Are Charitable Donations Tax Deductible Uk Limited Companies Making a donation to charity is a way for limited companies to get tax breaks on their Corporation Tax Check the process of claiming tax relief when your limited company

Companies are entitled to tax relief for qualifying charitable donations made to charities The donations are paid gross without the deduction of income tax The donations are If you are thinking of starting a limited company or own a limited company you can offer such help to charities It will improve the reputation of your company and

Are Charitable Donations Tax Deductible Uk Limited Companies

Are Charitable Donations Tax Deductible Uk Limited Companies

https://zonaltrabajoandahuaylas.com/wp-content/uploads/2020/02/Charity-donations-scaled.jpg

Donations And Tax Deductions Tax Deductions Charitable Contributions

https://i.pinimg.com/736x/56/c2/f8/56c2f82c540b892c04e5c20f94e392ad.jpg

Charitable Donations Tax Deduction Tips For Charitable Giving In NH

https://tslnh.com/wp-content/uploads/2017/11/donation-pile-1200x829.jpg

When you sponsor a charity and receive some kind of benefit like exposure from the display of marketing materials at an event these kinds of donations or rather In this insight we explain how to make tax deductible donations through your company and the financial benefits of doing so To qualify for tax relief donations must go towards UK

Your limited company can pay less Corporation Tax when it gives money to a charity or community amateur sports club CASC Deduct the value of the donations from your As a limited company you can deduct the value of your donations from your business profits to claim tax relief therefore paying less corporation tax Donations to

Download Are Charitable Donations Tax Deductible Uk Limited Companies

More picture related to Are Charitable Donations Tax Deductible Uk Limited Companies

Tips On Tax Deductions For Donations

https://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

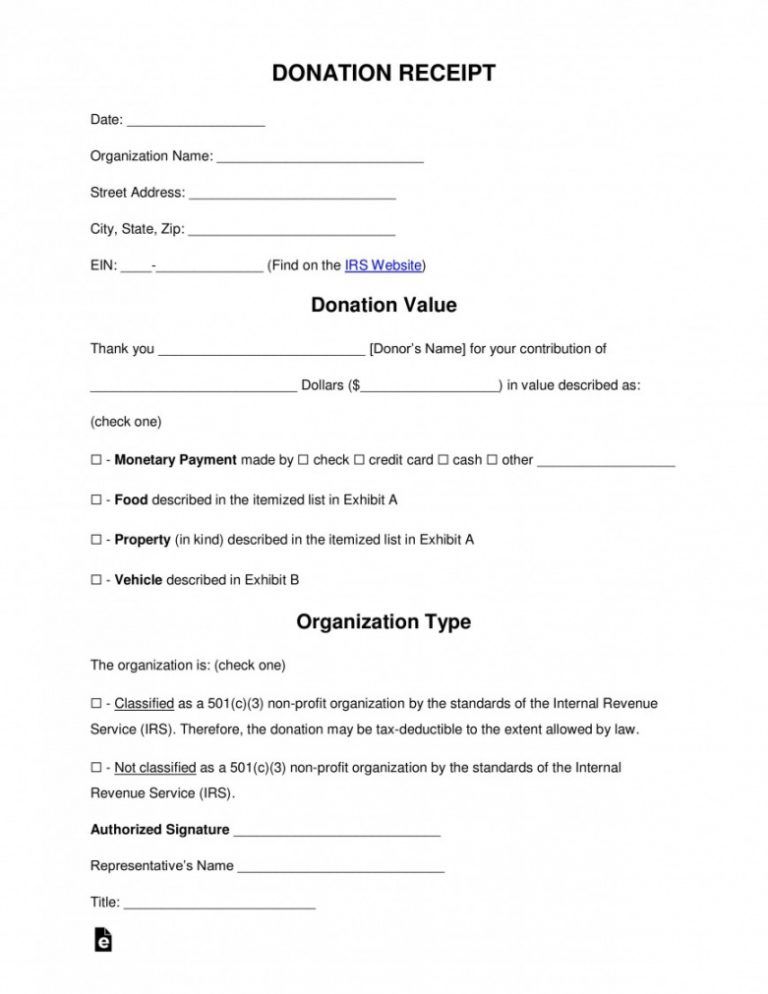

Free Tax Donation Form Template Addictionary Tax Deductible Donation

http://www.emetonlineblog.com/wp-content/uploads/2020/06/free-tax-donation-form-template-addictionary-tax-deductible-donation-receipt-template-sample-768x994.jpg

Charitable Donation Tax Credits Tax Tip Weekly YouTube

https://i.ytimg.com/vi/swRobMRG4fw/maxresdefault.jpg

Companies can obtain corporation tax relief for qualifying payments or certain transfers of assets to charity under the qualifying charitable donations regime There are special rules in place when a limited company gives to a charity This can include Corporation Tax relief for qualifying donations made to registered charities or

Companies but not sole traders or partnerships that give money to charity can deduct the value from their Corporation Tax profits The charity won t pay any If you re a UK taxpayer all donations you make to a charity that offers Gift Aid are eligible for the scheme assuming you pay enough tax more information on

The Complete Charitable Deductions Tax Guide 2023 2024

https://daffy.ghost.io/content/images/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022.png

Are Charitable Donations Tax deductible For Limited Companies

https://static.wixstatic.com/media/cee7ec_aaccca0366cc4da58aec4f69445d23a8~mv2.png/v1/fill/w_1000,h_563,al_c,q_90,usm_0.66_1.00_0.01/cee7ec_aaccca0366cc4da58aec4f69445d23a8~mv2.png

https://www.theukrules.co.uk/rules/business/tax/...

Making a donation to charity is a way for limited companies to get tax breaks on their Corporation Tax Check the process of claiming tax relief when your limited company

https://www.charitytaxgroup.org.uk/tax/donations/...

Companies are entitled to tax relief for qualifying charitable donations made to charities The donations are paid gross without the deduction of income tax The donations are

4 Things To Know About Charitable Donations And Taxes The Motley Fool

The Complete Charitable Deductions Tax Guide 2023 2024

You Could Claim Tax Relief Through Your Corporate Donation

Charitable Deductions For 2020

Sars 2022 Weekly Tax Tables Brokeasshome

Which Donations Matter For Taxes

Which Donations Matter For Taxes

How To Claim Tax Deductible Charitable Donations

Get 300 Tax Deduction For Cash Donations In 2020 2021

Donation Letter For Taxes Template In PDF Word

Are Charitable Donations Tax Deductible Uk Limited Companies - As a limited company you can deduct the value of your donations from your business profits to claim tax relief therefore paying less corporation tax Donations to