Alberta Income Tax Rate Corporate Here s a look at four prominent corporations tax rates their political contributions in the 2023 2024 election cycle and my opinion of their stock

Depending on the outcome of the 2024 US election the current corporate tax rate of 21 percent could be in for a change The 21 percent rate put in place by the 2017 tax reform brought the US rate in Brazil s government submitted a bill to Congress on Friday that increases some income taxes as part of a revenue raising effort including a more pronounced

Alberta Income Tax Rate Corporate

Alberta Income Tax Rate Corporate

https://d3n8a8pro7vhmx.cloudfront.net/parklandinstitute/pages/112/attachments/original/1452282255/thelionsshare_table2.jpg?1452282255

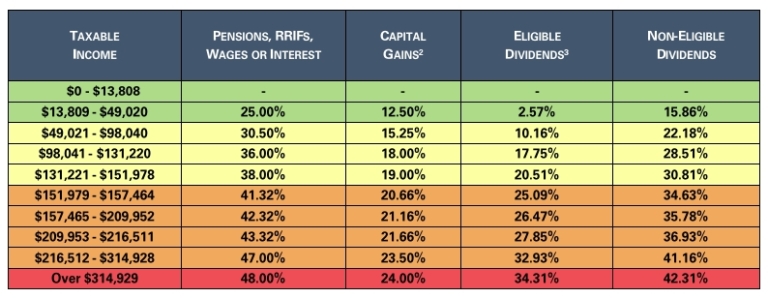

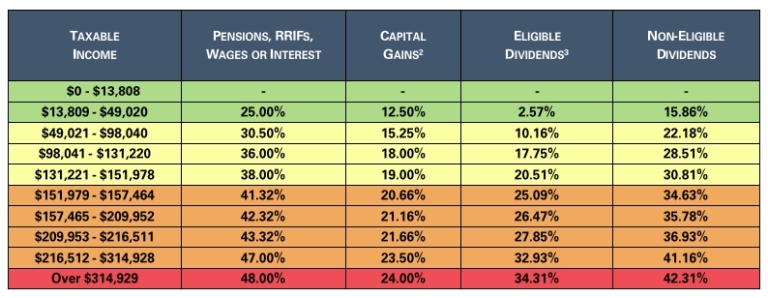

Alberta Income Tax Rates For 2021 Alitis Investment Counsel

https://www.alitis.ca/wp-content/uploads/2019/01/2021-Alberta-Tax-Rates-768x298.jpg

