Are Cell Phone Reimbursements Taxable In California Employees are entitled to a reimbursement that reflects a reasonable percentage of the actual cost of their cell phone bill They are entitled In California Labor Code 2802 requires employers to

Workers in California cannot voluntarily waive their right to cell phone reimbursements as it is protected by law According to California Labor Code 2802 California Employers Reimburse Workers for Use of Personal Cell Phone and Internet Plans May 18 2023 Hopkins Carley Reuse Permissions As most

Are Cell Phone Reimbursements Taxable In California

Are Cell Phone Reimbursements Taxable In California

https://api.time.com/wp-content/uploads/2015/10/microsoft-store-nyc-10.jpg

Are Per Diem Or Flat Sum Payments Considered Taxable Wages In

https://ferrarovega.com/wp-content/uploads/2022/03/Are-Per-Diem-or-Flat-Sum-Payments-Considered-Taxable-Wages-in-California-1024x683.jpeg

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Yes employers must reimburse employees for using personal cell phones for business purposes California law is clear on this issue Additionally employers may Whether extra expenses were actually incurred The court ruled that employers must reimburse employees a reasonable percentage of necessary cell phone use regardless

The bottom line The bottom line is that California employers are legally obligated to reimburse workers who must use their personal cell phones for work related purposes The appellate court ruled that reimbursement is always required and the employer must pay some reasonable percentage of the employee s cell phone bill to comply with the Labor Code Another regularly

Download Are Cell Phone Reimbursements Taxable In California

More picture related to Are Cell Phone Reimbursements Taxable In California

Can I Write Off My Phone For Business Can I Require Workers To Use

https://i.ytimg.com/vi/QKTvyCDgpfU/maxresdefault.jpg

Types Of Employee Reimbursements

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Types of employee reimbursements_fb.jpg#keepProtocol

Expense Reimbursement California Laws Sempers

https://sempers.com/assets/img/expense-reimbursement.webp

Yes if you use your personal mobile for work related communications you are entitled to reimbursements under California law Although the Fair Labor California Labor Code 2802 Section 2802 requires employers to reimburse California employees for all necessary business expenditures or losses

And while it could be seen as additional employee compensation if you re wondering are cell phone allowances taxable the answer is no Cell phone stipends are a non In California the Labor Code provides some guidance on this issue It states that if an employee s phone is used for both work related and personal activities

