Agriculture Income Tax Rebate Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income

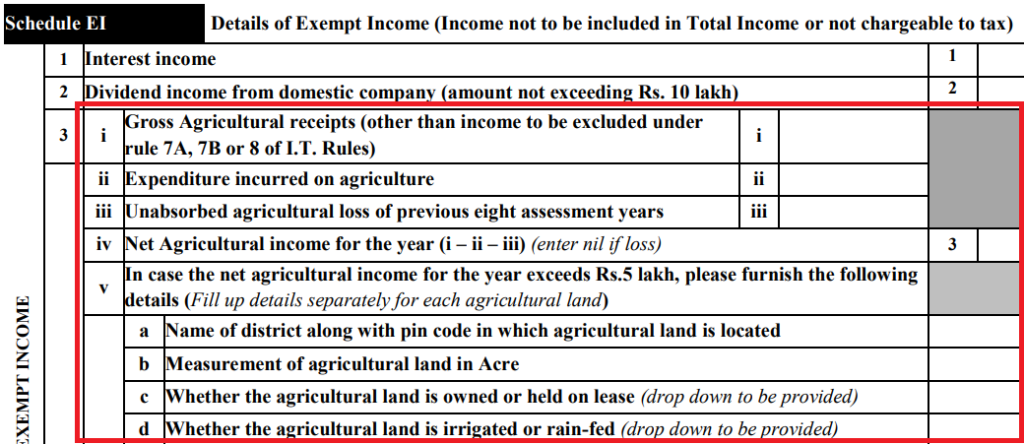

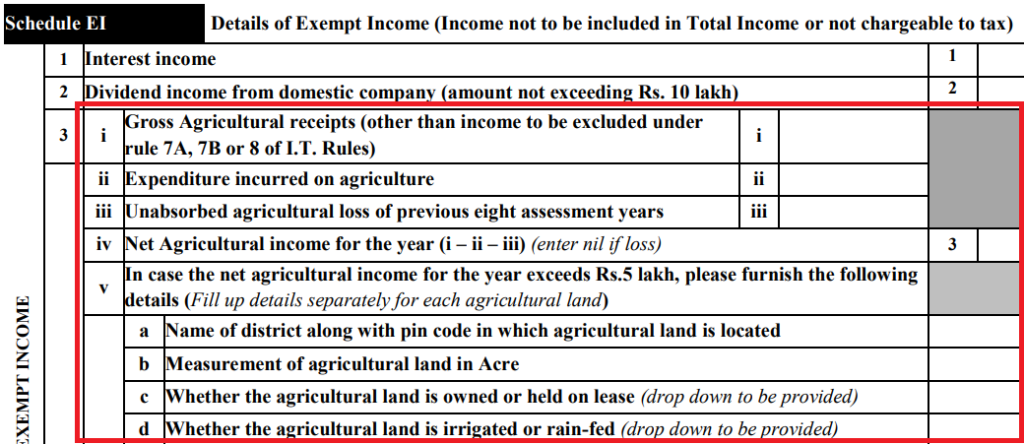

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two Web 31 juil 2019 nbsp 0183 32 As per the Income Tax Act agricultural income is exempt from income tax and is not included in the total income while calculating tax liability What is an

