Are 529 Plan Contributions Tax Deductible In California No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax

While contributions to California s plan are not deductible at the state or federal level Unique Tax Benefits As a 529 Plan ScholarShare 529 provides California families compelling income tax benefits Although contributions are not deductible on your federal tax return any investment earnings can

Are 529 Plan Contributions Tax Deductible In California

Are 529 Plan Contributions Tax Deductible In California

https://www.carsonwealth.com/wp-content/uploads/2022/09/GettyImages-1036079598-scaled.jpg

Are 529 Plans Tax Deductible In New Jersey Simon Quick Advisors

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Are Thrift Savings Plan Contributions Tax Deductible TSP Tax Free Pay

https://i.ytimg.com/vi/G34PTubDYVU/maxresdefault.jpg

Contributions to California 529 plans are not deductible on federal or Contributions to the California 529 plan are not tax deductible on state

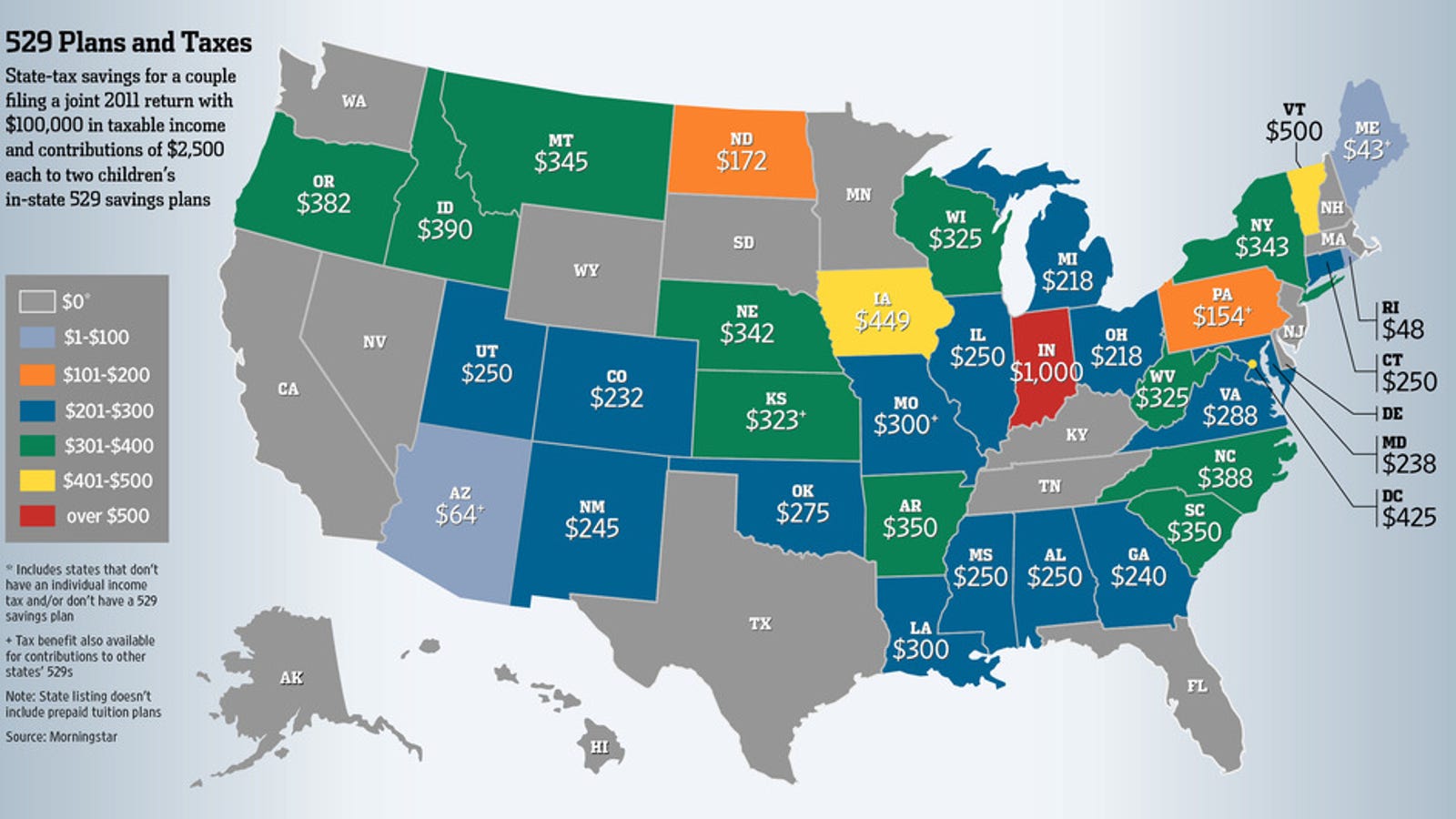

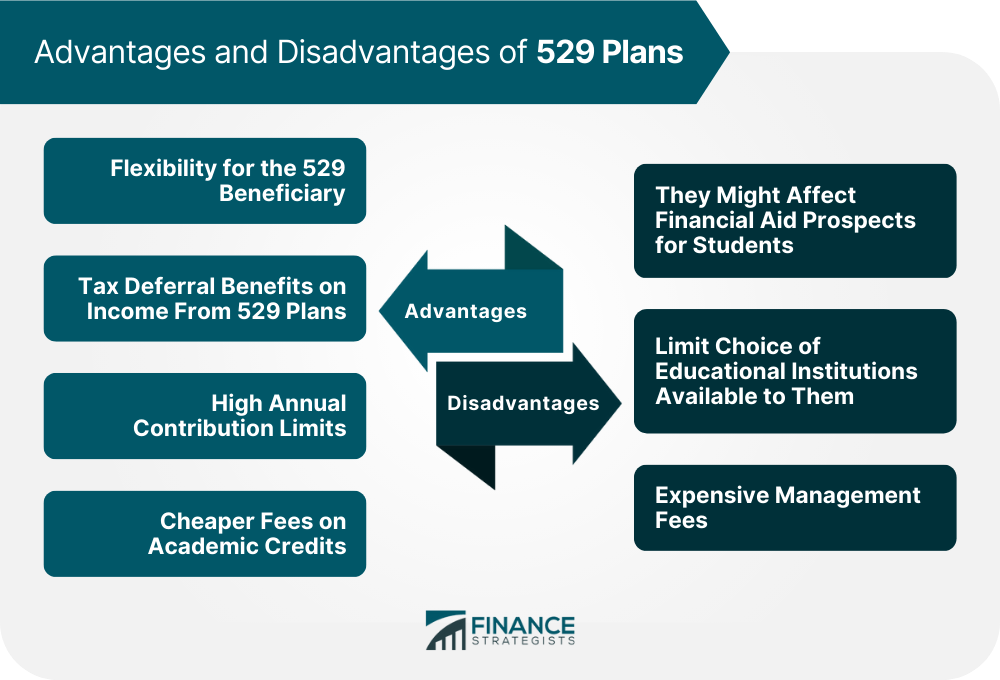

In short 529 contributions are not tax deductible on the federal level However some states consider contributions tax deductible Defer to your state treasurer for more info Plus 529 plans offer other tax benefits Four states currently have a state income tax but do not offer a contribution deduction California Hawaii Kentucky and North Carolina Potential annual tax savings by state Estimated tax savings for