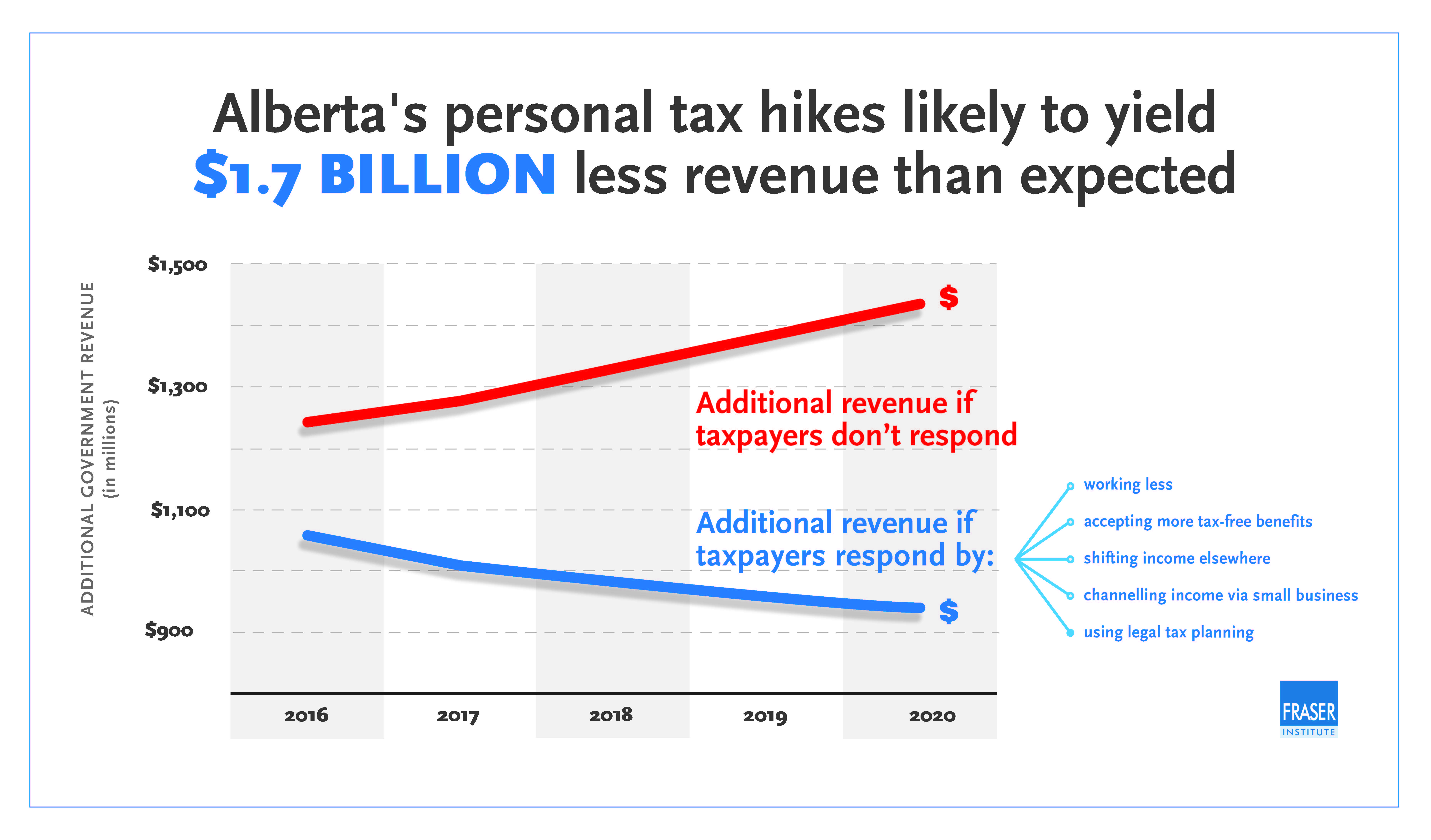

Albertas personal income tax increases infographic jpg Fraser Institute

https://www.fraserinstitute.org/sites/default/files/albertas-personal-income-tax-increases-infographic.jpg

Income tax The interest rate charged on overdue taxes Canada Pension Plan contributions and employment insurance premiums will be 9 The interest rate to be This includes the new tax on unrealized capital gains It applies only to individuals with at least 100 million in wealth who do not pay at least a 25 tax rate

Personal income tax PIT an increase of 458 million from budget mainly due to stronger 2023 tax assessments and an upward revision to personal income for 2024 Statistics on PAYE Income Tax and National Insurance contributions Bank Levy Bank Surcharge Corporation Tax and Bank Payroll Tax receipts from the

Download Alberta Income Tax Rate Corporate

More picture related to Alberta Income Tax Rate Corporate

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

Reminder That Alberta s Low Tax Rate Is Not Sustainable Corporate Tax

https://preview.redd.it/reminder-that-albertas-low-tax-rate-is-not-sustainable-v0-wuc2kvaww2ya1.jpg?auto=webp&s=9e5a63a68c84df818d501f3a40eb629badc90d1d

