Accounting For Rebates Received From Suppliers Web 1 What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are

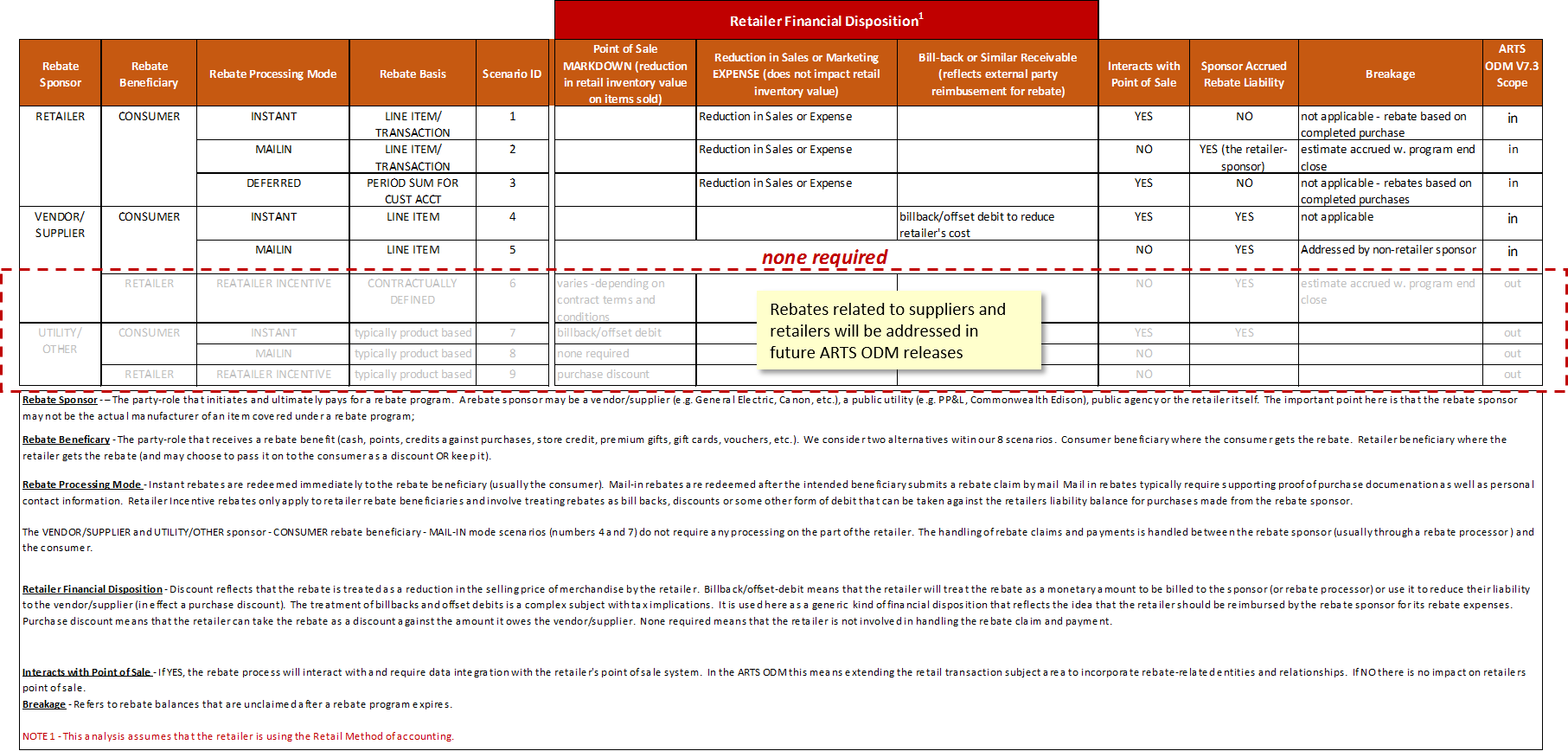

Web 12 nov 2015 nbsp 0183 32 IFRS Inventory discounts and rebates 12 Nov 2015 Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on the type of arrangement Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

