Arbitrage Rebate Tax Exempt Bonds Web At the end of this lesson you will be able to Distinguish the two distinct arbitrage systems of yield restriction and arbitrage rebate Compare and contrast yield restriction

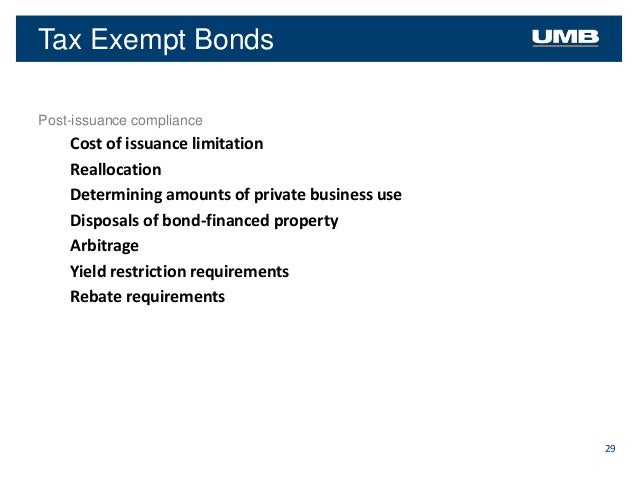

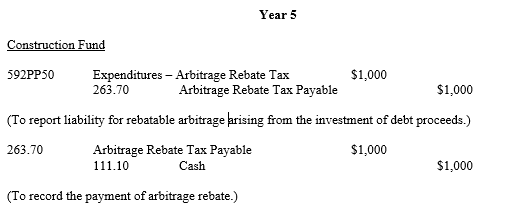

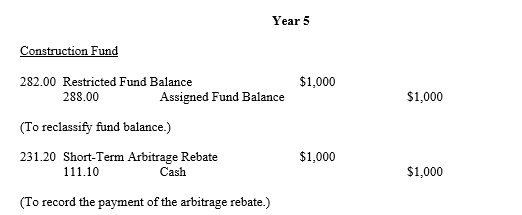

Web Context 167 103Interest on arbitrage bonds is not tax exempt Section 103 a provides that except as provide in 167 103 b gross income does not include interest on any State or Web bonds will become arbitrage bonds if any applicable arbitrage is not rebated or paid when due to the United States The rebate rules in Section 148 f of the Code and the

Arbitrage Rebate Tax Exempt Bonds

Arbitrage Rebate Tax Exempt Bonds

https://image3.slideserve.com/6526186/slide3-l.jpg

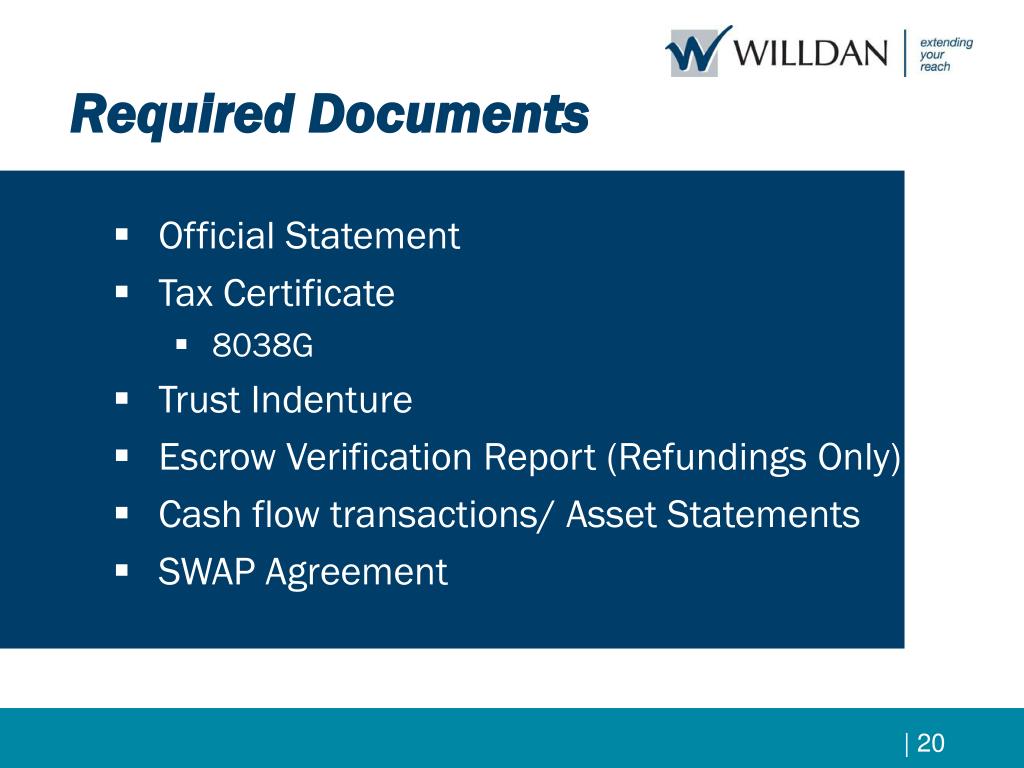

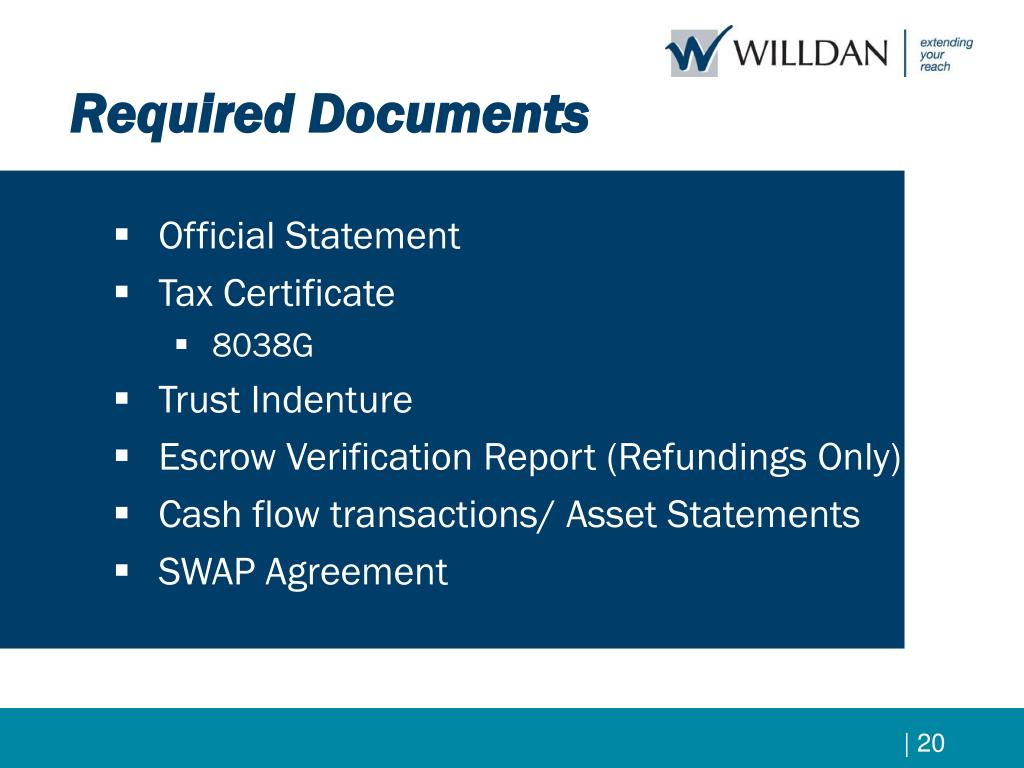

PPT The Arbitrage Advantage In Tax Exempt Financing PowerPoint

https://image3.slideserve.com/6526186/required-documents-l.jpg

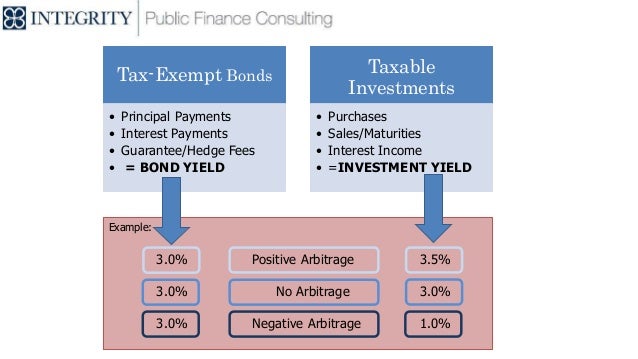

Arbitrage 101

https://image.slidesharecdn.com/arbitrage101-161117184552/95/arbitrage-101-4-638.jpg?cb=1479408465