Agriculture Income Tax Rebate

Agriculture Income Tax Rebate

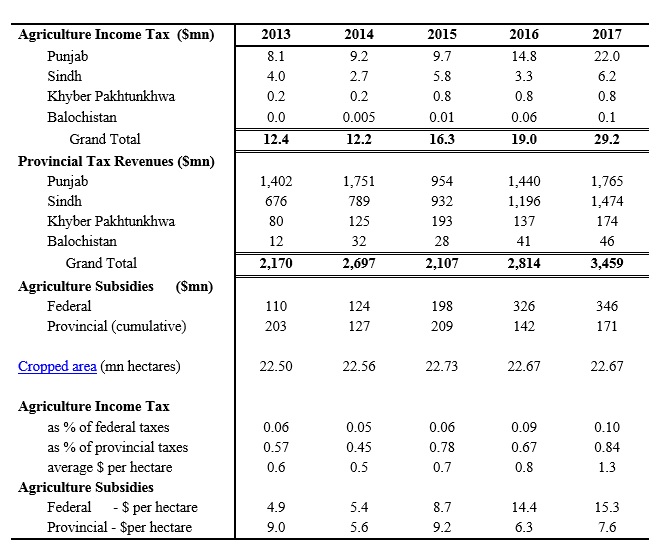

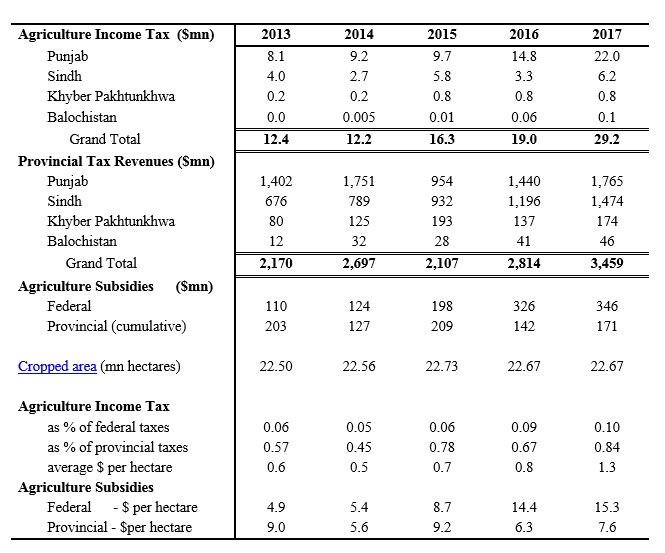

https://southasianvoices.org/wp-content/uploads/2017/05/Asim-Table.jpg

Tax On Agricultural Income In Pakistan Latest Tax Financial News

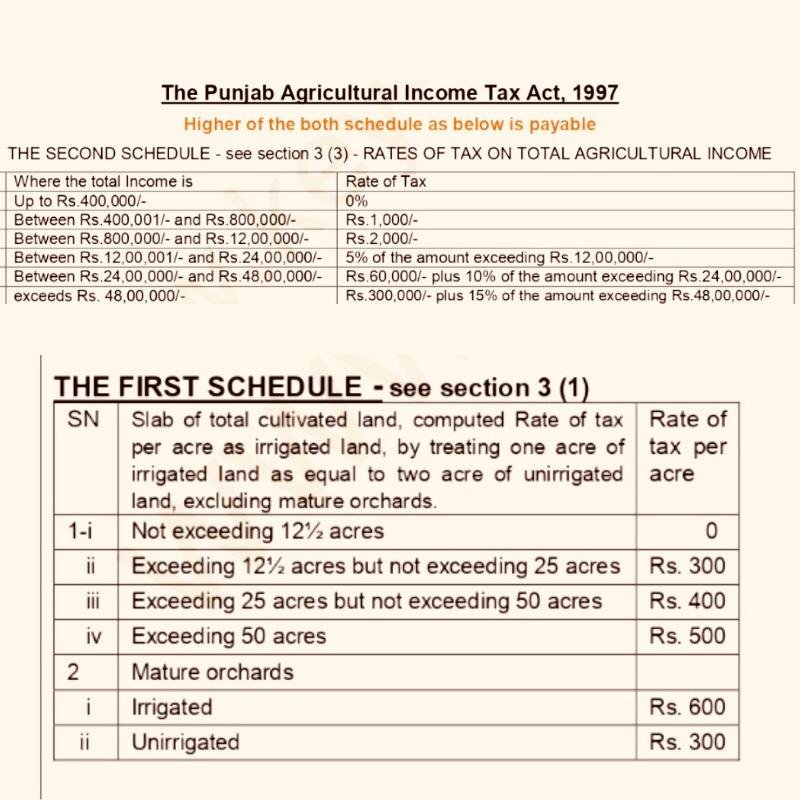

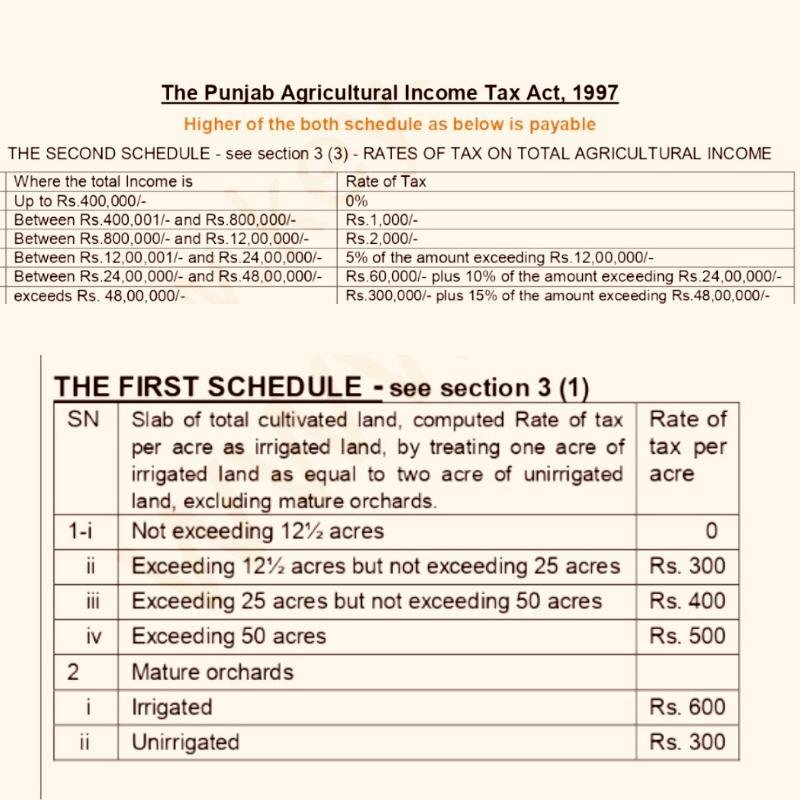

https://tax.net.pk/wp-content/uploads/2021/01/Agriculture-Income-Tax-Rates-Provincial.jpeg

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

Web Total income minus this net agricultural income is higher than the exemption limit of Rs 2 50 000 for individuals below 60 years of age Rs 3 00 000 for senior citizens and Rs Web 10 janv 2022 nbsp 0183 32 13 4 5Y CAGR What is Agricultural Income Section 2 1A of the Income Tax Act 1961 provides the meaning of the agricultural income for the purpose of

Web Is agricultural income exempt from income tax Income from agriculture is exempt if the net agricultural income is less than Rs 5000 or if the total income apart from Web 17 janv 2016 nbsp 0183 32 The rebate on agricultural income is calculated in the following manner 1 Calculate the total taxable income along with agricultural income 2 Then calculate tax

Download Agriculture Income Tax Rebate

More picture related to Agriculture Income Tax Rebate

Agriculture Accelerator Fund To Be Setup To Union Budget 2023

