Affordable Care Rebate Your Income Tax Eturn Web The federal mandate for the Affordable Care Act was in place from 2014 to 2018 and the requirement to report your health insurance on your tax return has expired for 2019

Web 13 f 233 vr 2023 nbsp 0183 32 If the credit that is calculated on your tax return is less that what you actually received you may have to pay back the difference with your tax return The American Rescue Plan Act of 2021 suspended this requirement for tax year 2021 Web 23 mai 2023 nbsp 0183 32 Although the total rebate amount dropped to just over 2 billion in 2021 that was still far higher than the 2019 rebate total had

Affordable Care Rebate Your Income Tax Eturn

Affordable Care Rebate Your Income Tax Eturn

https://i2.wp.com/www.financialsamurai.com/wp-content/uploads/2013/10/ACA-income-limit-for-subsidies.png

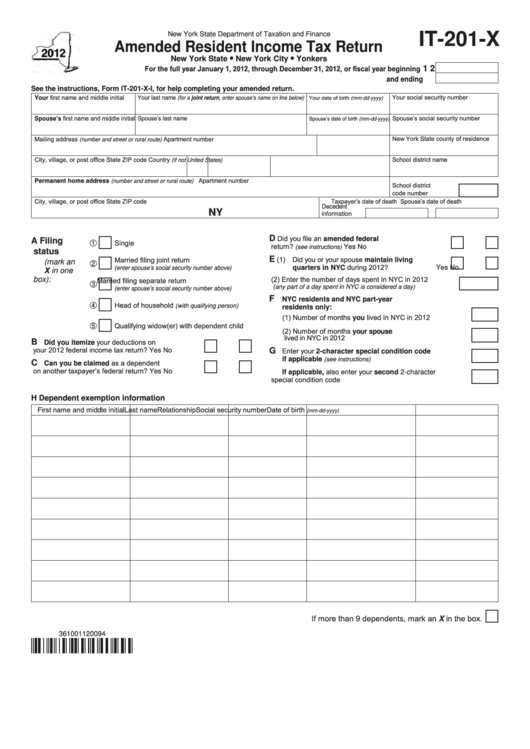

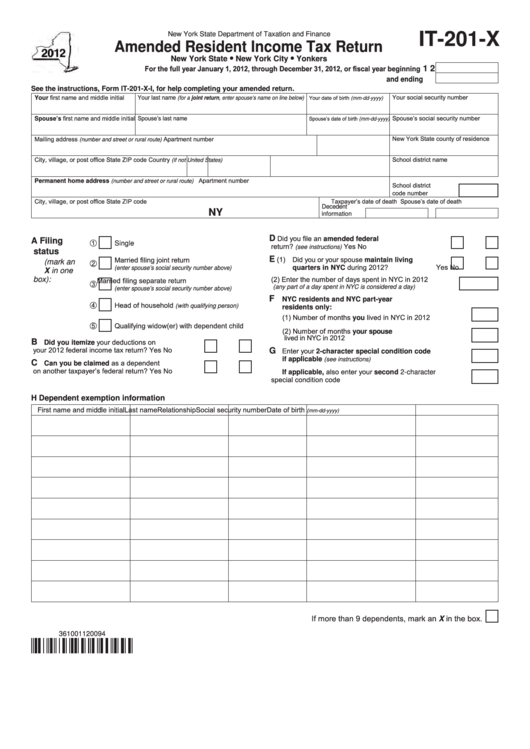

Fillable Form It 201 X Amended Resident Income Tax Return 2012

https://data.formsbank.com/pdf_docs_html/318/3187/318734/page_1_thumb_big.png

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?resize=750%2C480&is-pending-load=1#038;ssl=1

Web 1 mai 2023 nbsp 0183 32 The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals families businesses insurers tax Web 6 sept 2023 nbsp 0183 32 If you are an applicable large employer an estimate of the maximum amount of the potential liability for the employer shared responsibility payment that could apply to

Web The Affordable Care Act provides a one time 250 rebate in 2010 to assist Medicare Part D recipients who have reached their Medicare drug plan s coverage gap This payment is Web 4 juil 2022 nbsp 0183 32 For that reason the Car Taxes Rebate is not really offered Affordable Care Rebate amp Your Income Tax Eturn Requirements for EVs If you re shopping for an