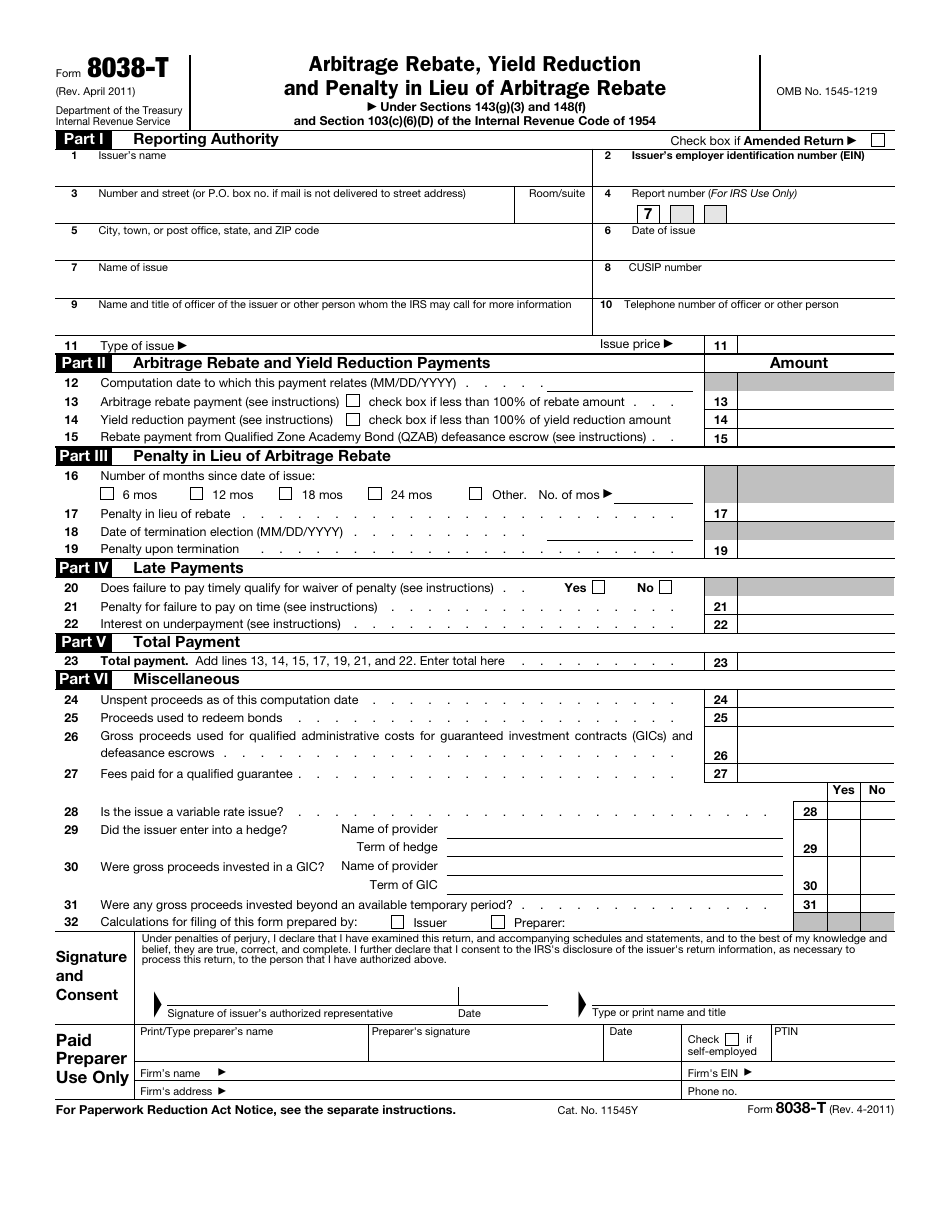

Web 17 f 233 vr 2023 nbsp 0183 32 Issuers of tax exempt bonds and any other bonds subject to the provisions of Internal Revenue Code section 148 must use this form to make arbitrage rebate and Web The final regulations do not remove however the need for arbitrage rebate analysis nor do they change when and how the rebate is calculated They also do not change any of