https://www.livelaw.in/content/servlet/RDESController?command=rdm.Picture&sessionId=RDWEBYJFQ4BQS80GDHMIRROGIPIAPBB4GATED&app=rdes&partner=livelaw&type=7&uid=22309qNtjJ2CaRLs13cS6qlSqK11CQZeQQ3bp7969907

Income Tax On Agriculture Income Easily Explained By TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Income-tax-on-agricultural-income-easily-explained-by-TaxHelpdesk-600x600.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 9 sept 2023 nbsp 0183 32 Now while filing returns under Part B TTI 1 c of ITR2 quot Rebate on agriculture income applicable is 12 13 of part b ti exceeds maximum amount not Web 19 f 233 vr 2022 nbsp 0183 32 1 Assessee is Individual HUF AOP BOI AJP 2 Agriculture Income more that 5000 3 Non agriculture income is more than basic exemption limit Let us

Web 31 ao 251 t 2018 nbsp 0183 32 Less Rebate on Agricultural Income Tax on Rs 4 00 000 Rs 2 50 000 being basic exemption 42500 Net Tax Payable 10 000 Add Health amp Education Web 18 mai 2019 nbsp 0183 32 STEP 1 TAX ON INCOME INCLUDING AGRICULTURE 800000 FIRST 250000 NIL SECOND 250000 12500 250000 5 BALANCE 300000 60000

.jpg)

Know About Agricultural Income Tax In Details

https://www.onlinelegalindia.com/blogs/asset/upload/feature_images/Agriculture_Income_Taxability,_(1).jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

https://saral.pro/blogs/agricultural-income

Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income

https://taxguru.in/income-tax/calculate-tax-a…

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Income Tax Liability if following two

