Am I Due A Tax Rebate 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Am I Due A Tax Rebate 2024

Am I Due A Tax Rebate 2024

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

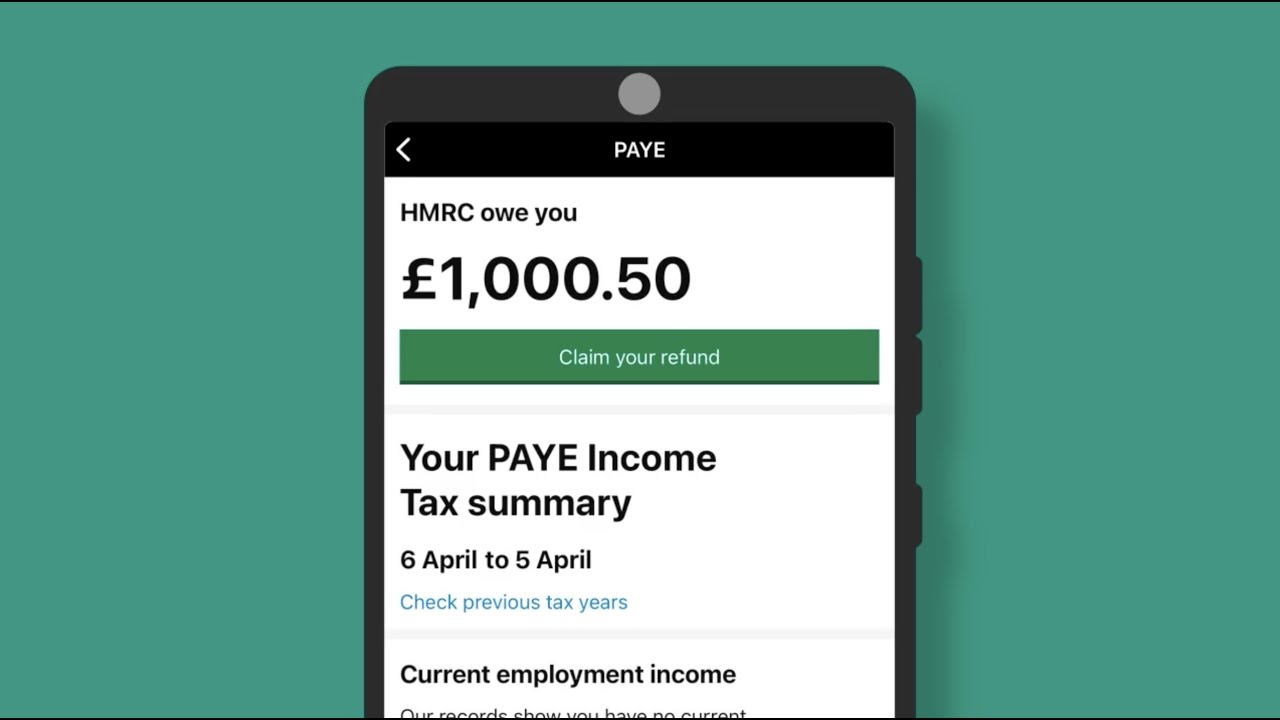

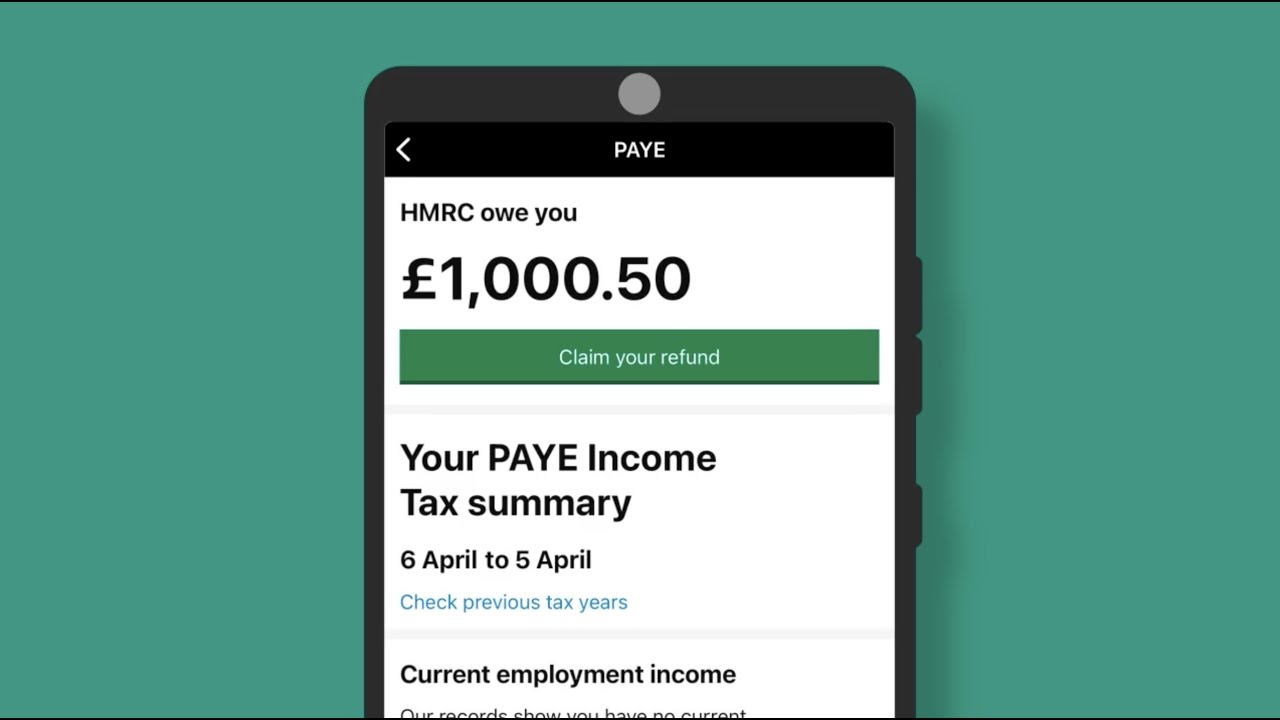

Am I Due A Tax Rebate Or Rebate From HMRC And How Can I Claim

https://www.thescottishsun.co.uk/wp-content/uploads/sites/2/2018/04/nintchdbpict0002942007121.jpg?w=2640

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax The IRS said Monday it will begin accepting tax returns on Jan 29 If you file your taxes electronically that day and there are no issues the IRS says it can usually issue a refund within 21

Estimate your 2023 refund taxes you file in 2024 with our tax calculator by answering simple questions about your life and income Terms of Service Loading tax calculator Be tax ready all year long with these free tax calculators TaxCaster Tax Calculator Estimate your tax refund and see where you stand I m a TurboTax customer I m a new user Tax Day is Apr 15 2024 for most taxpayers Taxpayers in Maine or Massachusetts have until Apr 17 2024 due to the Patriot s Day and Emancipation Day holidays Taxpayers living in a federally

Download Am I Due A Tax Rebate 2024

More picture related to Am I Due A Tax Rebate 2024

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