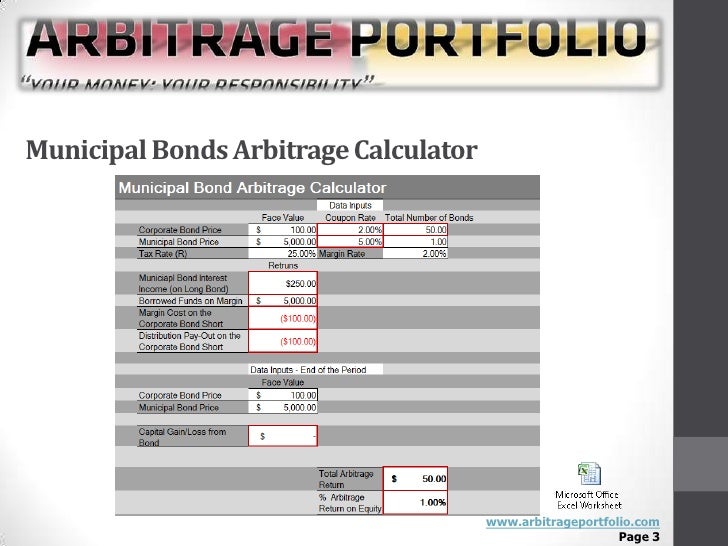

Web 18 janv 2023 nbsp 0183 32 Section 1 148 3 h provides that the failure to pay the correct rebate amount when required will cause the bonds of the issue to be arbitrage bonds unless Web 20 juin 2022 nbsp 0183 32 Municipal bond arbitrage involves hedging a portfolio of tax exempt municipal bonds by simultaneously shorting equivalent taxable corporate bonds of the

Download Arbitrage Rebate Tax Exempt Bonds

More picture related to Arbitrage Rebate Tax Exempt Bonds

Form 8038 T Arbitrage Rebate Yield Reduction And Penalty In Lieu Of

https://thumbs.dreamstime.com/b/business-concept-meaning-form-gc-information-return-small-tax-exempt-governmental-bond-issues-leases-installment-sales-203760970.jpg

ABCs Of Arbitrage Tax Rules For Investment Of Bond Proceeds By

https://prodimage.images-bn.com/pimages/9781641050623_p0_v1_s600x595.jpg

IRS Form 8038 T Download Fillable PDF Or Fill Online Arbitrage Rebate

https://data.templateroller.com/pdf_docs_html/618/6180/618027/irs-form-8038-t-arbitrage-rebate-yield-reduction-and-penalty-in-lieu-of-arbitrage-rebate_print_big.png

