After Deduction Tax Rebates Web 8 juin 2023 nbsp 0183 32 Votre abonnement a bien 233 t 233 pris en compte Vous serez alert 233 e par email d 232 s que la page 171 Imp 244 t sur le revenu Frais professionnels forfait ou frais r 233 els d 233 duction 187 sera mise 224

Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In Web De tr 232 s nombreux exemples de phrases traduites contenant quot tax rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

After Deduction Tax Rebates

After Deduction Tax Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

https://i.ytimg.com/vi/qxMqXY80pBc/maxresdefault.jpg

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

Web Tax calculation after claiming deductions and exemptions Total Taxable income Rs 5 lakh Income Tax A Up to Rs 2 5 lakh 0 Rebate under section 87A B Rs 12 500 Web 17 nov 2022 nbsp 0183 32 After Tax Contribution A contribution made to any designated retirement or any other account after taxes has been deducted from an individual s or companies

Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions Web 20 mars 2018 nbsp 0183 32 1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify

Download After Deduction Tax Rebates

More picture related to After Deduction Tax Rebates

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 2 mars 2023 nbsp 0183 32 Tax relief is any program or incentive that reduces the amount of tax owed by an individual or business entity Examples of tax relief include the allowable deduction for pension contributions Web Traductions en contexte de quot after rebate quot en anglais fran 231 ais avec Reverso Context The budget must include the applicable provincial and federal taxes and should be calculated

Web 13 juil 2021 nbsp 0183 32 After Tax Return The return on an investment including all income received and capital gains calculated by taking expected or paid income taxes into account Web 24 f 233 vr 2023 nbsp 0183 32 Difference between tax exemption tax deduction and rebate One can claim income tax deductions and tax exemptions from their income However one can

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Utilidad Neta Despu s De Impuestos NIAT Traders Studio

https://traders.studio/wp-content/uploads/2021/02/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

https://www.service-public.fr/particuliers/vosdroits/F1989

Web 8 juin 2023 nbsp 0183 32 Votre abonnement a bien 233 t 233 pris en compte Vous serez alert 233 e par email d 232 s que la page 171 Imp 244 t sur le revenu Frais professionnels forfait ou frais r 233 els d 233 duction 187 sera mise 224

https://turbotax.intuit.com/tax-tips/tax-relief/what-are-tax-rebates/L...

Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In

What Is Taxable Income 2023

Income Tax Deductions List FY 2019 20

What Is Income Tax Exemption Deduction And Rebate Inuranse

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

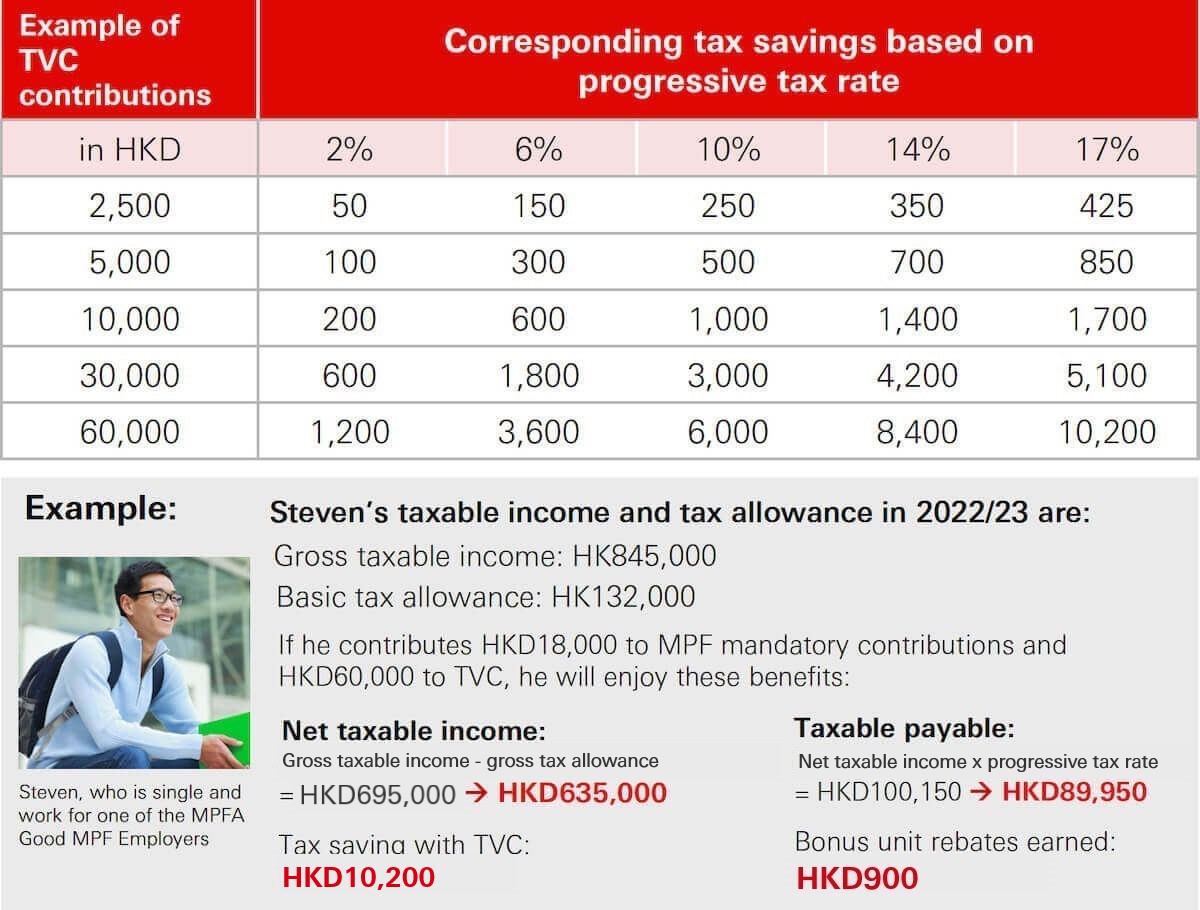

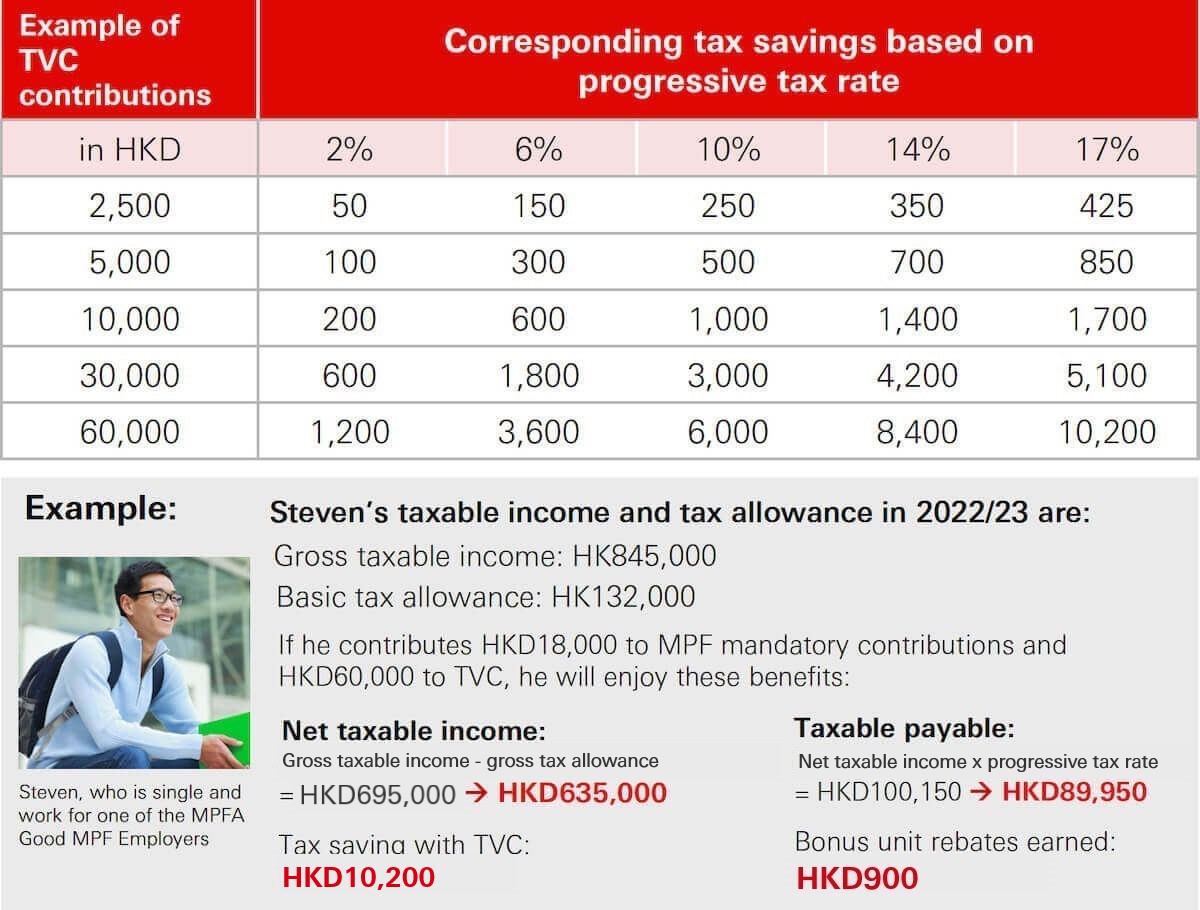

HSBC MPF Enjoy Up To HKD60 000 Tax Deduction And HKD4 500 Bonus Unit

HSBC MPF Enjoy Up To HKD60 000 Tax Deduction And HKD4 500 Bonus Unit

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Tax Deductions Template For Freelancers Google Sheets

After Deduction Tax Rebates - Web 1 f 233 vr 2023 nbsp 0183 32 Date 01 02 2023 Read 4 mins Learn the difference between an income tax rebate and tax exemption and compare it with a tax deduction Check how pensions