Accounting For Rebates Received From Suppliers

Accounting For Rebates Received From Suppliers

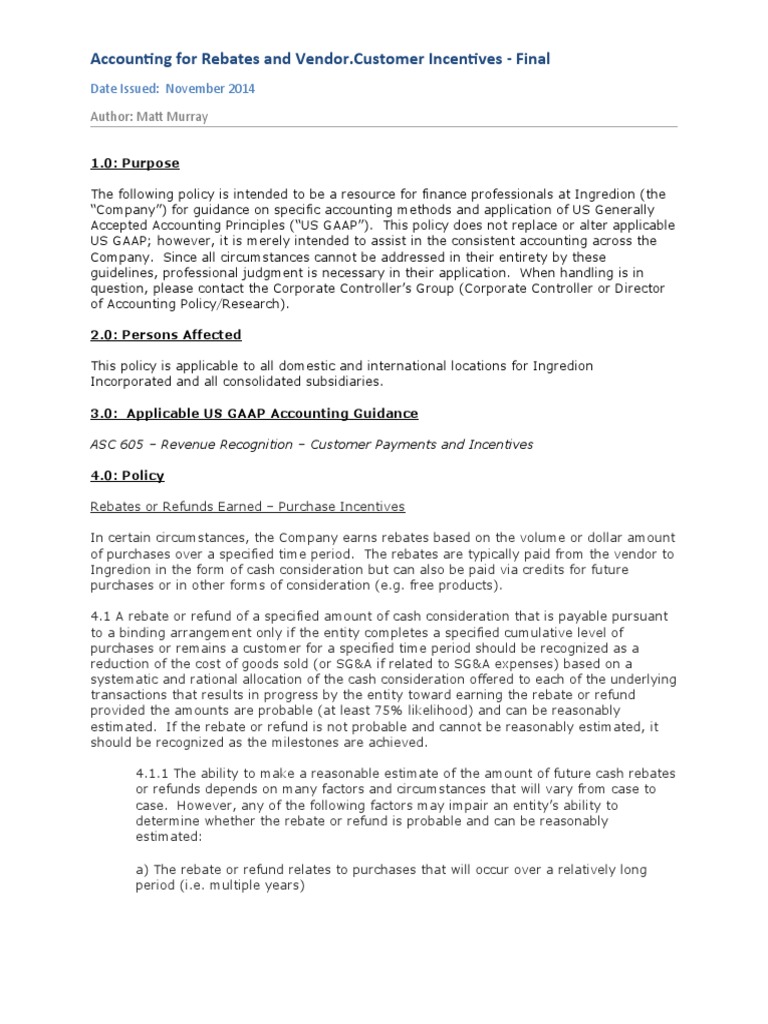

https://www.omg.org/retail-depository/arts-odm-73/arts_odm_v73_figure_0030_11.png

Rebate In MM SAP Blogs

https://blogs.sap.com/wp-content/uploads/2012/11/n_153380.jpg

Accounting For Rebates And Vendor Customer Incentives Final PDF

https://imgv2-1-f.scribdassets.com/img/document/616662756/original/38980061de/1689817345?v=1

Web When a rebate amount is received from a supplier the value of stock for those products is reduced to a lower net of rebates cost It is important to track and accrue this amount accurately in the balance sheet because Web 31 d 233 c 2021 nbsp 0183 32 ASC 705 20 provides accounting guidance on how a customer including a reseller of a vendor s products should account for cash consideration as well as sales incentives received from a vendor

Web An entity shall account for consideration payable to a customer as a reduction of the transaction price and therefore of revenue unless the payment to the customer is in exchange for a distinct good or service that the customer transfers to the entity Web 31 mai 2023 nbsp 0183 32 In response to investors calls for more transparency of supplier finance arrangements impacts on the financial statements the International Accounting Standards Board IASB has amended IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments Disclosures The amendments introduce additional disclosure requirements

