Accidentally Claimed Recovery Rebate Credit 2023 IRS Statements and Announcements Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

SOLVED by TurboTax 751 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate

Accidentally Claimed Recovery Rebate Credit 2023

Accidentally Claimed Recovery Rebate Credit 2023

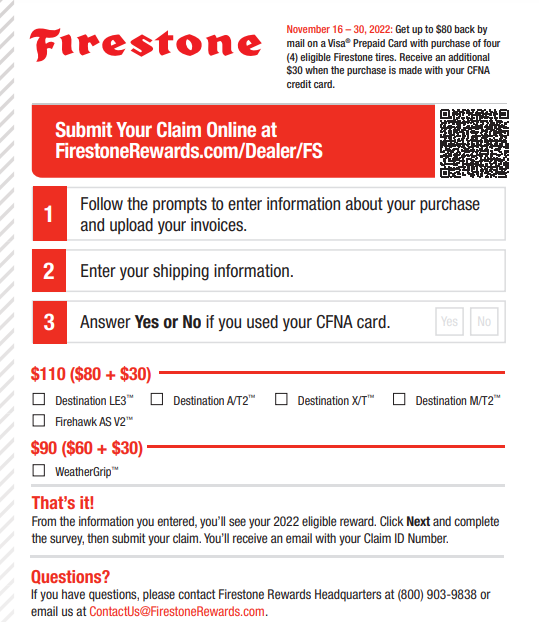

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

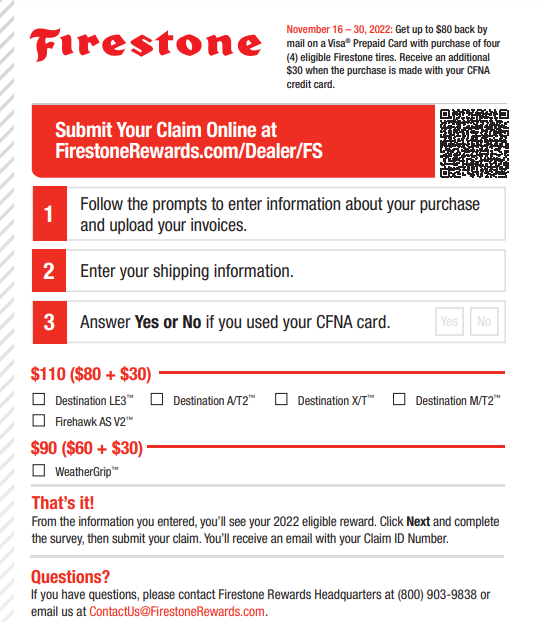

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-eligibility-calculator-how-to-claim-6.jpg?resize=768%2C596&ssl=1

Recovery Rebate Credit Married In 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/missing-stimulus-payments-irs-offers-details-to-receive-recovery-2.jpg

You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments

Who Is Eligible The recovery rebate credit is available to individuals who have not claimed the credit on a previously filed tax return and who did not receive an economic impact payment Some people never received or didn t get their full stimulus payment amount in 2021 If this applies to you or if you gained any dependents in 2021 you might be able to claim the 2021 Recovery Rebate Credit even if you don t usually file taxes Check out our FAQs about claiming the 2021 Recovery Rebate Credit below for general

Download Accidentally Claimed Recovery Rebate Credit 2023

More picture related to Accidentally Claimed Recovery Rebate Credit 2023

2023 Recovery Rebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/recovery-rebate-credit-2023.jpg?resize=980%2C551&ssl=1

Recovery Rebate Credit 2023 Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/2023-new-hsa-limits-claremont-insurance-services.jpg

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable As a credit the Recovery Rebate Credit can be claimed when you file your income tax return However since the stimulus payments were made in 2020 and 2021 the Recovery Rebate Credit must be claimed on your tax returns for those two years

Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the Economic Impact Payments To qualify for any of the three stimulus payments all of the following had to apply at the time You were a US citizen or US resident alien Background If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/parents-of-children-born-in-2021-could-get-1-400-tax-credit-miami-herald-2.jpg

2023 Recovery Rebate Credi Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-5.jpg

https://www. irs.gov /newsroom/recovery-rebate-credit

IRS Statements and Announcements Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

https:// ttlc.intuit.com /turbotax-support/en-us/...

SOLVED by TurboTax 751 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

What If I Accidentally Claimed The Recovery Rebate Credit Everything

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

VERIFY On Twitter You May Be Eligible To Claim A Recovery Rebate

Recovery Rebate Worksheet 2023 Form Recovery Rebate

Intoxalock Rebate Form 2023 Printable Rebate Form Rebate2022

Accidentally Claimed Recovery Rebate Credit 2023 - Jan 1 2024 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2024 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win