Age Tax Credit 2024 Calculator The federal age amount for 2023 is 8 396 8 790 for 2024 The tax credit is calculated using the lowest tax rate 15 federally so the maximum federal tax credit for 2023 is

Tax credits for age pension disability and family caregiver for infirm minor children Fed YT are automatically transferred to other spouse if unused 2024 Non Refundable Personal Tax Credits Base Amounts The tax credits in this table have been calculated using the indexation factors shown in the bottom line of the table

Age Tax Credit 2024 Calculator

Age Tax Credit 2024 Calculator

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png

One stop Guide To Child Tax Credit Resources SaverLife

https://partner.saverlife.org/wp-content/uploads/2021/07/CTC-payment-schedule-2.gif

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

You can use an independent free and anonymous benefits calculator to check what you could be entitled to This will give you an estimate of the benefits you could get how The calculation includes the following child and family benefits Canada child benefit including related provincial and territorial programs Goods and services

2024 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of June 1 2024 Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces Find out your tax brackets and how much Federal and Provincial

Download Age Tax Credit 2024 Calculator

More picture related to Age Tax Credit 2024 Calculator

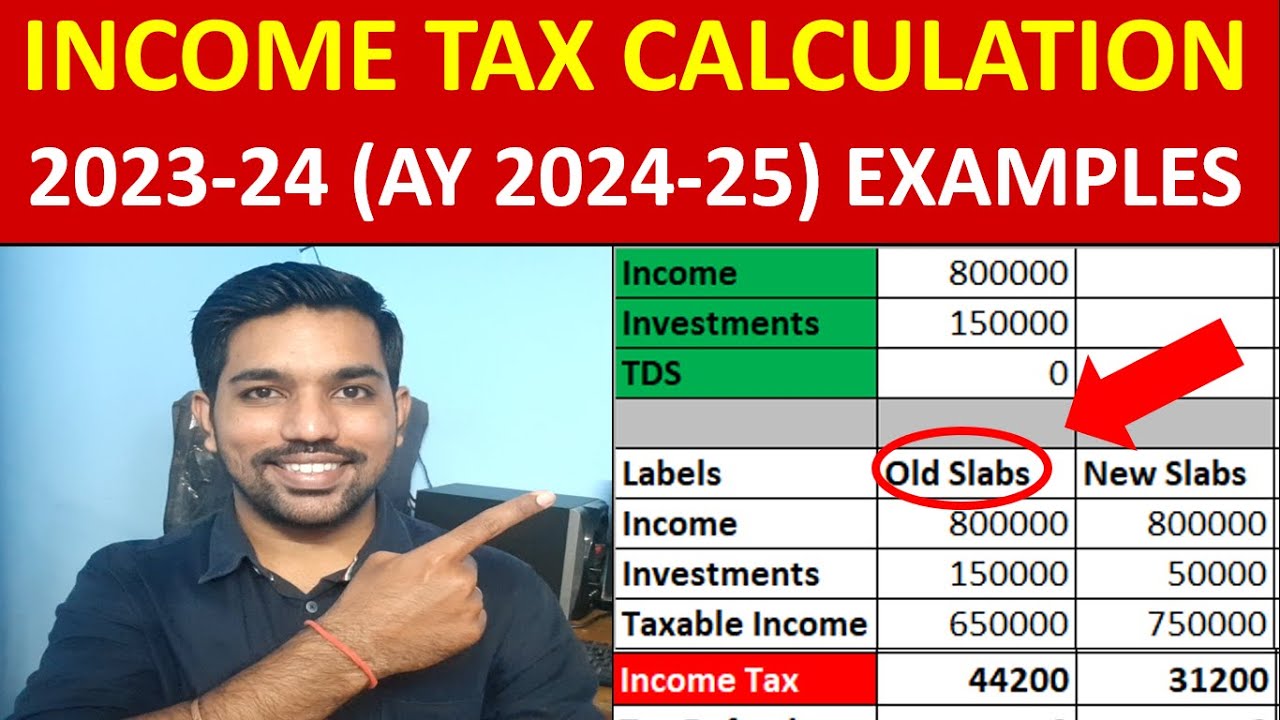

How To Calculate Income Tax 2023 24 AY 2024 25 Tax Calculation

https://i.ytimg.com/vi/H0NdeSQ2ZKQ/maxresdefault.jpg

2022 Child Tax Credit Refundable Amount Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

Age Tax Credit You can claim the yearly Age Tax Credit if you are 65 years or older in the tax year jointly assessed or separately assessed and your partner Use this free income tax calculator to project your 2023 2024 federal tax bill or refund based on earnings age deductions and credits

Use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status If you are 65 or older and blind the extra standard deduction for 2024 is 3 900 if you are single or filing as head of household It s 3 100 per qualifying

