Account Based Pension Tax Offset Eligibility for seniors and pensioners tax offset To be eligible for the seniors and pensioners tax offset SAPTO you must be eligible for an Australian Government pension or

You may be entitled to an Australian super income stream tax offset Your PAYG payment summary superannuation income stream may show the amount of tax Last updated 1 August 2023 Print or Download On this page How super is taxed How tax applies to your super withdrawals Tax free and taxable super You re under your

Account Based Pension Tax Offset

Account Based Pension Tax Offset

https://promenadewm.com.au/wp-content/uploads/2021/02/Understanding-accounta-based-pensions.jpg

Government Pension Offset GPO What You Need To Know Financial

https://www.tommymartin.com/wp-content/uploads/2022/08/government-pension-offset-1024x682.jpg

What s An Account Based Pension Choice Income Retirement Income

https://i.ytimg.com/vi/YALtOOMiYfA/maxresdefault.jpg

Finding an account based pension with low fees will allow you to enjoy more income once you re finished working Account based pensions can also save you on tax Once you ve retired you can turn your super or Income payments attract a 15 tax offset between preservation age and 59 and are tax free 1 at age 60 or over No tax is payable on investment earnings as the pension is in

The tax free component portion is received tax free and the taxable component portion is taxed at your marginal tax rate minus a 15 tax offset Are Account Based Pension Earnings Taxable Account based Once you start drawing a super pension both the earnings on investments in your pension account and the income you receive is tax free from age 60 If you are above the

Download Account Based Pension Tax Offset

More picture related to Account Based Pension Tax Offset

Spouse Contribution Tax Offset After Tax 18 FP

https://fpkoala.com/fpkoala/wp-content/uploads/2022/03/pexels-gustavo-fring-4148984-scaled.jpg

Account Based Pension Versus Accumulation Account Retirement

https://retirementessentials.com.au/wp-content/uploads/2022/11/from-saving-to-withdrawing-move-to-account-based-pension.jpg

Top 18 Low Income Tax Offset Calculator 2022

https://atotaxrates.info/wp-content/uploads/2021/05/foreign-income-tax-offset-claim-2021-1024x549.jpg

For an account based pension also referred to as an allocated pension a minimum amount is required to be paid each year with no maximum except for transition to retirement pensions which are What s an account based pension When you retire you can receive a regular income from your super while keeping your super balance invested It s easy with an account based pension You use money from your

Up to age 60 the taxable amount of your income from an account based pension is taxed at your personal income tax rate less a 15 tax offset Once you turn If you re aged 55 to 59 the taxable part of your pension is taxed at your marginal tax rate less a 15 tax offset Similar to your super fund account an account

Account Based Pension Vs Transition To Retirement Super Guy

https://superguy.com.au/wp-content/uploads/2018/10/Account-Based-Pension-vs-Transition-To-Retirement-980x551.jpg

The Age Pension Is Taxable But Here s Why Many Pensioners Pay No Tax

https://wp.thenewdaily.com.au/wp-content/uploads/2021/08/1627784162-happy-older-couple-getty.jpg?resize=1313,876&quality=90

https://www.ato.gov.au/individuals-and-families/...

Eligibility for seniors and pensioners tax offset To be eligible for the seniors and pensioners tax offset SAPTO you must be eligible for an Australian Government pension or

https://www.ato.gov.au/individuals-and-families/...

You may be entitled to an Australian super income stream tax offset Your PAYG payment summary superannuation income stream may show the amount of tax

