After Deduction Tax Retun Rebates Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 20 mars 2018 nbsp 0183 32 1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify Web 1 d 233 c 2022 nbsp 0183 32 Getting money back What is a tax rebate The 2001 federal tax rebate Click to expand Getting money back Federal state and local legislatures frequently issue tax

After Deduction Tax Retun Rebates

After Deduction Tax Retun Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

1065 Tax Retun Example Ascsesci

https://thumbor.forbes.com/thumbor/960x0/https://specials-images.forbesimg.com/imageserve/5f98403b90e982922b0da3b3/US-tax-form-1065-with-a-silver-pen/960x0.jpg

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

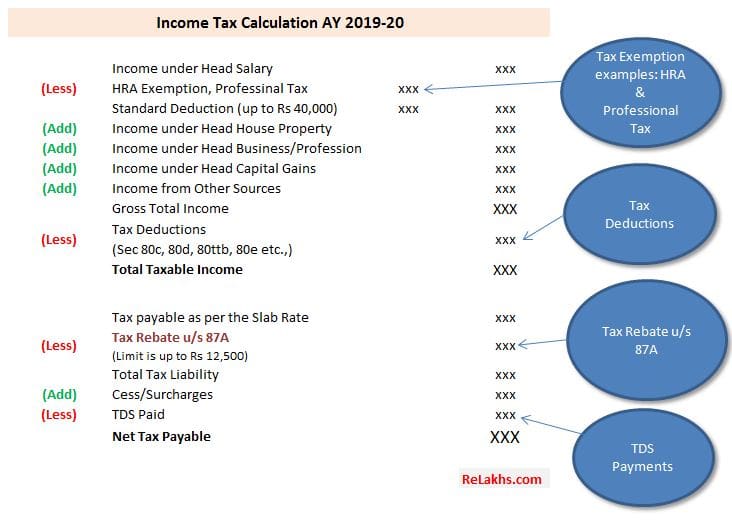

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web Income tax rebate is like the final bargain that you can claim from your taxable income after you have claimed exemptions and deductions Tax rebate under Section 87A of

Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the Web 24 f 233 vr 2023 nbsp 0183 32 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction

Download After Deduction Tax Retun Rebates

More picture related to After Deduction Tax Retun Rebates

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

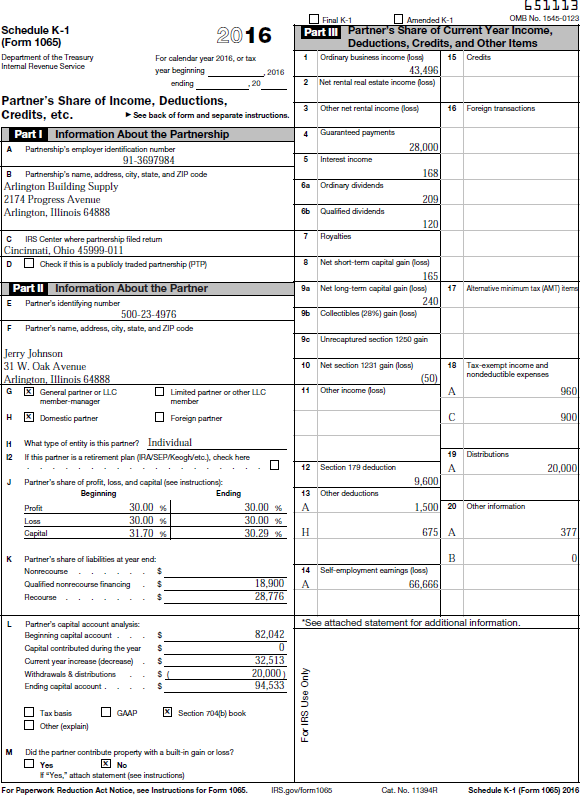

1065 Tax Retun Example Vietnamlasopa

https://www.investopedia.com/thmb/1vnjABWc29g4bYzPwxKSY6beb0Q=/640x827/filters:no_upscale():max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg

1065 Tax Retun Example Vietnamlasopa

https://media.cheggcdn.com/study/ebc/ebc3471a-9400-47f9-a35b-893b721d506e/724424-AC-2IPTR5.png

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web 13 juil 2021 nbsp 0183 32 After Tax Return The return on an investment including all income received and capital gains calculated by taking expected or paid income taxes into account

Web 13 avr 2022 nbsp 0183 32 Please do not call the IRS Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a Recovery Web 20 d 233 c 2022 nbsp 0183 32 It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a

2019 2023 Form Canada T778 E Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/536/408/536408955/large.png

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.taxtim.com/za/blog/the-3-rs-returns-rebates-and-refunds...

