Allowable Investment For Tax Rebate In Bangladesh 2023 24 Where to invest for tax rebate The area of investments have specified in the sixth schedule part B of Income Tax Ordinance ITO 1984 If you invest in the specified areas your investment will be allowable for tax rebate

Discover how the Income Tax Act 2023 offers various tax rebates and investment options to reduce your tax liabilities Learn about eligible tax benefits for life insurance premiums provident funds donations and more Anyone looking to maximum tax rebate must thus follow the new rules before June 30th However the act is yet to be finally approved by the parliament The new income tax act

Allowable Investment For Tax Rebate In Bangladesh 2023 24

Allowable Investment For Tax Rebate In Bangladesh 2023 24

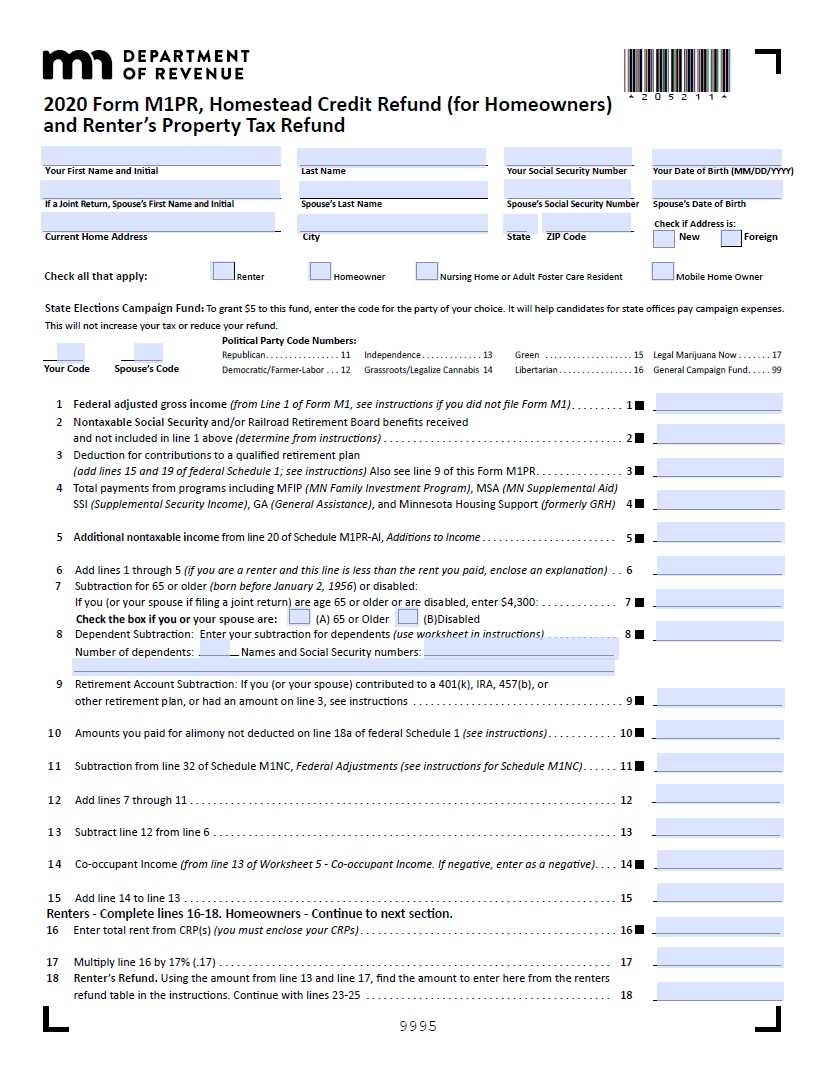

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

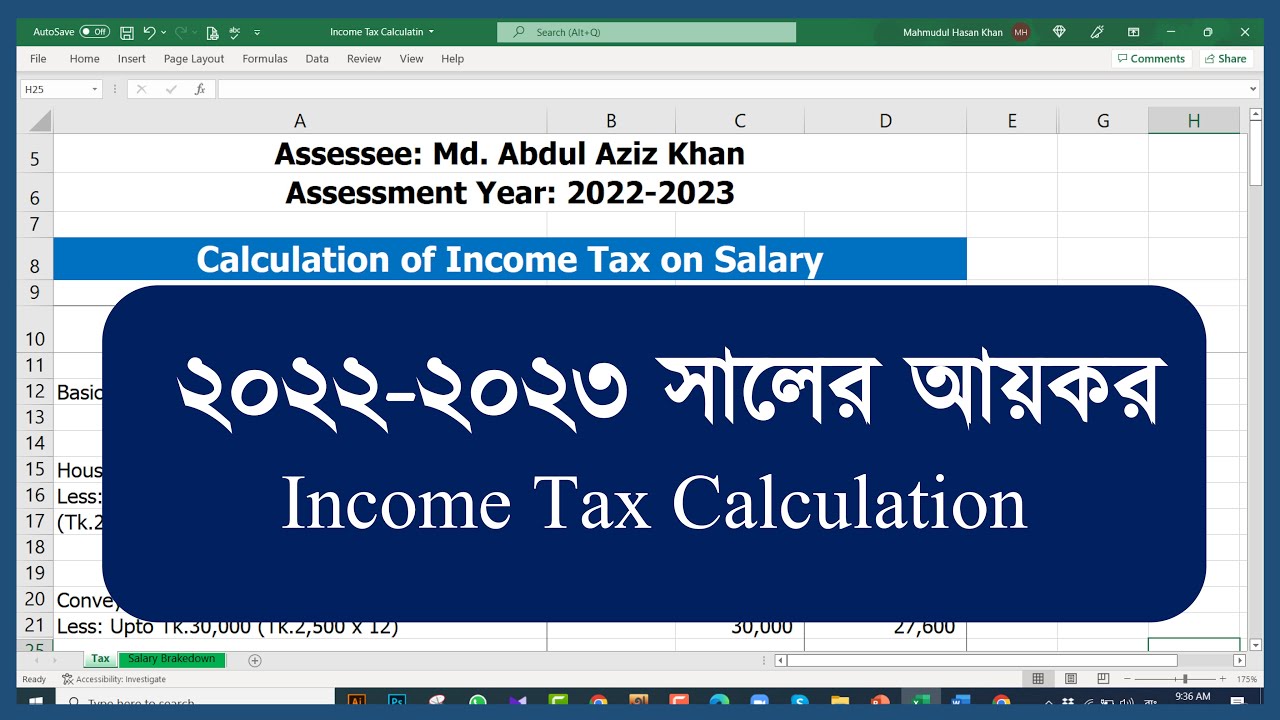

Income Tax Calculation 2022 2023 YouTube

https://i.ytimg.com/vi/HZl05bN8JDU/maxresdefault.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

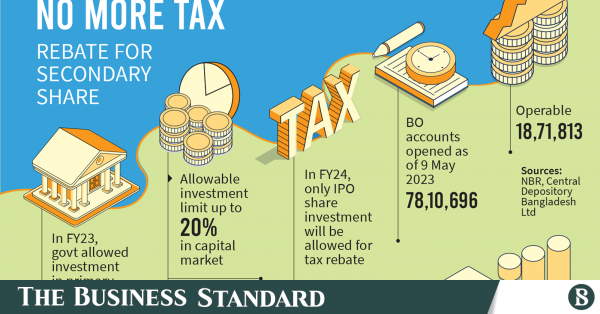

However currently according to the income tax rules 20 of total income is allowed to be invested in getting tax rebate benefits That means you can invest 20 of your The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act

The Income Tax Act 2023 has specified the amount of tax rebate you will get to reduce your tax liability But your investment allowance is not specified In Bangladesh you can reduce your tax burden by taking investment tax rebate as per Section 78 of Income Tax Act 2023 For taking investment tax rebate you have to invest into allowed areas as outlined in Part