Download Accounting For Rebates Received From Suppliers

More picture related to Accounting For Rebates Received From Suppliers

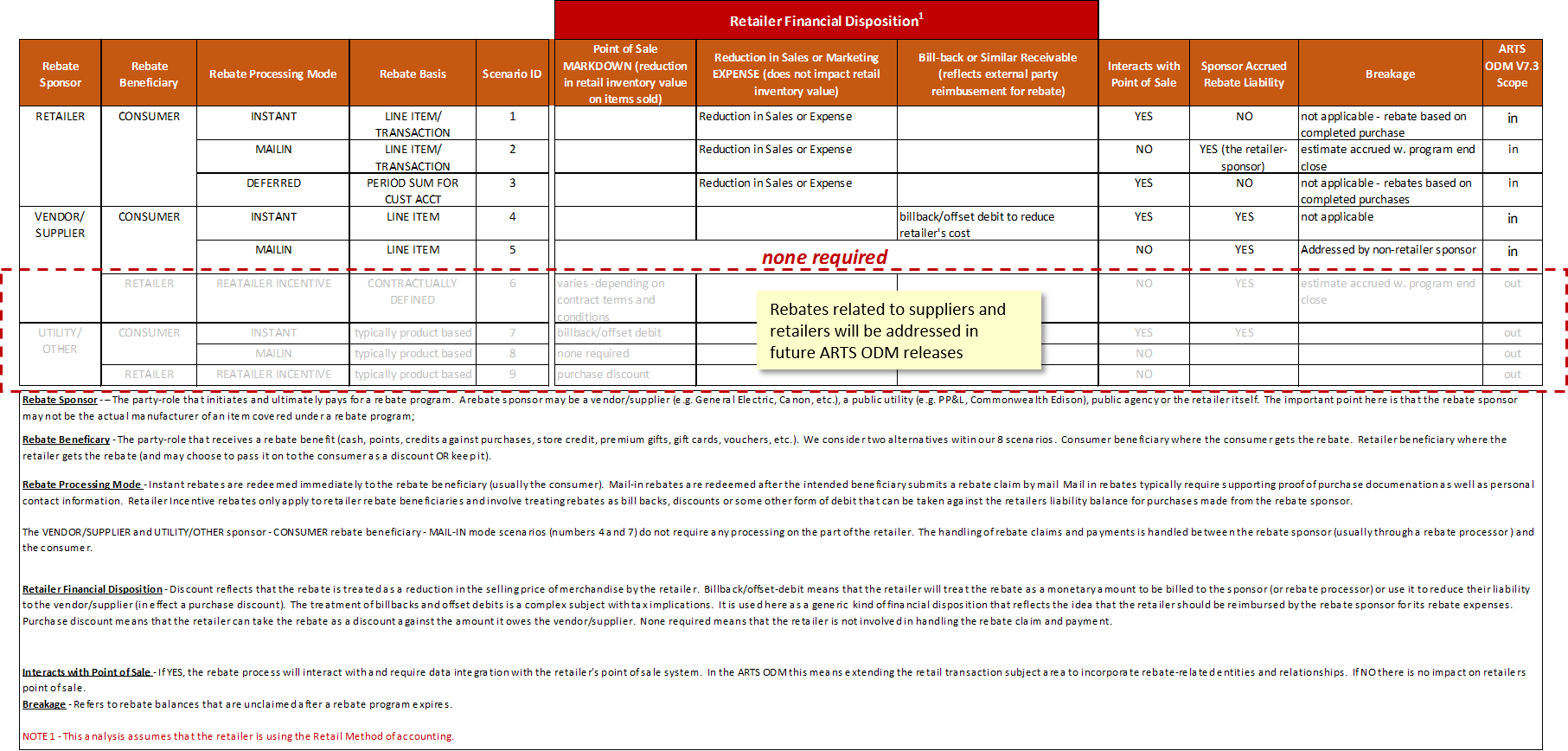

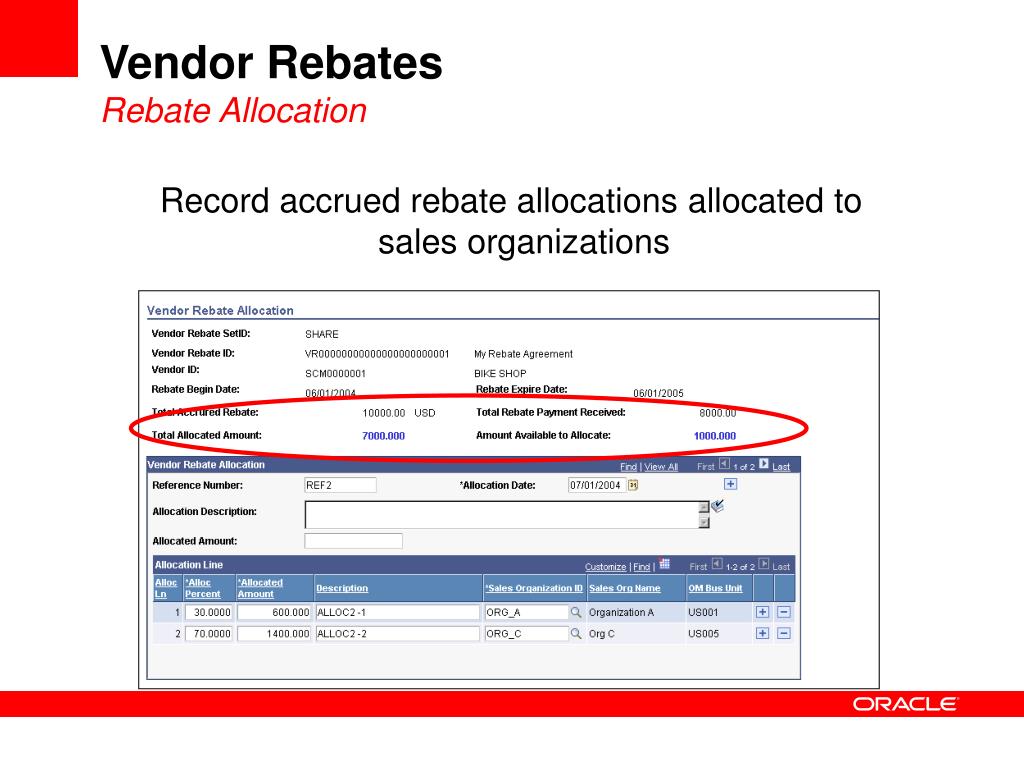

Rebates Rebate Allocation Form JIWA Training

https://jiwatraining.com.au/wp-content/uploads/2021/03/2021-02-19_14-16-24_3.jpg

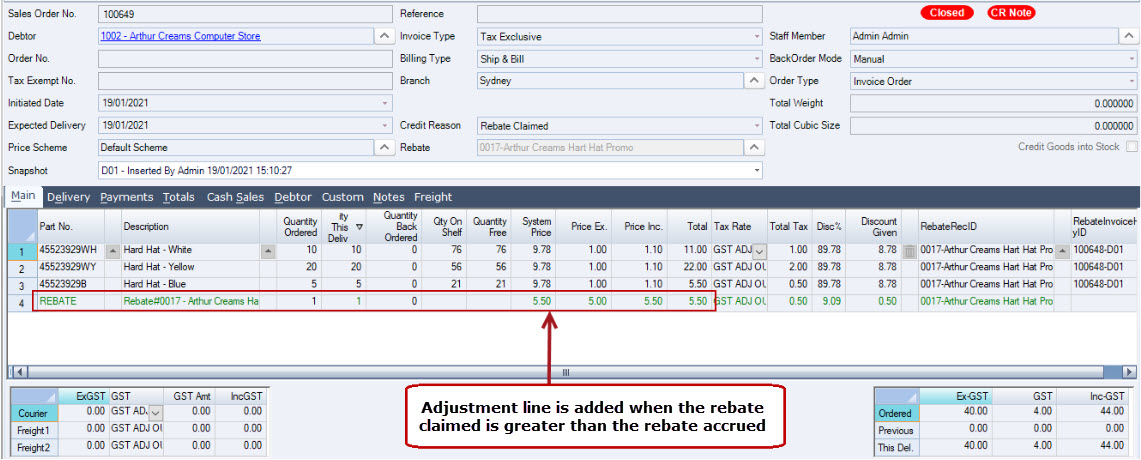

Rebates Rebate Accruals JIWA Training

https://austlinkwebresources.s3.amazonaws.com/www.jiwatraining.com.au/articles/Jiwa-Rebates-Rebate-Accruals/15-01-2021 11-40-25 AM.png

Rebate Accounting Entries pdf Rebate Marketing Debits And Credits

https://imgv2-2-f.scribdassets.com/img/document/128624427/original/990a15dfeb/1583426100?v=1

Web Recent media attention has brought into question retailers accounting for rebates Reports allege that retailers have maximised rebates on stock not yet sold and recorded these rebates as income or reductions in other expenses If true such practices could be in breach of accounting standards Web The rebate accrual is the amount of rebate that has been earnt but not yet received or for customer rebates the amount that is owed but not yet paid For example you may earn a quarterly rebate based on overall

