Are College Refunds Taxable 1 Best answer Carl Level 15 Yes It s taxable to you the student and must be reported How this works is explained below I ve bold italicized the relevant portion that applies to you College Education Expenses Colleges work in academic years while the IRS works in calendar years

But if you receive a refund of funds that you originally paid out of a tax favored account there may be tax consequences If you return money from a 529 college savings account to the account Emergency aid granted to students due to COVID is not taxable IR 2021 70 March 30 2021 WASHINGTON The Internal Revenue Service issued frequently asked questions today on how students and higher education institutions should report pandemic related emergency financial aid grants

Are College Refunds Taxable

Are College Refunds Taxable

https://i.ytimg.com/vi/1fx0vBdebcM/maxresdefault.jpg

What Is College Refunds Check

https://collegeaftermath.com/wp-content/uploads/2022/08/kenny-eliason-AOJGuIJkoBc-unsplash-768x512.jpg

Refunds Corefy Merchant Documentation

https://og-image.now.sh/Refunds.png?theme=dark&md=1&fontSize=150px&images=https:%2F%2Fassets.zeit.co%2Fimage%2Fupload%2Ffront%2Fassets%2Fdesign%2Fhyper-bw-logo.svg

Typically you ll use your financial aid information to claim deductions but occasionally you ll need to report it as taxable income For example if you re claiming educational expense deductions or college In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

If anyone receives a refund after 2023 of qualified education expenses paid on behalf of a student in 2023 and the refund is paid before you file an income tax return for 2023 the amount of qualified education expenses A financial aid refund can count as taxable depending on the source of the funds and what you are using the money for If the refund came from borrowed funds or is used to cover qualifying educational

Download Are College Refunds Taxable

More picture related to Are College Refunds Taxable

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Returns Refunds

https://therapeuticals.com.au/wp-content/uploads/2020/03/Png-1024x614.png

College Refunds And 529 Plans Your Wealth Matters

http://s29383.pcdn.co/wp-content/uploads/2019/10/College-money-saving.jpg.optimal.jpg

College scholarships provide significant help to students But do scholarships count as taxable income It depends on how they re used Which college expenses are tax deductible Due to tax changes in recent years the rules around which college expenses are tax deductible or allow you to take a credit have changed The list below covers categories of

If you participate in a work study program you will be working in a part time job usually for your college Your income from the job is taxable and you ll need to complete a W 4 so the college withholds the right amount of federal income tax If you use earnings from your work study program to pay for school related expenses tuition and Although this money you earn is intended to ease the financial burden of attending college the income is fully taxable on your tax return just like any other employment earnings When you prepare your tax return you must include these amounts on the appropriate line for wages and salary

TAX REFUND Deposit Codes Refunds Still Waiting To Be Processed YouTube

https://i.ytimg.com/vi/hh-EbF_eQa0/maxresdefault.jpg

College Tuition Refunds And COVID 19 What You Need To Know Chortek

https://www.chortek.com/wp-content/uploads/2020/04/College-Tuition-Refunds.png

https://ttlc.intuit.com/community/after-you-file/...

1 Best answer Carl Level 15 Yes It s taxable to you the student and must be reported How this works is explained below I ve bold italicized the relevant portion that applies to you College Education Expenses Colleges work in academic years while the IRS works in calendar years

https://www.forbes.com/sites/kellyphillipserb/2020/...

But if you receive a refund of funds that you originally paid out of a tax favored account there may be tax consequences If you return money from a 529 college savings account to the account

