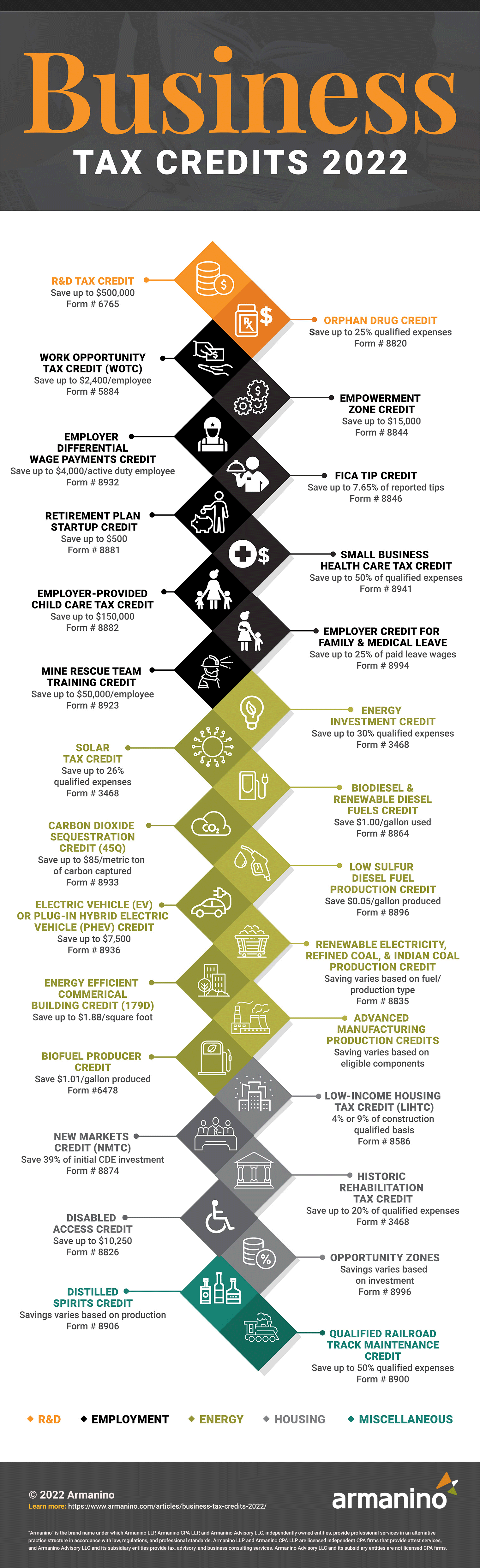

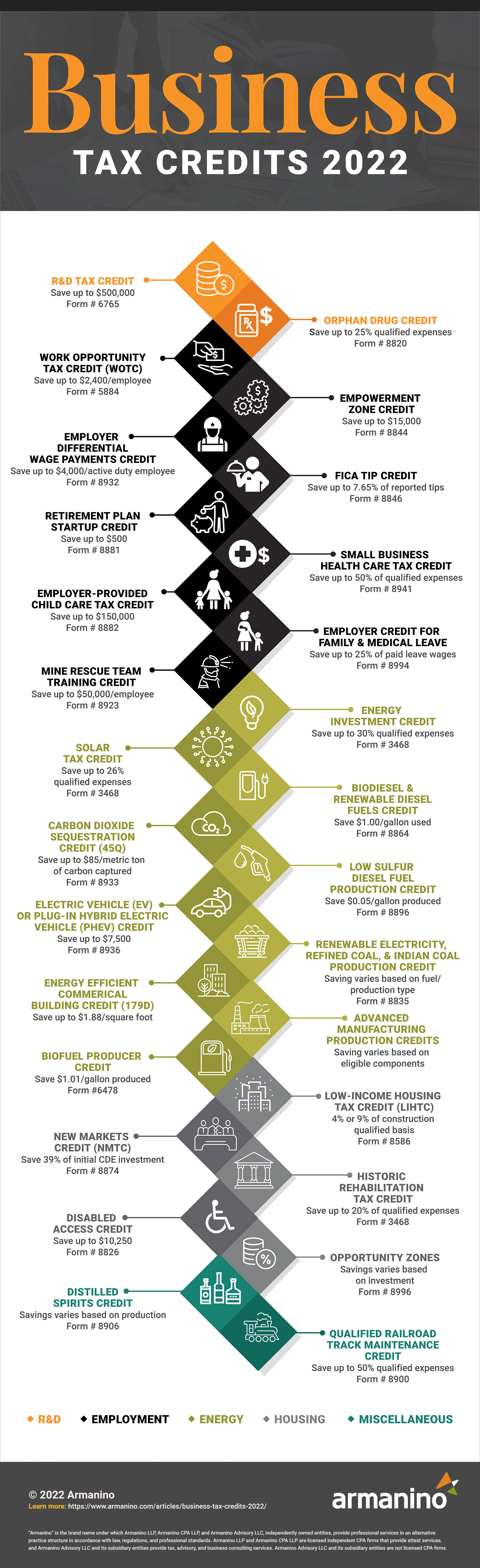

All Tax Credits 2022 A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a Elective payment and credit transfer The Inflation Reduction Act of 2022 allows new ways for ensuring eligible taxpayers receive their credits Elective payment and applicable credits and transfer of certain credits Register your dealership to enable credits for clean vehicle buyers

All Tax Credits 2022

All Tax Credits 2022

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Easy ERTC Application How Businesses Claim Employee Tax Credits For

https://ampifire.com/files/uploaded_images/56348e9222a751ceea3fb44cabf4630f.png

Credits and deductions are available for individuals and businesses The Inflation Reduction Act of 2022 provides new and extended credit and deductions for individuals and businesses tax exempt and government entities You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions

There are many tax credits you could take advantage for your 2022 tax return Here s a breakdown of some common tax credits that you could be eligible for Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A and the annual exclusion for gifts

Download All Tax Credits 2022

More picture related to All Tax Credits 2022

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Simplified ERC Application 2022 Claim Tax Credits For SMBs With PPP Loans

https://www.dailymoss.com/wp-content/uploads/2023/03/simplified-erc-application-2022-claim-tax-credits-for-smbs-with-ppp-loans-6407fcf41985b.jpg

Tax Credits To Claim In 2021 ProFed Credit Union

https://profedcu.org/uploads/page/top-tax-credits-to-claim.png

Don t miss out on these most overlooked tax deductions and credits when you file If you qualify claiming the deductions and credits on this list could lower your tax bill or in some Overall the most common credits fall into the following categories tax credits for college tax credits for families tax credits for income eligible households and tax credits

A tax credit is a dollar for dollar reduction in your income For example if your total tax on your return is 1 000 but you are eligible for a 1 000 tax credit your net liability drops to zero Tax credits reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability while on the other hand reducing how much of your income is subject to taxes This is a dollar amount that s subtracted from your tax bill There are two types refundable and nonrefundable

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

https://i.pinimg.com/originals/4c/9c/70/4c9c7048997bbeb1f91747edd3b1b1c5.jpg

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

https://galleyandtindle.co.uk/wp-content/uploads/2022/07/RD-Tax-Credits.jpg

https://www.investopedia.com › terms › taxcredit.asp

A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money

https://www.policygenius.com › taxes › tax-deductions...

While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a

Plastic Taxes Cheap Offer Save 63 Jlcatj gob mx

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Tax Filing Deadline 2021 Jan 08 2021 Johor Bahru JB Malaysia

2022 Education Tax Credits Are You Eligible

Tax And Secretarial Fee Tax Deduction Malaysia 2020 Dec 31 2020

Tax And Secretarial Fee Tax Deduction Malaysia 2020 Dec 31 2020

Tax Credits Vs Tax Deductions

Tax Update On Withholding Tax Nov 07 2022 Johor Bahru JB

Tax Credits Are Hidden Benefit For Homeowners

All Tax Credits 2022 - You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions