Ac Rebates 2024 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

Ac Rebates 2024

Ac Rebates 2024

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

DEC Savage Rascal Rebate Gun Rebates

https://gun-rebates.com/wp-content/uploads/2022/12/DEC-Savage-Rascal-Rebate.jpg

2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Central Air Conditioners Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032

The Inflation Reduction Act signed by President Biden on August 16 2022 stands as the most significant investment in clean energy and climate action in U S history As part of this transformative law tax credit opportunities have been expanded and are available to any homeowner making energy efficient home upgrades New Federal Rebate Program Many Americans will save thousands of dollars on home renovations when new rebates for a range of energy efficient upgrades kick in later this year as part of a 9 billion federal program passed by Congress in last summer s Inflation Reduction Act

Download Ac Rebates 2024

More picture related to Ac Rebates 2024

Business Energy Rebates Anaheim CA Official Website

https://www.anaheim.net/ImageRepository/Document?documentID=33399

CAT Rebates W L Inc

https://wl-parts.com/wp-content/uploads/2021/10/Cat-Rebates-WL-Flyer.png

Manufacturer Rebates CleanFreak

https://cdn.shopify.com/s/files/1/0624/3270/6740/files/rebates-q3-full-line.png?v=1686831920

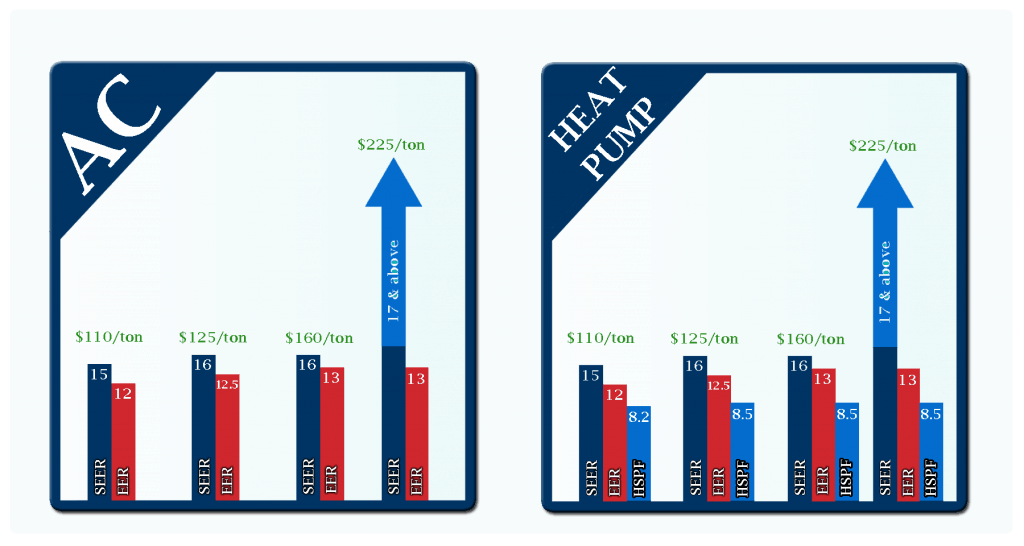

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits January 2024 Table of Contents o How rebates will be provided to eligible recipients o The state s expectation for which party is carrying the cost between the point of sale transaction and reimbursement by the state o Maximum time allowed for rebate reimbursement from the state and how the

2177 Records Found The links below will take you to Web sites external to the energystar gov domain Filter Your Results Filter By Product Appliances Clothes Dryers 75 Clothes Washers 138 Commercial Clothes Washers 10 Dehumidifiers purchase 57 Dehumidifiers recycling 6 Dishwashers 59 Freezers purchase 39 Rebate so that a blower door test is not required as part of the audit p 32 3 2 2 7 2024 By signing this document the State Energy Office signifies its understanding that its allocation will be redistributed to other State Energy Offices that applied for allocated funds If the State does not sign the document or convey to the DOE

Current AC Rebates Kobie Complete

https://kobiecomplete.com/wp-content/uploads/2018/03/trane-ac-rebates-spring-banner-social.png

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

https://www.hhshootingsports.com/wp-content/uploads/2022/11/SmithWessonRebates-HalfPage-scaled.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Rebates Are Inherently Collaborative YouTube

Current AC Rebates Kobie Complete

How Do Home Rebates Work DC MD VA Home Rebates

Promotional Offers Rebates HVAC And Plumbing Contractor MN

NWC Tryouts 2023 2024 NWC Alliance

Milwaukee Tool Rebates Printable Rebate Form

Milwaukee Tool Rebates Printable Rebate Form

Buy Sports Illustrated Swimsuit Planner 2023 2024 Sports Illustrated Swimsuit 2023 2024

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Air Conditioner Rebates From CPS Energy Champion AC

Ac Rebates 2024 - In 2023 the U S Department of Energy released its program guidance for the Home Efficiency Rebates HER and Home Electrification and Appliance Rebates HEAR programs which together allocate over 208 million to North Carolina to provide energy efficiency rebates As of January 2024 DEQ is applying for the planning grant funding for the