Alberta Tax Rebates Web 2 janv 2023 nbsp 0183 32 Edmonton 183 CBC Explains Here s where Albertans will find extra expenses and cost relief in 2023 Provincial affordability measures kick in but so do increased CPP and EI contributions Janet

Web 14 juil 2022 nbsp 0183 32 Albertans who have filed their 2021 tax returns should wake up Friday morning with some extra money in their bank accounts as the federal government pays out its first round of carbon tax Web Government Taxes and tax credits Tax credits benefits and exemptions Information on the Alberta Child and Family Benefit tax credits exemptions and the Innovation

Alberta Tax Rebates

Alberta Tax Rebates

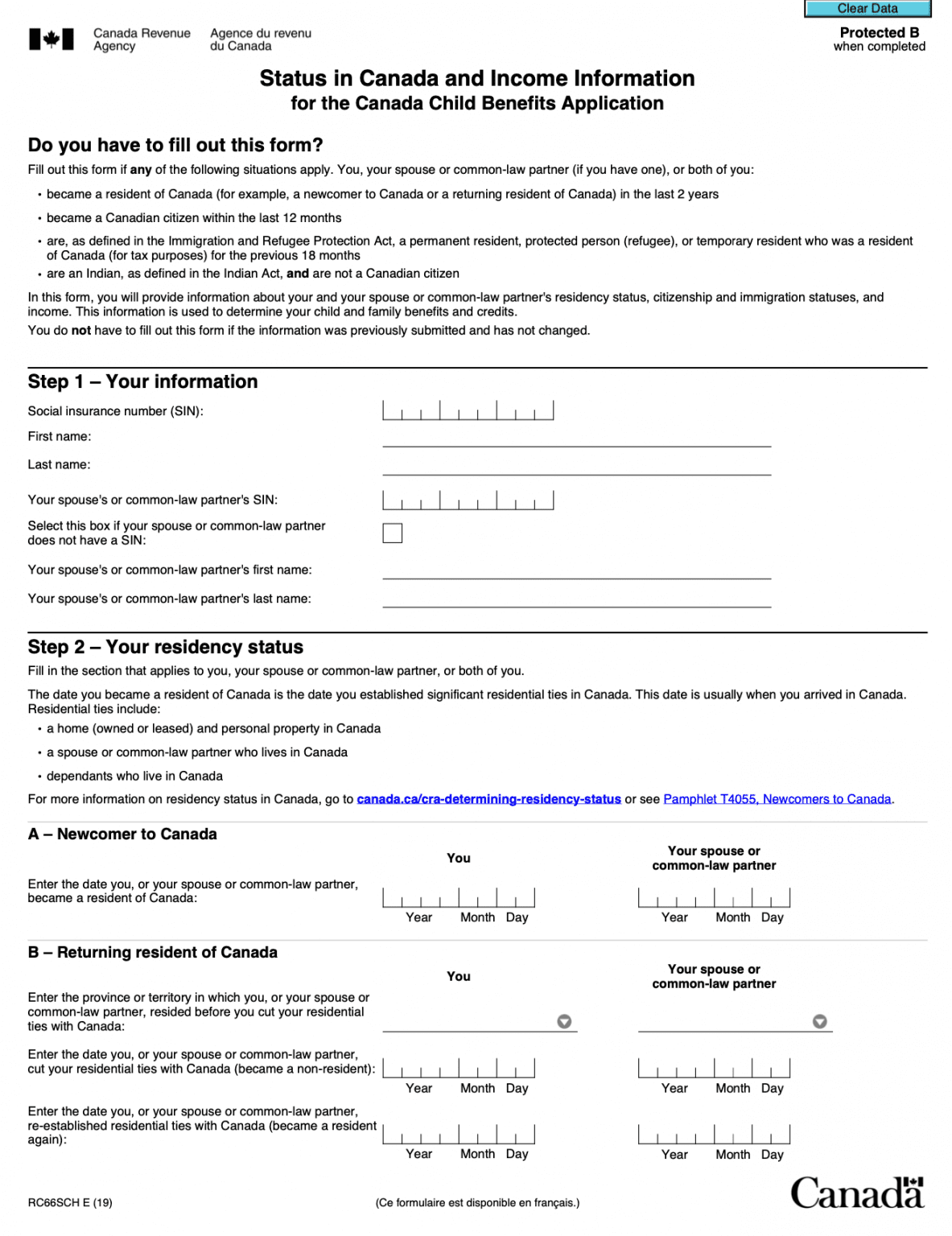

https://printablerebateform.net/wp-content/uploads/2022/02/Carbon-Tax-Rebate-2022-Income-Information-1183x1536.png