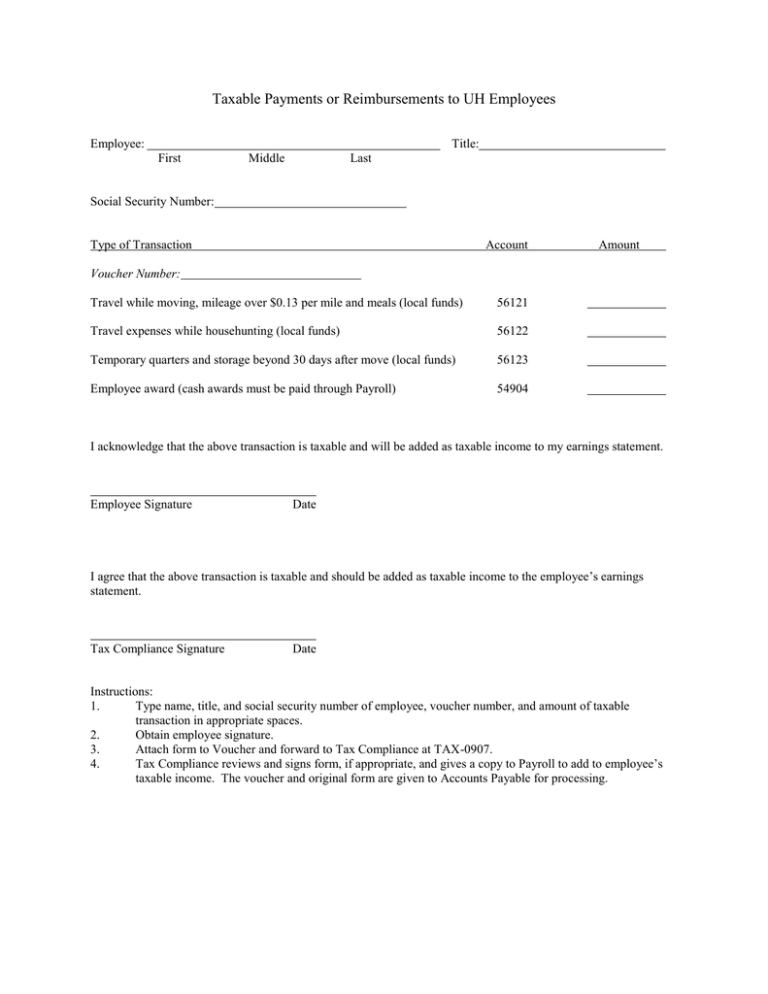

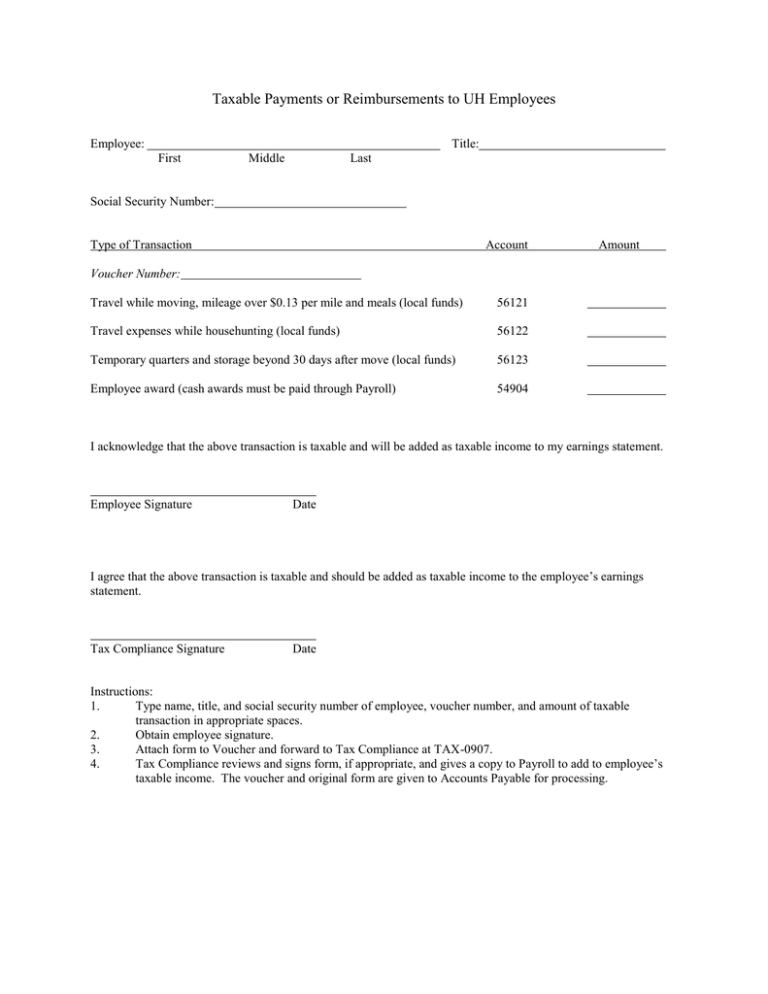

Taxable Payments Or Reimbursements To UH Employees

https://s2.studylib.net/store/data/014545700_1-7e4bdd9328a73bb7934b63bf1f5b95d3-768x994.png

Do California Employers Need To Provide Cell Phone Reimbursements To

https://ferrarovega.com/wp-content/uploads/2022/03/Do-California-Employers-Need-to-Provide-Cell-Phone-Reimbursements-to-Employees-1-2048x996.jpeg

https://www.shouselaw.com/ca/blog/d…

Employees are entitled to a reimbursement that reflects a reasonable percentage of the actual cost of their cell phone bill They are entitled In California Labor Code 2802 requires employers to

https://calljonnylaw.com/cell-phone-reimbursement-in-california

Workers in California cannot voluntarily waive their right to cell phone reimbursements as it is protected by law According to California Labor Code 2802

