All Tax Return Preparers Must Verkko 5 tammik 2023 nbsp 0183 32 Return to Return Preparer Regulations Page Last Reviewed or Updated 05 Jan 2023 Frequently asked questions about the new requirements for

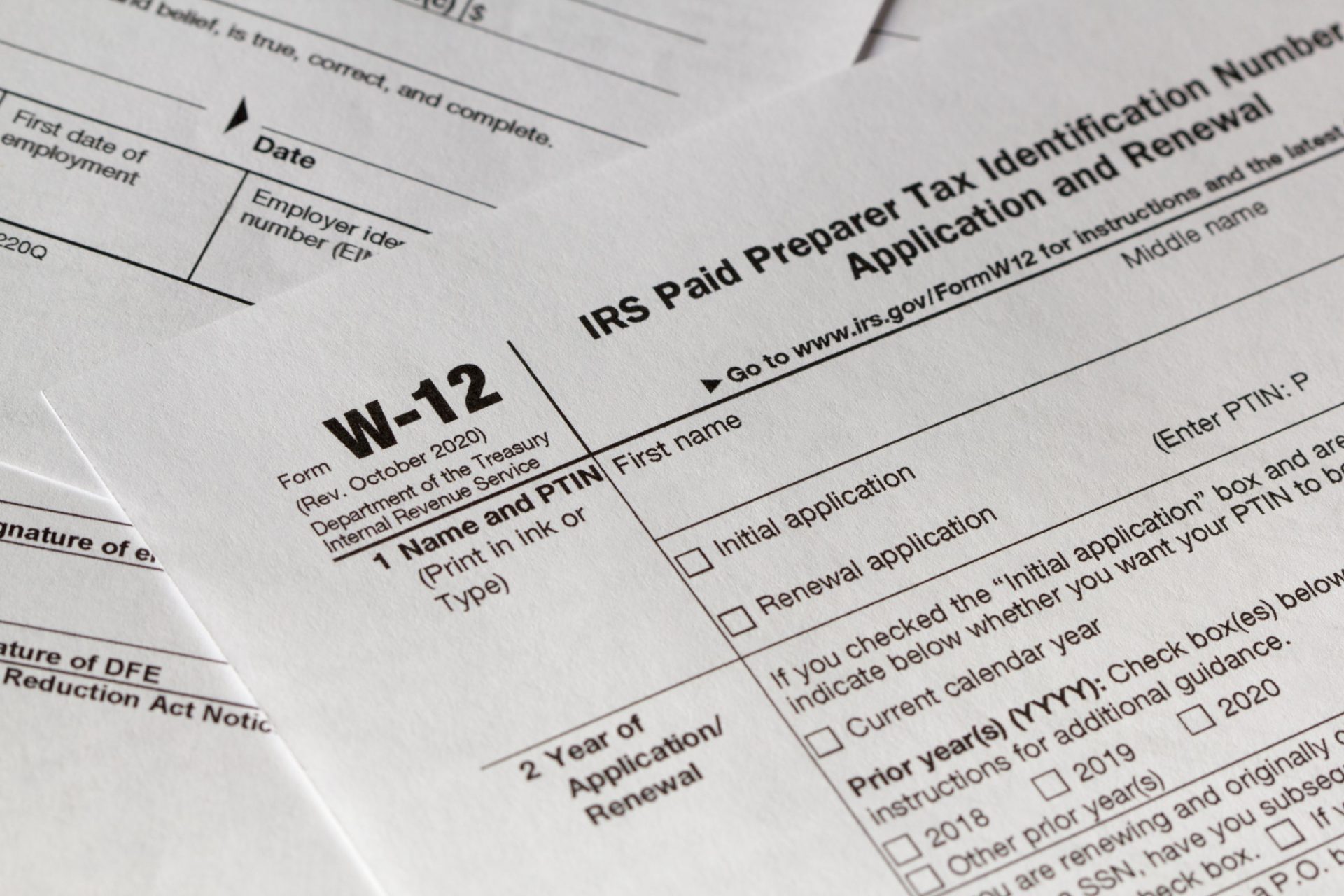

Verkko Under the return preparer registration requirements individuals including CPAs who are tax return preparers and prepare all or substantially all of a tax return or claim for Verkko Virtually all individuals who prepare tax returns for compensation must have a Preparer Tax Identification Number PTIN This requirement generally applies to all attorneys

All Tax Return Preparers Must

All Tax Return Preparers Must

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/11/PTIN-form.jpg

What Are Tax Benefits

https://www.gannett-cdn.com/-mm-/bb6cf63f02b0e43f74d7d33372dc3748b2dc9d9f/c=0-0-505-285/local/-/media/2016/02/15/USATODAY/USATODAY/635911366526752609-tax-help.jpg?width=3200&height=1680&fit=crop