CalEITC can be worth up to 3 529 while YCTC and FYTC can be up to 1 117 Individuals earning less than 63 398 may also qualify for the federal EITC Your family could receive up to 12 076 from CalEITC YCTC and the federal EITC You can claim CalEITC YCTC and FYTC by filing a state tax return and make sure to file a federal return with IRS Free File participants These tax providers are participating in IRS Free File in 2024 Tax Tip 2024 03 Jan 22 2024 IRS Free File is now available for the 2024 filing season With this program eligible taxpayers can prepare and file their federal tax returns using free tax software from trusted IRS Free File partners

September 16 Third Quarter Estimated Taxes Due The third estimated tax payment is due on Sept 16 2024 This is for taxes on money you earned from June 1 through Aug 31 The deadline is Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

https://i.ytimg.com/vi/ygbB3OHf28o/maxresdefault.jpg

US Entertainment News Celebrity News Gossip Geels

https://geels.net/wp-content/uploads/2021/05/Am-I-due-a-tax-rebate-or-rebate-from-HMRC-and-how-can-I-claim-880x660.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Property Tax Rebate Pennsylvania LatestRebate

What Is A Tax Rebate Reasons Why You Could Be Due A Tax Rebate Accounting Firms

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Best Tax Rebate Calculator In UK 2022 Business Lug

Best Tax Rebate Calculator In UK 2022 Business Lug

Big Update On Income Tax Rebate In Union Budget 2023 No Tax Upto 7 Lakh YouTube

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000 And 14 890 See If You

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Am I Due A Tax Rebate 2024 - Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 taxes which you ll file in 2024