Tuition Refunds Waubonsee Community College

TAX REFUND Deposit Codes Refunds Still Waiting To Be Processed YouTube

How College Refunds Are Created What To Do With The Refund

Are State Tax Refunds Taxable The TurboTax Blog

Write Off An Employee s Loan Tax Tips Galley And Tindle

Instant Refunds

Instant Refunds

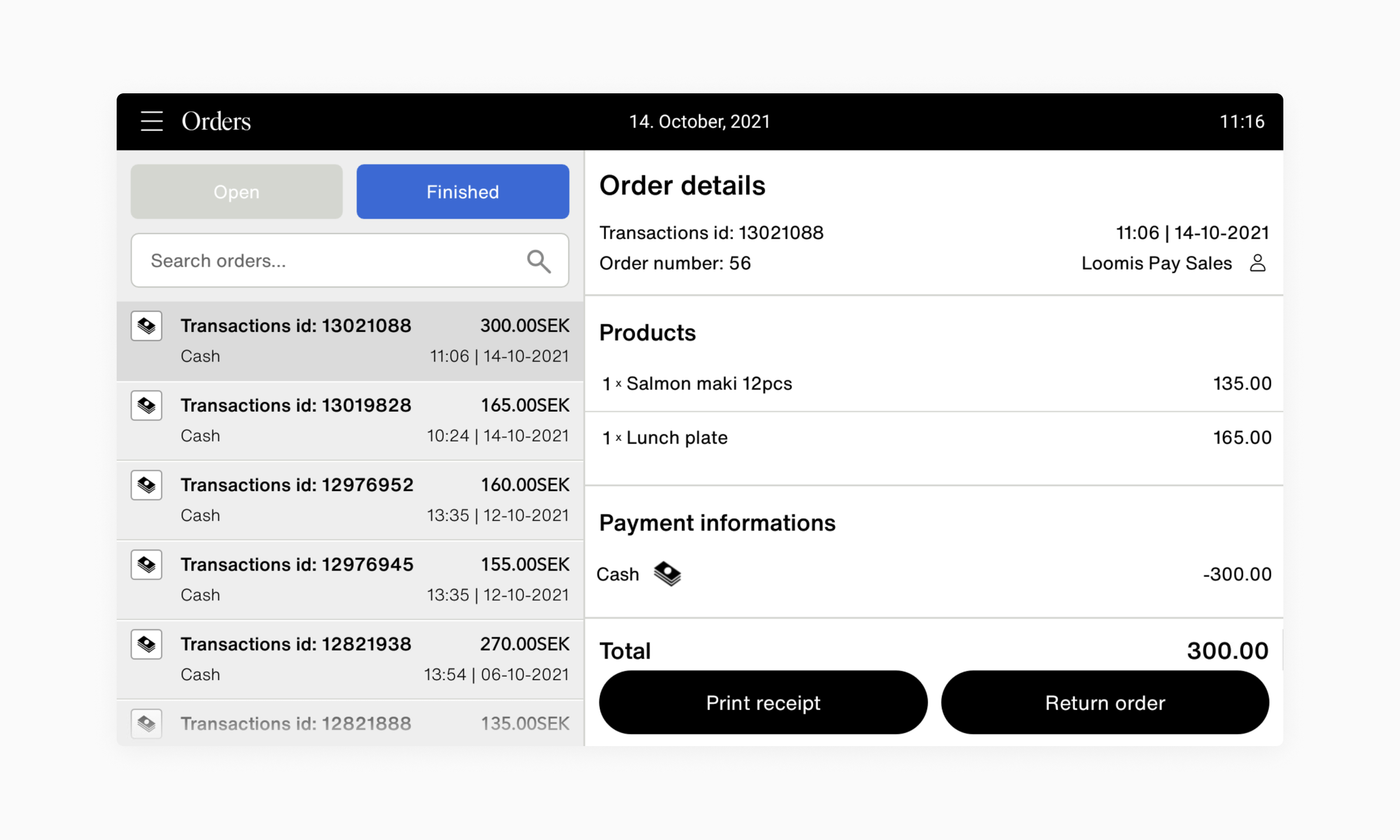

Refunds Loomis Pay

Your Tax Refund Could Be Smaller Than Last Year Here s Why Metro US

Financial Concept College Free Stock Photo Public Domain Pictures

Are College Refunds Taxable - A financial aid refund can count as taxable depending on the source of the funds and what you are using the money for If the refund came from borrowed funds or is used to cover qualifying educational