American Standard Rebates 2024 Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Although the 2022 tax credit is not as robust it will credit 10 percent of the costs of installing qualified equipment and 100 percent of the costs associated with installing qualified water heaters heat pumps central air conditioning systems furnaces hot water boilers and air circulating fans For tax years 2024 and 2025 taxpayers may at their election use their earned income from the prior taxable year in calculating their maximum child tax credit if the taxpayer s earned income in the current taxable year was less than the taxpayer s earned income in the prior taxable year Part 2 American Innovation and Growth

American Standard Rebates 2024

American Standard Rebates 2024

https://amaticanada.com/wp-content/uploads/2021/02/American-Standard-2546004.020-–-Town-Square-S-Freestanding-Tub.png

American Standard Air Conditioner Rebates CPT00695 American Standard Trane 25 5 MFD 440 Volt

https://www.easternairflowky.com/uploads/1/3/0/5/13054271/s606783835915754110_p17_i2_w1096.jpeg

Q A FAQ On Standard Deductions In F Y 2023 2024 And Other Rebates In New Regime And Old Regime

https://i.ytimg.com/vi/wU1NAUSQ3lI/maxresdefault.jpg

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners Offer expires 12 31 2024 Explore the range of American Standard Heating Cooling Solutions Our AccuComfort Platinum 19 Low Profile Heat Pump is ideal for zero lot line applications and other space constrained areas this unit is our most efficient and quiet to date

Updated Oct 12 2022 7 16pm We earn a commission from partner links on Forbes Home Commissions do not affect our editors opinions or evaluations Our Verdict American Standard has a strong About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification and Appliance Rebates will put money directly

Download American Standard Rebates 2024

More picture related to American Standard Rebates 2024

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Boise Valley Heating Air Heating

https://a-cloud.b-cdn.net/media/iW=1200&iH=630/573d60cb65fc0bf6023cff6c5554f656.png

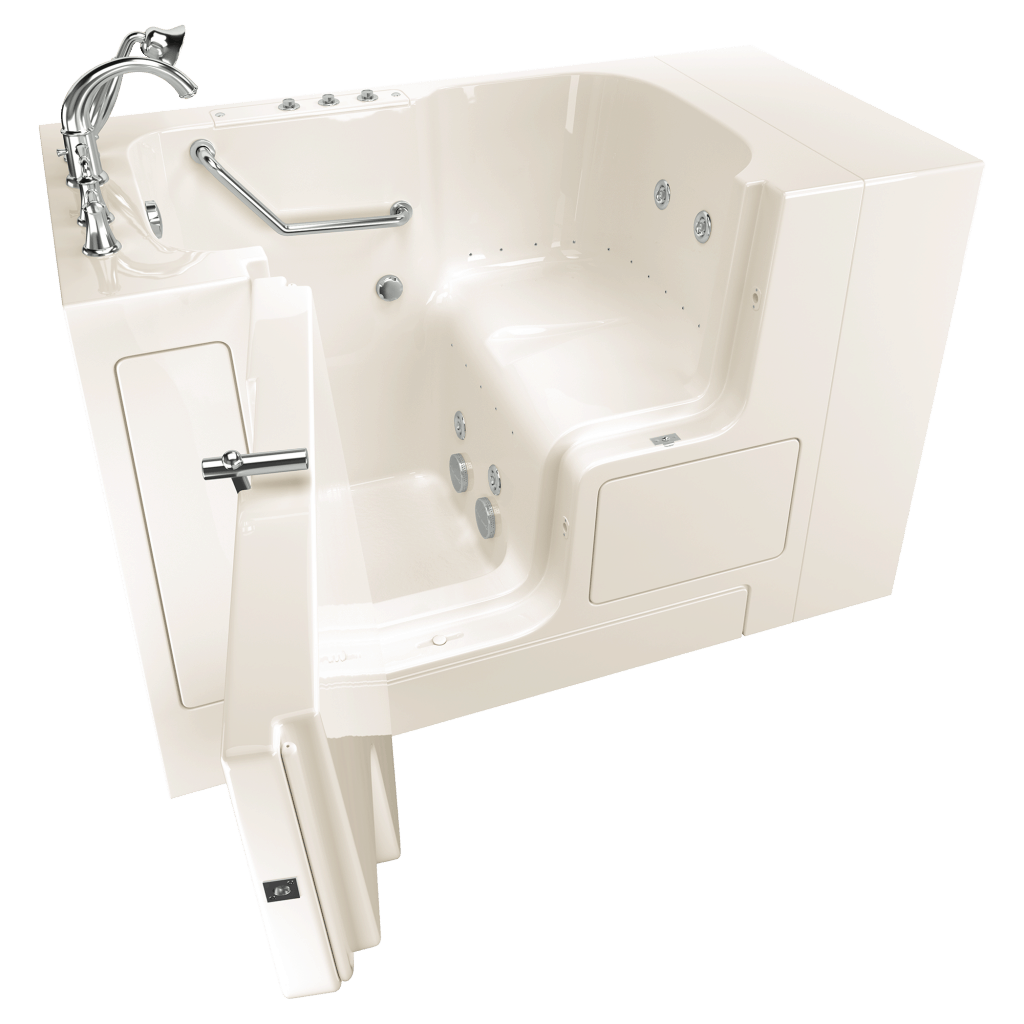

American Standard Walk In Tub Reviews And Pricing 2023

https://www.theseniorlist.com/app/uploads/2019/04/American-Standard-walk-in-tub-1024x1024.png

Bloomberg Jan 27 2023 11 31 AM PT For Americans with a New Year s resolution to trade in their gas furnace or water heater for climate friendly heat pumps a word of caution Generous The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Updated Oct 31 2023 Save Get Quote 3 7 U S News Rating Best for Homeowners who live in a harsh climate Owners of mobile and small homes Shoppers who want a trusted name brand Not recommended On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

American Standard Air Conditioner Rebates Ottawa Furnace Hvac Fireplaces Air Conditioner

https://www.furnaceprices.ca/wp-content/uploads/2020/08/American-Standard-Silver-14.jpg

American Standard Walk in Tub TechRadar

https://cdn.mos.cms.futurecdn.net/jYPWEbtzgvEJZ24f9MXXrm.jpg

https://airconditionerlab.com/what-hvac-systems-qualify-for-tax-credit/

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

https://www.americanstandardair.com/resources/blog/home-improvement-tax-credit-25c/

Although the 2022 tax credit is not as robust it will credit 10 percent of the costs of installing qualified equipment and 100 percent of the costs associated with installing qualified water heaters heat pumps central air conditioning systems furnaces hot water boilers and air circulating fans

NEW American Standard 360insights Consumer Rebates Module YouTube

American Standard Air Conditioner Rebates Ottawa Furnace Hvac Fireplaces Air Conditioner

CAT Rebates W L Inc

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

Rebates For Seniors Mark Coure MP

CTV News On Twitter Most Canadians Got More From Carbon price Rebates Than They Spent In 2021

CTV News On Twitter Most Canadians Got More From Carbon price Rebates Than They Spent In 2021

Primary Rebate South Africa Printable Rebate Form

American Standard Gelcoat Standard Series 48 In X 28 In Walk In Whirlpool Tub In White 2848

How Do Home Rebates Work DC MD VA Home Rebates

American Standard Rebates 2024 - May 16 2023 Trusted for nearly 150 years American Standard has become part of homeowners everyday routines and is known for its innovative and creative products that improve daily living in and around the bathroom and kitchen American Standard products featured on the HomeSphere Rebate Program Toilets