Are Ca State Income Tax Refunds Taxable It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized deductions on your federal income tax return You had the option to choose to deduct either state and local income taxes or general sales taxes

California s Middle Class Tax refund isn t taxable on state returns but it s unclear what the IRS will decide about federal income taxes In general if you didn t deduct state and local income taxes last year you don t need to pay taxes on your refunds this year For instance if you didn t itemize your deductions in 2006 you took the standard deduction then your state refund is

Are Ca State Income Tax Refunds Taxable

Are Ca State Income Tax Refunds Taxable

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Tax Refund Could Be Smaller Take Longer How To Track Spend It

https://www.gannett-cdn.com/presto/2023/01/26/PDTF/56e94ec8-5532-4892-9155-6e80c0250cfd-012623_DFP_Tompor_EITC_2.jpg?crop=2399,1350,x0,y209&width=2399&height=1350&format=pjpg&auto=webp

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/fhMsh6Xlf0g/maxresdefault.jpg

Now the IRS has confirmed it won t challenge the taxability of California s middle class tax refunds Californians who received a 1099 MISC related to their MCTR shouldn t have to worry If the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit for example because the 10 000 tax deduction limit applied the payment is not included in income for federal tax purposes

Filing is advised if you are eligible to receive refunds such as the California earned income tax credit EITC or if state taxes were withheld from the paycheck California s income tax rates range from 1 to 12 3 with nine brackets based on taxable income filing status and residency status Per the Board you should expect your California state tax refund about three weeks after e filing or three months after mailing a paper return

Download Are Ca State Income Tax Refunds Taxable

More picture related to Are Ca State Income Tax Refunds Taxable

Are State Tax Refunds Taxable Taxation Portal

https://taxationportal.com/wp-content/uploads/2022/01/Taxes.jpg

State Tax Refunds Are State Tax Refunds Taxable

https://1.bp.blogspot.com/-NvJ6PoFk2lM/Xassvldoa-I/AAAAAAAAAQE/_cq70vDF1TwrGzBh1DA4eWPhjzMIlJRsQCLcBGAsYHQ/s1600/State%2BTax%2BRefunds_%2BAre%2Bstate%2Btax%2Brefunds%2Btaxable_.png

