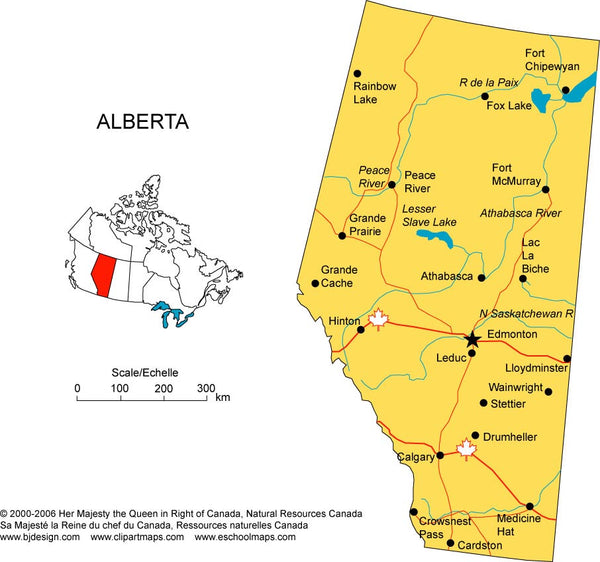

Alberta Sales Tax Rate Calculate the GST 5 amount in Alberta by putting either the after tax or before tax amount Check Alberta sales tax rates rebates