Download Allowable Investment For Tax Rebate In Bangladesh 2023 24

More picture related to Allowable Investment For Tax Rebate In Bangladesh 2023 24

Where To Invest For Tax Rebate

https://i.ytimg.com/vi/wHMetXXJeXU/maxresdefault.jpg

Budget For Fiscal Year 2023 24 Tax Waivers Counted In Subsidy Account

https://tfe-bd.sgp1.cdn.digitaloceanspaces.com/posts/10010/uj.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Have a look at the Income Tax Act 2023 of Bangladesh with a detailed view of the new tax regulations rates exemptions and compliance requirements Calculate your maximum tax rebate for the fiscal year 2024 2025 in Bangladesh based on your expected income Learn about eligible investments to maximize your rebate

Deductions on basis of specified allowable investments A tax rebate on investments is applicable for a resident and non resident Bangladeshi which is the lower of the following 3 of taxable We ll first look into your amount of investment and how much qualifies for a tax rebate check the excel file for calculation The amount of investment that qualifies for tax

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

Investment Plan Rebate Under Income Tax Ordinance 1984 In Bangladesh

https://i.ytimg.com/vi/zeFzDcIi_qU/maxresdefault.jpg

https://www.jasimrasel.com › invest-for-tax-rebate

Where to invest for tax rebate The area of investments have specified in the sixth schedule part B of Income Tax Ordinance ITO 1984 If you invest in the specified areas your investment will be allowable for tax rebate

https://taxationlinkbd.com

Discover how the Income Tax Act 2023 offers various tax rebates and investment options to reduce your tax liabilities Learn about eligible tax benefits for life insurance premiums provident funds donations and more

Investment For Tax Rebate In Bangladesh

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Minnesota Property Tax Refund 2019 2024 Form Fill Out And Sign