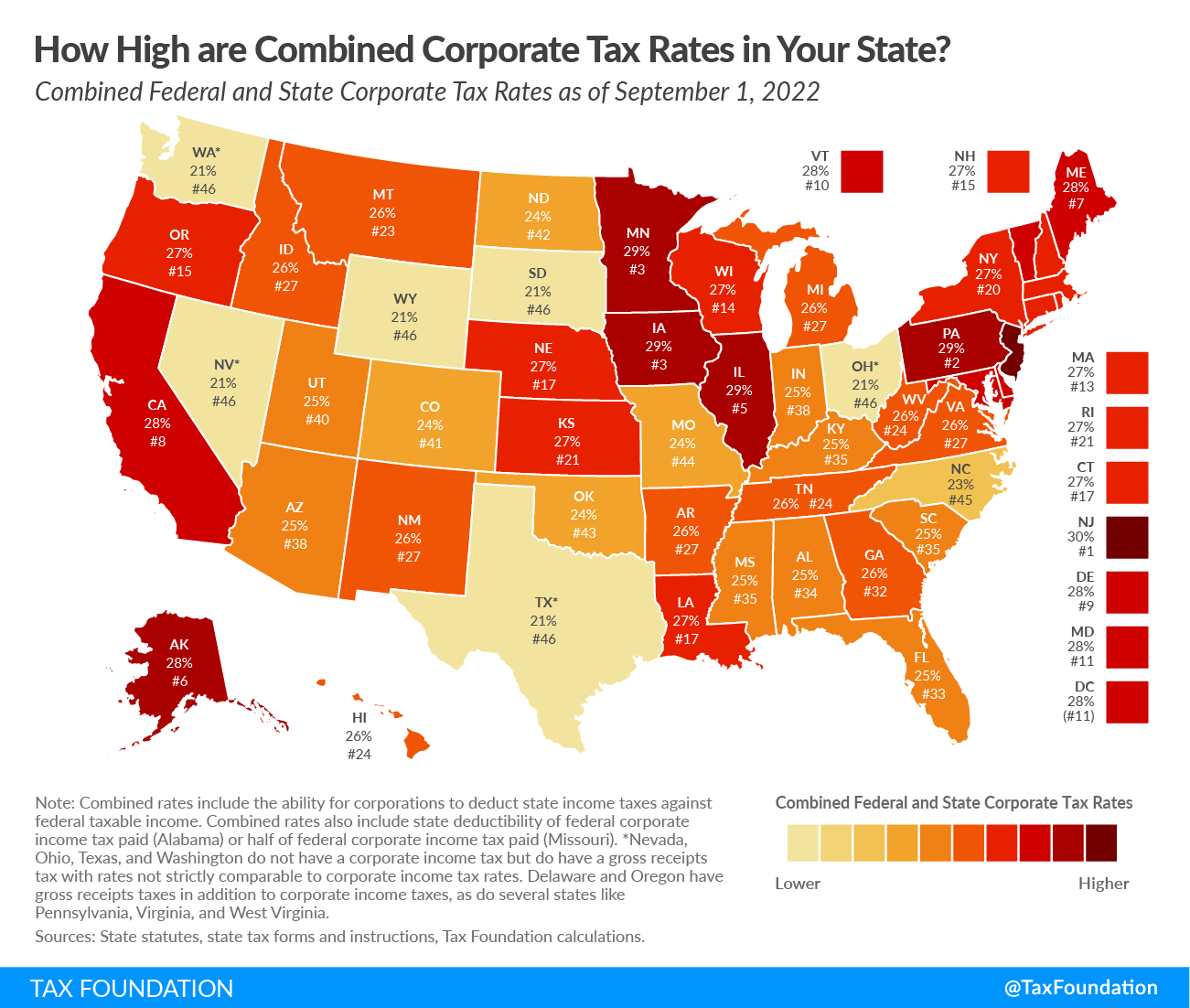

State Corporate Income Tax Rates And Brackets Tax Foundation Free

https://files.taxfoundation.org/20210202171217/2021-state-corporate-income-tax-rates-and-brackets.-2021-state-corporate-tax-rates.-What-are-the-state-corporate-tax-rates-for-2021.-Lowest-state-corporate-tax-rate-1024x915.png

Brazil s government submitted a bill to Congress on Friday that increases some income taxes as part of a revenue raising effort including a more pronounced Under the tax collection agreements the federal government chooses the tax base and collects taxes on behalf of the provinces through the Canada Revenue

Vice President Kamala Harris will push to increase the corporate tax rate to 28 from the current 21 her campaign said Monday the first day of the Democratic Total government revenue is forecast to reach 76 2 billion up 2 7 billion from the budget including a 458 million increase in personal income tax revenue and a 55