Web 20 mars 2018 nbsp 0183 32 1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

2019 2023 Form Canada T778 E Fill Online Printable Fillable Blank

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

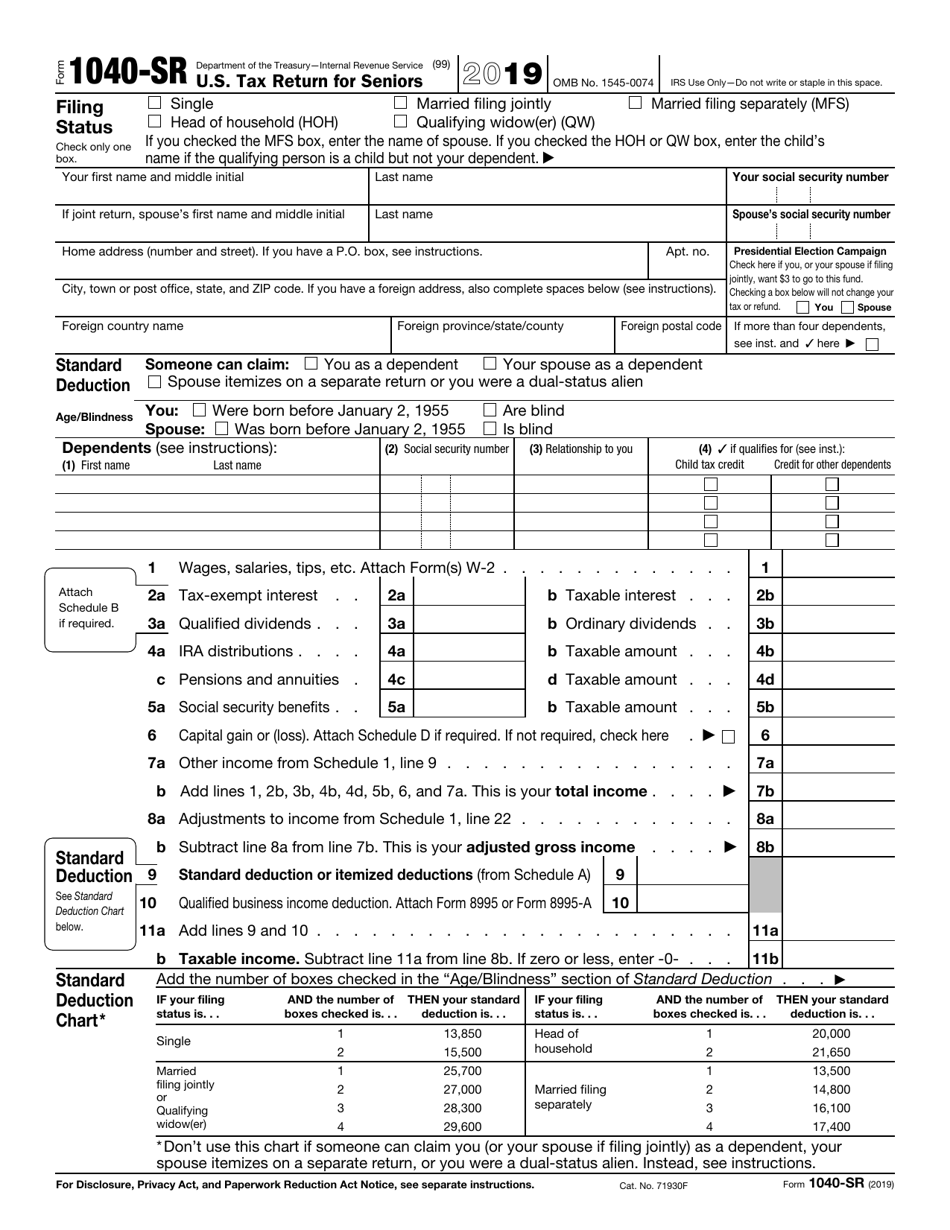

IRS Form 1040 SR 2019 Fill Out Sign Online And Download Fillable

Solved Janice Morgan Age 24 Is Single And Has No Chegg

