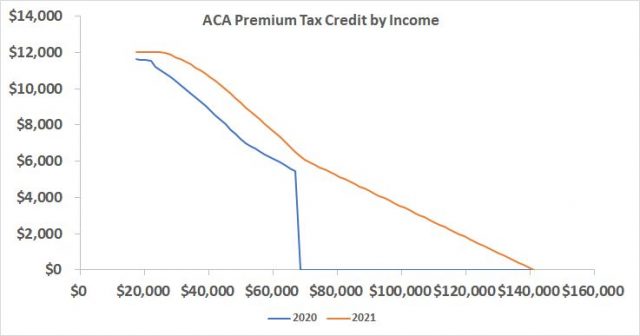

Affordable Care Act Tax Credit Income Limits Through 2025 if you make over 400 FPL tax credits will gradually decrease as your taxable income rises eliminating the sharp cutoff or subsidy cliff at 58 320 120 000

Through 2025 if you make over 400 FPL tax credits gradually decrease as your taxable income rises That means there is no sharp cutoff or subsidy cliff at 60 240 To be eligible for the premium tax credit your household income must be at least 100 percent and for years other than 2021 and 2022 no more than 400 percent of the federal poverty line

Affordable Care Act Tax Credit Income Limits

Affordable Care Act Tax Credit Income Limits

https://www.gyf.com/wp-content/uploads/2018/01/ACA-image.png

Does Affordable Care Act Repeal And Replace Mention Workers Comp

https://cutcompcosts.com/wp-content/uploads/2017/03/Affordable-Care-Act-Repeal-and-Replace-1200x800.jpg

Fact Sheet On Why Affordable Care Act

https://s3.studylib.net/store/data/007785623_2-4f620ac479b7c3380c3bb13c98a9b910-768x994.png

How have the income limits for ACA premium subsidies changed Prior to 2021 Marketplace buyers were eligible for premium subsidies if their projected household income didn t exceed 400 of the prior year s federal This means an eligible single person can earn from 15 060 to 60 240 in 2025 and qualify for the tax credit Tax credit information for the 2025 coverage year is based on 2024 federal poverty guidelines A family of three

Premium tax credits are available to people who buy Marketplace coverage and whose income is at least as high as the federal poverty level For an individual that means an income of at least A text version of a graphic featuring a flow chart with yes or no questions to help you find out if you may be eligible for the premium tax credit

Download Affordable Care Act Tax Credit Income Limits

More picture related to Affordable Care Act Tax Credit Income Limits

New Report Details How Government Undermines The Affordable Care Act

https://citizentruth.org/wp-content/uploads/2019/07/32730342840_32a38bfe66_k.jpg

ACA Premium Subsidy Cliff Turns Into A Slope In 2021 And 2022

https://thefinancebuff.com/wordpress/wp-content/uploads/2021/04/aca-ptc-2021-640x336.jpg

What Is The Income Limit For Aca Subsidies 2022 2022 Top Virals

https://i2.wp.com/www.financialsamurai.com/wp-content/uploads/2013/10/ACA-income-limit-for-subsidies.png

Section 9661 of the American Rescue Plan ARP simply caps marketplace health insurance premiums for the benchmark plan at no more than 8 5 of household income These subsidies or Premium Tax Credits PTC or Advance Premium Tax Credits APTC lower your monthly health insurance payments In 2025 your eligibility is based on your projected income and the benchmark

There s a cap on how much you need to pay back The cap varies depending on your Modified Adjusted Gross Income MAGI relative to the Federal Poverty Level FPL and Compare your income with the Federal Poverty Level FPL to calculate the premium subsidy tax credit for health insuance under the Affordable Care Act

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Affordable Care Act Plans Available Even If Job Offers Health Insurance

https://www.goerie.com/gcdn/presto/2023/06/20/NETN/95923369-d9fd-4d6a-bf32-ea314910d234-p1davebruce060723.jpg?crop=2776,1562,x0,y238&width=2776&height=1562&format=pjpg&auto=webp

https://obamacarefacts.com

Through 2025 if you make over 400 FPL tax credits will gradually decrease as your taxable income rises eliminating the sharp cutoff or subsidy cliff at 58 320 120 000

https://obamacarefacts.com

Through 2025 if you make over 400 FPL tax credits gradually decrease as your taxable income rises That means there is no sharp cutoff or subsidy cliff at 60 240

Repealing The Affordable Care Act Would Cut Taxes For High Income

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

.png?h=34e2d690&itok=E-OFMNAM)

Affordable Care Act Tax Credits Have Been Expanded Philadelphia

Affordable Care Act Makes This Tax Season Painful For Many WJCT NEWS

How The Affordable Care Act Is Poised To Increase Healthcare Job Growth

Cost Of Website For Affordable Care Act Summers Forebole

Cost Of Website For Affordable Care Act Summers Forebole

Refundable Child Tax Credit Heaven Alvarez LLC

Income Limits San Benito TX Official Website

Repeal Of The Affordable Care Act Taxes TRI AD

Affordable Care Act Tax Credit Income Limits - The premium tax credit helps qualifying individuals and families afford health insurance purchased from the federally regulated marketplace better known as the Affordable