2019 Provincial Tax Rates Frontier Centre For Public Policy

https://i0.wp.com/fcpp.org/wp-content/uploads/2019-Provincial-Tax-Rates.png?resize=781%2C582&ssl=1

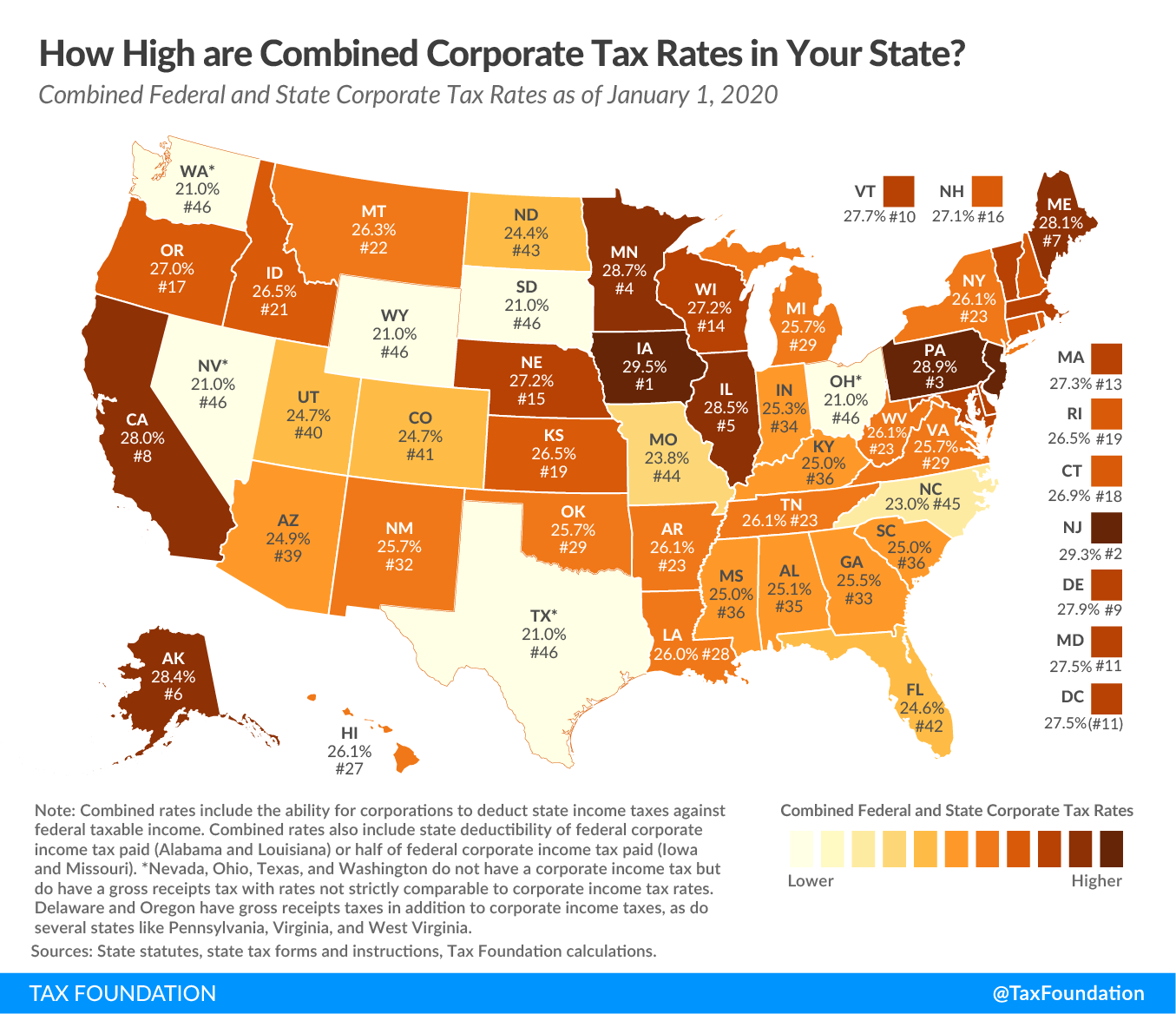

Combined State And Federal Corporate Income Tax Rates In 2020 Upstate

https://upstatetaxp.com/wp-content/uploads/2020/01/CIT-Tax-Burden-on-Corporate-Profits-01-e1580483509757-1.png