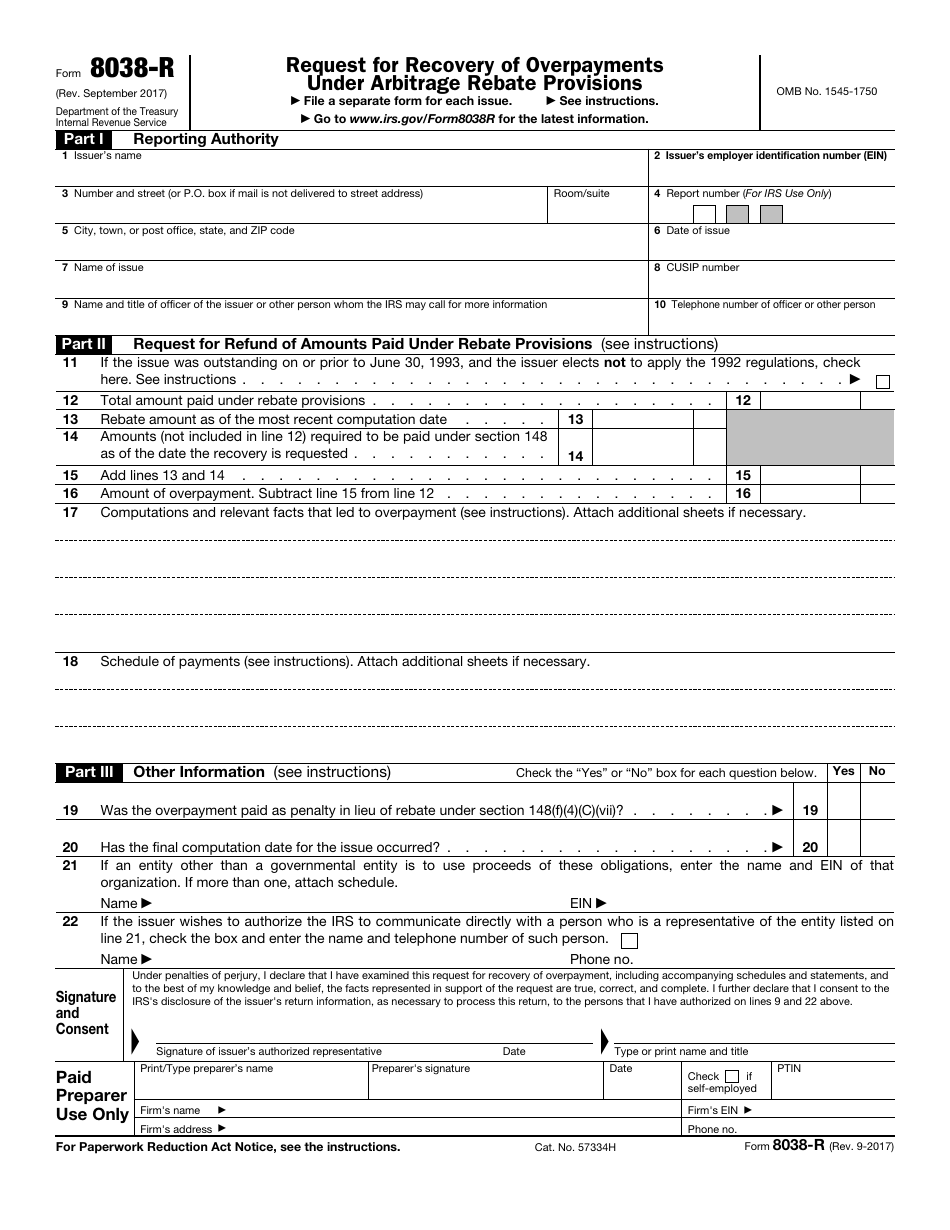

Web Arbitrage Rebate is the dollar profit earned from arbitrage that must be paid back or rebated to the federal government In general Arbitrage Rebate applies to Gross Web 22 nov 2016 nbsp 0183 32 What we now call rebate was once the payment of excess earnings on investments of tax exempt single family mortgage bond proceeds that issuers made to

Web Section 148 imposes arbitrage investment restrictions on the investment of proceeds of tax exempt bonds and requires issuers to rebate certain excess earnings above the yield Web Generally tax exempt bond issues issued on or after September 1 1986 are subject to the arbitrage rebate requirements Such requirements detail that any profit or arbitrage

How Did Arbitrage rebate Get Its Name The Public Finance Tax Blog

https://www.publicfinancetaxblog.com/wp-content/uploads/sites/18/2016/11/table.png

Arbitrage Calculation Rebate Services Bond Compliance

https://i1.wp.com/rebatebyacs.com/wp-content/uploads/2019/03/Video-image.jpg?w=3840&ssl=1

https://www.irs.gov/pub/irs-tege/teb2_lesson1.pdf

Web At the end of this lesson you will be able to Distinguish the two distinct arbitrage systems of yield restriction and arbitrage rebate Compare and contrast yield restriction

https://www.irs.gov/pub/irs-tege/teb1_lesson5.pdf

Web Context 167 103Interest on arbitrage bonds is not tax exempt Section 103 a provides that except as provide in 167 103 b gross income does not include interest on any State or

