Are Car Lease Payments Tax Deductible You can claim back up to 50 percnt of the tax on the monthly payments of your lease up to 100 percnt of the tax on a maintenance package and depending on the vehicle s CO2 emissions costs of leasing can be deducted from taxable profits if

Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to lease As explained by HMRC In some cases if you lease or hire a car you cannot claim all of the hire charges or rental payments If you lease a car you use in business you may not deduct both lease costs and the standard mileage rate You may either Deduct the standard mileage rate for the business miles driven

Are Car Lease Payments Tax Deductible

Are Car Lease Payments Tax Deductible

https://images.prismic.io/leasefetcher/42a783fa-eba8-4c0c-93a8-253f80c11eac_car-lease-tax-deduction.jpg?auto=compress,format

.jpg?auto=compress,format)

Are Car Lease Payments Tax Deductible Lease Fetcher

https://images.prismic.io/leasefetcher/ddcb84fb-59d8-4b0f-b430-c39099df9f55_eligibility-car-lease-tax-deduction+(1).jpg?auto=compress,format

Are Car Lease Payments Tax Deductible Lease Fetcher

https://images.prismic.io/leasefetcher/e1186da2-b16e-4d06-a669-9d6cf8f001ff_electric-car-for-reduced-tax.jpg?auto=compress,format

Car lease payments aren t always tax deductible but with business leasing you can reclaim up to 100 of VAT Check out who s eligible and how to claim Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off this common business expense First and foremost you must be self employed or a business owner to qualify for a car lease payment write off

Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than 50g km This was previously set at 110g km for vehicles leased or hired before April 1st 2021 For example if the car is used 75 percent for business then 75 percent of the lease payment can be deducted The tax rules require that the lease deduction be reduced by an inclusion amount

Download Are Car Lease Payments Tax Deductible

More picture related to Are Car Lease Payments Tax Deductible

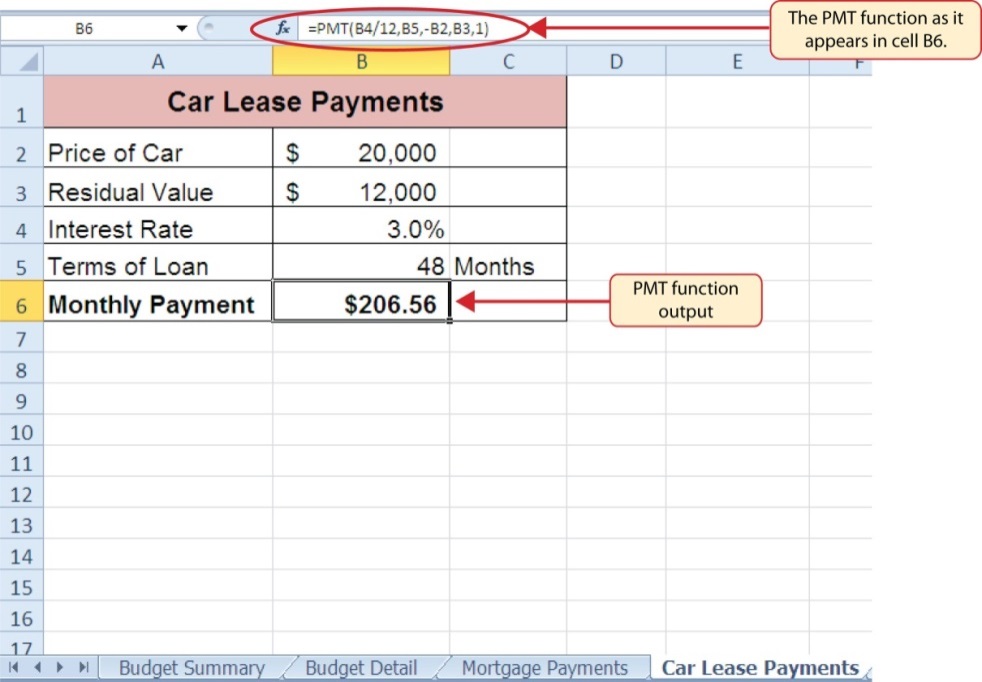

How Car Lease Payments Are Calculated The Canada Car Buying Guide

https://d3ucbh6bp4ctsj.cloudfront.net/wp-content/uploads/2017/09/30085436/HG_Lease-Payment-Calculated_30jan2018-1024x235.jpg

Are Car Lease Payments Tax Deductible Lease Fetcher

https://images.prismic.io/leasefetcher/f10ae2bc-12da-4d1b-a7a1-13f576bde703_tax-return-form.jpg?auto=compress,format

Do Car Lease Payments Help Build Credit Coulter Credit

https://coultercredit.com/wp-content/uploads/2022/08/car-lease-payments.jpg

Leases allow you to access a new car every three years or so In addition because lease payments are generally less expensive than a traditional car loan you may be able to afford a In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle

[desc-10] [desc-11]

How To Calculate Car Lease Payments Blog D M Auto Leasing

https://dev.dmautoleasing.com/wp-content/uploads/2016/07/EZLeaseAdvantages-1.jpg

Are Equipment Lease Payments Tax Deductible Tax Relief Saving

https://www.towerleasing.co.uk/wp-content/uploads/2022/01/equipment-lease-750.jpg

https://www.moneyshake.com › car-leasing-guides › ...

