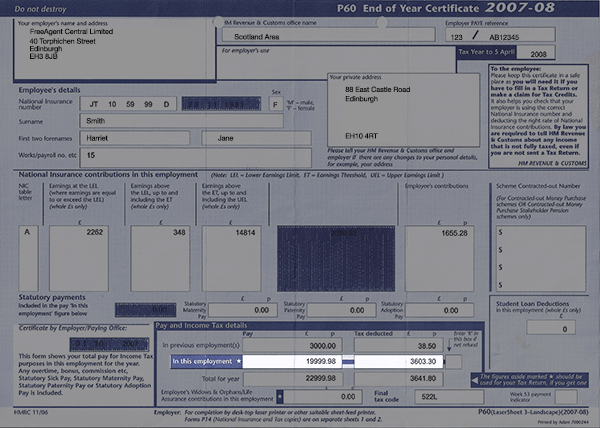

Am I Due A Tax Rebate P60 Web 15 mai 2019 nbsp 0183 32 To create a Government Gateway account you will need your National Insurance number and a recent payslip P60 or valid UK passport For a GOV UK Verify account you ll need a UK address and a valid passport or photo driving licence Using

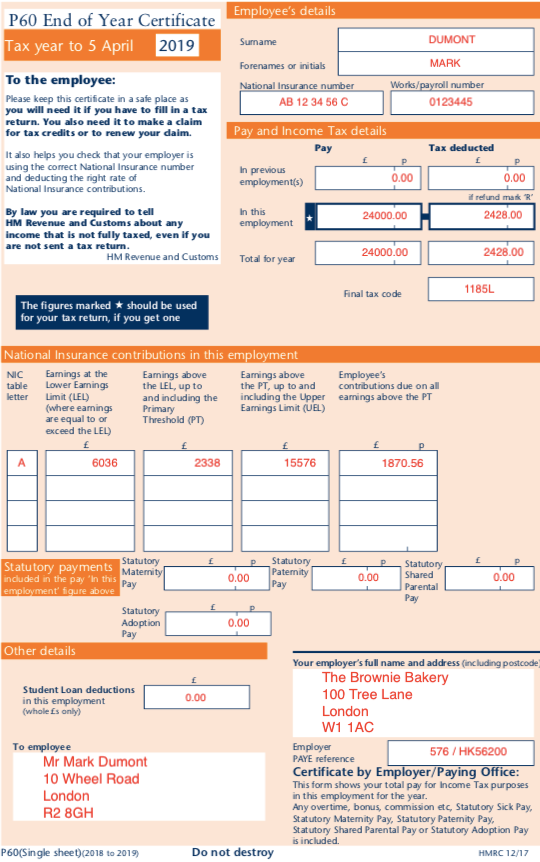

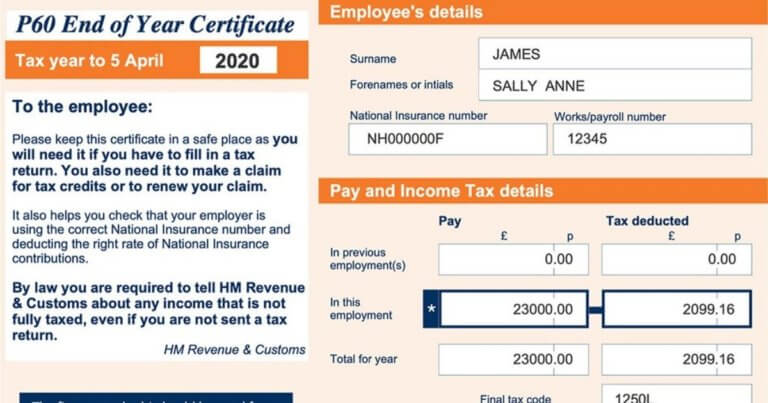

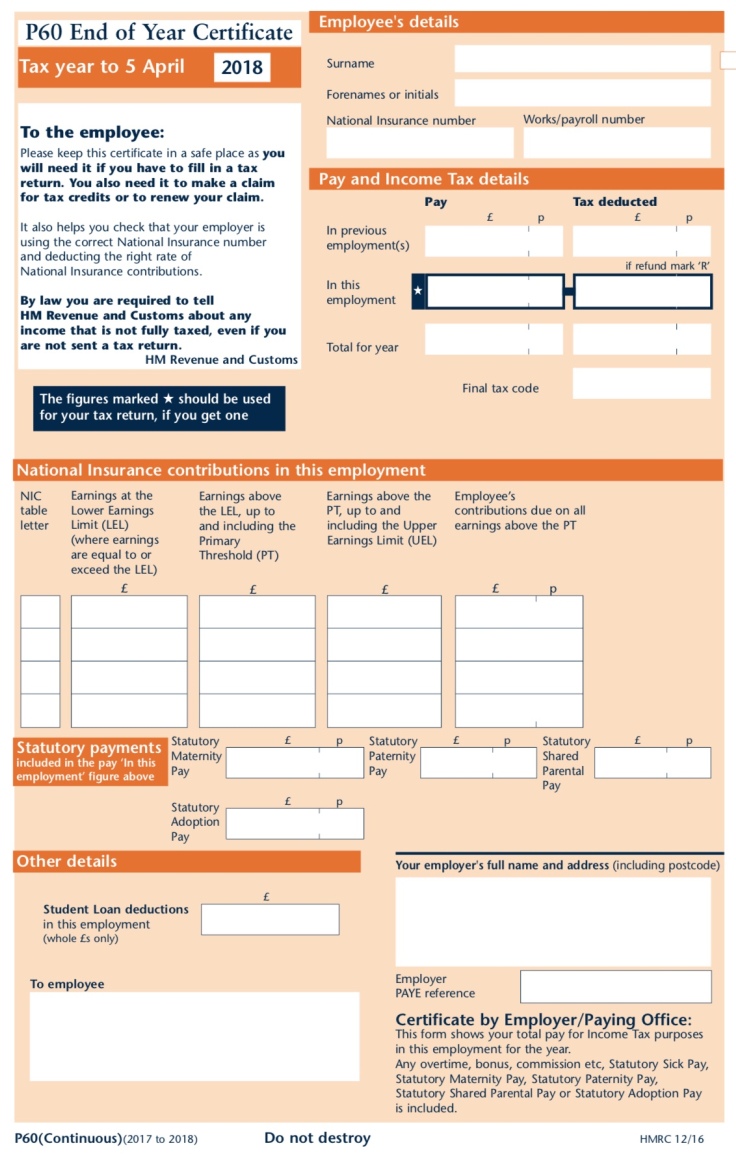

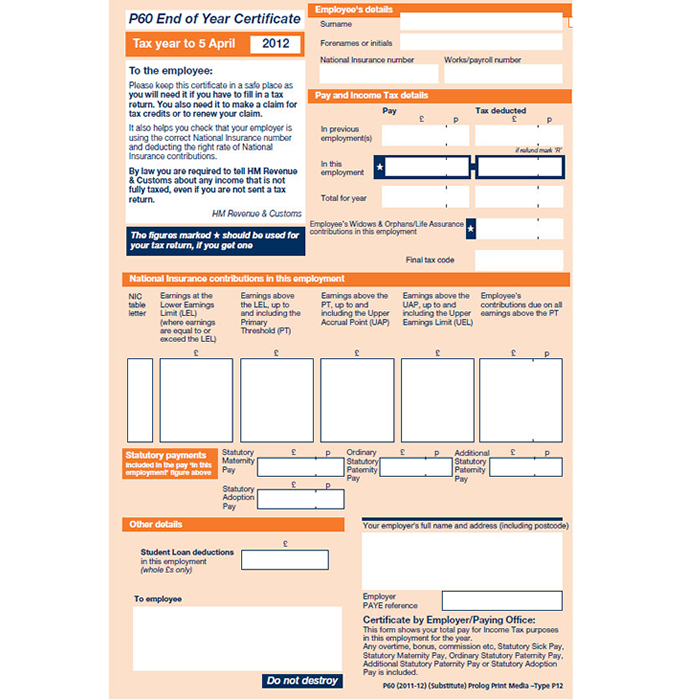

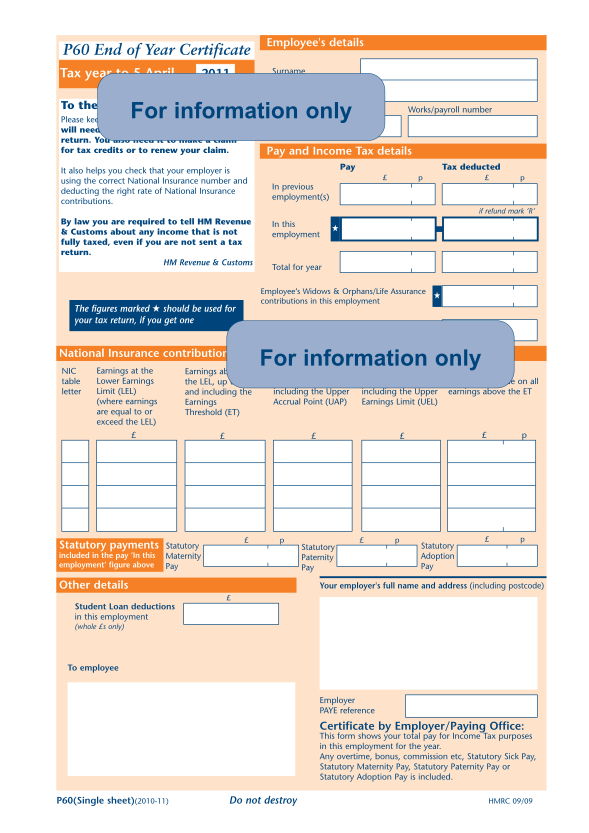

Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such as working Web 29 mars 2022 nbsp 0183 32 29 March 2022 Supplying employees with P60s is an annual job that shouldn t take up too much of your time But what happens if you miss the P60 deadline and how can you claim a P60 tax refund This simple guide explores the P60 meaning

Am I Due A Tax Rebate P60

Am I Due A Tax Rebate P60

https://www.taxback.com/resources/blogimages/20170303175437.1488556477275.bbddfc04a2248a818e6a3876eee.png

What Is A P60 Form In The UK

https://osome.com/content/images/size/w380/2019/11/--------------2019-10-25---16.55.02-1.png

A Guide To UK PAYE Tax Forms P45 P60 And P11D

https://www.sableinternational.com/images/default-source/blog/p60.jpg?sfvrsn=7a7be833_0

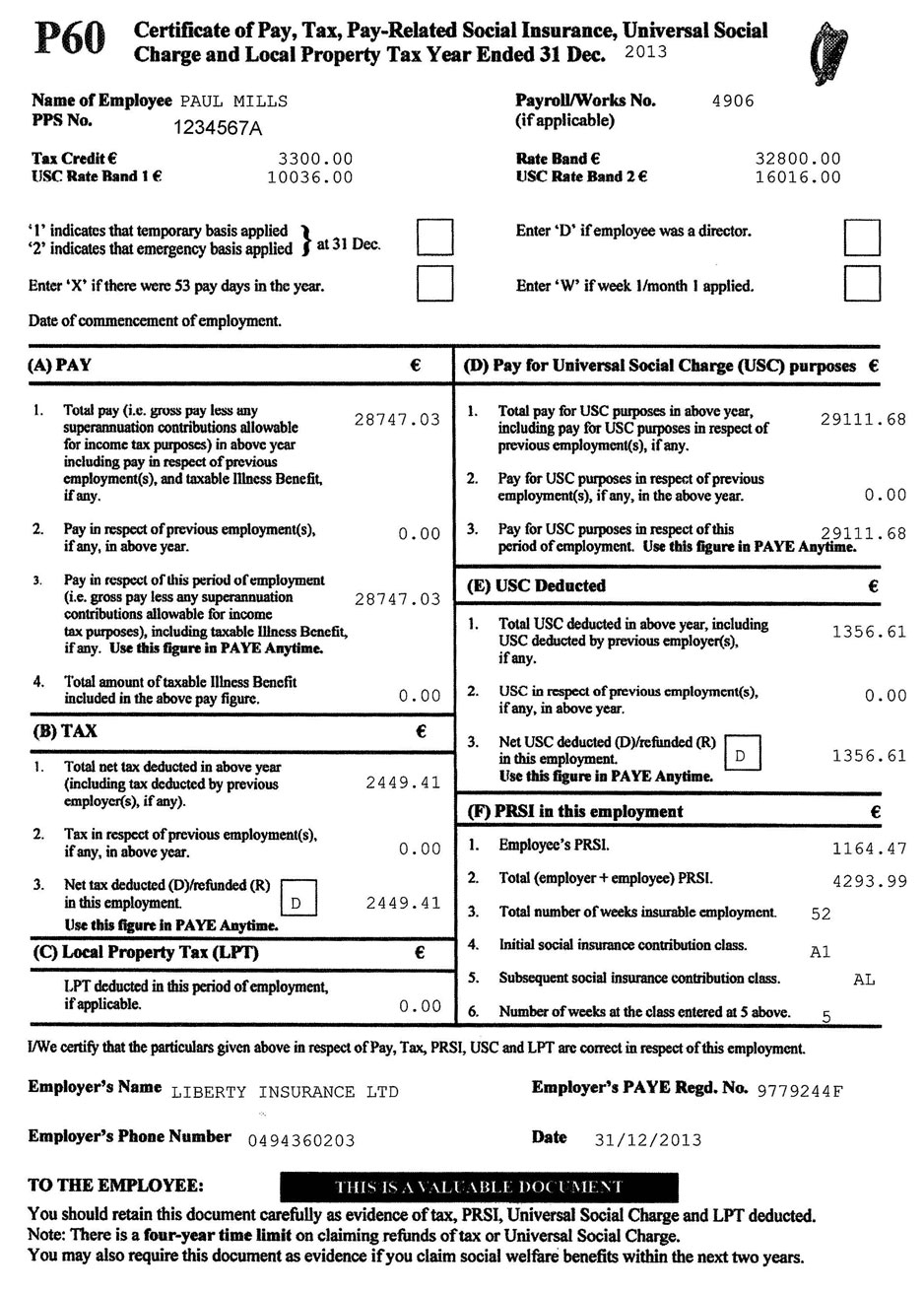

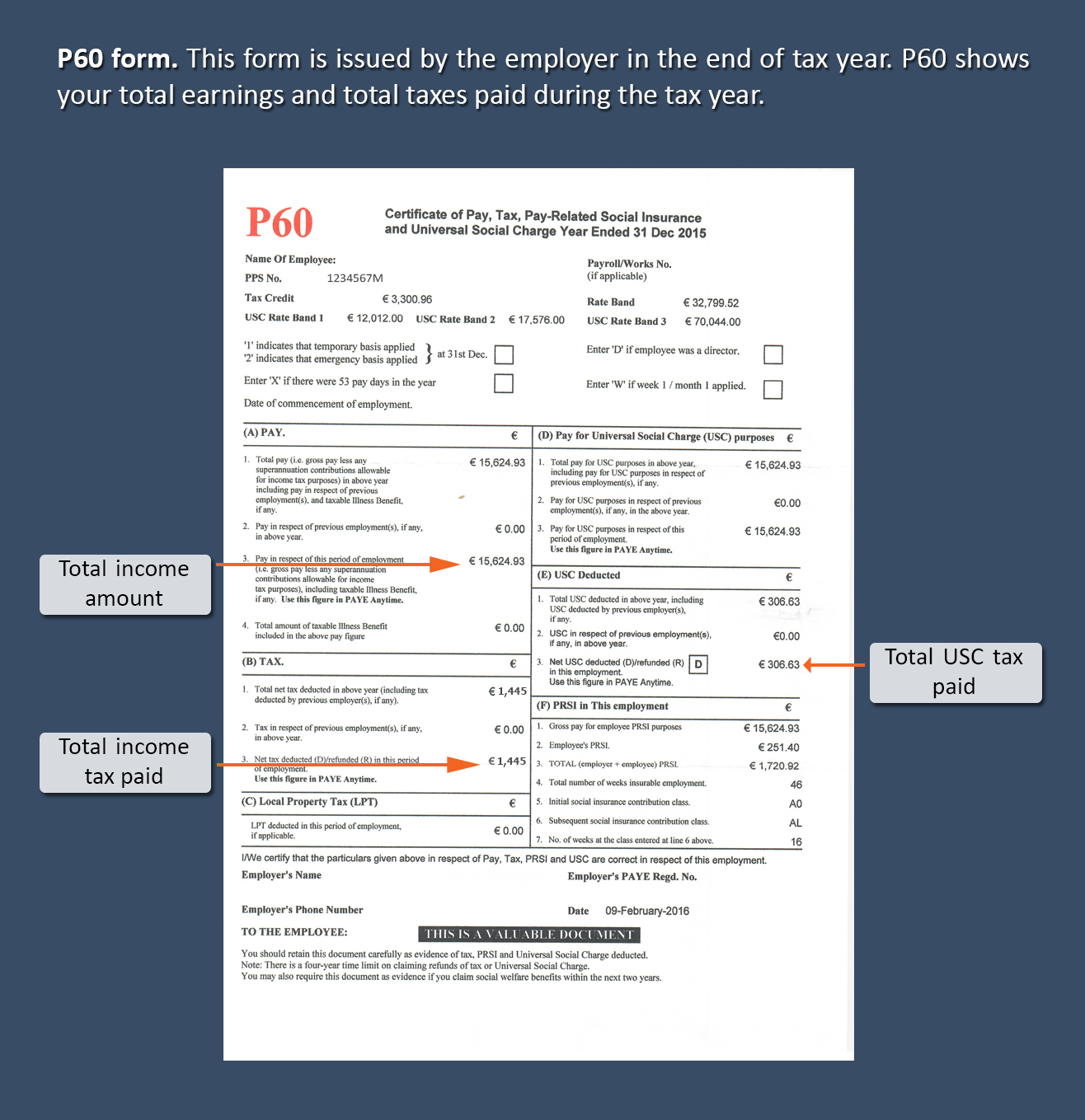

Web 2 juin 2023 nbsp 0183 32 To check your tax code you can refer to your payslips P45 or P60 forms These documents provide valuable information about your income and tax deductions Additionally HMRC offers an Web You need details of your earnings before and after tax get this from your P60 any savings get this from your bank statements or annual statement from your bank or building society any