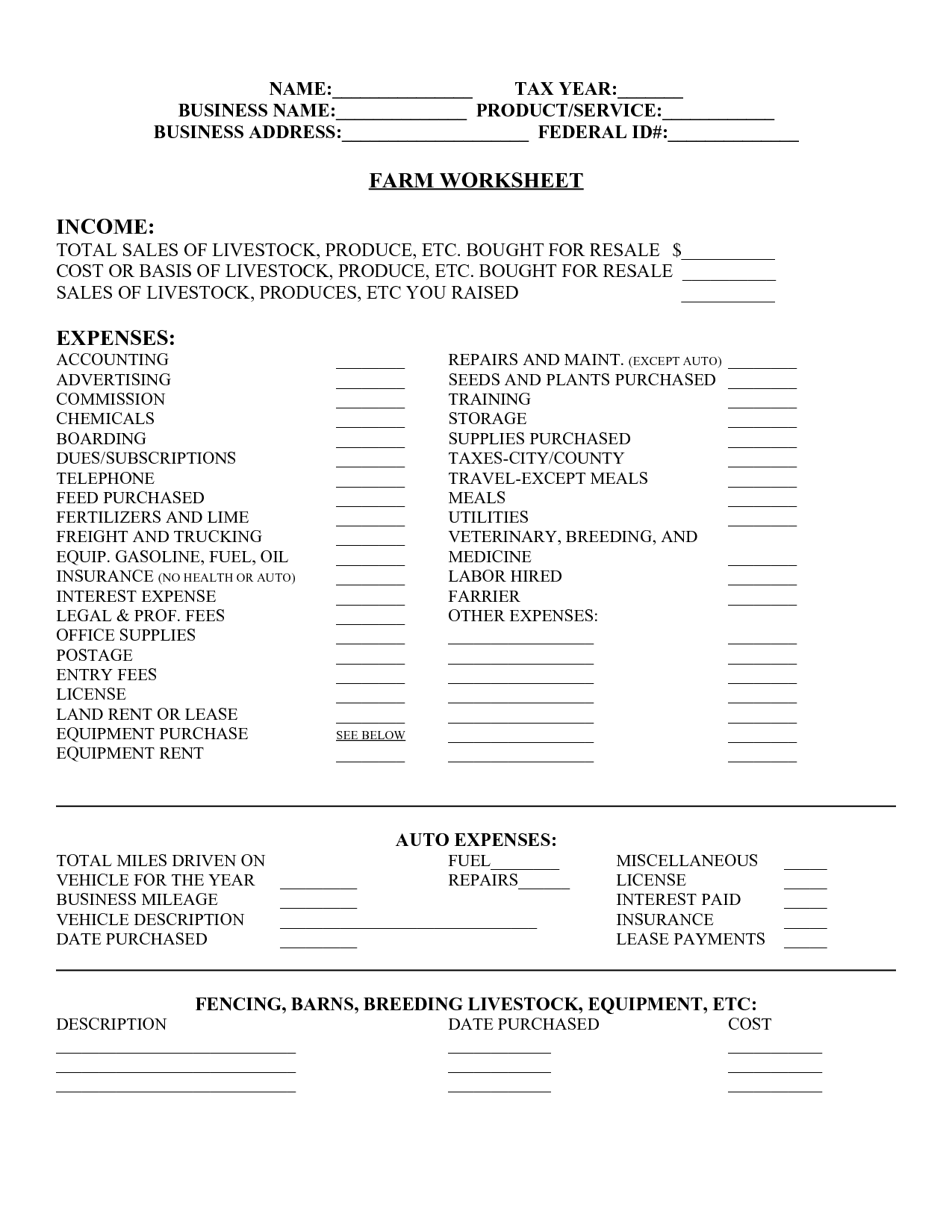

14 Monthly Income Expense Worksheet Template Worksheeto

.jpg)

Know About Agricultural Income Tax In Details

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Know New Rebate Under Section 87A Budget 2023