State And Local Tax Refund Worksheet

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

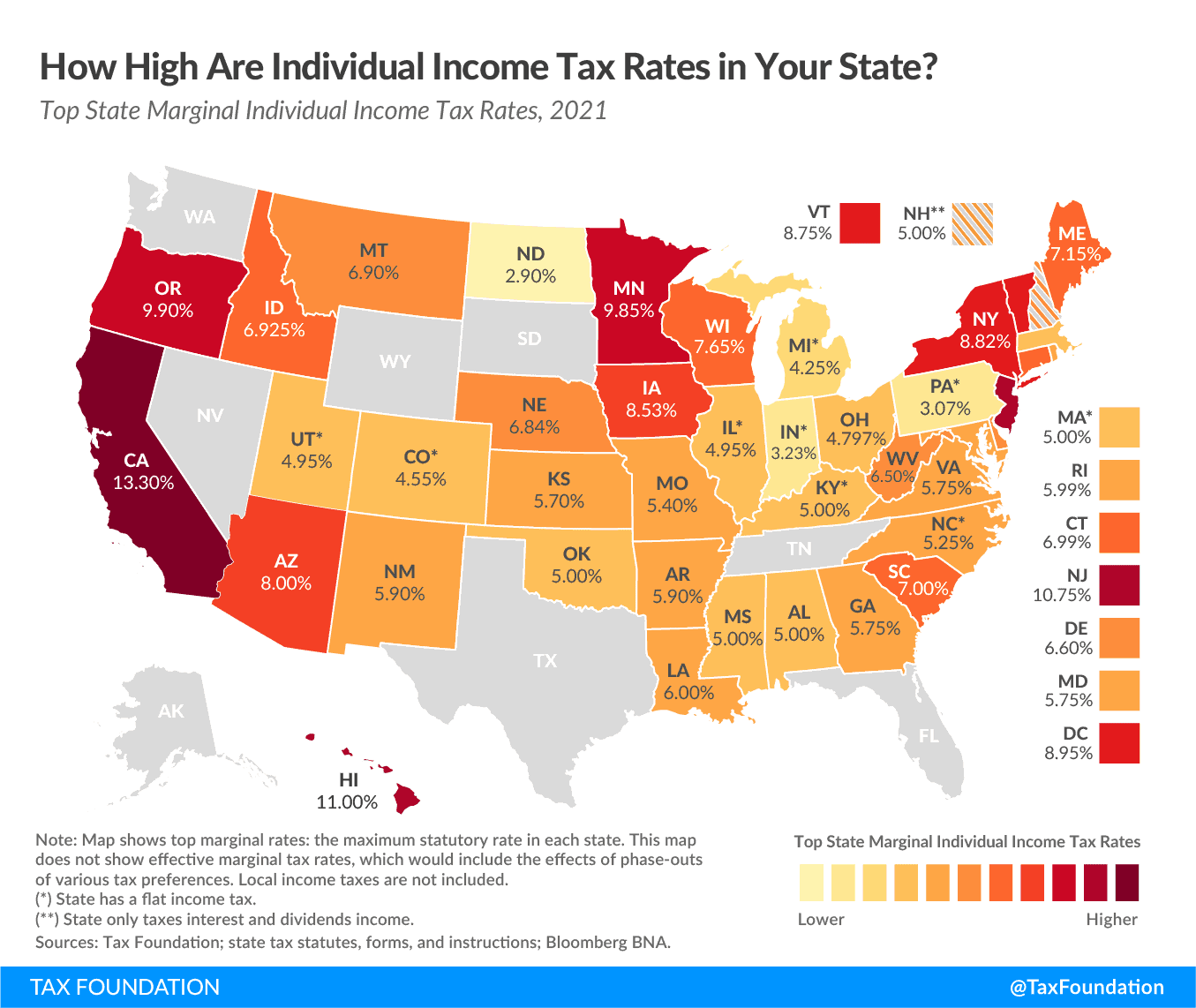

California and more than 20 other states authorized tax rebates last year as their coffers were buoyed by strong economic growth and federal pandemic aid with the goal of helping their California s top individual income tax rate is 12 3 on annual incomes over 677 275 for single taxpayers and married or registered domestic partner RDP taxpayers who file separate returns The 12 3 threshold for married and RDP partners filing jointly is 1 354 550 and 921 095 for head of household filers

The IRS as clarified that most special payments made during 2022 by 21 states do not need to be treated as taxable so do not need to be reported on IRS tax returns for 2022 The California Franchise Tax Board FTB offers tips on the most common audit issues found on the personal income tax returns of state residents These mistakes include incorrectly calculating adjusted gross income

Pa Income Tax Refunds Are Available Find Out If You re Eligible

https://www.goerie.com/gcdn/-mm-/b10a309f3918ef8193b468174eae4528e462b2d9/c=0-109-2123-1303/local/-/media/2021/10/07/USATODAY/usatsports/tax-form-1040_gettyimages-624709906.jpg?width=2123&height=1194&fit=crop&format=pjpg&auto=webp

Is My State Tax Refund Taxable Intuit TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2022/03/Untitled-design4.png?w=411&h=600&crop=1

https://www.hrblock.com/.../is-a-state-refund-taxable

It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized deductions on your federal income tax return You had the option to choose to deduct either state and local income taxes or general sales taxes

https://calmatters.org/newsletters/whatmatters/...