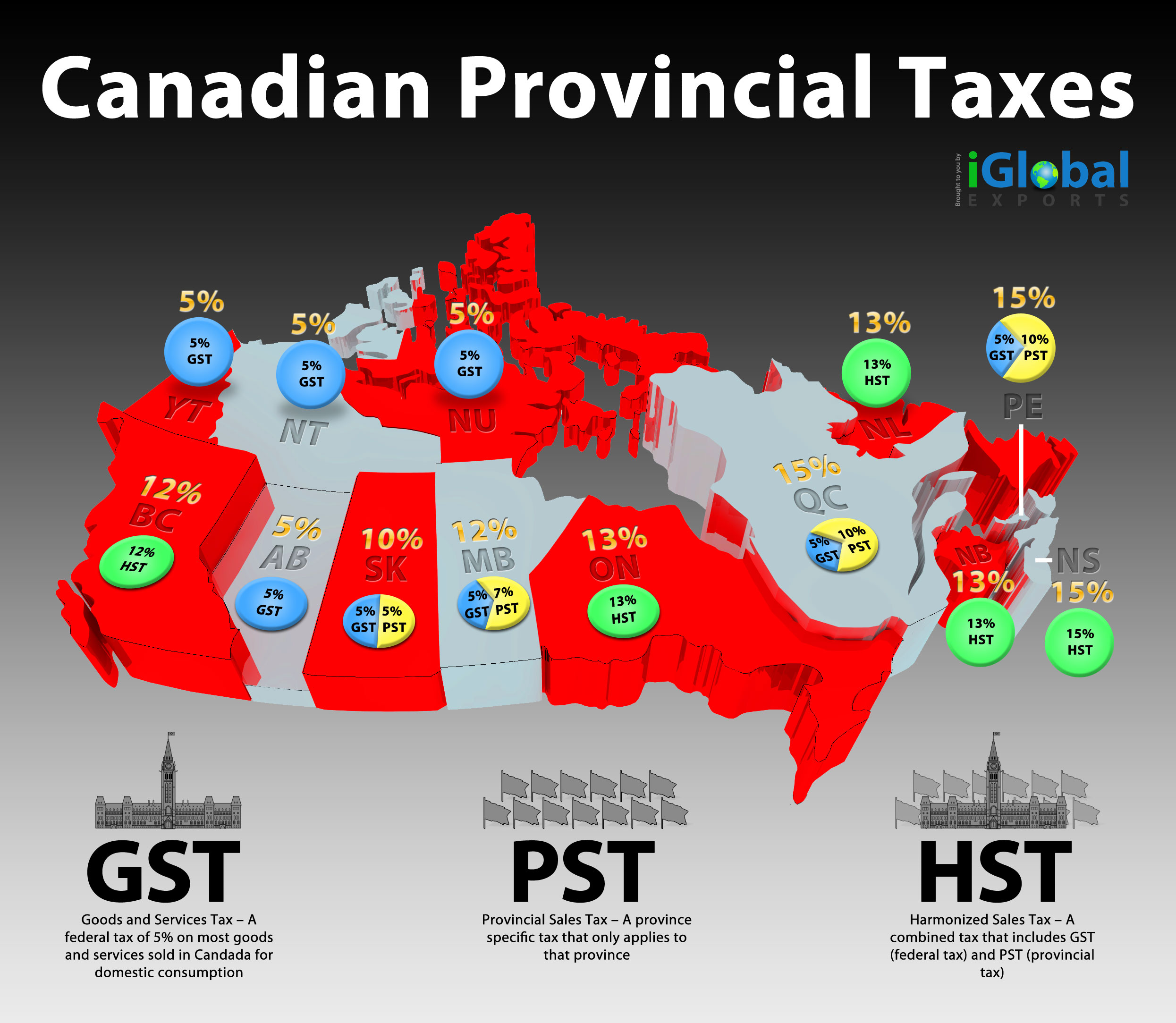

Find out more about PST GST and HST sales tax amounts for each province and territory in Canada Keep up to date to the latest Canada s tax rates trends Current GST Rate for Alberta in 2024 The global sales tax for Alberta is calculated from the Goods and Services Tax GST rate in Canada which is currently 5 Alberta does not have a provincial sales tax PST nor a Harmonized Sales Tax HST making it one of the few provinces in Canada with only the GST applied to most goods and services

Alberta Sales Tax Rate

Alberta Sales Tax Rate

https://gigonway.com/wp-content/uploads/2021/12/ffearatn-768x448.jpg

Alberta Canada Sales Tax Zip2Tax LLC

https://cdn.shopify.com/s/files/1/0277/4197/8708/files/AlbertaC_600x600.jpg?v=1608513238

Local Alberta Sales Tax And Countrywide Rates

https://unloop.com/wp-content/uploads/2022/01/alberta-sales-tax.jpg

The rate of tax to charge depends on the place of supply This is where you make your sale lease or other supply A zero rated supply has a 0 GST HST rate throughout all of Canada For example basic groceries are taxable at the rate of zero 0 GST HST in every province and territory Currently the GST rate is set at 5 and applies to Alberta British Columbia Manitoba Northwest Territories Nunavut Quebec Saskatchewan and Yukon In some provinces the GST is combined with a provincial sales tax PST to create the HST