Salary Tax Calculator 2023 24 Pakistan Revised Tax Card 2024

https://tax.net.pk/wp-content/uploads/2023/07/Salary-Tax-Calculator-2023-24-Pakistan-and-salary-tax-card-tax-year-2024.jpg

Free Images Number Pen Macro Balance Paper Close Up Cash Font

https://get.pxhere.com/photo/number-pen-macro-balance-paper-close-up-cash-font-banking-commerce-tax-calculator-paperwork-data-finance-statistics-accounting-calculation-numeric-keypad-office-equipment-916424.jpg

https://www.taxtips.ca/filing/age-amount-tax-credit.htm

The federal age amount for 2023 is 8 396 8 790 for 2024 The tax credit is calculated using the lowest tax rate 15 federally so the maximum federal tax credit for 2023 is

https://www.taxtips.ca/calculators/canadian-tax/...

Tax credits for age pension disability and family caregiver for infirm minor children Fed YT are automatically transferred to other spouse if unused

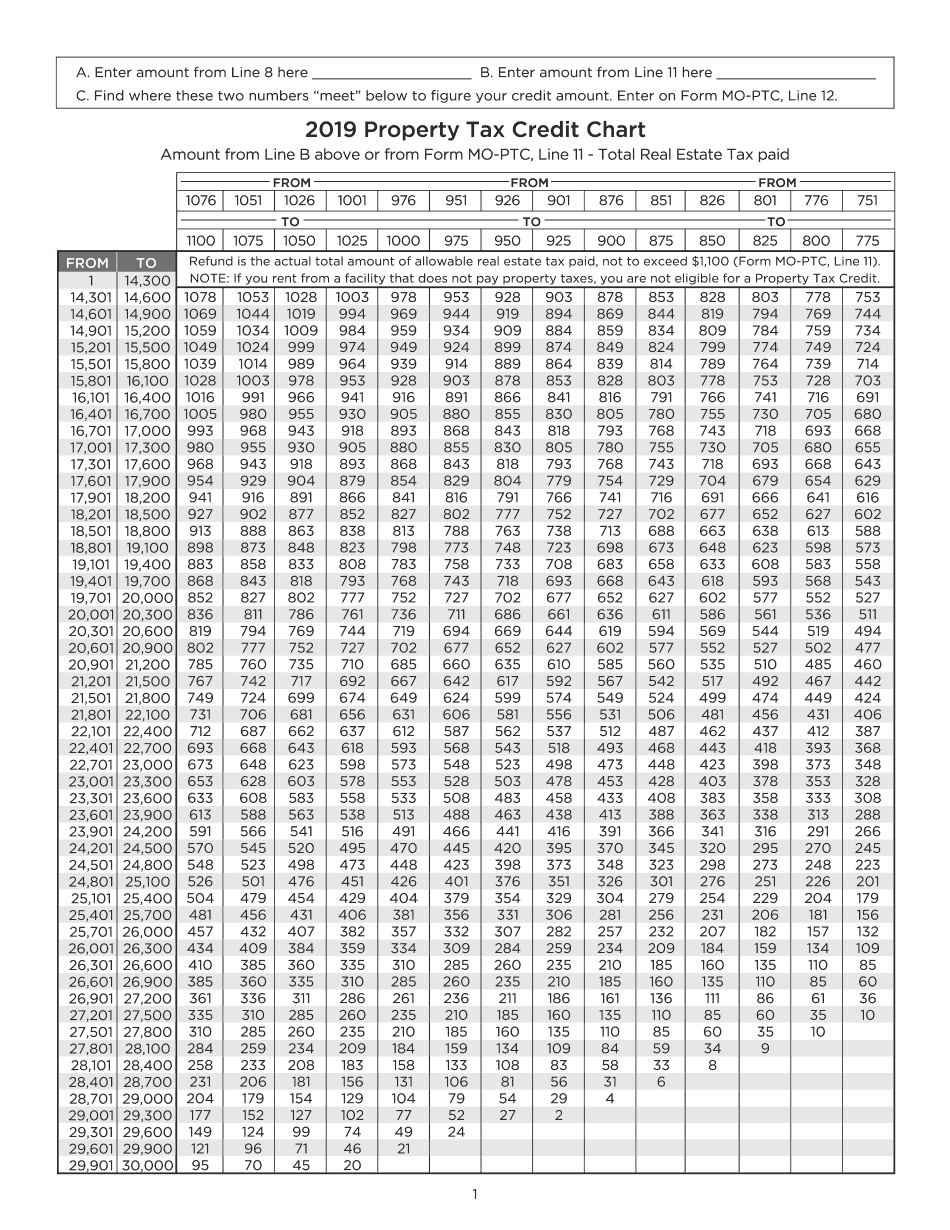

Edit Document Property Tax Credit Chart Form With Us Fastly Easyly

Salary Tax Calculator 2023 24 Pakistan Revised Tax Card 2024

Medicaid Tax Law Internal Revenue Service Earned Income Tax Credit

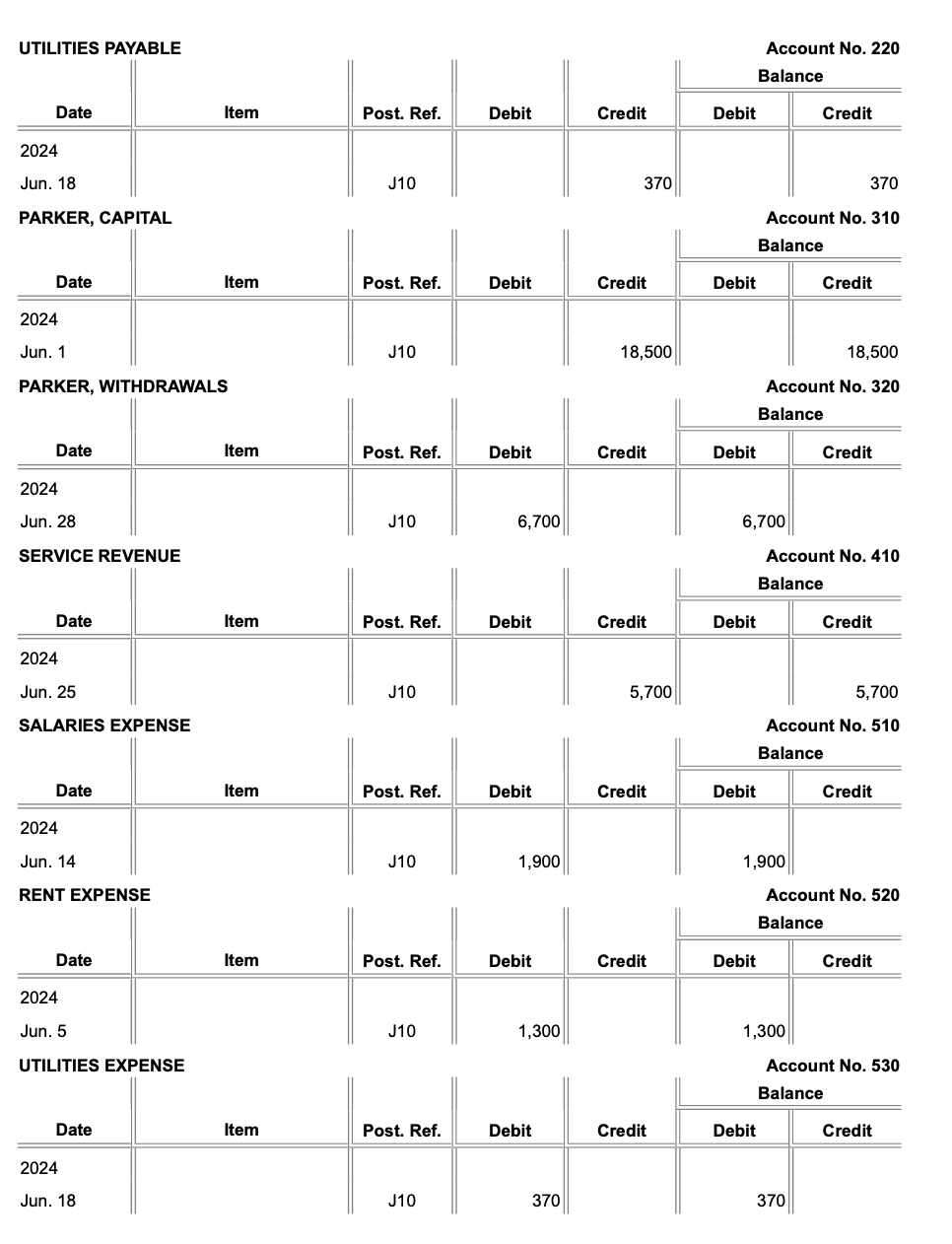

Solved Requirement 2 Prepare The Trial Balance As Of June Chegg

Tax Credit Bill For Rural Physicians Passes House Committee

New Tax Credit To Fully Offset The Cost For Small Businesses Who

New Tax Credit To Fully Offset The Cost For Small Businesses Who

2023 Tax Brackets The Best Income To Live A Great Life

Maximize Your Paycheck Understanding FICA Tax In 2024

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

Age Tax Credit 2024 Calculator - You can use an independent free and anonymous benefits calculator to check what you could be entitled to This will give you an estimate of the benefits you could get how