Are Charitable Donations Tax Deductible For Sole Traders This also applies to sole traders and partnerships There are different rules for limited companies If you want to donate to a sports club check if it s registered as a community amateur

1 Donating from your company doesn t automatically make it deductible If you own a pass through entity such as a sole proprietorship a partnership or an S corp any charitable donations made Taxpayers who itemize can generally claim a deduction for charitable contributions to qualifying organizations The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of

Are Charitable Donations Tax Deductible For Sole Traders

Are Charitable Donations Tax Deductible For Sole Traders

https://media.freshbooks.com/wp-content/uploads/2021/09/what-can-i-claim-on-tax-as-a-sole-trader.jpg

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Surrey Coronavirus Response Fund Exceeds 1 Million Crispin Blunt MP

https://www.blunt4reigate.com/sites/www.blunt4reigate.com/files/2020-04/charitable-donations-1.jpg

If you re a sole proprietor and want a tax write off for giving to charity you must take it as a person not a business Instead of deducting it on Schedule C as a business expense sole Donations to a qualified charity are deductible for taxpayers who itemize their deductions using Schedule A of IRS Form 1040 Cash donations for 2022 and later are

For contributions of food inventory in 2020 business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using Schedule A of Form 1040 Charitable contribution deductions

Download Are Charitable Donations Tax Deductible For Sole Traders

More picture related to Are Charitable Donations Tax Deductible For Sole Traders

Are Charity Donations Tax Deductible For Companies Tapoly

https://blog.tapoly.com/wp-content/uploads/2022/08/volunteers-working-in-community-charity-donation-c-2022-01-19-00-02-09-utc.jpg

Tips On Tax Deductions For Donations

https://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

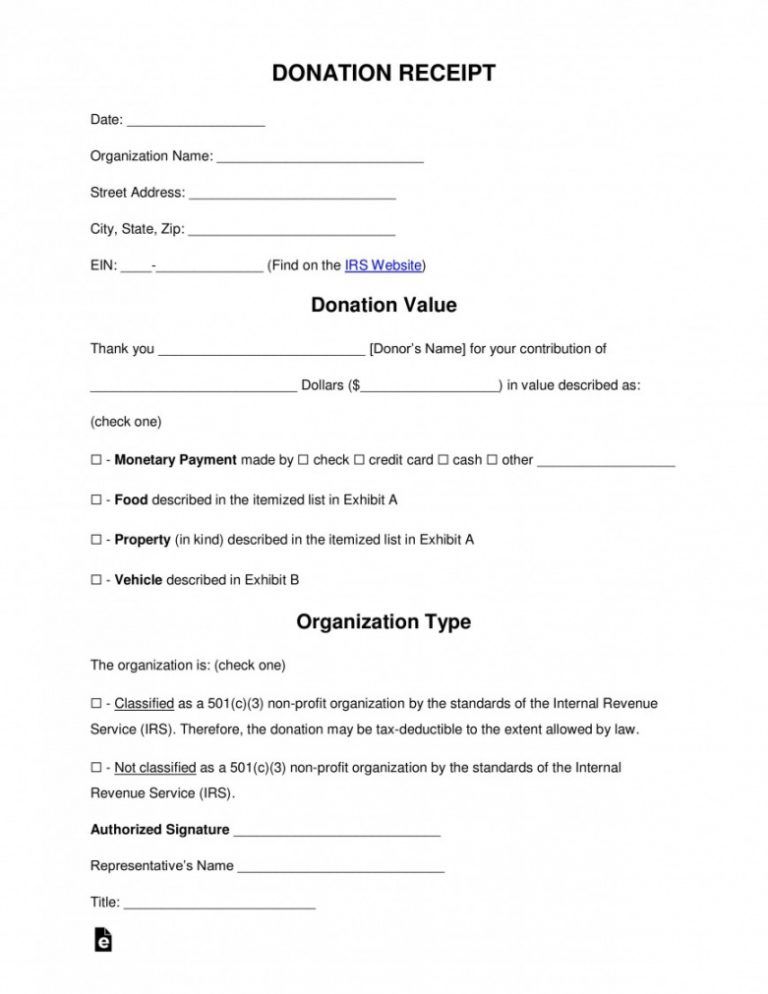

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

OVERVIEW For giving money goods or property to certain types of organizations the IRS allows you to take a tax deduction Only donations to groups defined by section 501 c 3 of the Internal Revenue Code are eligible With TurboTax Live Full Service a local expert matched to your unique situation will do your taxes for you start to finish Your deduction for charitable contributions generally can t be more than 60 of your AGI but in some cases 20 30 or 50 limits may apply Table 1 gives examples of contributions you can and can t deduct Table 1 Examples

A full guide on the process of claiming tax relief on charitable donations for individuals sole traders and Ltd companies Sole Trader 1 pricing pay as you earn Charitable donations of cash investments and physical property may be tax deductible But you must itemize to deduct your donations If the standard deduction is larger than your itemized deductions you would use that instead

Reasons Why We Donate To Charity And Non profit Zonaltra

https://zonaltrabajoandahuaylas.com/wp-content/uploads/2020/02/Charity-donations-scaled.jpg

Charitable Donations Tax Deduction Tips For Charitable Giving In NH

https://tslnh.com/wp-content/uploads/2017/11/donation-pile-1200x829.jpg

https://www.gov.uk/donating-to-charity

This also applies to sole traders and partnerships There are different rules for limited companies If you want to donate to a sports club check if it s registered as a community amateur

https://www.forbes.com/sites/forbesfinancecouncil/...

1 Donating from your company doesn t automatically make it deductible If you own a pass through entity such as a sole proprietorship a partnership or an S corp any charitable donations made

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Reasons Why We Donate To Charity And Non profit Zonaltra

The Complete Charitable Deductions Tax Guide 2023 2024

How Much Do You Need To Donate For Tax Deduction

4 Things To Know About Charitable Donations And Taxes The Motley Fool

Which Donations Matter For Taxes

Which Donations Matter For Taxes

Charitable Deductions For 2020

How To Maximize Your Charity Tax Deductible Donation WealthFit

Printable Excel Donation List Template Printable Blank World

Are Charitable Donations Tax Deductible For Sole Traders - If you re a sole proprietor and want a tax write off for giving to charity you must take it as a person not a business Instead of deducting it on Schedule C as a business expense sole