Download Are 529 Plan Contributions Tax Deductible In California

More picture related to Are 529 Plan Contributions Tax Deductible In California

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Are Retirement Plan Contributions Tax Deductible Human Interest

https://images.ctfassets.net/tj9jxg7kaxby/5Ls3ZlZ4FGXCILA7TKXrLC/da9896a7e87bdc75d36157e69333dfdd/Retirement-plan-contributions-tax-deductible.jpg

/mitch-mclean---mandeville-copy/pexels-andrea-piacquadio-3768131-baa13.jpg)

Are Pension Plan Contributions Tax Deductible In Canada Blog

https://img.pagecloud.com/Xdm3g-aVnTyh70TTQjrvpujsxso=/1600x0/filters:no_upscale()/mitch-mclean---mandeville-copy/pexels-andrea-piacquadio-3768131-baa13.jpg

California Hawaii and Kentucky do not offer any type of 529 tax deduction but do assess income tax This table breaks down the 529 tax deduction by state 529 Tax Deductions by State 5 000 single filers While no federal tax break exists for deducting 529 plan contributions

Learn more about 529 plans with answers to frequently asked questions about tax In California s 529 plan you can select to invest your funds primarily in

IRS Announces 2023 HSA Limits Blog Medcom Benefits

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

https://finance.zacks.com/california-allow-d…

No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax

https://www.merrilledge.com/article/tax-advantages...

While contributions to California s plan are not deductible at the state or federal level