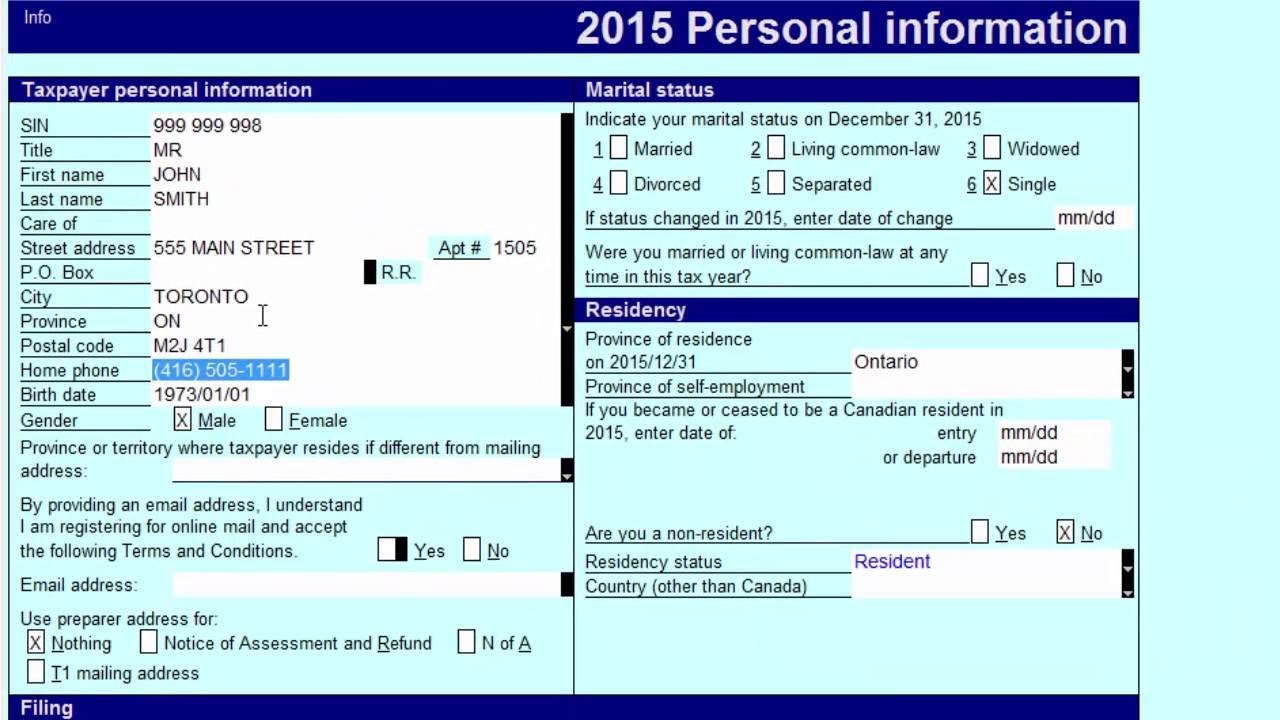

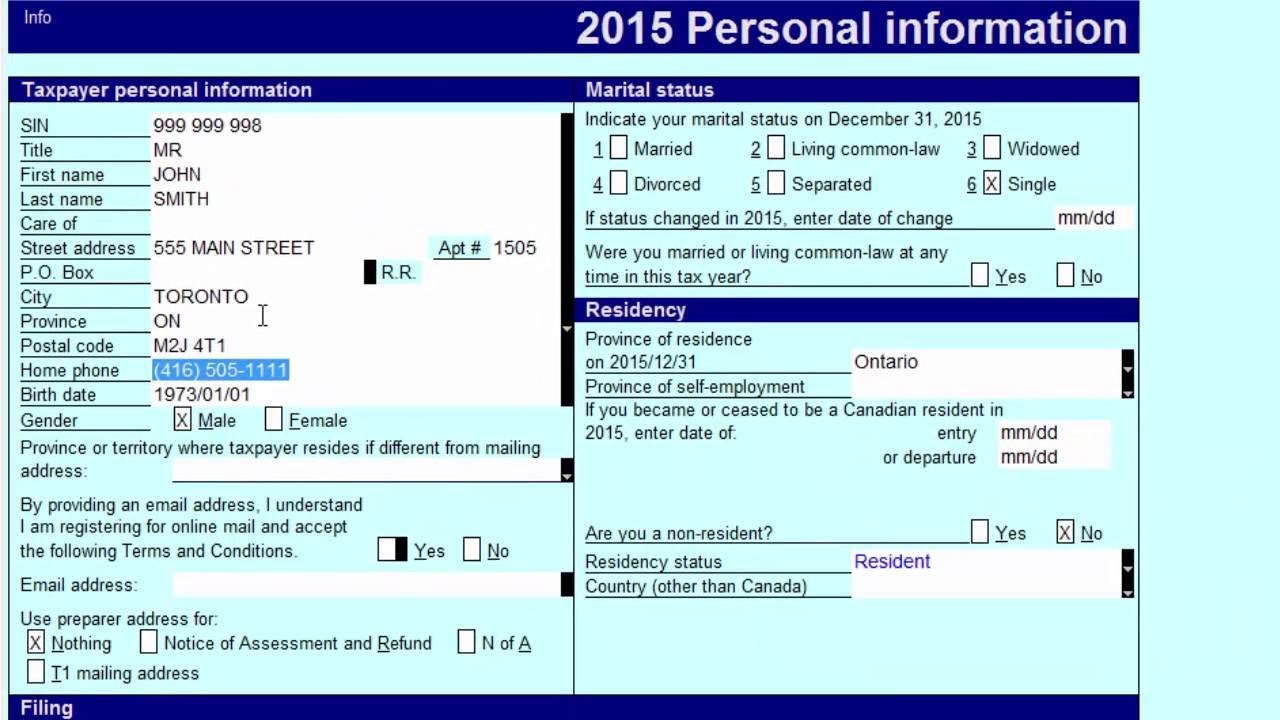

How To Professionally File Tax Retun By ProFile Software YouTube

How To Professionally File Tax Retun By ProFile Software YouTube

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

2022 Deductions List Name List 2022

After Deduction Tax Retun Rebates - Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the