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

Verkko Any tax professional with an IRS Preparer Tax Identification Number PTIN is authorized to prepare federal tax returns However tax professionals have differing levels of Verkko 21 huhtik 2023 nbsp 0183 32 Anyone with an IRS Preparer Tax Identification Number PTIN can be a paid tax preparer However to be able to obtain a PTIN you need to have among

Verkko A PTIN must be obtained by all enrolled agents as well as all tax return preparers who are compensated for preparing or assisting in the preparation of all or substantially Verkko 8 marrask 2023 nbsp 0183 32 Ensure you use a preparer with a PTIN Paid tax return preparers must have a PTIN to prepare all or substantially all of a tax return Use a reputable

Download All Tax Return Preparers Must

More picture related to All Tax Return Preparers Must

Plastic Taxes Cheap Offer Save 63 Jlcatj gob mx

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/04/18/16502788138655.jpg

Regulating Tax Return Preparers A Solution In Search Of A Problem

https://imageio.forbes.com/specials-images/imageserve/469912835/0x0.jpg?format=jpg&width=1200

New Mileage Rates Announced By IRS For 2018 Tax Attorney Orange

https://www.kahntaxlaw.com/wp-content/uploads/2018/01/tax-return-2018-filing.jpg

Verkko 7 helmik 2019 nbsp 0183 32 All paid tax preparers must have a Preparer Tax Identification Number By law paid preparers must sign returns and include their PTIN Report Verkko Starting January 1 2012 the IRS requires all paid preparers who anticipate preparing and filing 11 or more individual returns during a calendar year to e file those returns

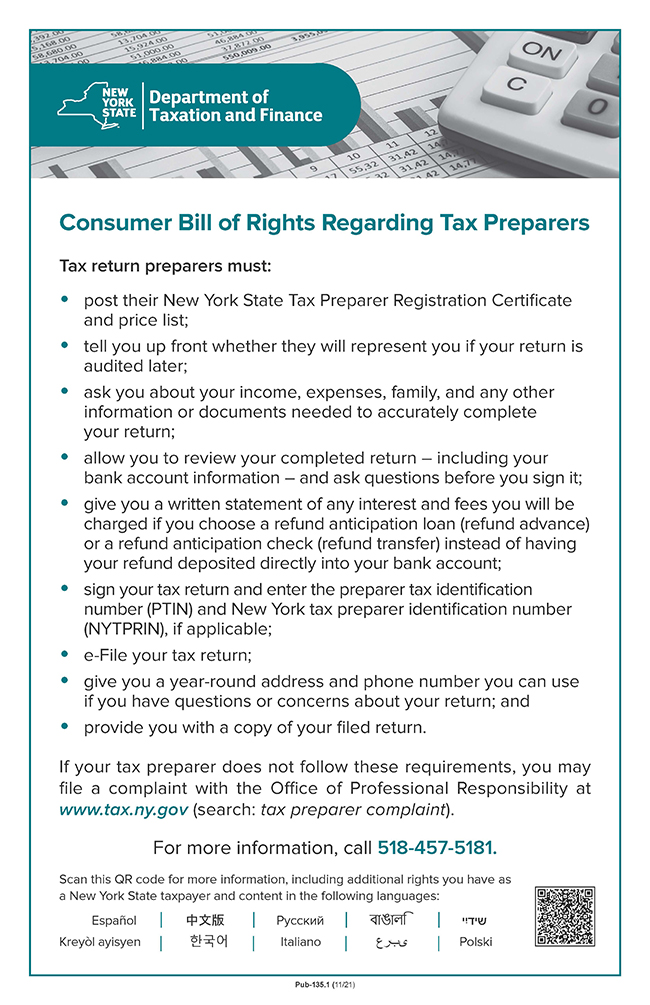

Verkko 24 hein 228 k 2020 nbsp 0183 32 Choosing a Tax Return Preparer If you decide to have a tax return preparer prepare and file your income tax return it is important to choose the Verkko IR 2023 13 January 24 2023 WASHINGTON The Internal Revenue Service today reminded taxpayers to choose a tax return preparer with care Even though most tax

CountingWorks PRO The IRS Is Forcing All Tax Pros To Have A WISP

https://global-uploads.webflow.com/6295a06686070f851ef36b13/6346e58986c31429038f0c8a_GettyImages-1137415864-p-2000.jpg

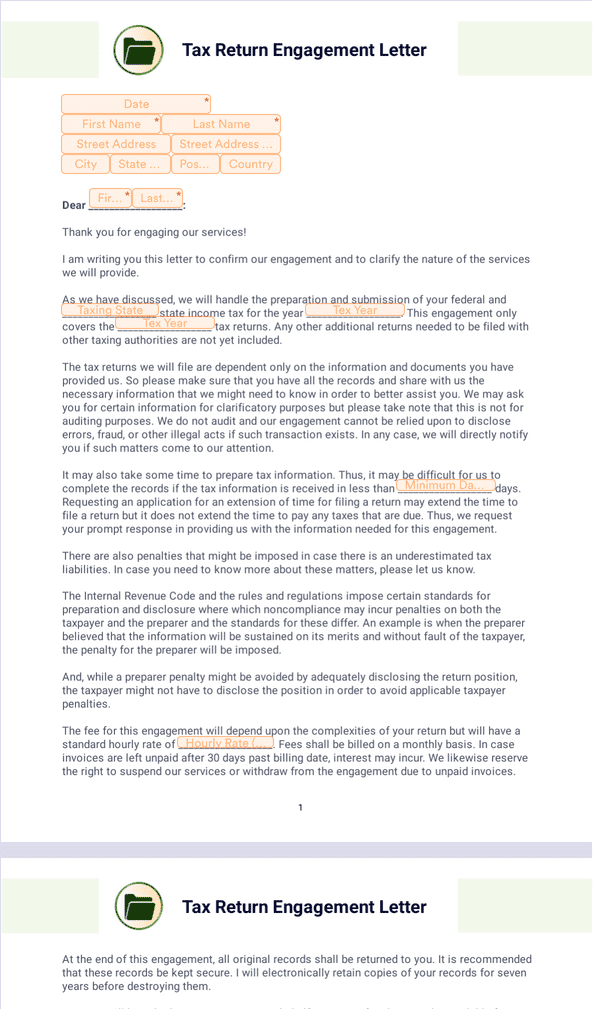

Tax Return Engagement Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-return-engagement-letter-b367df64e2cb9e588c62860163aa9e7e_og.png

https://www.irs.gov/tax-professionals/requirements-for-tax-return...

Verkko 5 tammik 2023 nbsp 0183 32 Return to Return Preparer Regulations Page Last Reviewed or Updated 05 Jan 2023 Frequently asked questions about the new requirements for

https://www.thetaxadviser.com/issues/2011/may/hodes-may11.html

Verkko Under the return preparer registration requirements individuals including CPAs who are tax return preparers and prepare all or substantially all of a tax return or claim for

Tax Return Deadline Extension

CountingWorks PRO The IRS Is Forcing All Tax Pros To Have A WISP

Adding Managing Tax Codes

Consumer Bill Of Rights Regarding Tax Preparers

Withholding Tax Return

Tax Return Employment Self Employment Dividend Rental Property

Tax Return Employment Self Employment Dividend Rental Property

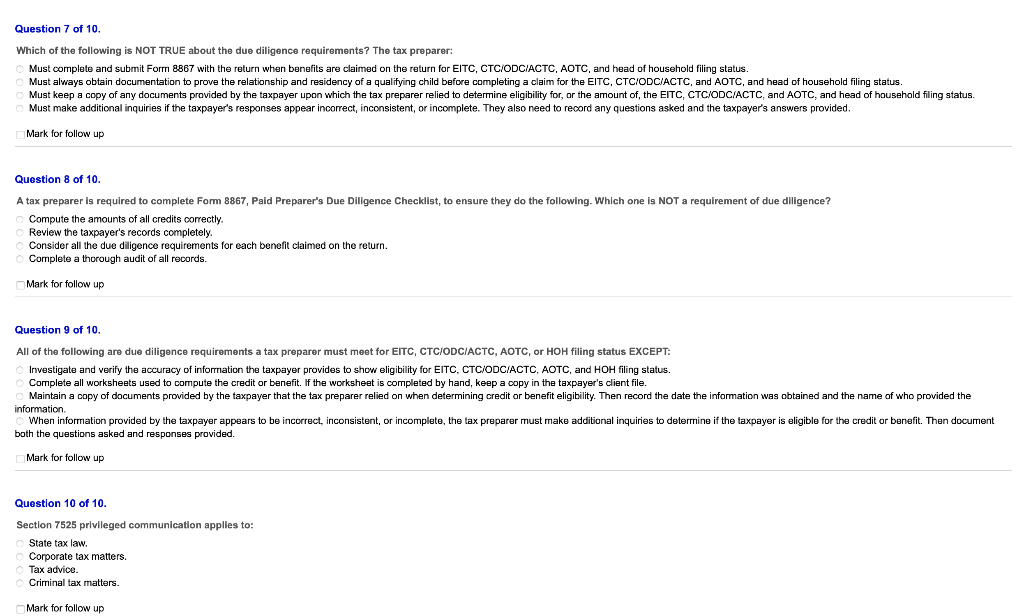

Solved Question 5 Of 10 Josh One Of Your Clients Gives Chegg

How To Use Aadhaar Card For Electronic Tax Return Verification

Tax Preparer Fraud Can Lead To Serious Consequences For Both The Tax

All Tax Return Preparers Must - Verkko 10 huhtik 2023 nbsp 0183 32 All paid tax return preparers must now comply with new regulations and possess a Preparer Tax Identification Number PTIN Ask if the preparer is a