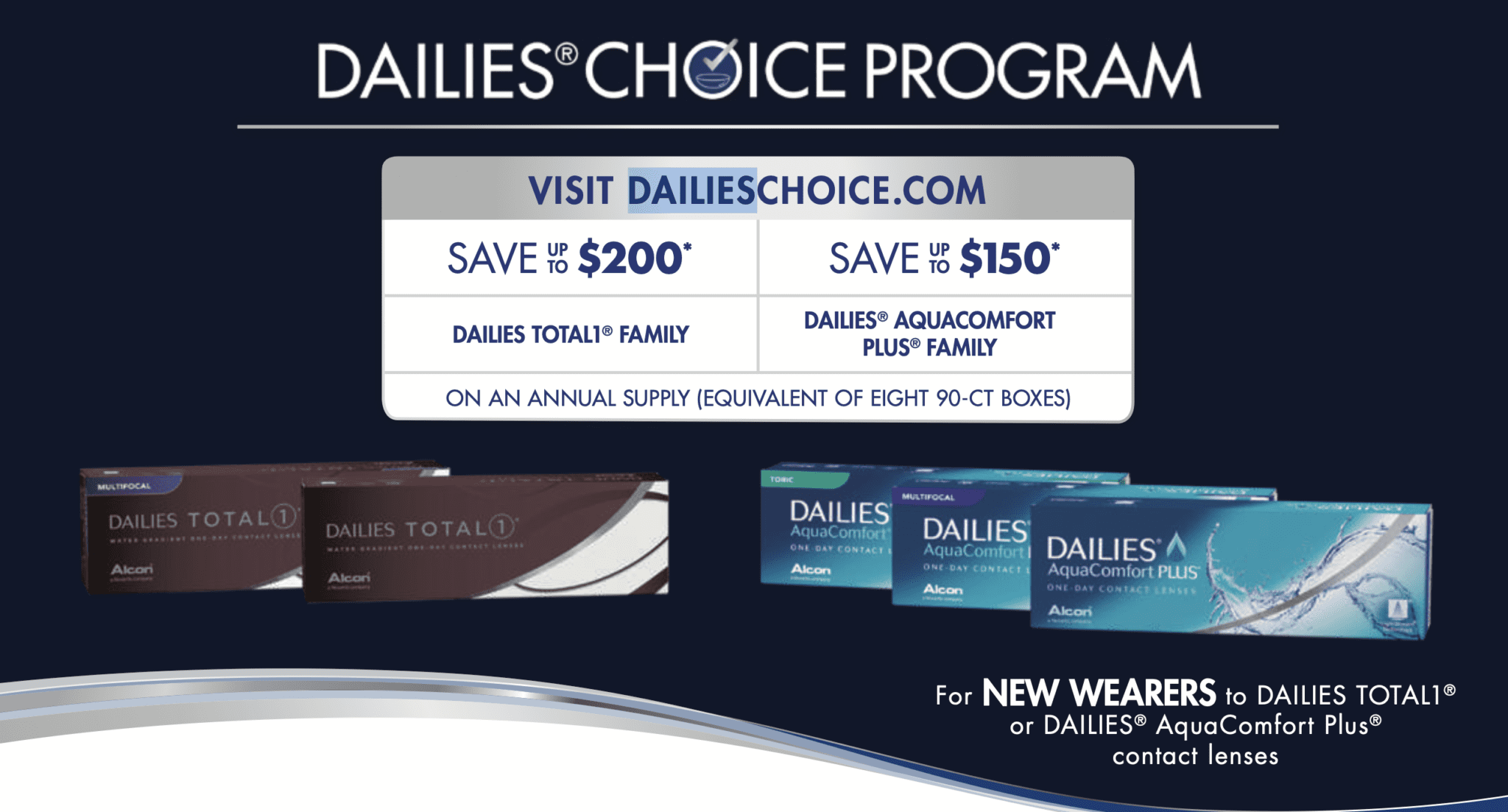

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000 The federal Inflation Reduction Act will provide funding for whole house energy efficiency For households with low or moderate income LMI it will also fund point of sale rebates for panel upgrades and qualified high efficiency electric appliances such as heat pumps for space heating cooling The act includes funding for contractor training

Many Inflation Reduction Act rebates on green technology such as heat pumps and induction stoves being installed in homes in this Riverside subdivision went into effect Jan 1 but homeowners 2024 CENTRAL AC AIR SOURCE HEAT PUMP TUNE UP REBATE APPLICATION 1 of 2 SIGNATURE By typing my first and last names in the CUSTOMER SIGNATURE box below I am signing this document and certify o I have completely filled out Section A o All equipment has been installed at the address listed in Section A o I have read understand and agree to the terms and conditions Section D 1

Download Ac Rebate 2024

More picture related to Ac Rebate 2024

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

https://images.squarespace-cdn.com/content/v1/58c880d7893fc0f2350b0bbd/1671046938649-FD50N05XDSCYNJTD97B7/2023-01+to+2023-06-30+B%26L+Rebate+Form+Front.jpg

Alcon Rebate Form 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

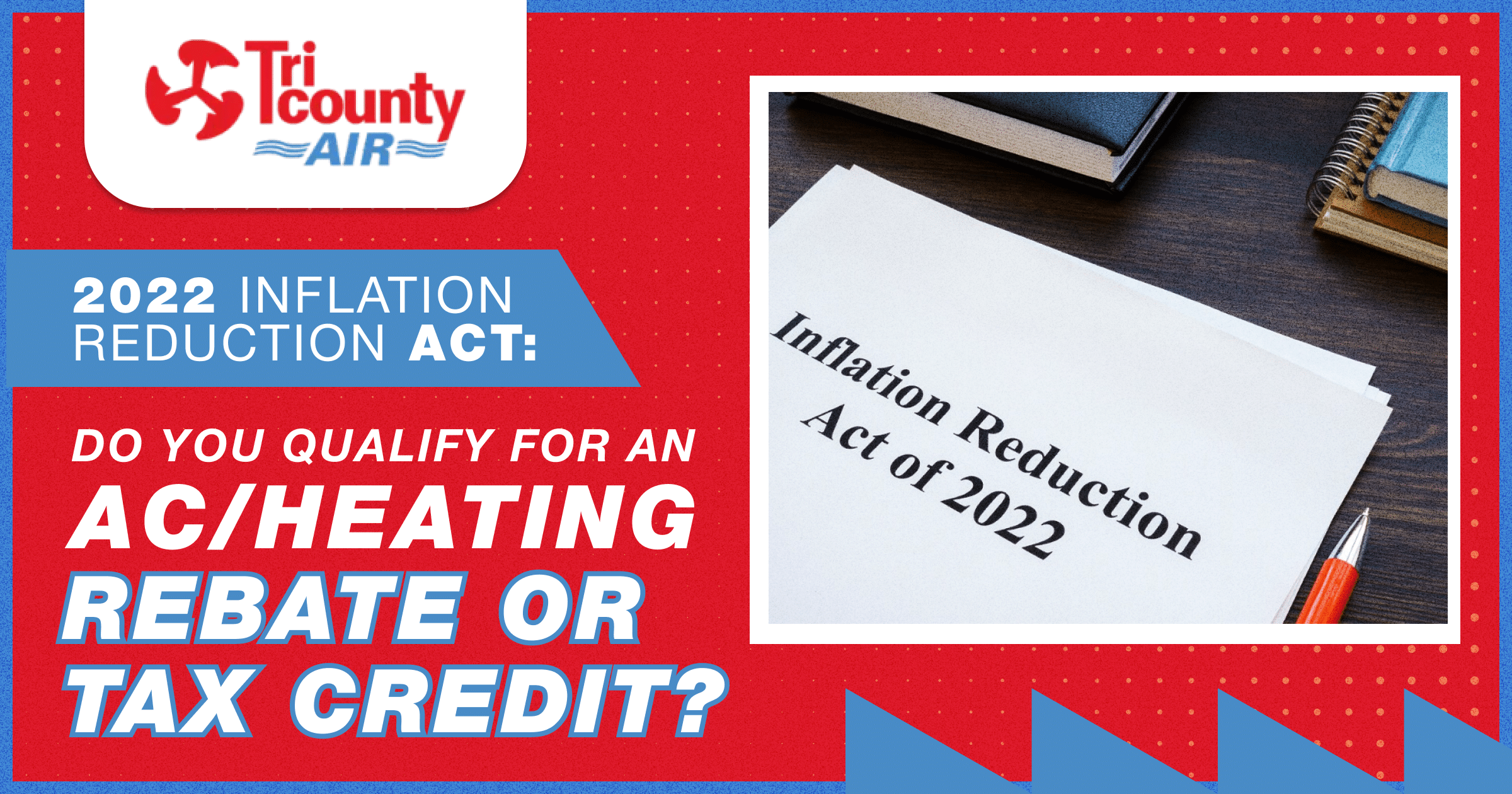

Comprehensive Guide To Elanco Trifexis Rebate Form How To Claim Your Rebate Elanco Rebate

https://i0.wp.com/www.elancorebate.net/wp-content/uploads/2023/05/Elanco-Trifexis-Rebate-Form.png?fit=1174%2C813&ssl=1

2024 Rebate Application Residential Programs Submit your documents one of four ways Call 800 573 3503 for questions about this application Fax 517 337 0437 Email hometownenergysavers michiganenergyoptions For central air conditioning and central air source heat pumps the indoor coil and outdoor condenser must be a matching set and IR 2023 97 May 4 2023 The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits

Refrigerators purchase 73 Refrigerators recycling 40 Room Air Cleaners 36 Building Products Sealing and Insulation Products 59 Storm Windows 4 Windows Doors and Skylights 37 Commercial Food Service Commercial Coffee Brewers 16 Commercial Dishwashers 47 Commercial Fryers 68 Commercial Griddles 56 Maximum Allowed Rebate Amount Per Household Above 80 Area Median Income AMI Home Efficiency Project with at least 20 predicted energy savings 80 of project costs up to 4 000 50 of project costs up to 2 000 maximum of 200 000 for a multifamily building Home Efficiency Project with at least 35 predicted energy savings

Printable Alcon Rebate Form 2023 Printable Forms Free Online

https://s3.amazonaws.com/VisionSource/Promos/June2023-AlconUpgradeRebate-A.jpg

Seresto Rebate Form PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/09/Seresto-Rebate-Form-768x563.png

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

https://www.energy.gov/scep/home-energy-rebates-programs

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

Printable Alcon Rebate Form 2023 Printable Forms Free Online

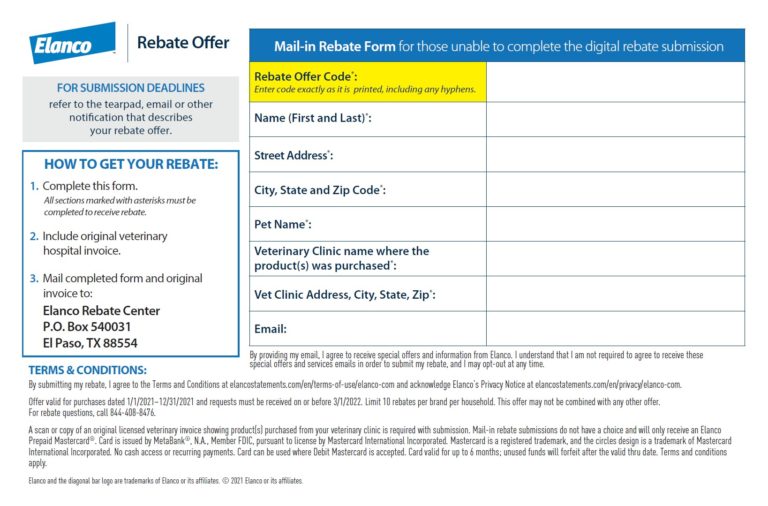

Rebate Air Optix Printable Rebate Form

NWC Tryouts 2023 2024 NWC Alliance

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Traderider Rebate Program Verify Trade ID

Dailies Total 1 Rebate Form Printable Rebate Form

Rebate Management HubHero

Ac Rebate 2024 - 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit