Amended Tax Return Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 A1 Yes if your 2020 has been processed and you didn t claim the credit on your original 2020 tax return you must file an Amended U S Individual Income Tax

Web 10 d 233 c 2021 nbsp 0183 32 A5 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate Web 13 janv 2022 nbsp 0183 32 If your 2021 tax return has been processed and you didn t claim the credit on your return but are eligible for it you must file an amended return to claim the

Amended Tax Return Recovery Rebate Credit

Amended Tax Return Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-third-stimulus-stimulusinfoclub.png?w=1370&ssl=1

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate

Download Amended Tax Return Recovery Rebate Credit

More picture related to Amended Tax Return Recovery Rebate Credit

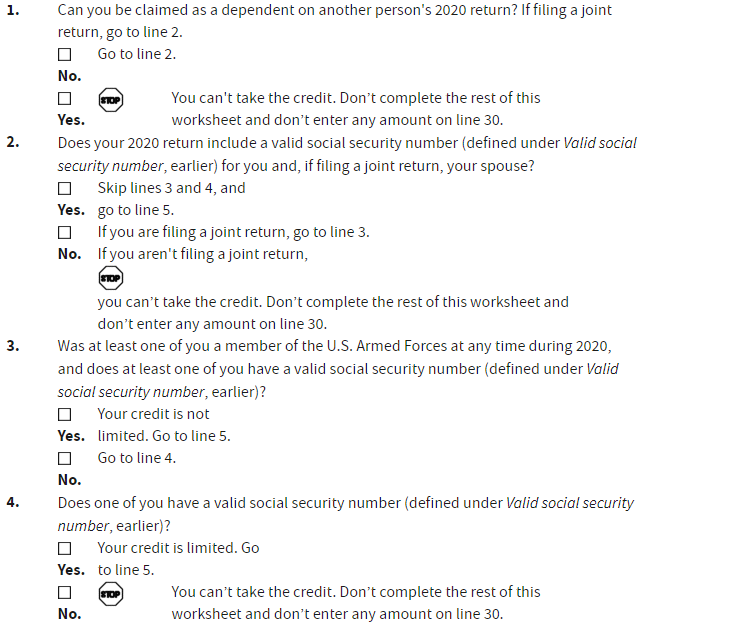

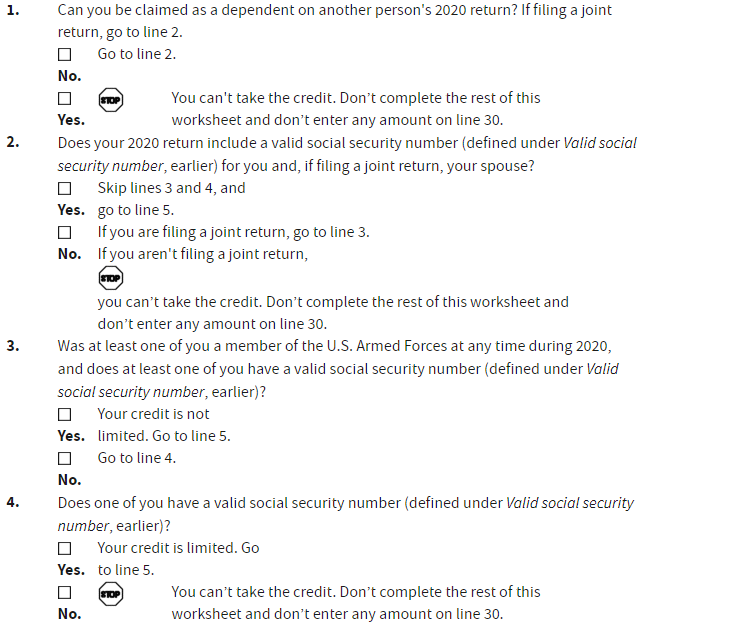

Recovery Rebate Credit Worksheet Tax Guru Ker Tetter Letter Recovery

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-on-amended-return.png

Still Haven t Received My Tax Refund 2022 TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/amended-refund-completed-still-havent-received-it-it-says-completed.jpeg

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/fill-free-fillable-thetaxbook-pdf-forms.png?w=600&ssl=1

Web 19 f 233 vr 2021 nbsp 0183 32 1 Best answer CatinaT1 Expert Alumni If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on Web I m eligible for a 2021 Recovery Rebate Credit but I already filed and didn t claim the credit What should I do If you didn t claim the credit on your original tax return you must file an amended return using Form

Web 9 avr 2021 nbsp 0183 32 A1 If you didn t claim the credit on your original tax return you will need to file an Amended U S Individual Income Tax Return Form 1040 X The IRS will not Web 24 f 233 vr 2023 nbsp 0183 32 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction

Recovery Rebate Credit Worksheet Explained Support Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-explained-support-19.png

Stimulus Checks From The Government Explained Vox Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/stimulus-checks-from-the-government-explained-vox.png?w=1200&ssl=1

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 A1 Yes if your 2020 has been processed and you didn t claim the credit on your original 2020 tax return you must file an Amended U S Individual Income Tax

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 A5 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate

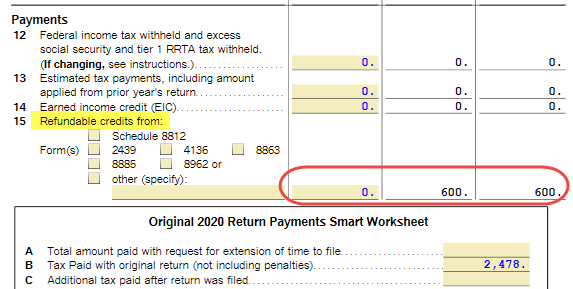

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Explained Support Recovery Rebate

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

1040 Line 30 Recovery Rebate Credit Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

The Recovery Rebate Credit Calculator MollieAilie

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Amended Tax Return Recovery Rebate Credit - Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate