Are 529 Contributions Tax Deductible A 529 plan is a savings plan that can provide tax free investment growth and withdrawals for qualified education expenses 529 plans have high contribution limits which are generally

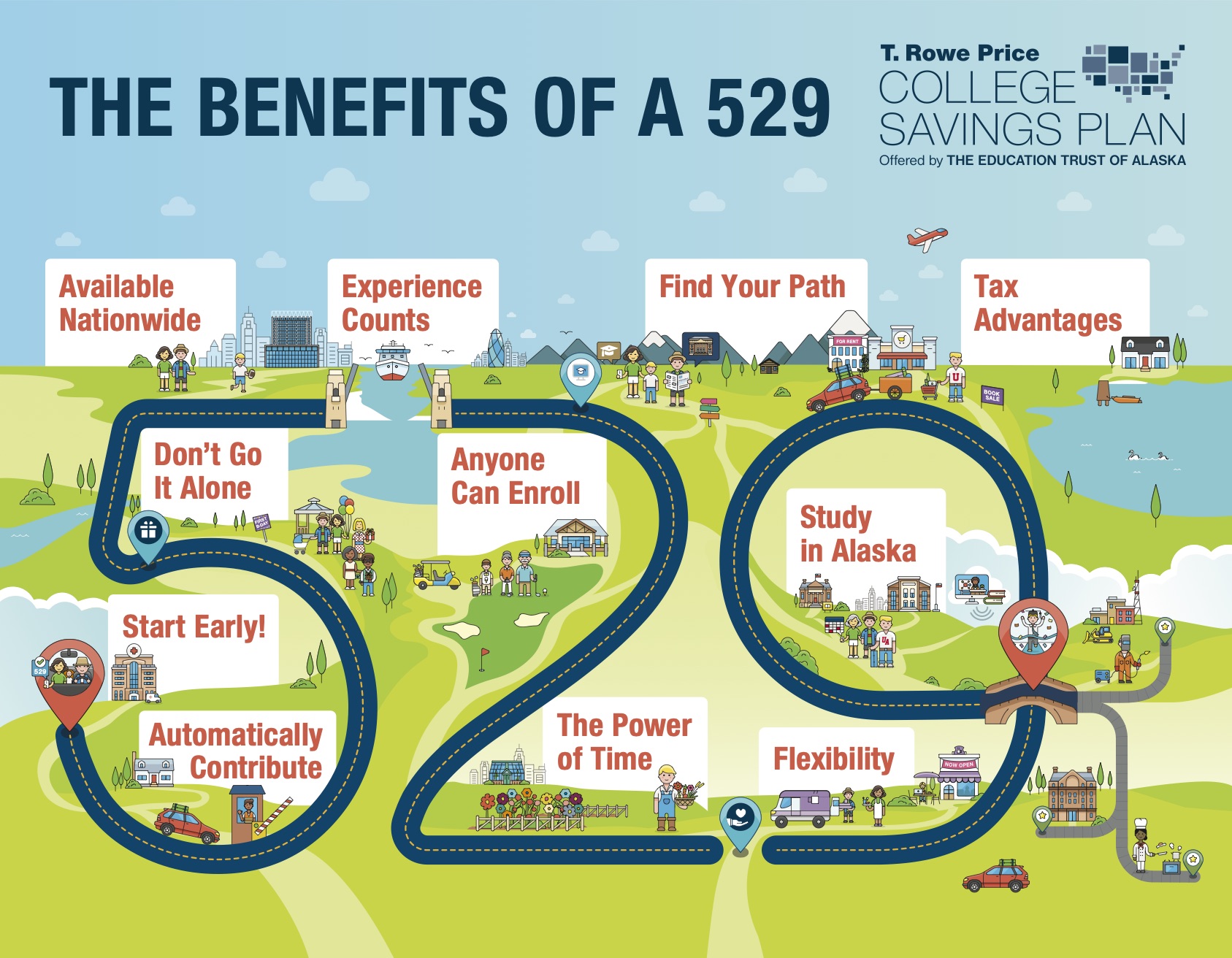

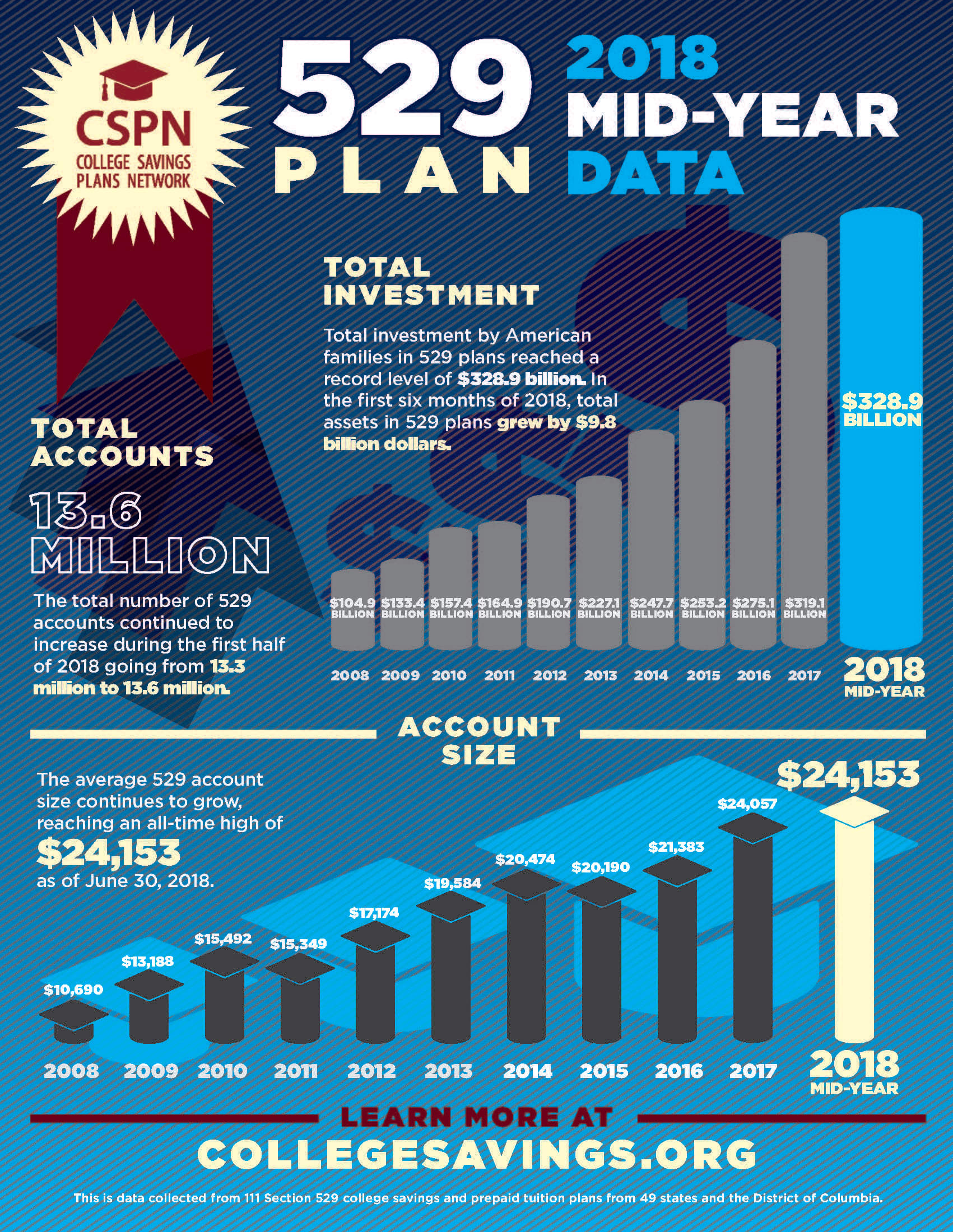

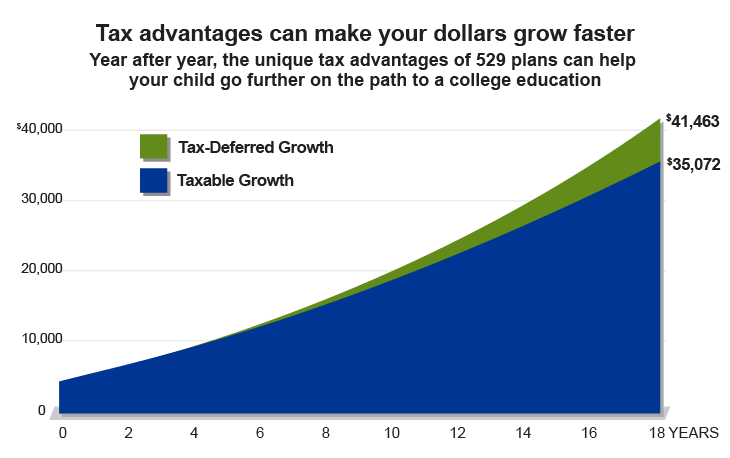

They are not tax deductible on the federal level But if you re saving for college you ll want to know that 529 savings plans offer other tax benefits such as tax free earnings growth and tax free withdrawals for qualified expenses Contributions to a 529 plan aren t tax deductible for federal income tax purposes However more than 30 states provide tax deductions or credits of varying amounts for these

Are 529 Contributions Tax Deductible

Are 529 Contributions Tax Deductible

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2015/02/vg529tool.gif

Infographic 529 State Tax Deduction Value Comparison Map 2017 KAP

http://blog.kksppartners.com/wp-content/uploads/2017/12/529state_infog2-1-720x400.gif

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

https://im.morningstar.com/content/CMSImages/9914.png

Unlike an IRA contributions to a 529 plan are not deductible and do not have to be reported on federal income tax returns What s more the investment earnings in your account are not reportable until the year they are withdrawn 529 plans save taxpayers billions of dollars on their income taxes For both types of 529 plans contributions are not tax deductible for your federal taxes although some states provide a state tax deduction for contributions