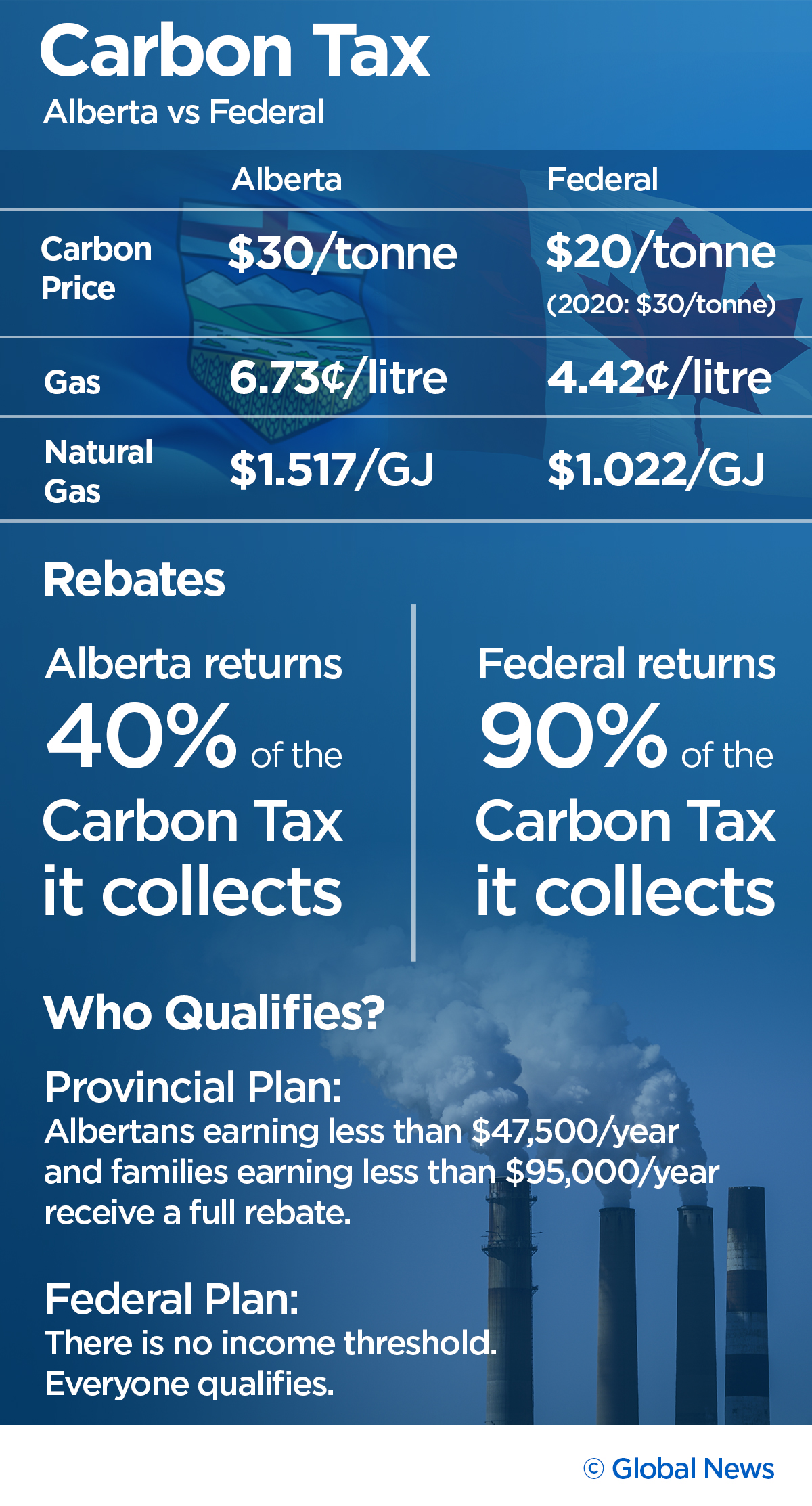

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

https://globalnews.ca/wp-content/uploads/2019/05/infogfx_carbon_tax_comparison_1.jpg?quality=85&strip=all&w=1200

Printable Td1 Form Printable World Holiday

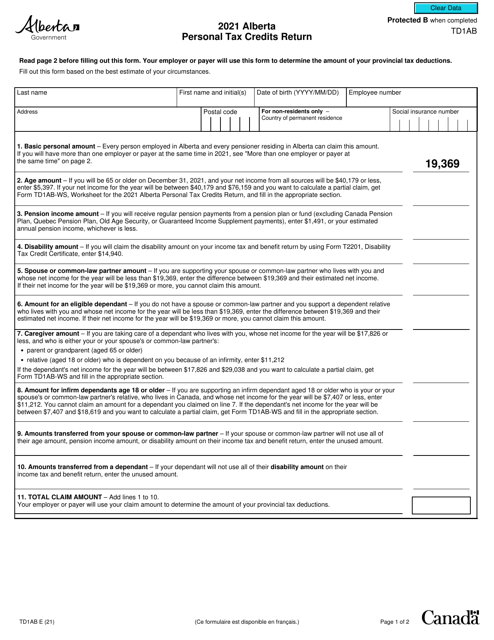

https://data.templateroller.com/pdf_docs_html/2119/21193/2119314/form-td1ab-alberta-personal-tax-credits-return-canada_big.png

Web 15 juil 2022 nbsp 0183 32 Albertans who filed their 2021 tax return got extra cash in their bank accounts Friday morning as the carbon tax rebate was deposited This marks the first Web Contact Overview Alberta s tax system is competitive fair and efficient For more information see Alberta Budget 2023 tax plan PDF 5 6 MB Alberta s tax advantage

Web Alberta personal and business taxes and levies including corporate income tax fuel tobacco and education property tax and the tourism levy Tax credits benefits and Web 22 juin 2022 nbsp 0183 32 Alberta will extend its fuel tax relief program until September and provide monthly electricity rebates of 50 this summer after news that inflation in the province