Municipal Bond Arbitrage

How Did Arbitrage rebate Get Its Name The Public Finance Tax Blog

Tax Exempt Financing What 501c3 Organizations Should Know

Arbitrage Rebates Office Of The Washington State Auditor

T Bill Vs Arbitrage Funds Bonds Trading Q A By Zerodha All Your

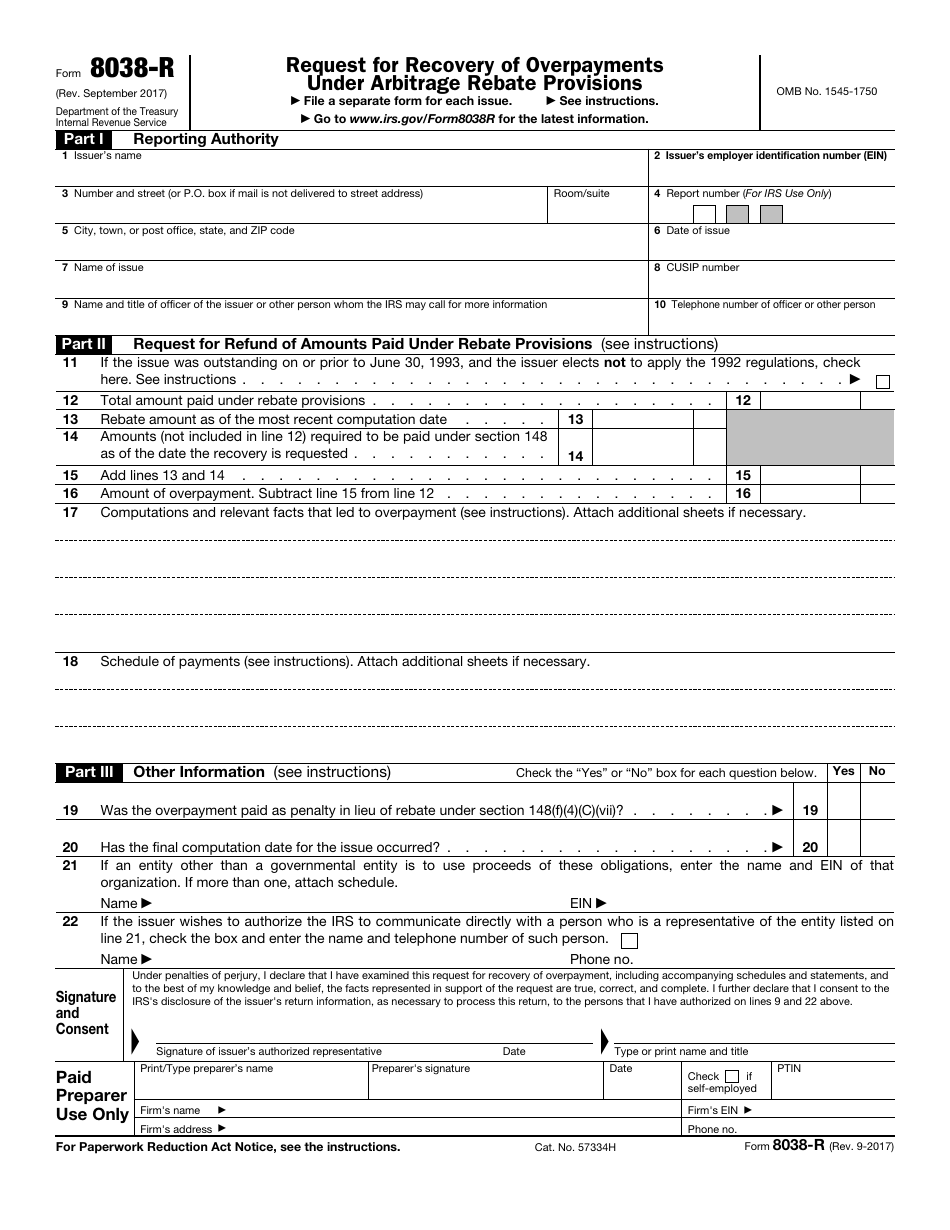

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

Irs Tax Rebate LatestRebate

Arbitrage Rebates Office Of The Washington State Auditor

PPT Chapter 5 PowerPoint Presentation Free Download ID 1462780

Arbitrage Rebate Tax Exempt Bonds - Web 4 sept 2019 nbsp 0183 32 Arbitrage Rebate amp Yield Restriction It s the Law To prevent abuses the tax code limits the permitted uses of tax exempt bonds Prevents issuance of more