Hey SLPs Do YOU Know What Is Tax Deductible In Your Private Practice

IRS Announces 2023 HSA Limits Blog Medcom Benefits

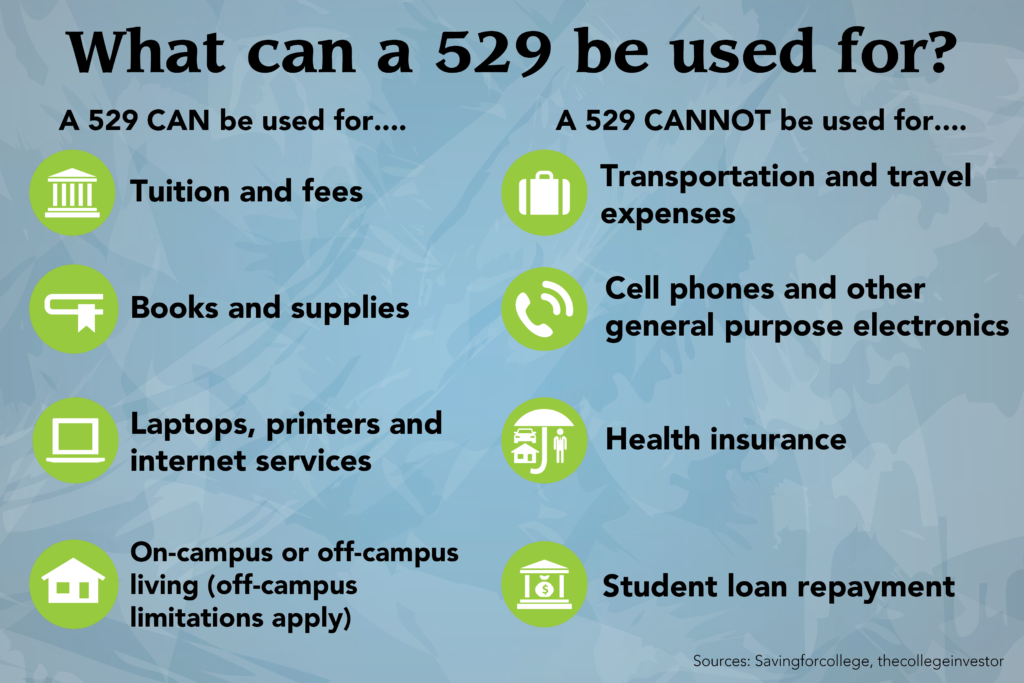

What You Need To Know About 529 Plans CNBconnect

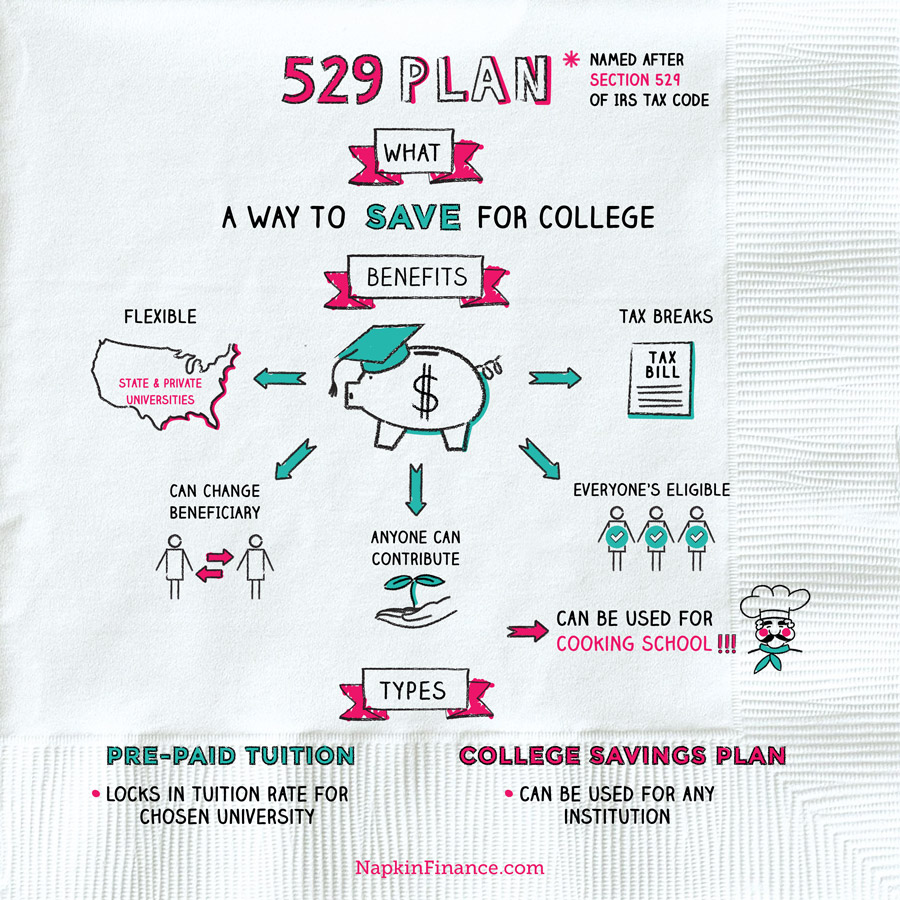

529 Plan Napkin Finance

Are Oklahoma 529 Contributions Tax Deductible Diamond Carranza

529 Plans Definition Types How It Works Pros And Cons

529 Plans Definition Types How It Works Pros And Cons

Which Charitable Contributions Are Tax Deductible Buy Side From WSJ

529 Plan Tax Deductible College Savings Plans

Letter Of Donation To Charity Collection Letter Template Collection

Are 529 Plan Contributions Tax Deductible In California - Contributions to the California 529 plan are not tax deductible on state