Are Car Lease Payments 100 Tax Deductible Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to lease As explained by HMRC In some cases if you

Car lease payments aren t always tax deductible but with business leasing you can reclaim up to 100 of VAT Check out who s eligible and how to claim You can claim back up to 50 percnt of the tax on the monthly payments of your lease up to 100 percnt of the tax on a maintenance package and depending on the vehicle s CO2

Are Car Lease Payments 100 Tax Deductible

Are Car Lease Payments 100 Tax Deductible

https://coultercredit.com/wp-content/uploads/2022/08/car-lease-payments.jpg

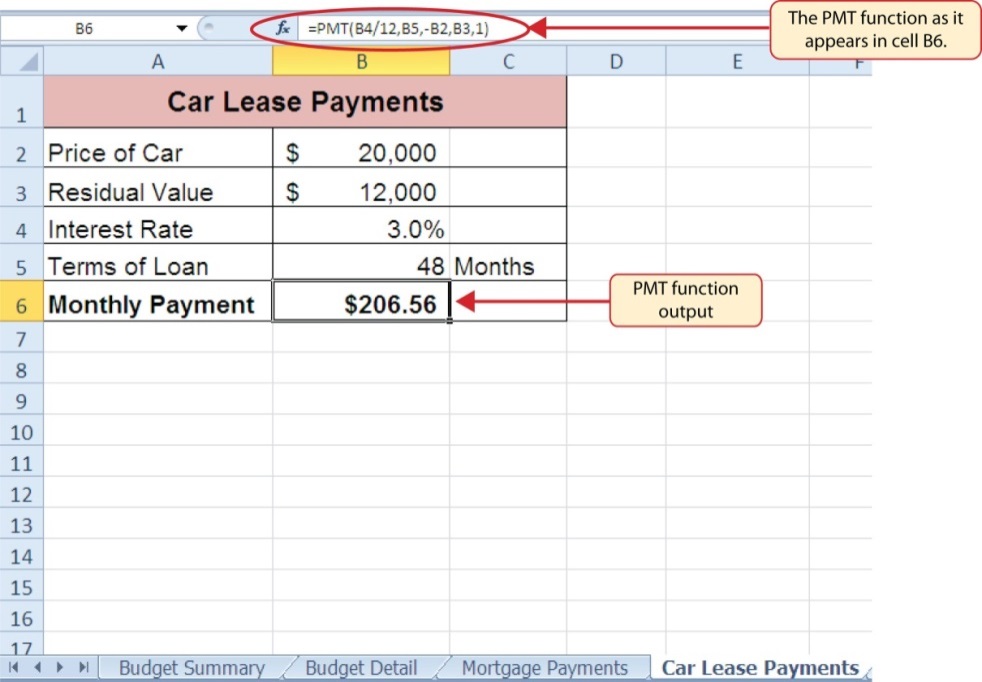

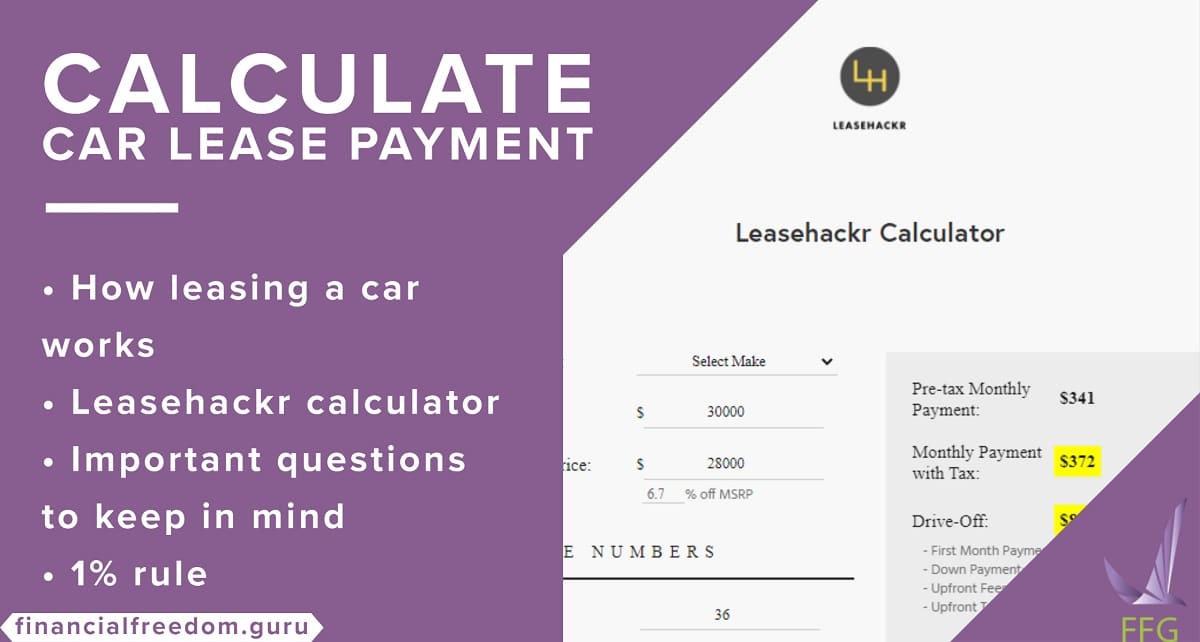

How To Calculate Car Lease Payments Blog D M Auto Leasing

https://dev.dmautoleasing.com/wp-content/uploads/2016/07/EZLeaseAdvantages-1.jpg

Are Equipment Lease Payments Tax Deductible Tax Relief Saving

https://www.towerleasing.co.uk/wp-content/uploads/2022/01/equipment-lease-750.jpg

Are car lease payments tax deductible In short yes Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both

Claim actual expenses which would include lease payments If you choose this method only the business related portion of the lease payment is deductible An income inclusion amount For lessees the sales tax paid on monthly lease payments can be deductible if they opt for the sales tax deduction This requires itemizing deductions on Schedule A of the

Download Are Car Lease Payments 100 Tax Deductible

More picture related to Are Car Lease Payments 100 Tax Deductible

How To Deduct Car Lease Payments In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cae7e9c465079cefe358_60d8c6557a8c3d545307e3be_car-lease-payment-savings.jpeg

Present Value Of Lease Payments Formula TerenceDevin

https://lh6.googleusercontent.com/zSEXcGiXvPBW5885HlHbeibQZIF6gauvDqka5seJNlOexKPGTgqtym5WV2egvYBUhugWL_cl_xF9RG_JMR3y1AWPf6RJkoq0Q_buGn8MKN2UECU2xn4TbsxEEUPoexRAFbGcgFan

9 2 De PMT betaling Functie Voor Leases Excel Voor Besluitvorming

https://uhlibraries.pressbooks.pub/app/uploads/sites/5/2019/03/image35-1.jpeg

What Are the Tax Benefits of Leasing a Business Vehicle Can You Deduct Lease Payments on Your Tax Return Yes the Internal Revenue Service allows you to deduct a Leasing companies typically require you to make an advance or down payment to lease a car You can deduct this cost but you must spread the deduction out equally over the entire lease period You may also deduct your actual

Are business car lease payments tax deductible The short answer is yes If you run a business you can use the cost of leasing a car to lower your taxes For Limited In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore

Car Lease Payments WhyBuyCars

https://whybuycars.co.za/Uploads/Index/606?filename=car-lease-payments.jpg&width=1366

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

https://www.moneydonut.co.uk › blog › leas…

Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to lease As explained by HMRC In some cases if you

https://www.leasefetcher.co.uk › guides › c…

Car lease payments aren t always tax deductible but with business leasing you can reclaim up to 100 of VAT Check out who s eligible and how to claim