There isn t a 529 federal tax deduction but there may be for state income tax 529 contributions are tax deductible for most states allowing you to lessen your tax burden at the end of each fiscal year What Is a 529 Plan Named after Section 529 of the Internal Revenue Code 529 plans are legally known as qualified tuition plans and are sponsored by states state agencies or educational institutions The primary benefit of a 529 plan is its tax advantages which can significantly aid families in managing the high costs of education

Download Are 529 Contributions Tax Deductible

More picture related to Are 529 Contributions Tax Deductible

529 Tax Deduction

https://uploads-ssl.webflow.com/5f9e3058e3ecc6040724fa97/62b42763a1415814fdde9d3e_image4.png

Are 529 Contributions Tax Deductible In Virginia Tax Walls

https://im.morningstar.com/content/CMSImages/10402.png

The Benefits Of A 529 Plan INFOGRAPHIC

https://web-resources.savingforcollege.com/images/sponsored-articles/the-benefits-of-a-529-infographic-thumbnail.jpg

For example if you contribute 10 000 to your son s 529 plan this year your state might allow you to deduct only 4 000 on your state income tax return Check the Here s what you should know about 529 tax deductions plus how the 529 tax benefits and plans work in general 529 plan accounts are investment vehicles 529 plan accounts grow tax free There are no federal 529 tax deductions Many states have 529 tax deductions for contributions