https://www.forbes.com/sites/johndorf…

Here s a look at four prominent corporations tax rates their political contributions in the 2023 2024 election cycle and my opinion of their stock

https://taxfoundation.org/blog/trump-ha…

Depending on the outcome of the 2024 US election the current corporate tax rate of 21 percent could be in for a change The 21 percent rate put in place by the 2017 tax reform brought the US rate in

2021 2023 Form Canada AT1 Fill Online Printable Fillable Blank

2019 Provincial Tax Rates Frontier Centre For Public Policy

-1625833913635.png)

Canada Corporate Tax Rate 2024 Viki Almeria

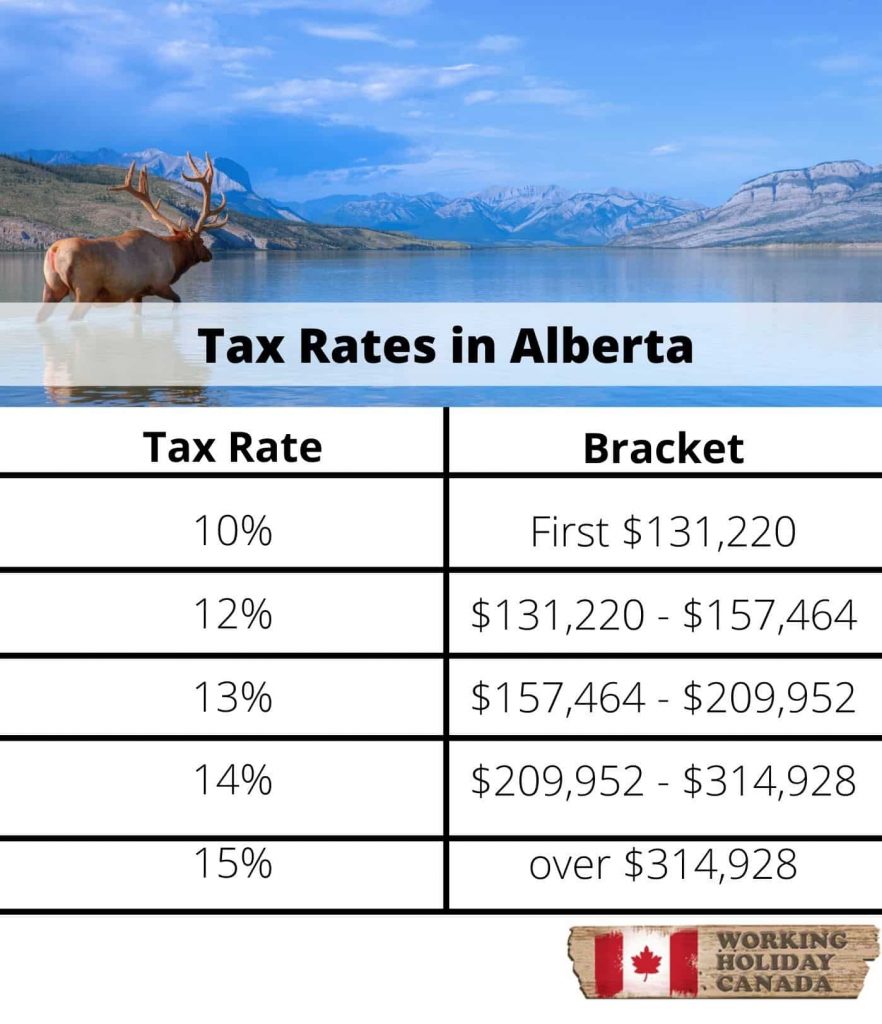

The Basics Of Tax In Canada Workingholidayincanada

Canada Corporate Tax Rate 2024 Take profit

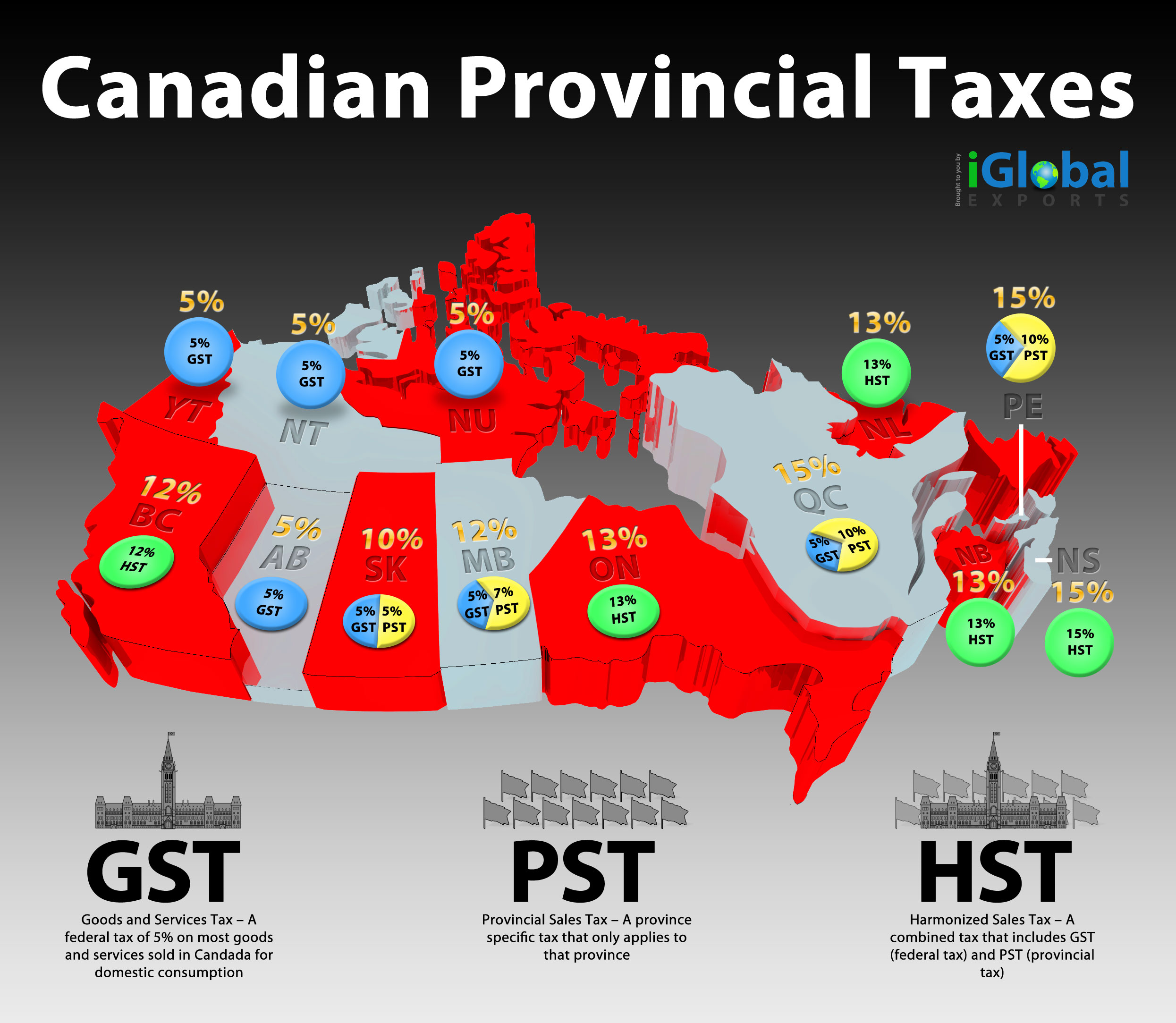

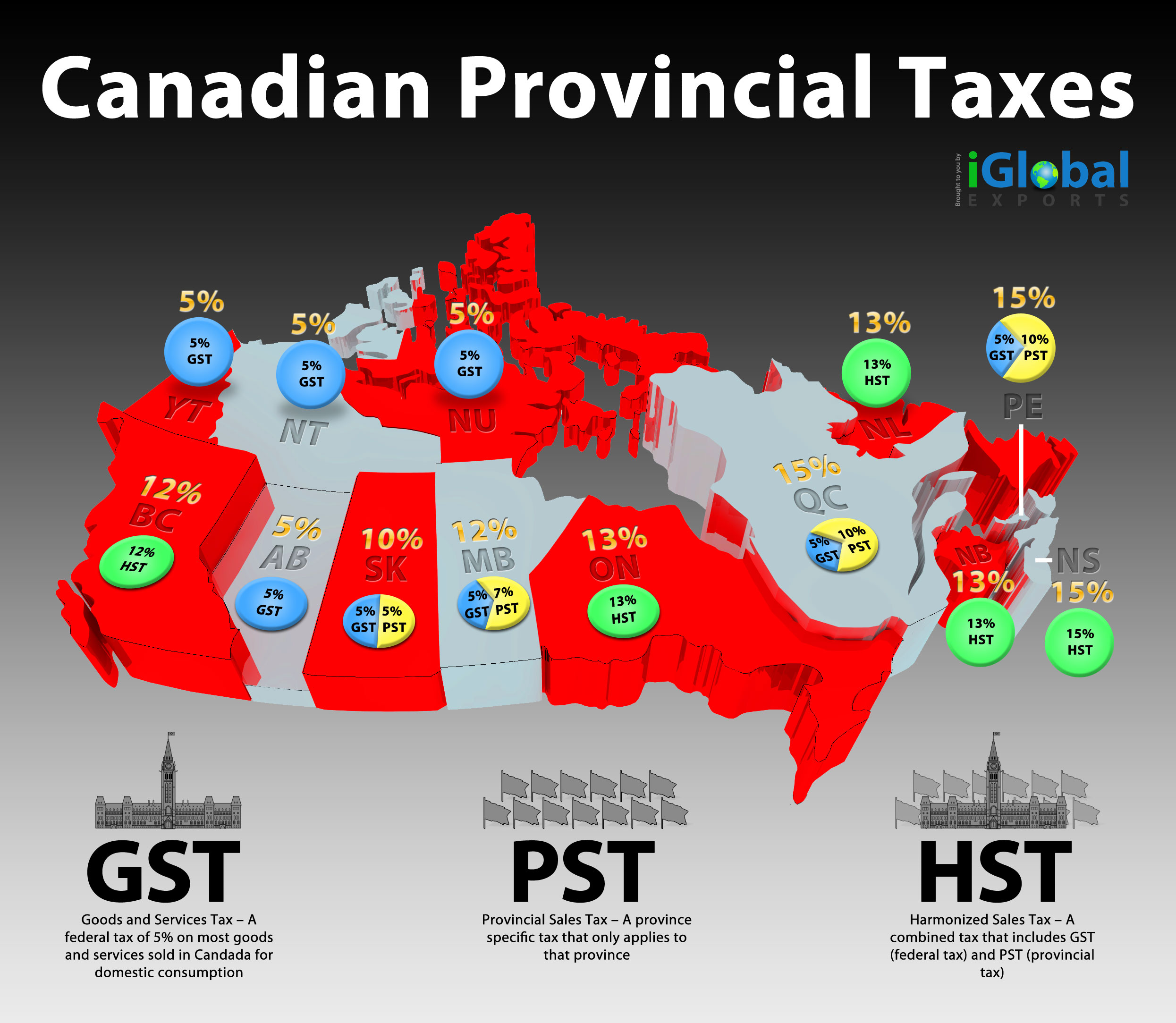

Canadian Provincial Taxes Visual ly

Canadian Provincial Taxes Visual ly

The Basics Of Tax In Canada WorkingHolidayinCanada

Combined State And Federal Corporate Tax Rates In 2022

Jason Kenney Says UCP Would Cut Alberta s Corporate Tax Rate To 8 The

Alberta Income Tax Rate Corporate - Income tax The interest rate charged on overdue taxes Canada Pension Plan contributions and employment insurance premiums will be 9 The interest rate to be