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

Car Lease Payments WhyBuyCars

Financial Agreement Template

Car Sale Contract With Payments Vehicle Loan Agreement Sample

Planet Jack Jumping Formal Right Of Use Asset Calculation Terorist

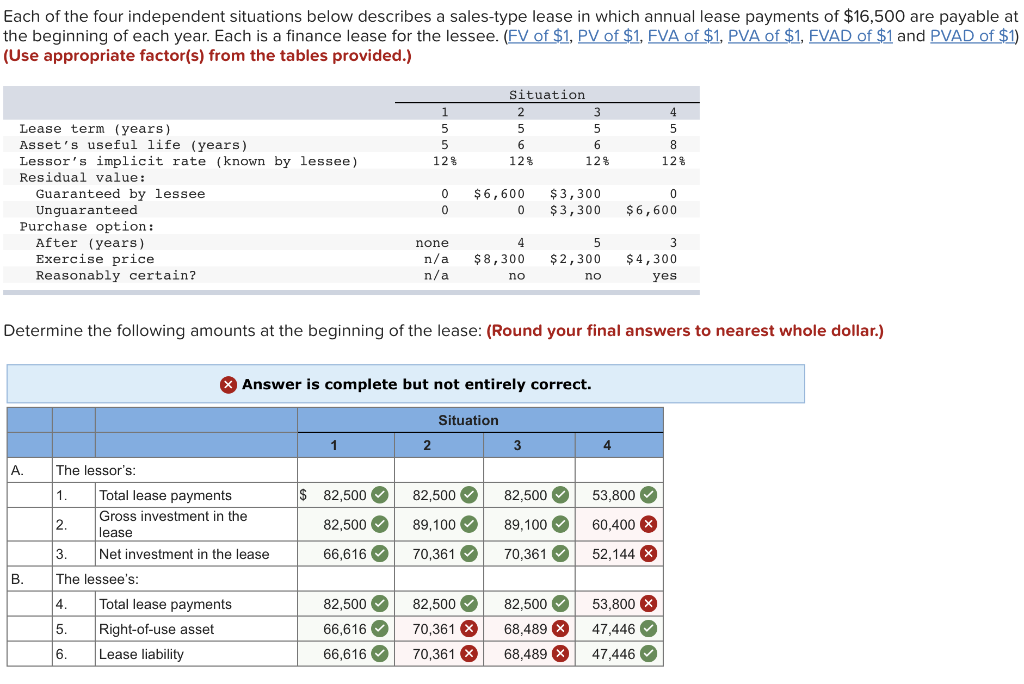

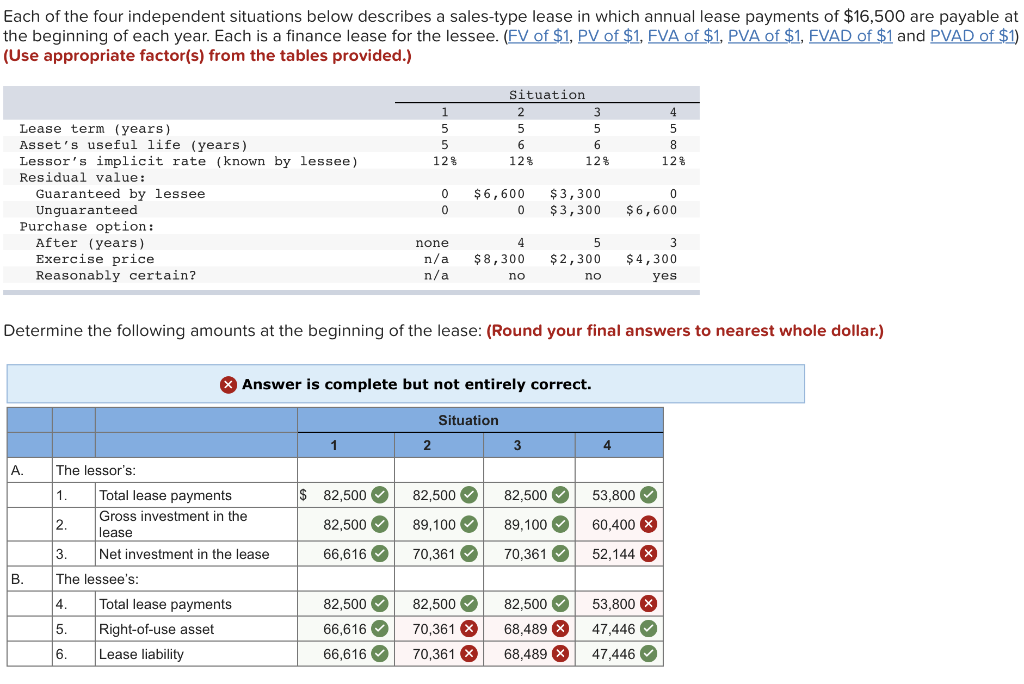

Each Of The Four Independent Situations Below Chegg

Each Of The Four Independent Situations Below Chegg

Installment Payment Agreement Template Free

What Does 100 Tax Deductible Mean Uk PHYQAS

Leasehackr Calculator 1 Rule Calculate Car Lease Payments Like A Guru

Are Car Lease Payments 100 Tax Deductible - Yes you can write off your car lease if you use the vehicle for business and the use qualifies for a deduction Sound complicated It s not Just make sure you know the