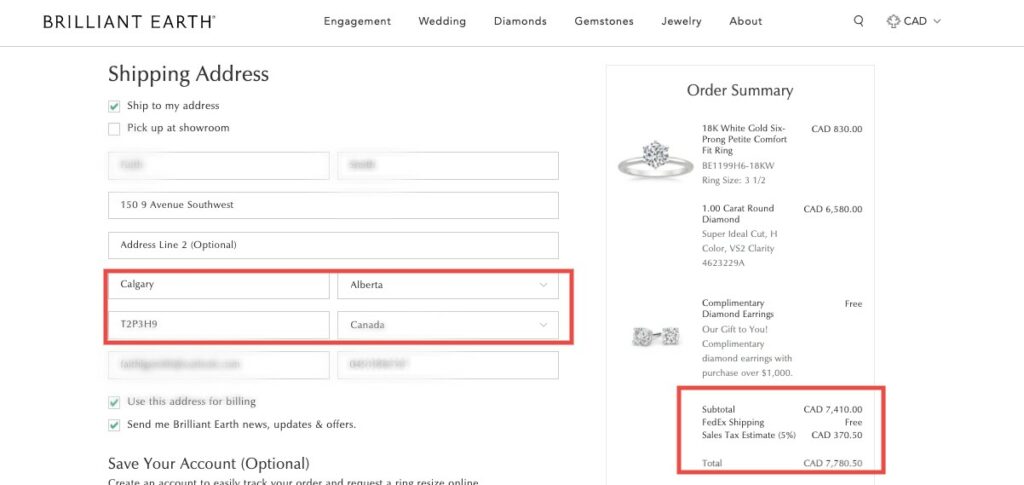

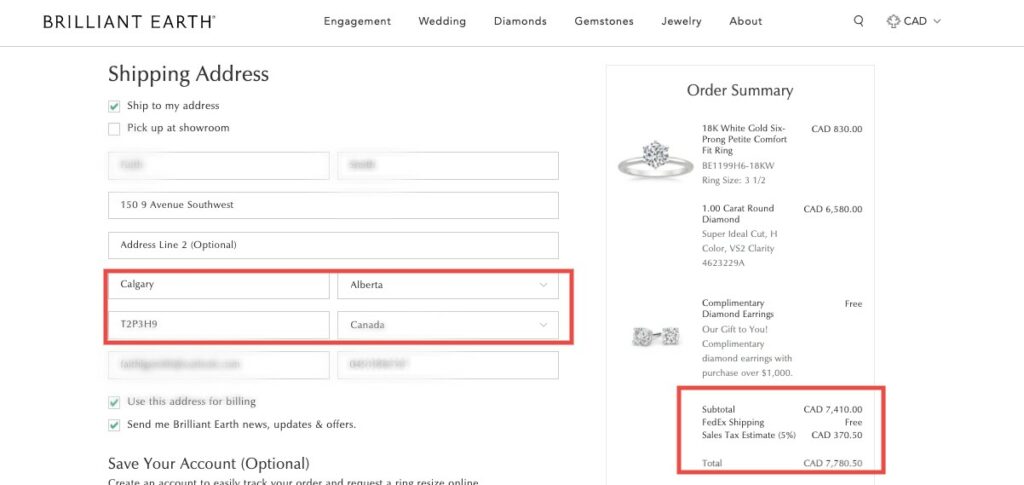

The cumulative sales tax rate in Alberta Canada is 5 This total rate simply consists of a Goods and Services Tax GST of 5 Aside from GST there is also a 4 tax on lodging and 4 tax on hotel room fees Calculating sales tax in Alberta is easy Alberta applies 5 GST to most purchases meaning a 5 total sales tax rate GST stands for General Sales Tax Here is an example of how Alberta applies sales tax What sales tax do I charge for out of province sales