Key Changes In Income Tax Return ITR Forms For AY 2019 20

Key Changes In Income Tax Return ITR Forms For AY 2019 20

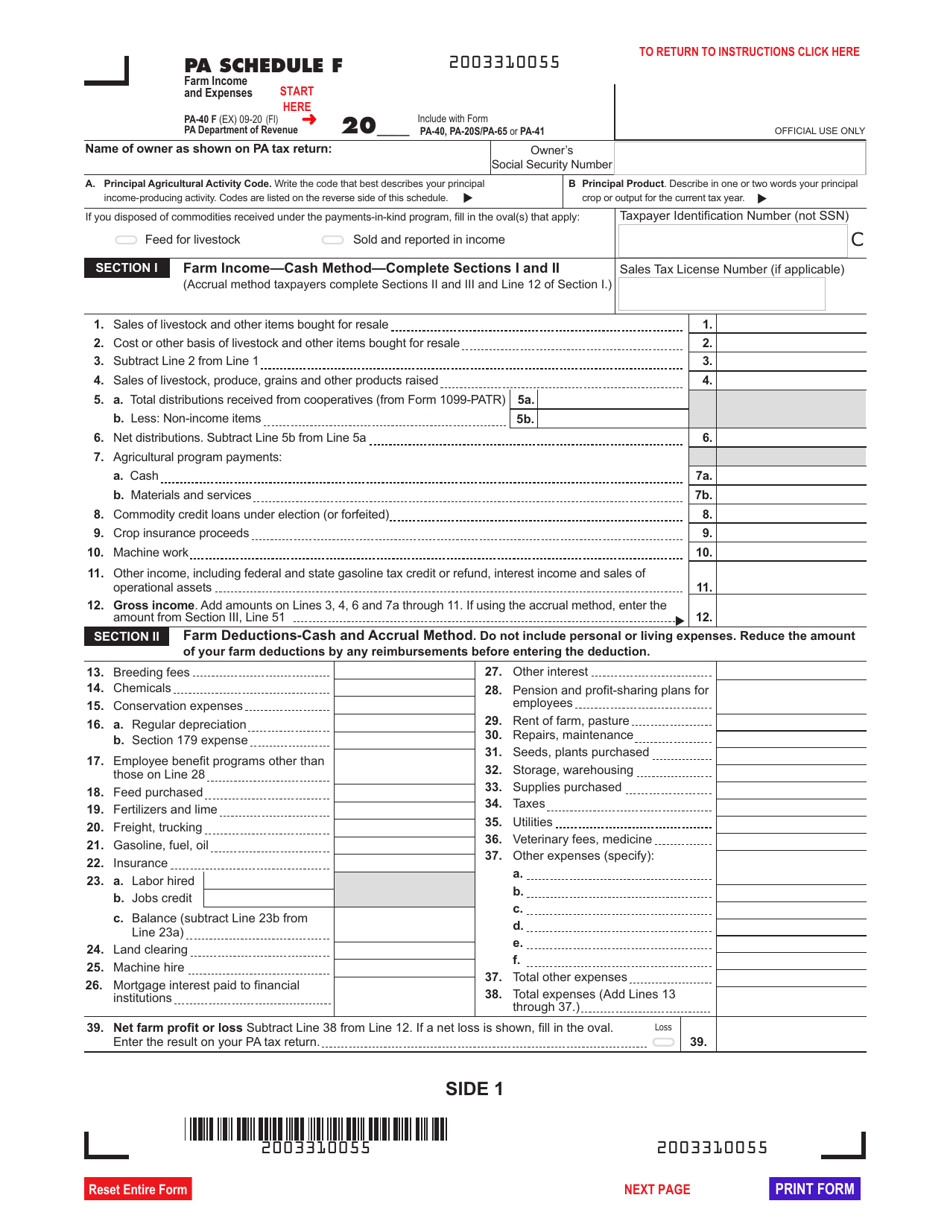

Form PA 40 Schedule F Download Fillable PDF Or Fill Online Farm Income

Illinois Tax Rebate Tracker Rebate2022

Farm Expense Spreadsheet Excel Dgetreadsheet Cash Flow Farm Cash Flow

Agriculture Income Tax Rebate - Web 27 sept 2022 nbsp 0183 32 Crucially farmers can apply for the Business Energy Support Scheme that will allow for payments toward electricity costs of up to 10 000 per month They will