You can claim back up to 50 percnt of the tax on the monthly payments of your lease up to 100 percnt of the tax on a maintenance package and depending on the vehicle s CO2 emissions costs of leasing can be deducted from taxable profits if

.jpg?auto=compress,format?w=186)

https://www.moneydonut.co.uk › blog › leasing-a-car-tax-deductible

Leasing or hiring a car is an allowable expense ie tax deductable but CO2 emissions should be carefully considered when you re choosing a vehicle to lease As explained by HMRC In some cases if you lease or hire a car you cannot claim all of the hire charges or rental payments

Are Car Finance Payments Tax Deductible Motorfit

How To Calculate Car Lease Payments Blog D M Auto Leasing

Car Lease Tax Deduction Hmrc Jeraldine Will

9 2 De PMT betaling Functie Voor Leases Excel Voor Besluitvorming

Car Lease Tax Deduction Hmrc Jeraldine Will

Car Lease Payments WhyBuyCars

Car Lease Payments WhyBuyCars

How To Deduct Car Lease Payments In Canada

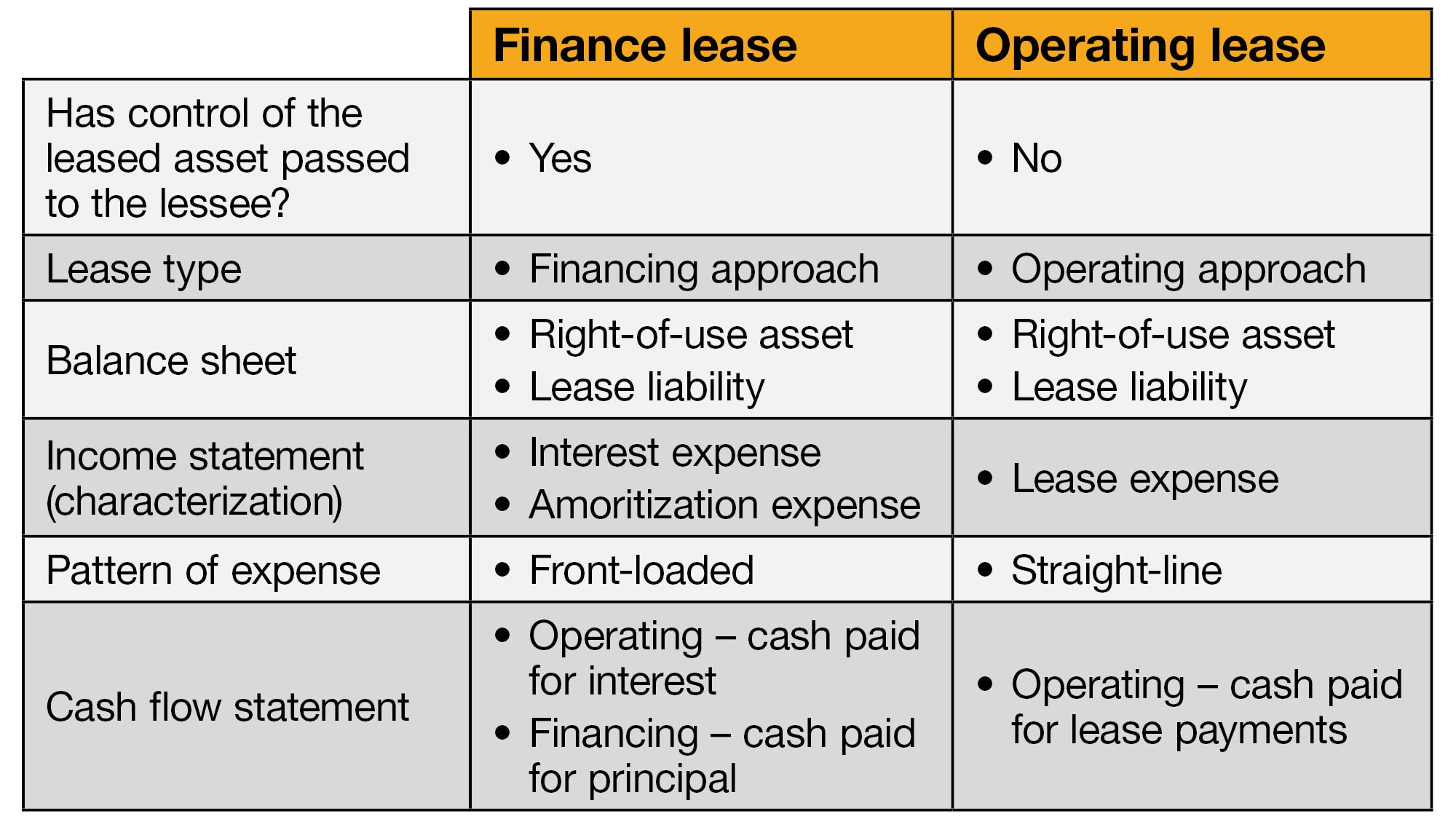

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

Backwards Design Lesson Plan Template Pdf Hopkins Whathe

Are Car Lease Payments Tax Deductible - Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off this common business expense First and foremost you must be self employed or a business owner to qualify for a car lease payment write off