Tax Rebate On Investment In Secondary Stock May Go Budget 2023 24 FY

Law Proposes Cutting Tax Rebate By A Third For Investments In

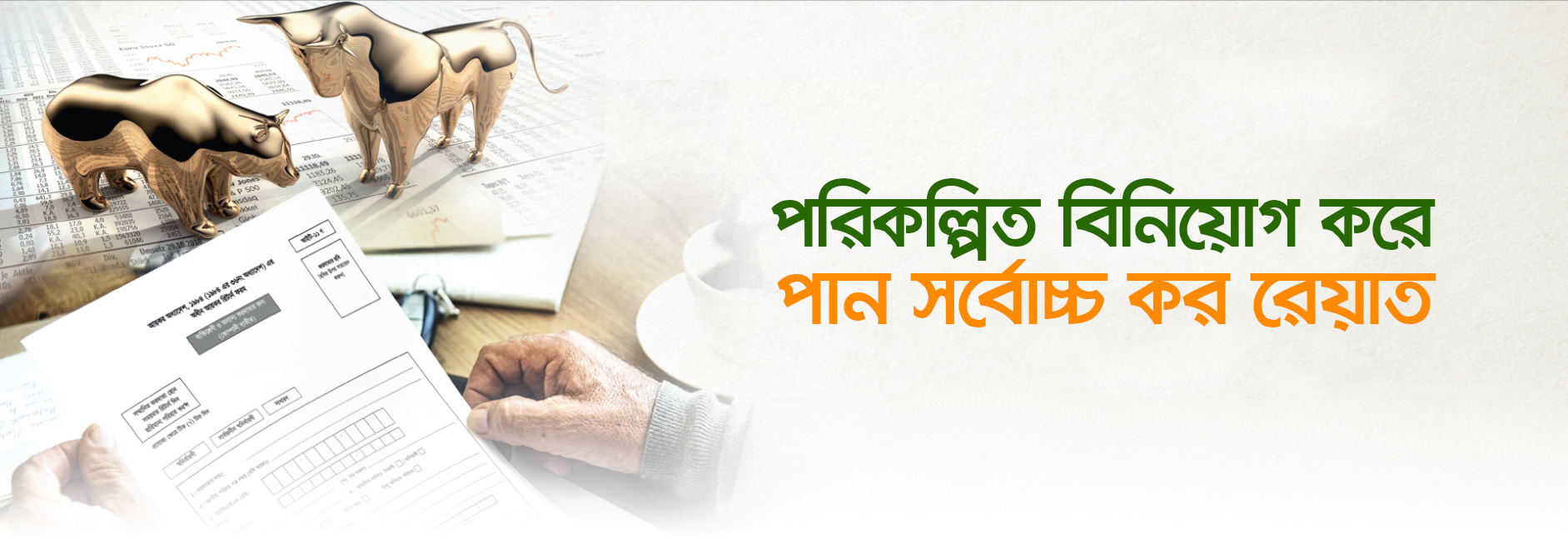

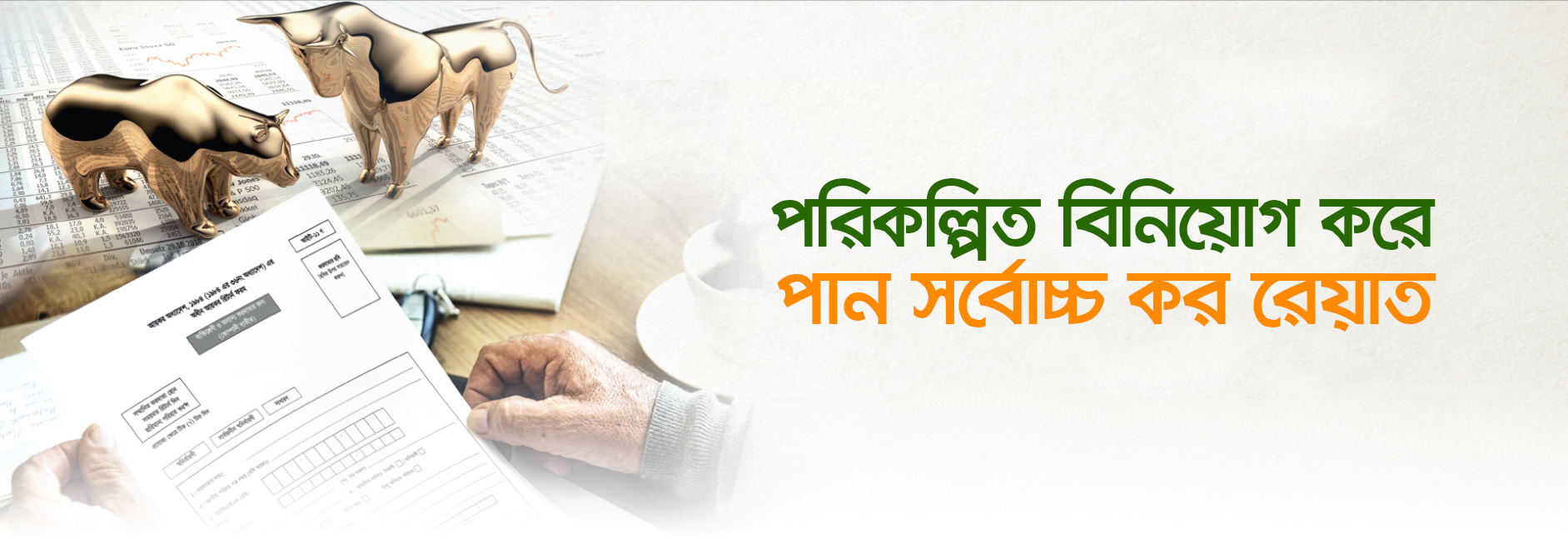

Tax Rebate Lanka Bangla Asset Management Company Limited

Tax Rebate Lanka Bangla Asset Management Company Limited

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Best Tax Saving Investment Options Salma Sony CFP

Tax Incentive Removal Why The Proposal Raises Concern Over Long term

Allowable Investment For Tax Rebate In Bangladesh 2023 24 - However currently according to the income tax rules 20 of total income is allowed to be invested in getting tax rebate benefits That means you can invest 20 of your