Address For Hmrc Tax Refund Posted Sat 30 Jan 2021 13 14 32 GMT by HMRC Admin 5 Hello You would need to contact the taxes helpline to get a replacement cheque sent 0300 200 3300

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help Confirming your identity it s crucial that we only communicate with established contacts at their correct email addresses

Address For Hmrc Tax Refund

Address For Hmrc Tax Refund

https://www.lamontpridmore.co.uk/wp-content/uploads/2022/08/Scam-letter.png

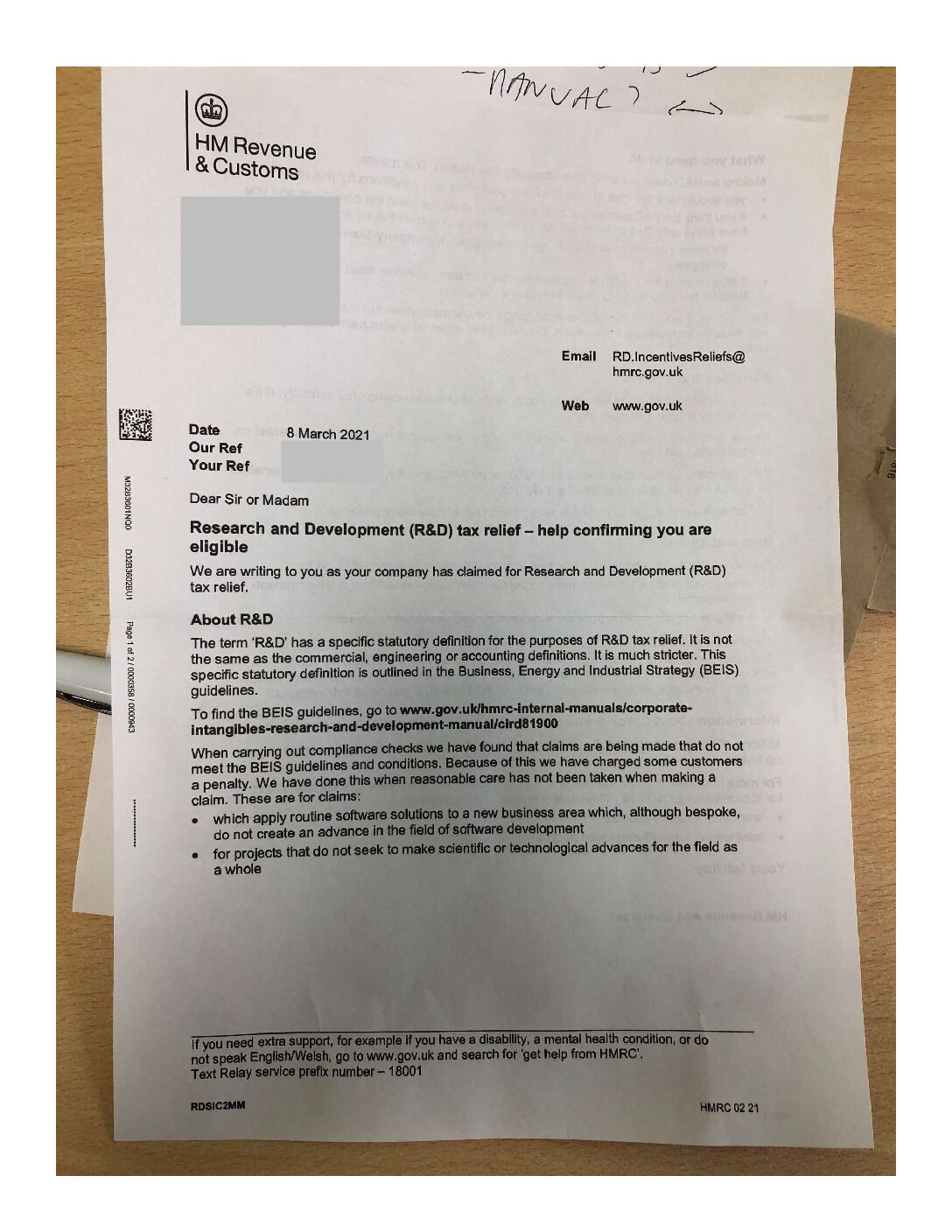

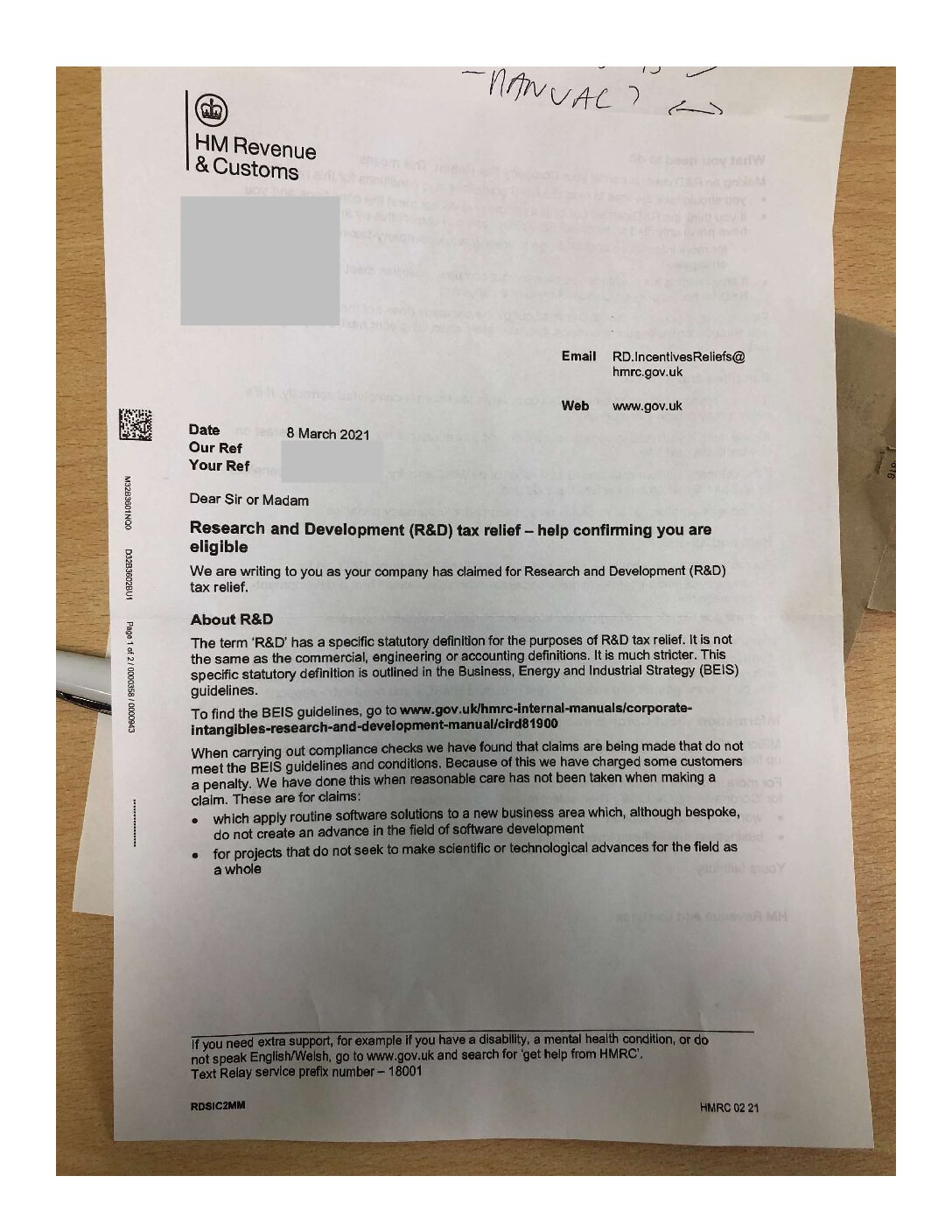

134 In 3 No 7 Have You Or Your Clients Received A NUDGE Letter

https://tectonapartnership.com/wp-content/uploads/2021/04/RD-Letter-1-pdf.jpg

14 INFO HMRC NOTIFICATION LETTER FREE PRINTABLE DOWNLOAD ZIP

https://www.informdirect.co.uk/wp-content/uploads/2014/07/HMRC-confirmation-that-a-company-will-be-treated-as-dormant.jpg

Last Updated 08 September 2022 HM Revenue Customs have different addresses for Pay As You Earn PAYE Self Assessment SA and Capital Gains Tax Back to top This guide provides a list of regularly used HMRC contact information It includes telephone numbers and postal addresses together with a number of tips The

If you believe you have overpaid tax and don t receive a P800 you can initiate the refund process by contacting HMRC directly This can be done either by phone or If you believe that you are owed a tax refund or are paying too much tax due to an incorrect tax code you have three main options open to you in order to claim back tax from HMRC Option 1 Your online personal tax

Download Address For Hmrc Tax Refund

More picture related to Address For Hmrc Tax Refund

Hmrc Tax Return

https://img.yumpu.com/28600181/1/500x640/sample-letter-to-hmrc-on-receiving-a-2007-08-paye-tax-.jpg