California s Middle Class Tax refund isn t taxable on state returns but it s unclear what the IRS will decide about federal income taxes

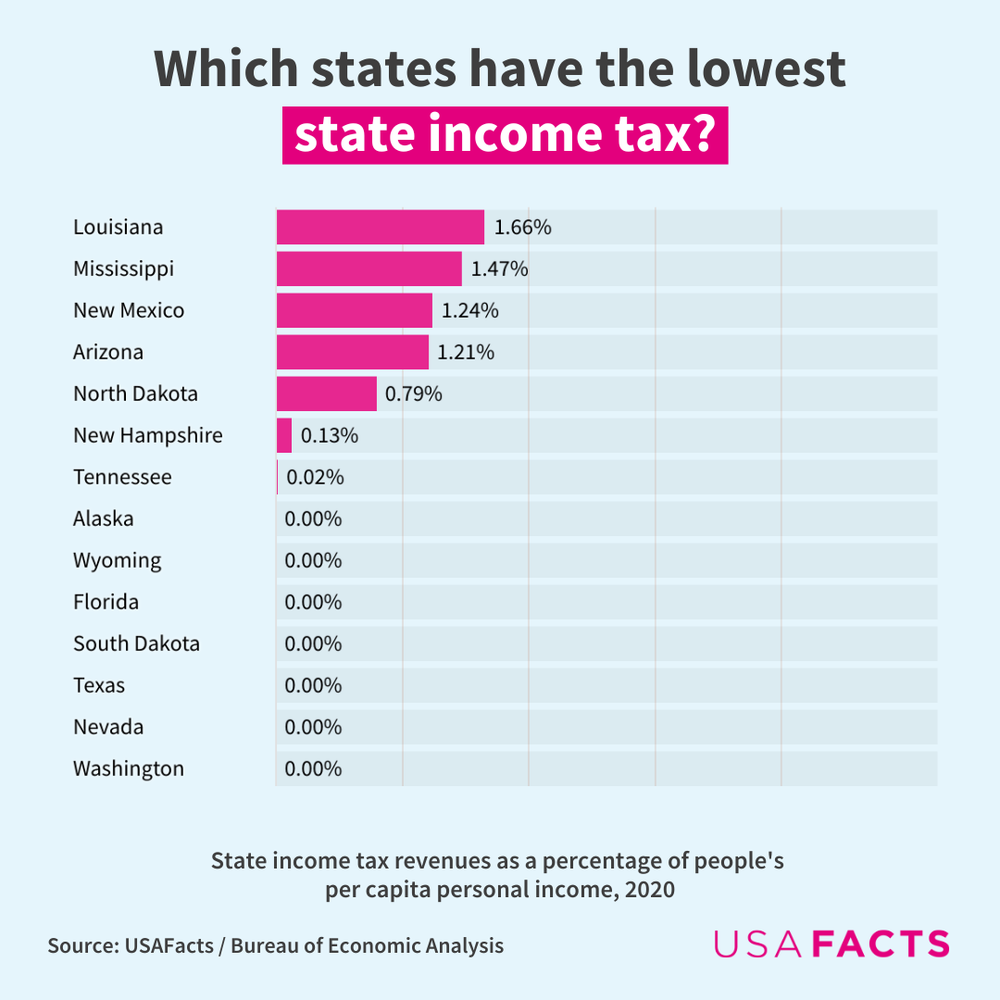

TAX HACKS The 9 States With No Income Tax and The Hidden Catch In Each

Pa Income Tax Refunds Are Available Find Out If You re Eligible

Massachusetts Income Tax Calculator 2023 2024

2022 Tax Brackets Lashell Ahern

Which States Have The Highest And Lowest Income Tax USAFacts

Historical Income Tax Rates Chart SexiezPicz Web Porn

Historical Income Tax Rates Chart SexiezPicz Web Porn

Tax Refunds On 10 200 Of Unemployment Benefits Start In May IRS

Federal And Selected State Income Tax Rates Download Table

Corporate Income Tax Relief Gains Support In Red And Blue States

Are Ca State Income Tax Refunds Taxable - Now the IRS has confirmed it won t challenge the taxability of California s middle class tax refunds Californians who received a 1099 MISC related to their MCTR shouldn t have to worry