[desc-10] [desc-11]

Are 529 Contributions Tax Deductible Student Loan Planner

https://www.studentloanplanner.com/wp-content/uploads/2020/12/Are-529-Contributions-Tax-Deductible_.jpg

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

529 Plan Contribution Limits In 2023

https://www.investopedia.com/thmb/GepQiraogYwUTtMhxzD48_BlGPk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg

https://www.nerdwallet.com/article/investing/529-plan-rules

A 529 plan is a savings plan that can provide tax free investment growth and withdrawals for qualified education expenses 529 plans have high contribution limits which are generally

https://www.hrblock.com/tax-center/filing/...

They are not tax deductible on the federal level But if you re saving for college you ll want to know that 529 savings plans offer other tax benefits such as tax free earnings growth and tax free withdrawals for qualified expenses

Are Contributions To A 529 Plan Tax Deductible Sootchy

Are 529 Contributions Tax Deductible Student Loan Planner

529 Plans The Smartest Way To Save For College Safe Smart Living

College Tuition Can Be Tax Deductible

Is Your 529 Savings Plan In The Red Here s What To Do

The Tax Benefits Of 529 Plans 529 Plan How To Plan Saving For College

The Tax Benefits Of 529 Plans 529 Plan How To Plan Saving For College

Tax Advantages Of 529 Plans

The DC College Savings Plan 529 Basics

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

Are 529 Contributions Tax Deductible - [desc-12]