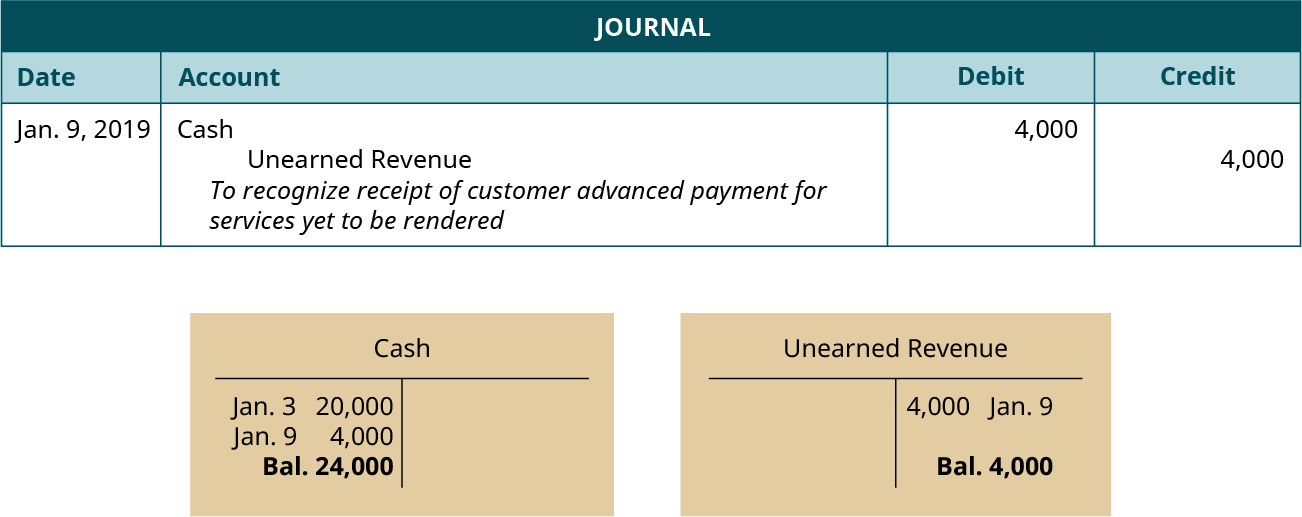

Web Journal Entry for Rebate Received When the company receives a rebate from the supplier they will recognize cash received and the decrease in purchase items It is considered as the price adjustment over the purchase of the asset The company cannot record it as revenue Web 31 d 233 c 2016 nbsp 0183 32 Accounting policy Supplier income comprises fixed price discounts volume rebates and customer sales support Fixed price discounts and volume rebates received and receivable in respect of goods which have been sold are initially deducted from the cost of inventory and therefore reduce cost of sales in the income statement when the goods

Rebate Accounting Product

https://assets-global.website-files.com/61eedc0893a3ae85c3fe7761/634d30bf0007a1380634b2a1_watchlist.png

PPT Vendor Rebates PowerPoint Presentation Free Download ID 2924033

https://image1.slideserve.com/2924033/vendor-rebates-rebate-allocation-l.jpg

https://www.solvexia.com/blog/accounting-fo…

Web 1 What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are

https://www.grantthornton.ie/insights/factsheets/ifrs-viewpoint-3

Web 12 nov 2015 nbsp 0183 32 IFRS Inventory discounts and rebates 12 Nov 2015 Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on the type of arrangement

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

Rebate Accounting Product

7 Common Problems With Accounting For Rebates Enable

The South Carolina Department Of Revenue SCDOR Is Looking To Clear Up

Due To Due From Accounting Tewssa

FREE Richard s Rainwater Still Whole Foods Market After Ibotta Rebate

FREE Richard s Rainwater Still Whole Foods Market After Ibotta Rebate

What Is Rebate GETBATS Blog

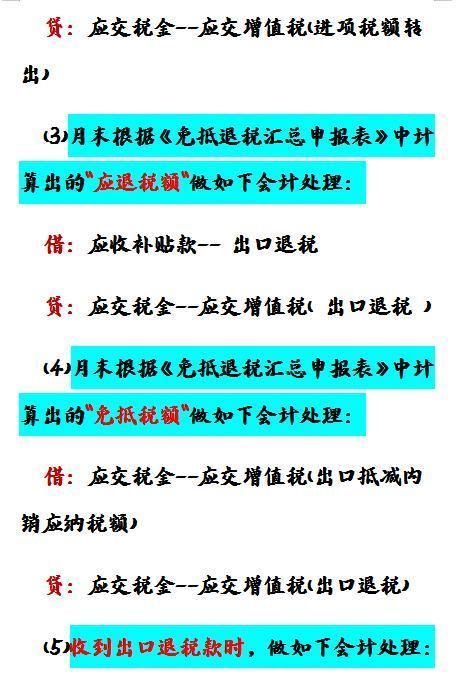

Foreign Trade Accountant Come Here This Export Tax Rebate Accounting

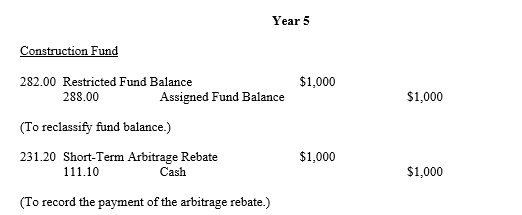

Arbitrage Rebates Office Of The Washington State Auditor

Accounting For Rebates Received From Suppliers - Web Auditing for vendor rebates can be complicated In this article person share some common procedures key and choose to perform it easier for your team