Apply For New York State Star Program The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR

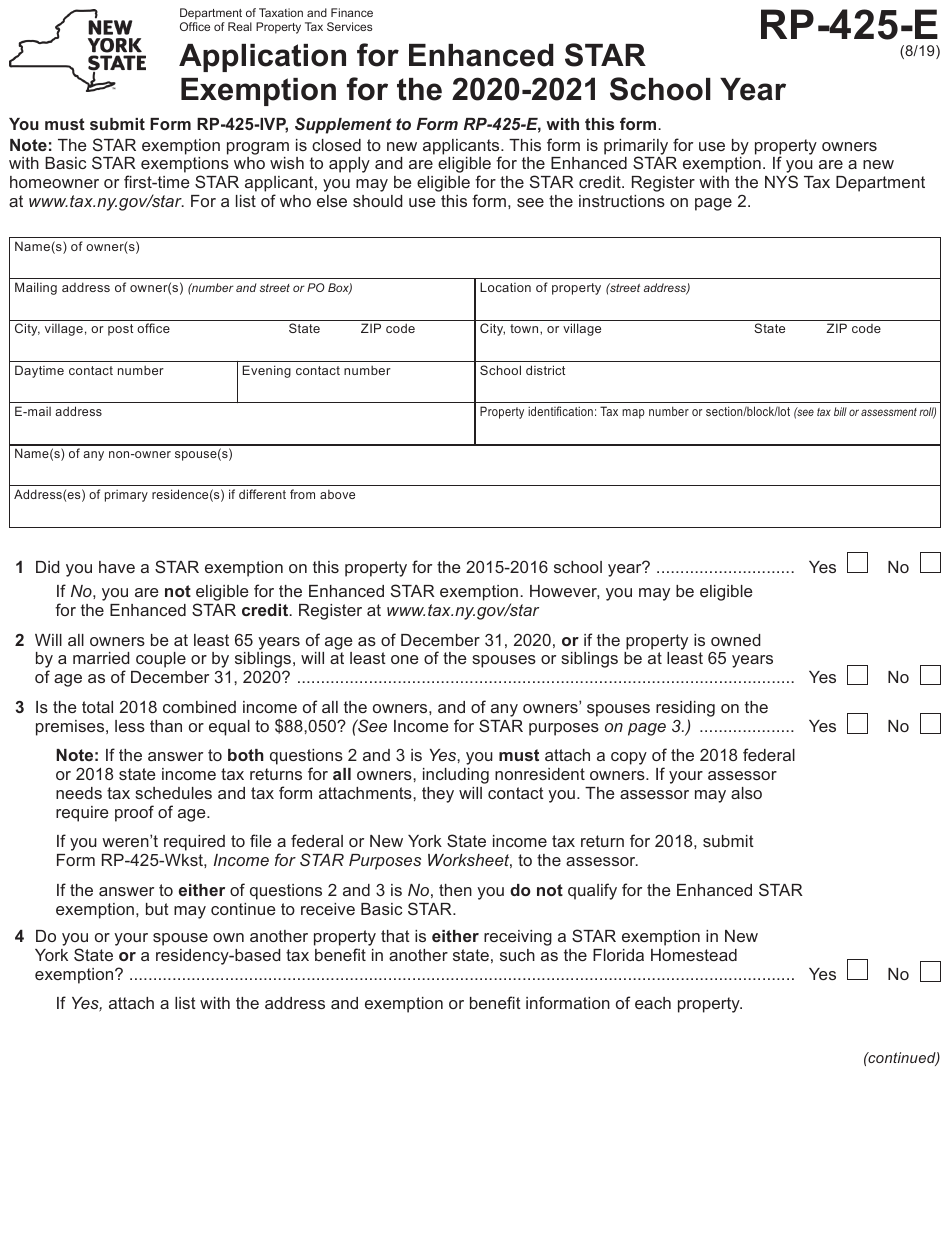

To apply for the Enhanced STAR exemption submit the following to your assessor Form RP 425 E Application for Enhanced STAR Exemption The application deadline is Applying online You can apply for STAR or E STAR online from September 15 to March 15 Filing online is the fastest and easiest way to file STAR ESTAR Online Initial Application

Apply For New York State Star Program

Apply For New York State Star Program

https://i.ytimg.com/vi/TGcLRfcdRKM/maxresdefault.jpg

Fakta Og Information Om Staten New York

https://cdn.storyboardthat.com/storyboard-srcsets/da-examples/statsprofil--new-york.png

What Is The New York State STAR Program YouTube

https://i.ytimg.com/vi/mCk1IH-CVG0/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLD1FuawQDD_XEbPAvXK-XwWiNdq4g

New STAR applicants must register with New York State directly for the Personal Income Tax Credit Check Program by telephone at 518 457 2036 or online NYS will determine a First Time New homeowner s eligibility for the Basic or Apply online for the New York State STAR tax credit If you get the Basic STAR exemption as of 2015 16 and are now eligible for Enhanced STAR Apply online through the

Homeowners not currently receiving STAR who meet the program s eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance How do I apply for Basic STAR File an application with your local assessor STAR applications are available from your assessor s office or on the internet large print forms are also