ACT FAST 33 Hourly Non Phone Sandy Hook Remote Job Cell Phone

Taxable Payments Or Reimbursements To UH Employees

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

Can I Track A Cell Phone With Just A Number Avosmart Parental

Is Disability Income Taxable In California Resources On Disability

Drivers Beware Are Mileage Reimbursements Taxable The Handy Tax Guy

Drivers Beware Are Mileage Reimbursements Taxable The Handy Tax Guy

Is A Cell Phone Stipend A Taxable Benefit What You Need To Know To

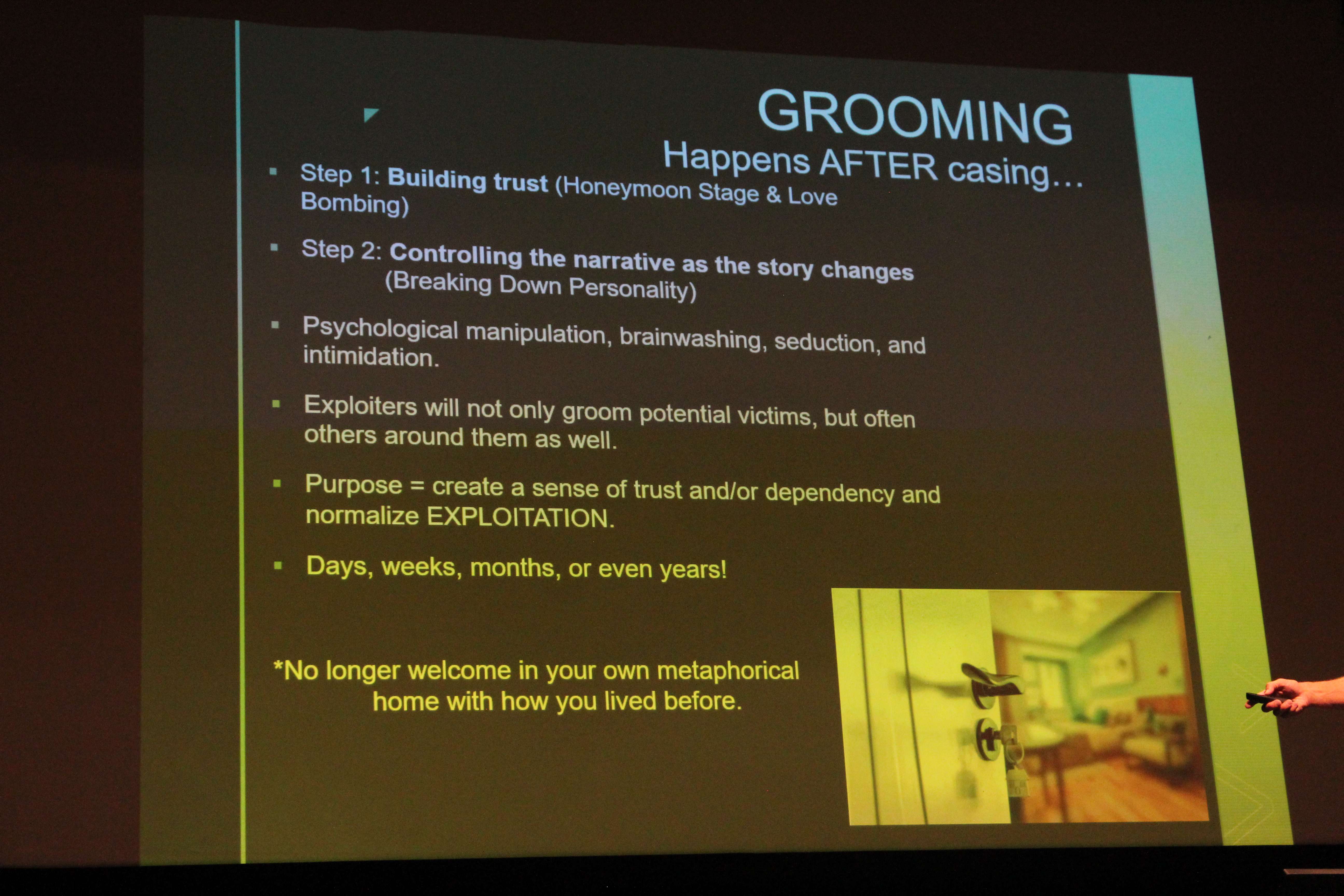

Speaker Children Are Cell Phone Chat Away From Predators Perverts Pimps

How To Include Non taxable Benefits Into Your Caregiver s Payroll

Are Cell Phone Reimbursements Taxable In California - Yes employers must reimburse employees for using personal cell phones for business purposes California law is clear on this issue Additionally employers may