Download Affordable Care Rebate Your Income Tax Eturn

More picture related to Affordable Care Rebate Your Income Tax Eturn

Pin On Tax Tips Forms

https://i.pinimg.com/originals/95/ae/9f/95ae9f36e3ed71d56300eeaab21d4dce.jpg

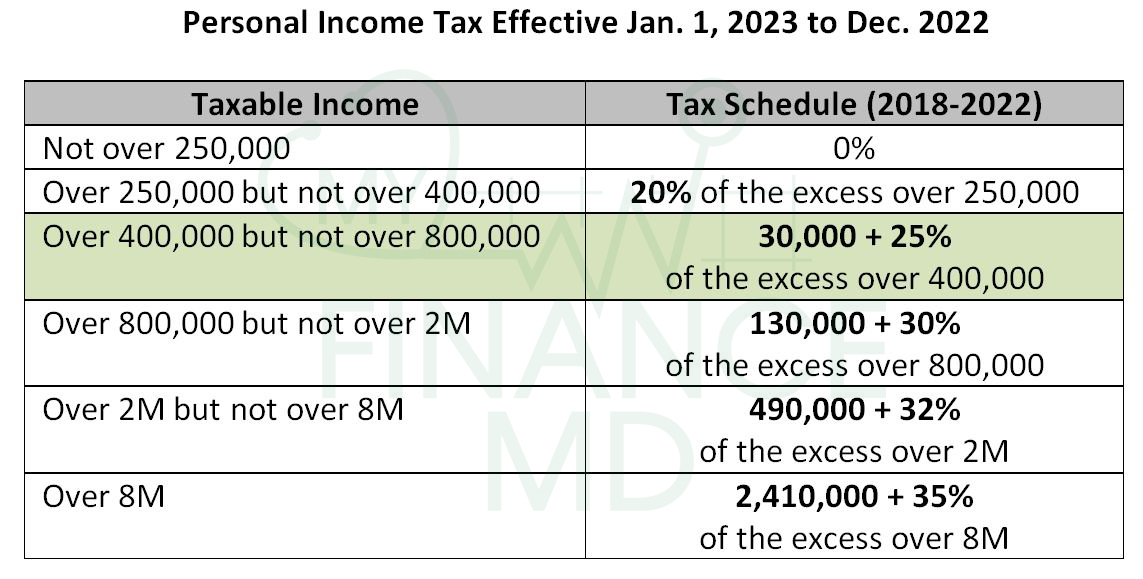

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

https://myfinancemd.com/wp-content/uploads/2018/08/Personal-Income-Tax-myfinancemd.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 24 f 233 vr 2022 nbsp 0183 32 The Basics Q1 What is the premium tax credit updated February 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance Web 6 sept 2023 nbsp 0183 32 The tax changes in the ACA were primarily intended to implement credits for low income Americans and tax hikes for higher earners notably people who earn

Web 15 mars 2023 nbsp 0183 32 The Affordable Care Act ACA includes government subsidies to help people pay their health insurance costs One of these health insurance subsidies is the Web Pay less every month for Health Insurance 59 PER MONTH Get a Quote Insurance providers are required under the Affordable Care Act ACA to spend a minimum

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

https://www.efile.com/health-care-reform-obamacare-taxes

Web The federal mandate for the Affordable Care Act was in place from 2014 to 2018 and the requirement to report your health insurance on your tax return has expired for 2019

https://turbotax.intuit.com/tax-tips/health-care/video-how-to-claim...

Web 13 f 233 vr 2023 nbsp 0183 32 If the credit that is calculated on your tax return is less that what you actually received you may have to pay back the difference with your tax return The American Rescue Plan Act of 2021 suspended this requirement for tax year 2021

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Rebate Income Tax Return 2022 Carrebate

Affordable Care Act Obamacare And Your 2014 Individual Income Tax

T20 0253 Repeal 0 9 Percent Additional Medicare Tax Enacted By The

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Affordable Care Rebate Your Income Tax Eturn - Web For a person filing individually in 2015 for tax year 2014 this means between 11 670 and 46 680 For a family of four it s between 23 850 and 95 400 sources CBPP HSS