Download Alberta Tax Rebates

More picture related to Alberta Tax Rebates

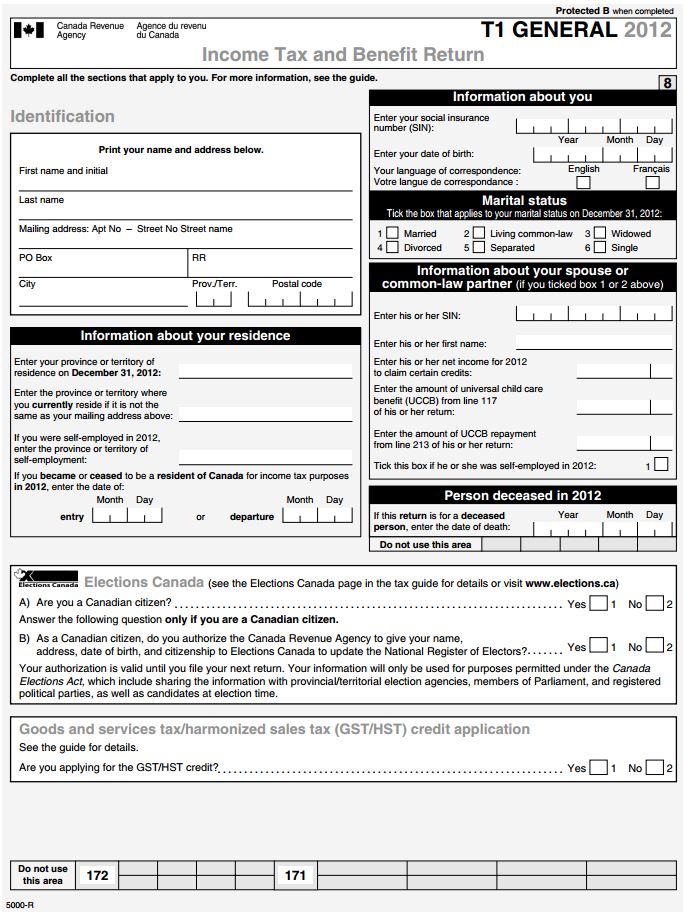

Free Alberta Canada Income Tax And Benefit Return Form T1 General

https://b669276.smushcdn.com/669276/wp-content/uploads/2013/09/Alberta-Canada-Income-Tax-and-Benefit-Return-Form-T1-General.jpg?lossy=1&strip=1&webp=1

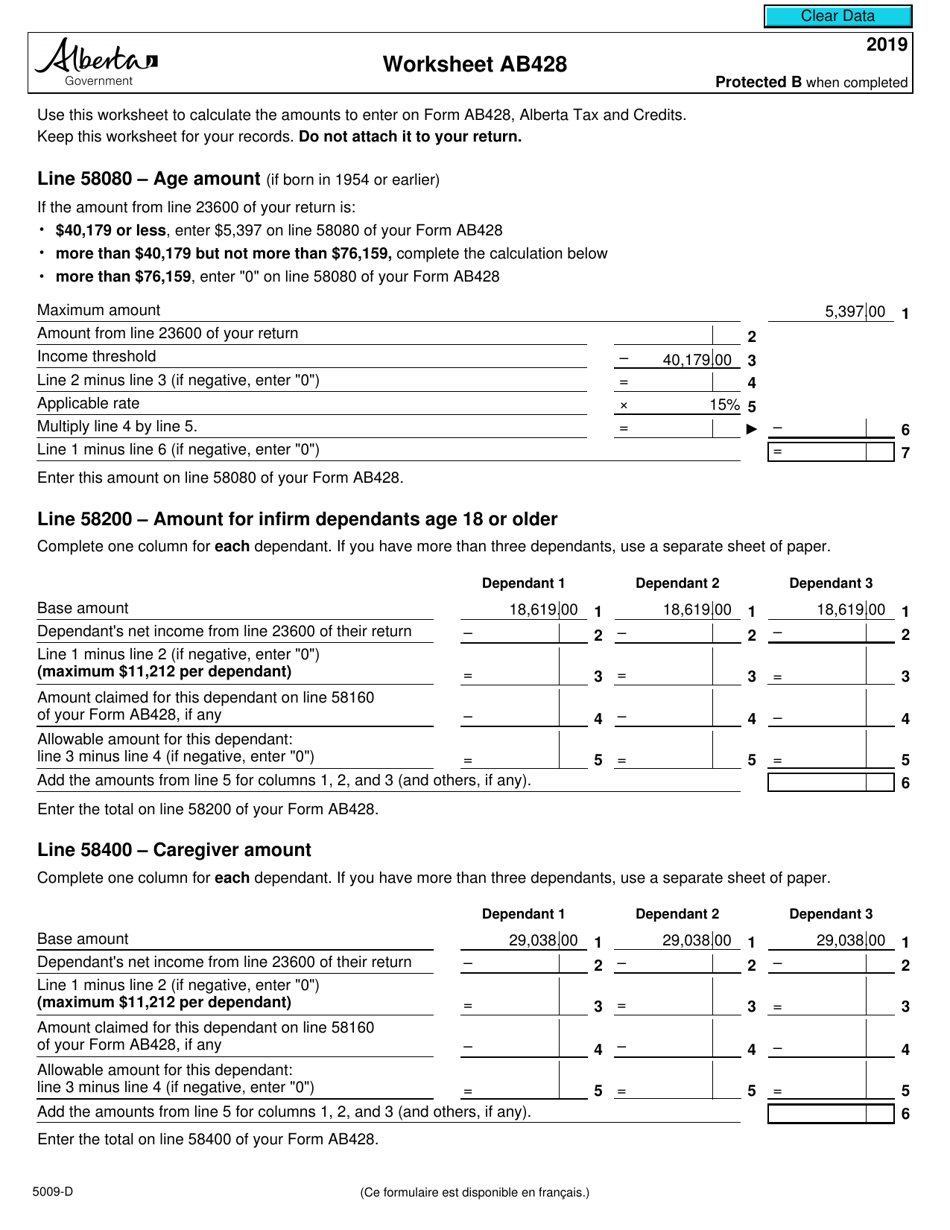

Form 5009 D Worksheet AB428 Download Fillable PDF Or Fill Online

https://data.templateroller.com/pdf_docs_html/2066/20666/2066646/form-5009-d-worksheet-ab428-alberta-canada_print_big.png