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

Account Based Pension Vs Transition To Retirement Super Guy

Understanding The Seniors And Age Pension Tax Offset SAPTO LifeTime

Reduction In Account based Pension Minimums Trusted Aged Care Services

Guide To Low And Middle Income Tax Offset LMITO Of 1 080 Sydney

Understanding Account Based Pension Payment Changes Saige

Understanding Account Based Pension Payment Changes Saige

What Is An Account Based Pension LiveWell

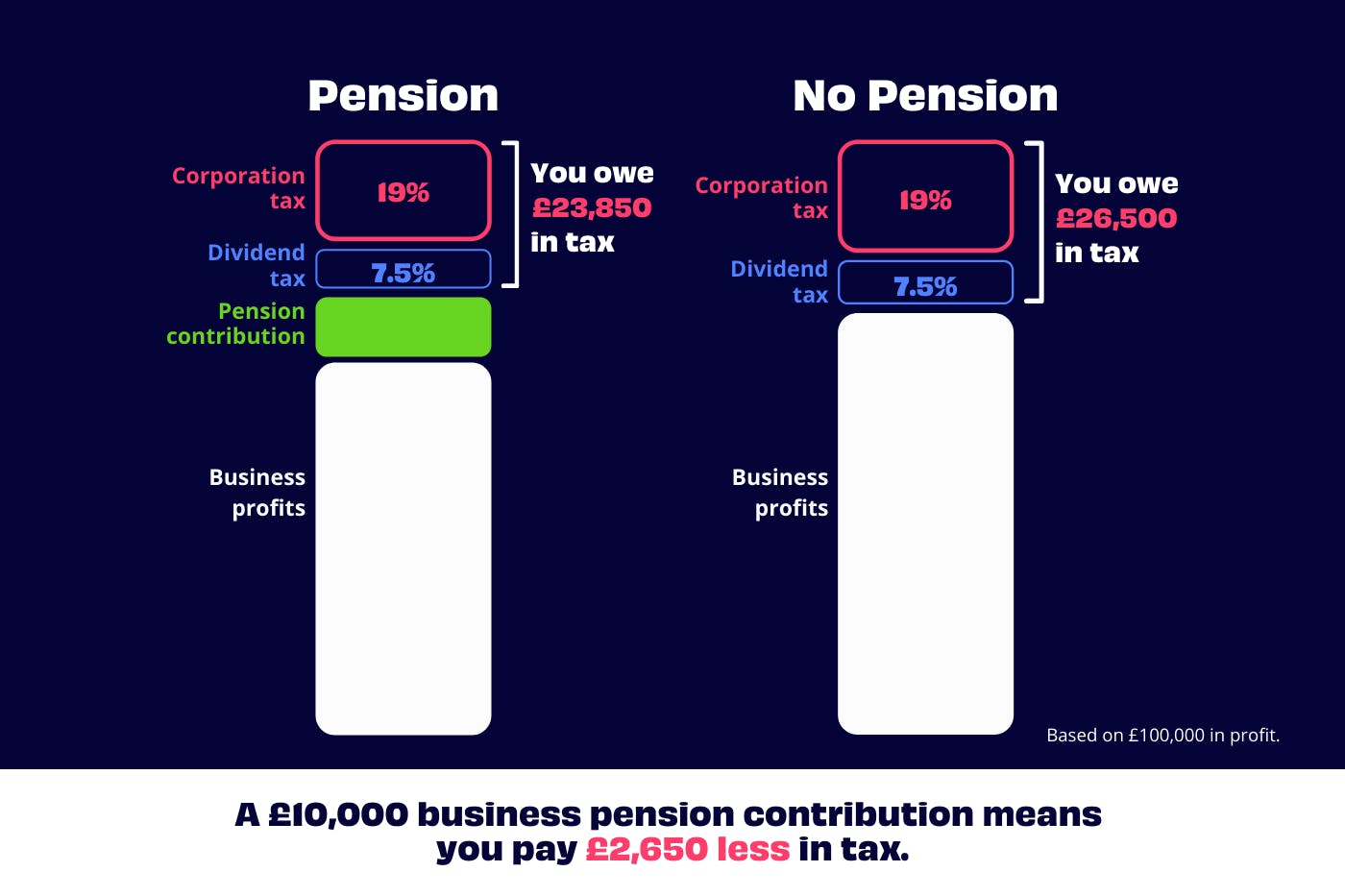

Self Employed Pension Tax Relief Explained Penfold Pension

Do Pensioners Need To Lodge A Tax Return Expat US Tax

Account Based Pension Tax Offset - Once you start drawing a super pension both the earnings on investments in your pension account and the income you receive is tax free from age 60 If you are above the