Web 5 avr 2021 nbsp 0183 32 You won t need to keep records of what you ve paid for if you claim a flat rate deduction At Taxback we can check it you re due any relief in the form of a flat rate deduction when you apply for a tax rebate Web A P60 tax refund is a repayment of income tax because you have paid too much The figures on the P60 will show whether you ve paid too much tax against the income you have had How do I get a P60 The employer you re working for at the end of the tax year

Download Am I Due A Tax Rebate P60

More picture related to Am I Due A Tax Rebate P60

PY GB New P60 Report For Tax Year End IProCon

http://www.iprocon.de/wp-content/uploads/2014/02/img4_ep60.jpg

How To Get A Replacement P60 Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/p60-certificate-768x403.jpeg

What Is P60 Freddy s Musings

https://freddysmusingshome.files.wordpress.com/2018/11/img_0763.jpg?w=736

Web 26 janv 2022 nbsp 0183 32 Your P60 tax return form is one of the better ways to show the income earned and the tax paid according to HRMC guidelines Some of the things when you may need to use the P60 form are Applying for the mortgage Filing self assessment tax Web Using our free tax rebate calculator it instantly gives you an estimate of how much of a tax refund you could be due from HMRC Why wait Claim your tax rebate with QuickRebates today Average rebate 163 3 265 Tax

Web 28 oct 2022 nbsp 0183 32 Guide To Getting A P60 Tax Refund Riley Nixon October 28 2022 8 mins In the UK P60 forms are used by taxpayers to report their income and tax liabilities for the previous tax year These forms are generally issued by employers and provide important Web 30 mai 2010 nbsp 0183 32 If your total income is under the 6475 year then you would be entitled to a refund of tax from your BR coded jobs and you need to write to the tax office send your P60 s and ask for the refund of over paid tax Unfortunately if the amounts are only

P60 TAX FORM END OF YEAR CERTIFICATE P60 REVENUE

https://www.moneysoft.co.uk/images/guides/p60-print-858x922.png

P60 TAX FORM END OF YEAR CERTIFICATE P60 REVENUE

https://www.sageaccountssolutions.co.uk/wp-content/uploads/2018/02/Sage-Self-Seal-P60-2017-2018-0615P60S50-1.jpg

https://www.which.co.uk/news/article/are-you-owed-a-tax-rebate-check...

Web 15 mai 2019 nbsp 0183 32 To create a Government Gateway account you will need your National Insurance number and a recent payslip P60 or valid UK passport For a GOV UK Verify account you ll need a UK address and a valid passport or photo driving licence Using

https://www.gov.uk/claim-tax-refund

Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such as working

P60 Form How To Get A P60 Tax Form Swiftrefunds co uk

P60 TAX FORM END OF YEAR CERTIFICATE P60 REVENUE

21 P60 Form Download Page 2 Free To Edit Download Print CocoDoc

So You Got Your P60 And A Self Assessment Tax Return Letter Bettertax

Use Your Irish P60 To Get A Tax Refund

Can I Claim Ppi Back From My Catalogue

Can I Claim Ppi Back From My Catalogue

Ireland Tax Refund AmberTax

Employment Page sole Traders FreeAgent

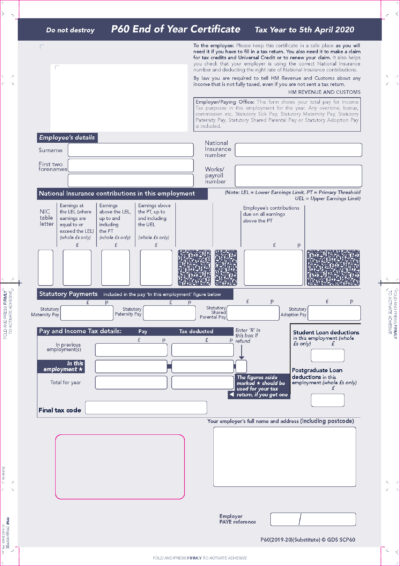

P60 Year End Forms For Tax Year Ending April 2020

Am I Due A Tax Rebate P60 - Web 2 juin 2023 nbsp 0183 32 To check your tax code you can refer to your payslips P45 or P60 forms These documents provide valuable information about your income and tax deductions Additionally HMRC offers an