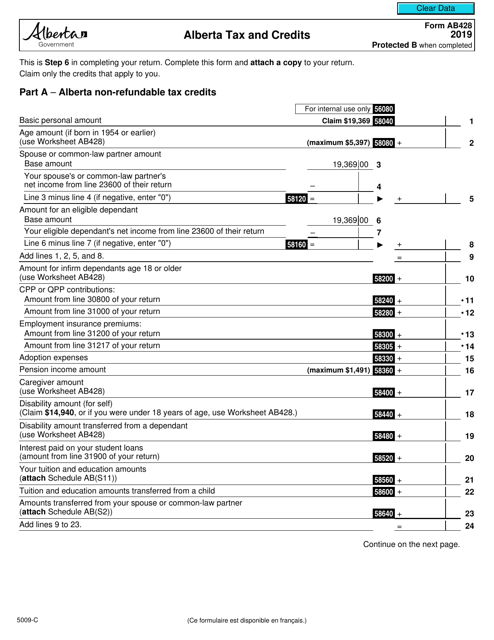

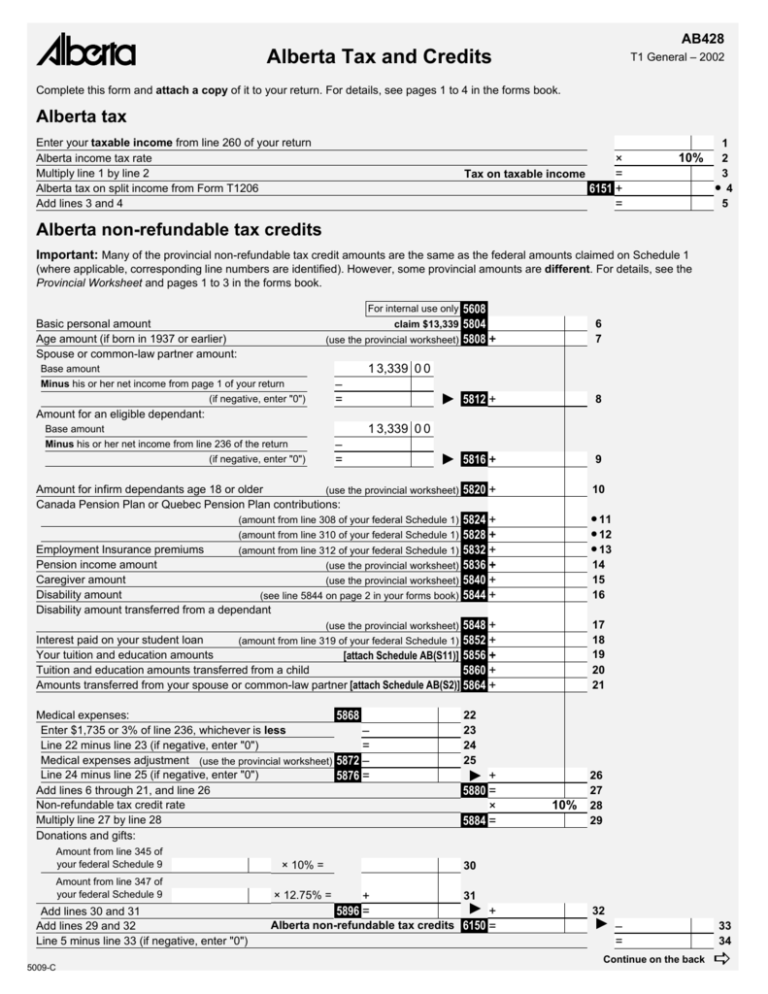

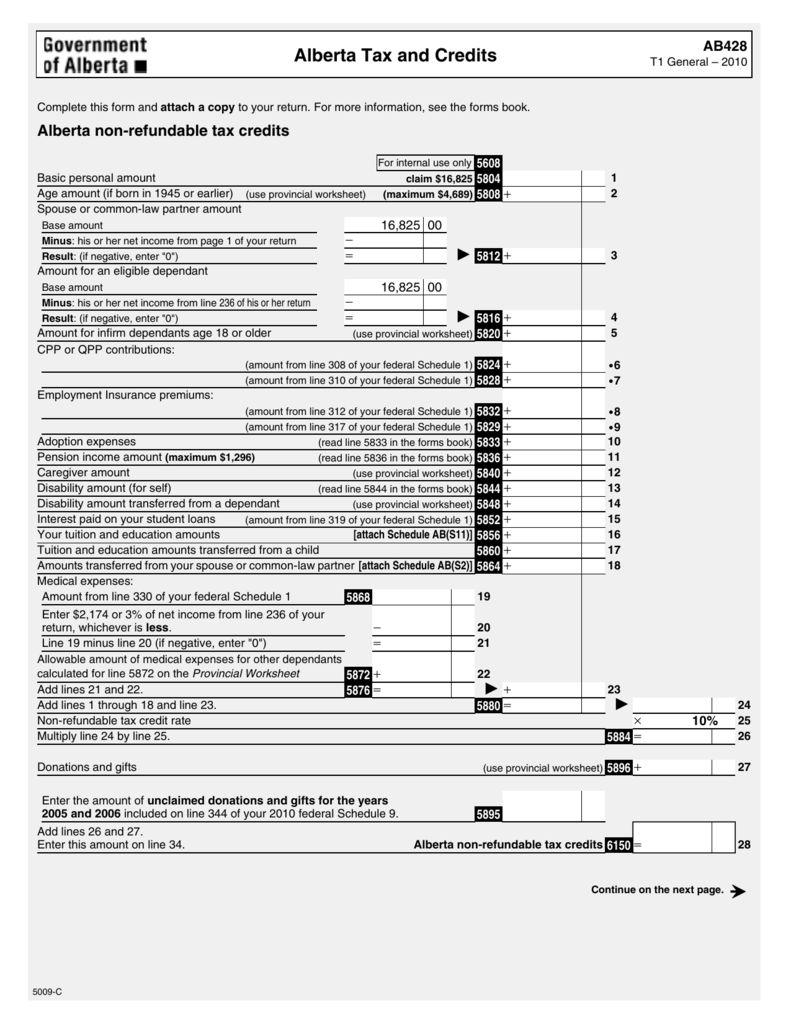

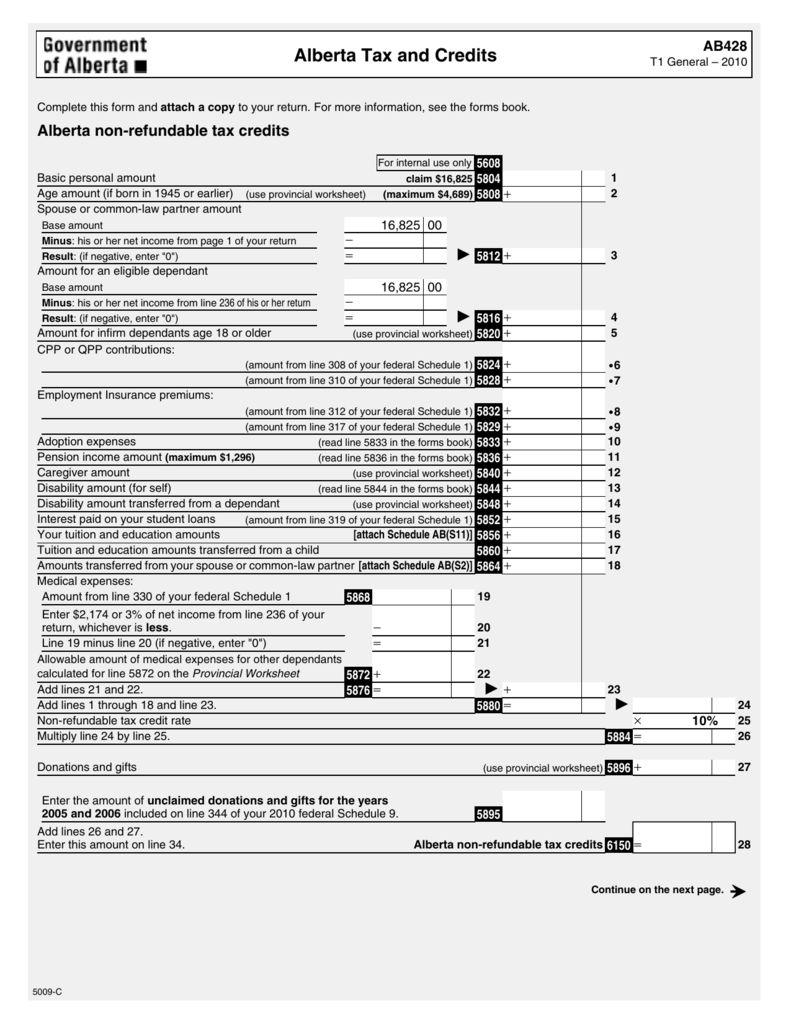

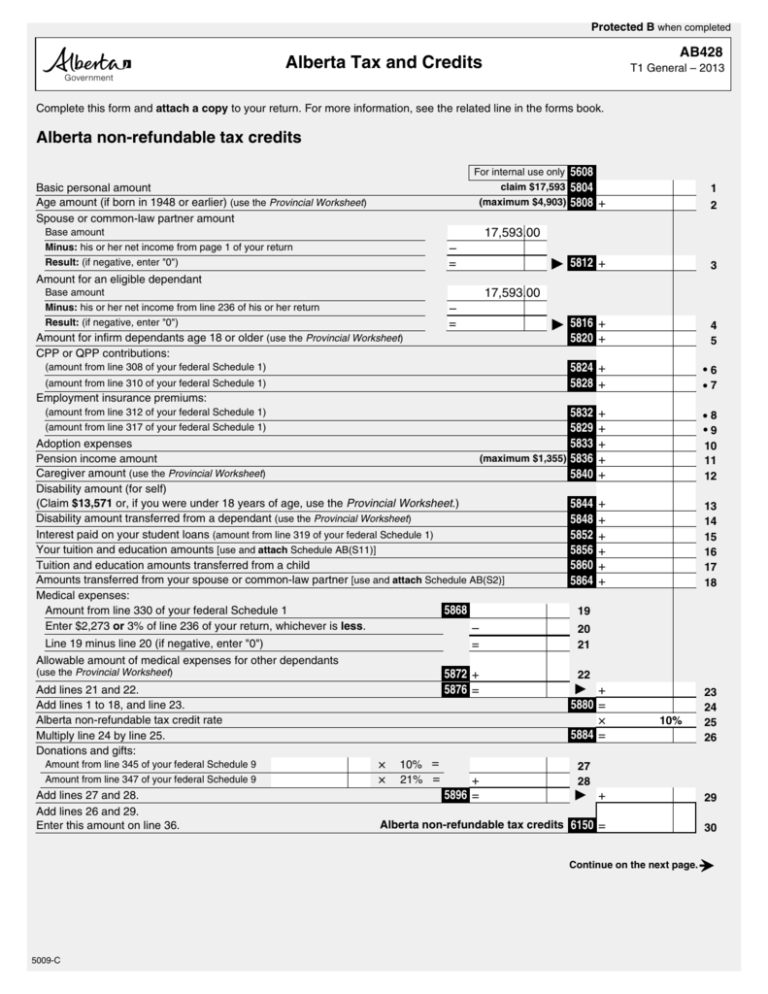

Form AB428 5009 C Download Fillable PDF Or Fill Online Alberta Tax

https://data.templateroller.com/pdf_docs_html/2080/20800/2080072/form-ab428-5009-c-alberta-tax-and-credits-canada_big.png

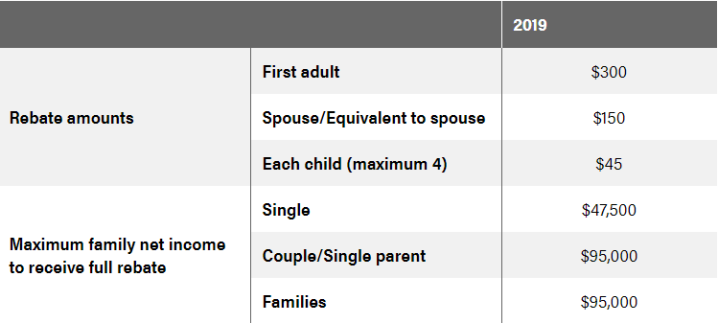

Web However it has posted illustrative carbon tax rebate amounts assuming a 15 tonne annual increase in the federal fuel charge starting in 2023 For 2025 and 2030 the current Web 1 oct 2019 nbsp 0183 32 25 Government Grants Rebates amp Tax Credits for Alberta Homeowners 2023 Show Me the Green Show Me the Green Province Grants Ontario Renovation Grants Ontario Energy Rebates Alberta

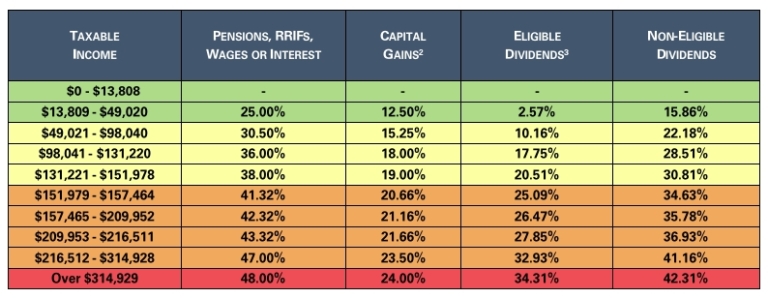

Web 15 juil 2022 nbsp 0183 32 1 079 in Alberta 1 101 in Saskatchewan 832 in Manitoba 745 in Ontario Residents of small and rural communities will receive an extra 10 per cent on Web 15 ao 251 t 2022 nbsp 0183 32 For the 2022 tax year the Alberta basic personal amount is 19 369 while the federal basic personal amount is 14 398 Moreover the first tax bracket in Alberta

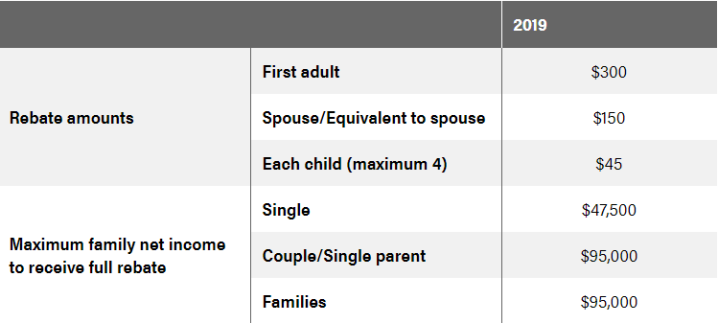

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

https://globalnews.ca/wp-content/uploads/2019/05/ab-carbon-rebates-2019.png?w=720