Not Sure Why My Self Assessment Tax Bill Is So High For

https://f01.justanswer.com/xcKPrzV2/HMRC-_View_your_calculation_-_View_your_full_calculation.jpg

HMRC Self Assessment Late Payment Appeal Page 2 RTG Sunderland

http://i.imgur.com/Xg7Cj4B.jpg

Self Assessment helpline 0300 200 3310 Child Benefits helpline 0300 200 3100 Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 Household money lovemoney staff Updated on 19 September 2023 HMRC tax refund P800 letters Your employer gives HM Revenue Customs HMRC details of how much income you receive

17 May 2010 at 5 52PM There should be a number on her P60 called a Employer Reference Tax Reference or something like this It is in the format 123 AB45678 Enter 3 January 2024 Press release Child Benefit claims can be made online for the first time Estimate how the January 2024 National Insurance contributions changes will affect you

HMRC MarvicBladyn

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

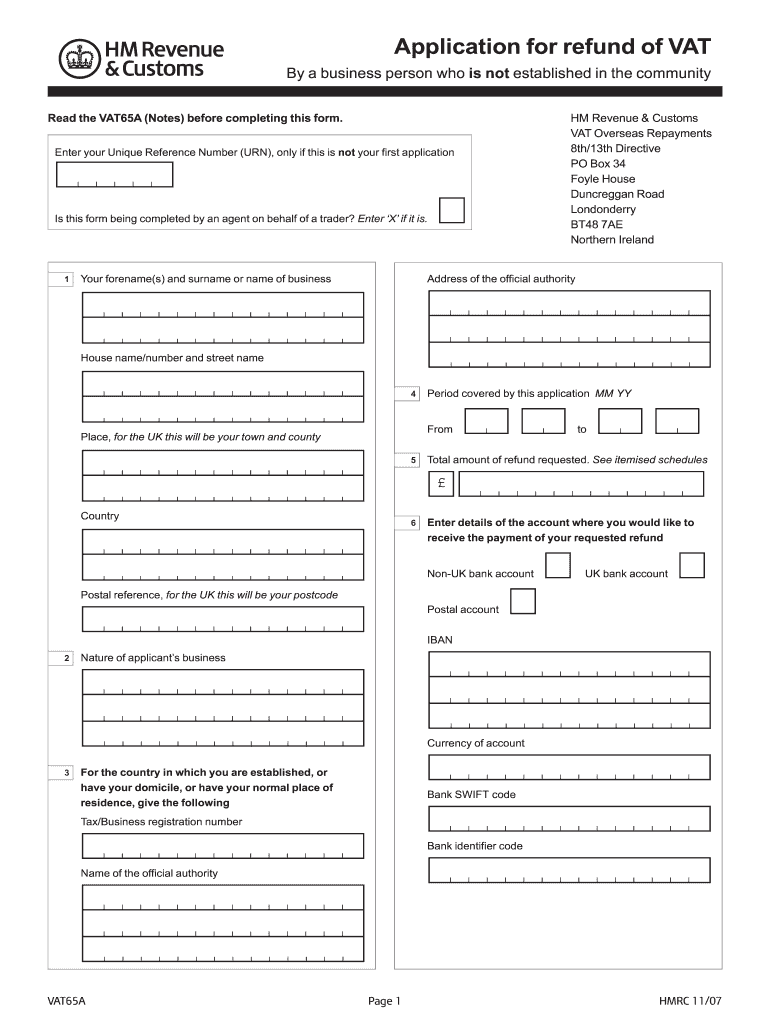

HMRC Form Refund Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/22/339/22339794/large.png

https://community.hmrc.gov.uk/customerforums/pt/d9...

Posted Sat 30 Jan 2021 13 14 32 GMT by HMRC Admin 5 Hello You would need to contact the taxes helpline to get a replacement cheque sent 0300 200 3300

https://assets.publishing.service.gov.uk/...

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help

HMRC Security Notice Requests HMRC Fraud Investigation Service

HMRC MarvicBladyn

Sample HMRC Letters Business Advice Services

HMRC Really Do Not Want To Collect Corporation Tax

HMRC Staff Are Not Being Protected By The Autumn Statement They re

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

HMRC Give Tax Relief Pre approval Save The Thorold Arms

What Does HMRC Do Tax Banana

Customs Forms Printable Printable Forms Free Online

Address For Hmrc Tax Refund - Last Updated 08 September 2022 HM Revenue Customs have different addresses for Pay As You Earn PAYE Self Assessment SA and Capital Gains Tax