Download Apply For New York State Star Program

More picture related to Apply For New York State Star Program

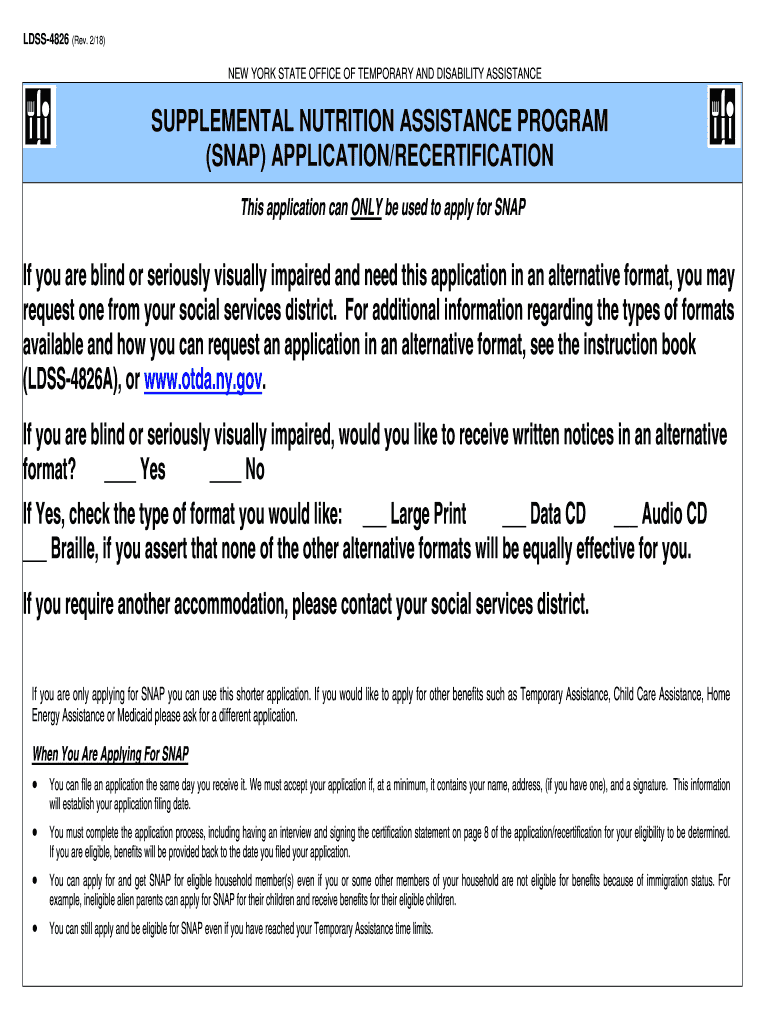

Ny Snap Application Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/617/468617721/large.png

ENDORSEMENT Progressive Women Of New York Endorse Lea Webb For New

https://static.wixstatic.com/media/fe55a1_580f167899da4acf8ff929afa586d381~mv2.png/v1/fill/w_1000,h_1000,al_c,q_90,usm_0.66_1.00_0.01/fe55a1_580f167899da4acf8ff929afa586d381~mv2.png

E Source Developing IEDR Platform For New York State North American

https://nawindpower.com/wp-content/uploads/2022/12/tschltz-696x696.jpg

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners of any age If you re eligible and enrolled in the STAR program you ll How to Apply for STAR Benefits Don t miss out on potential savings To apply for STAR benefits or check your eligibility visit the STAR Exemption Forms page and complete

The STAR program provides eligible homeowners with relief on their school property taxes There are two types of STAR exemptions The Basic STAR exemption is New property owners must apply directly with New York State by calling 518 457 2036 or visiting STAR New York You will need social security numbers of owners along with the closing

Call To Action Sustain And Expand Funding Supports For People With

https://p2a-files.s3.amazonaws.com/production/campaigns/89220/AKIVDOWdnCiO06mUEHx51hu3Iw8052png

New York DMV Federal REAL ID

https://dmv.ny.gov/sites/default/files/styles/panopoly_image_original/public/nffp_0.png?itok=C9TCleeO

https://www.tax.ny.gov › star

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR

https://www.tax.ny.gov › pit › property › star › ivp.htm

To apply for the Enhanced STAR exemption submit the following to your assessor Form RP 425 E Application for Enhanced STAR Exemption The application deadline is

How To Apply For New York State s STAR Credit Program

Call To Action Sustain And Expand Funding Supports For People With

Herkimer And Oneida Counties Census Data Affiliate New Process To Be

Former Barenaked Ladies Lead Steven Page Will Play New York State Fair

What Is New York State Star Program The Right Answer 2022 TraveliZta

Census 2010 Redistricting Data First Impressions For New York State

Census 2010 Redistricting Data First Impressions For New York State

New York State Star Exemption Form ExemptForm

Part Time Community College Students Have Until July 18 To Apply For

A Redesign For New York State Hopefully It s Not Too NYC Focused

Apply For New York State Star Program - New STAR applicants must register with New York State directly for the Personal Income Tax Credit Check Program by telephone at 518 457 2036 or online NYS will determine a First Time New homeowner s eligibility for the Basic or