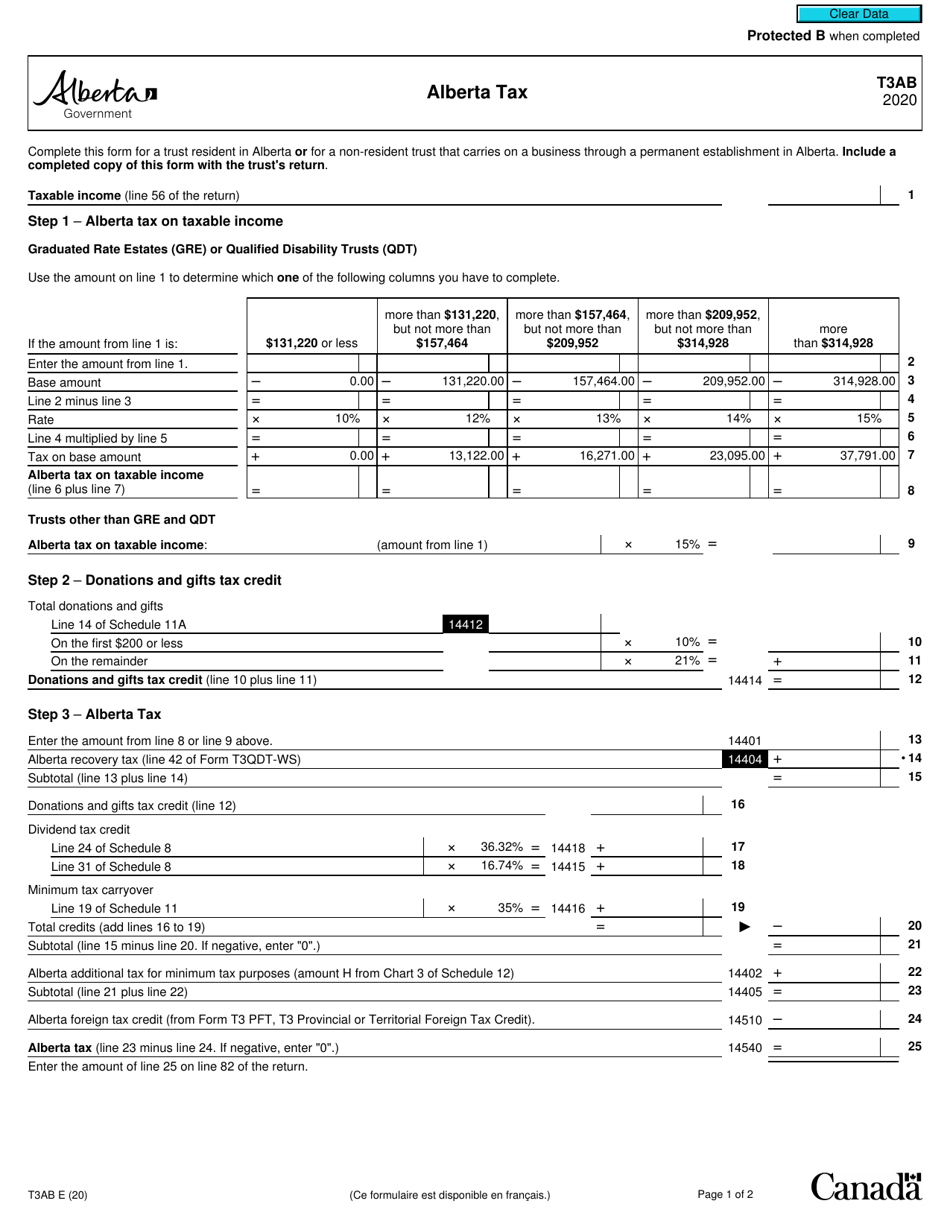

Form T3AB Download Fillable PDF Or Fill Online Alberta Tax 2020

https://data.templateroller.com/pdf_docs_html/2131/21317/2131749/form-t3ab-alberta-tax-canada_print_big.png

https://www.cbc.ca/news/canada/edmonton/h…

Web 2 janv 2023 nbsp 0183 32 Edmonton 183 CBC Explains Here s where Albertans will find extra expenses and cost relief in 2023 Provincial affordability measures kick in but so do increased CPP and EI contributions Janet

https://globalnews.ca/news/8991526/albertan…

Web 14 juil 2022 nbsp 0183 32 Albertans who have filed their 2021 tax returns should wake up Friday morning with some extra money in their bank accounts as the federal government pays out its first round of carbon tax

Room To Move Alberta s Taxes Are Too Low Parkland Institute

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

Alberta Tax And Credits

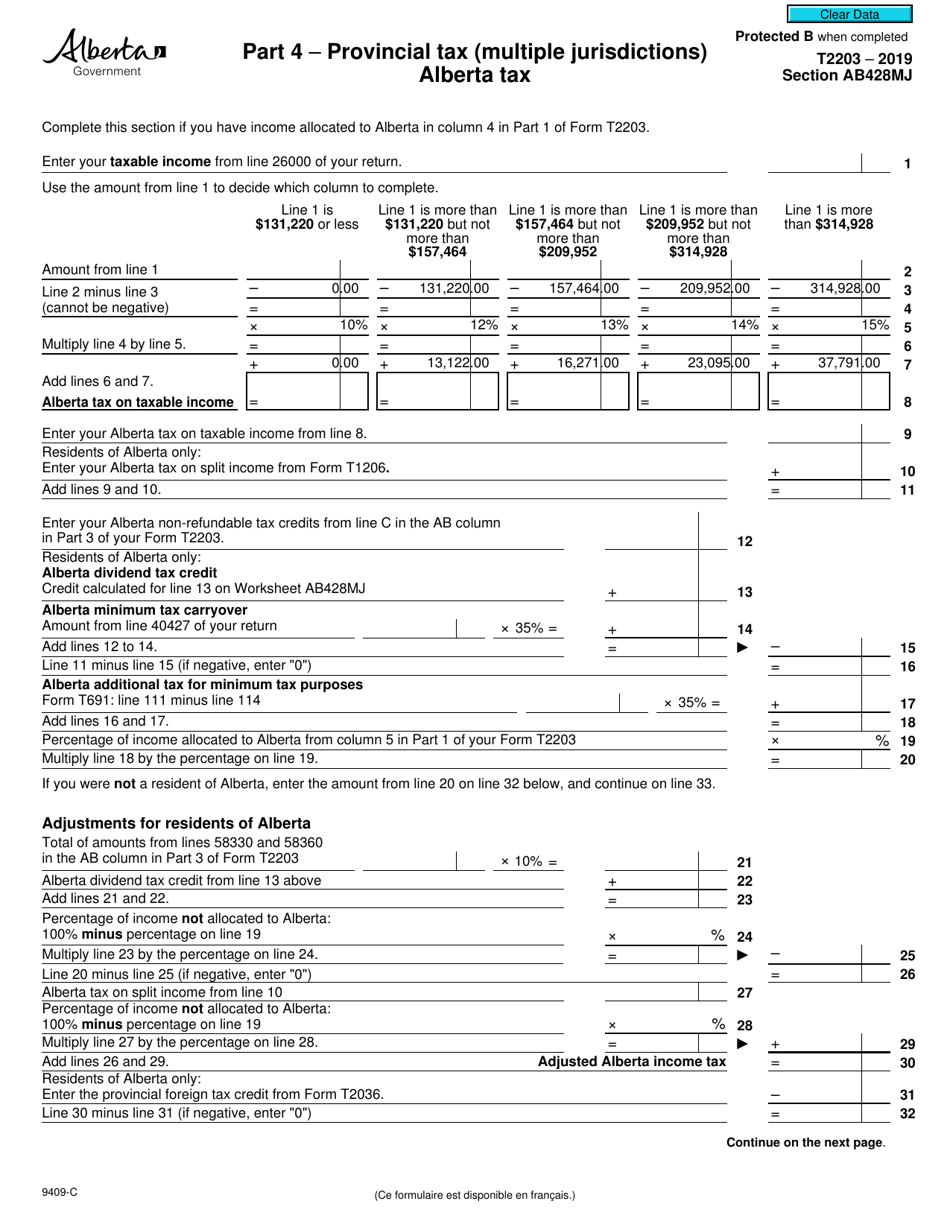

Form T2203 9409 C Section AB428MJ Download Fillable PDF Or Fill

Alberta s Carbon Tax Brought In Billions See Where It Went CBC News

Alberta Tax And Credits

Alberta Tax And Credits

Alberta Tax And Credits

Alberta Income Tax Rates For 2021 Alitis Investment Counsel

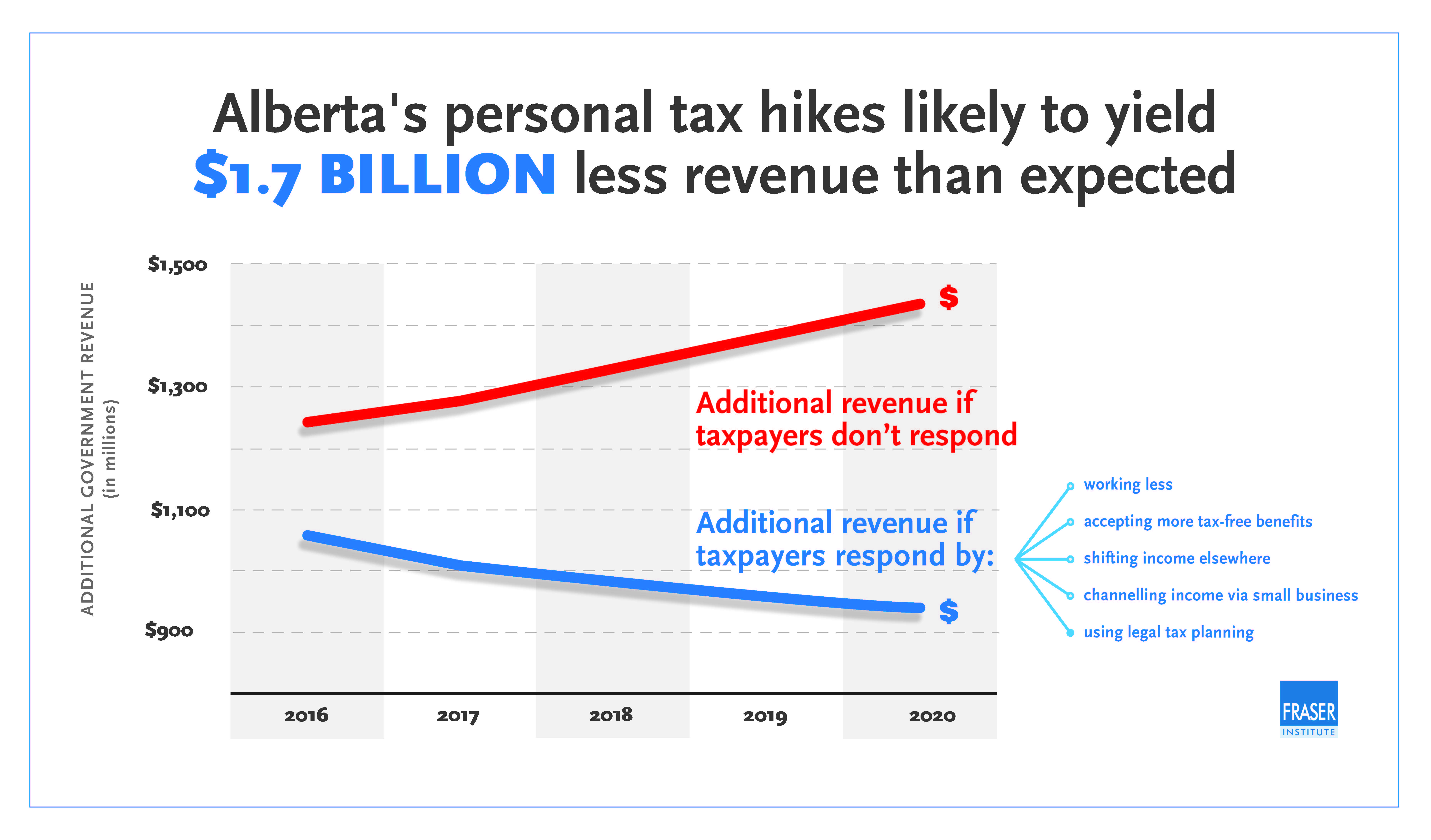

Albertas personal income tax increases infographic jpg Fraser Institute

Alberta Tax Rebates - Web Government Taxes and tax credits Alberta s tax advantage Alberta continues to have an overall tax advantage compared to other provinces with no sales tax no payroll tax and