Download Alberta Sales Tax Rate

More picture related to Alberta Sales Tax Rate

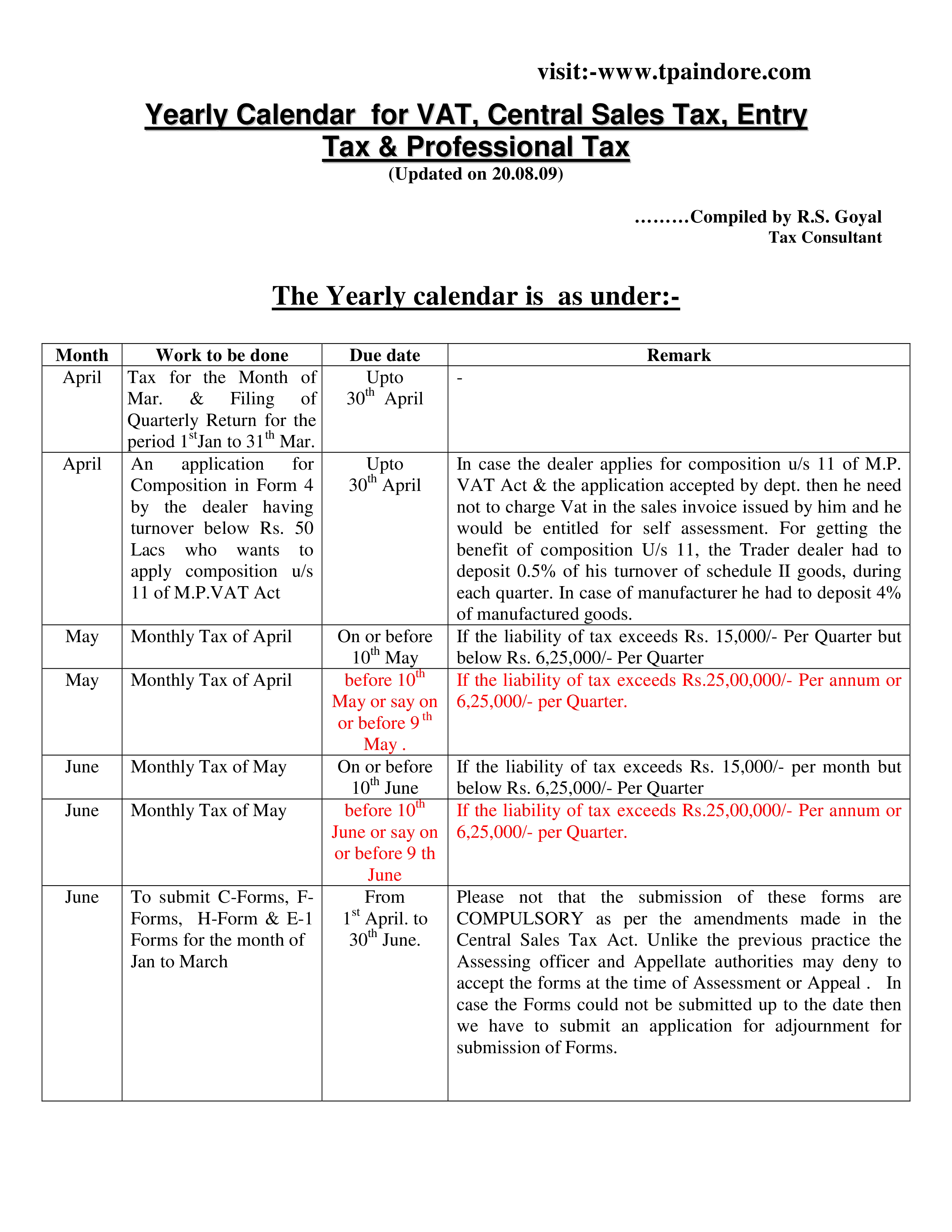

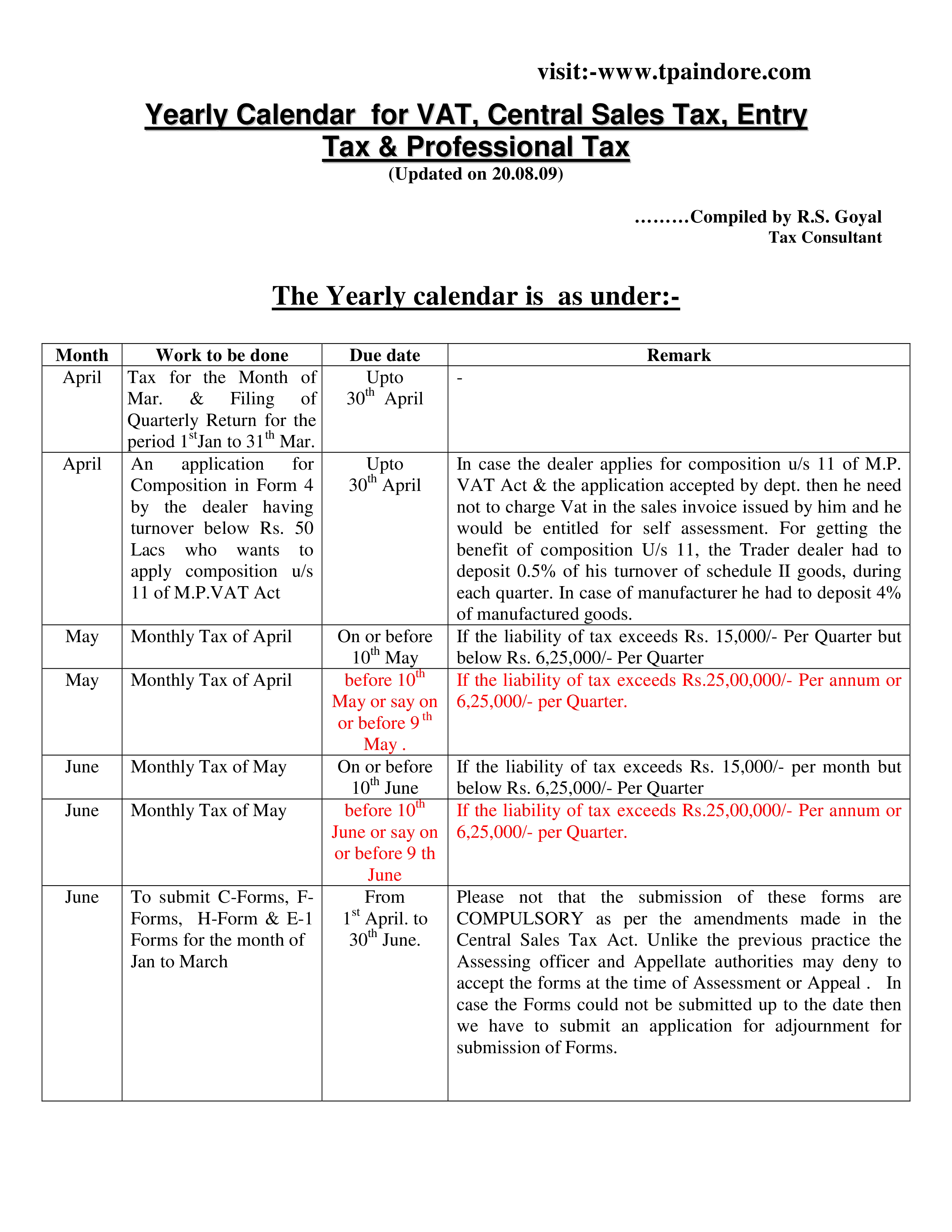

Sales Tax Liabilities

https://d1ka0itfguscri.cloudfront.net/i3e1/2022/03/09/16/35/c3eQDaVFDwm/preview.jpg

A Sales Tax For Alberta Why And How Ascah

https://tmm.chicagodistributioncenter.com/IsbnImages/9781771992978.jpg

Monthly Sales Tax Revenue Report A Boost For Most Bay Area Cities

https://s.hdnux.com/photos/01/23/23/22/21836949/3/rawImage.jpg

Discover the Alberta GST sales rate and average sales tax rate in Canada with ATS Accounting For accurate and up to date information contact us at 780 484 4006 Residents and businesses in Alberta only pay the federal Goods and Services Tax GST which is set at 5 This is significantly lower than in most other provinces where consumers are subject to both GST and a provincial tax such as PST Harmonized Sales Tax HST or Quebec Sales Tax QST

[desc-10] [desc-11]

Gratis Verkoop Tax pdf

https://www.allbusinesstemplates.com/thumbs/6e659190-6e21-499f-b500-e7f0a3517f93_1.png

Provincial Taxation In The Ur III State Cuneiform Monographs

https://i.visual.ly/images/canadian-provincial-taxes_502914bc01c88.jpg

https://wowa.ca › calculators › alberta-gst-calculator

Calculate the GST 5 amount in Alberta by putting either the after tax or before tax amount Check Alberta sales tax rates rebates

https://www.retailcouncil.org › resources › quick...

Find out more about PST GST and HST sales tax amounts for each province and territory in Canada Keep up to date to the latest Canada s tax rates trends

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales

Gratis Verkoop Tax pdf

Those Earning Below RM230 000 Not Impacted By Income Tax Rate

Sales Tax Calculations Smartsheet Community

An Alberta Sales Tax The Unpopular Idea That Just Won t Die CBC News

Brilliant Earth Canada Ringspo Canada

Brilliant Earth Canada Ringspo Canada

US Companies Push Hard For Lower Tax Rate On Offshore Profits

Ca Tax Brackets Chart Jokeragri

Tax Sales Carroll County Tax Commissioner

Alberta Sales Tax Rate - The cumulative sales tax rate in Alberta Canada is 5 This total rate simply consists of a Goods and Services Tax GST of 5 Aside from GST there is also a 4 tax on lodging and 4 tax on hotel room fees